Intro

Discover 5 ways a Geico insurance card benefits policyholders, including digital ID cards, roadside assistance, and claims filing, with convenient mobile access and 24/7 support.

The world of insurance can be complex and overwhelming, with numerous providers and policies to choose from. One of the most recognizable names in the industry is Geico, known for its gecko mascot and catchy advertisements. For those who have chosen Geico as their insurance provider, understanding the Geico insurance card is essential. This small piece of plastic or digital file holds significant importance, serving as proof of insurance and offering various benefits. In this article, we will delve into the five ways a Geico insurance card can be beneficial, exploring its uses, the information it contains, and how it can be accessed.

Geico insurance cards are issued to policyholders as soon as their coverage begins, and they can be used in several situations. Whether you're involved in an accident, pulled over by law enforcement, or simply need to verify your insurance status, having a valid Geico insurance card is crucial. But what exactly does this card entail, and how can you make the most of it? Let's dive into the specifics and explore the five key ways a Geico insurance card can be advantageous.

Understanding the Geico Insurance Card

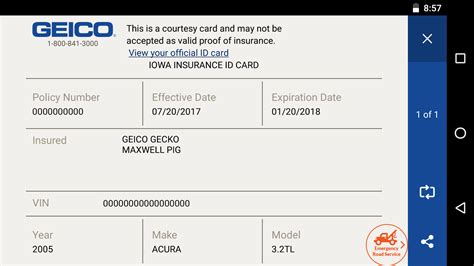

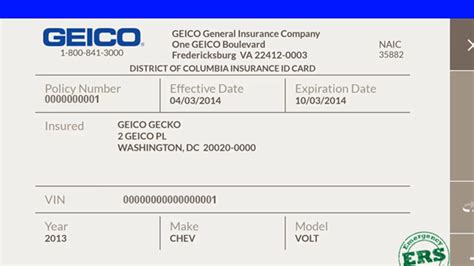

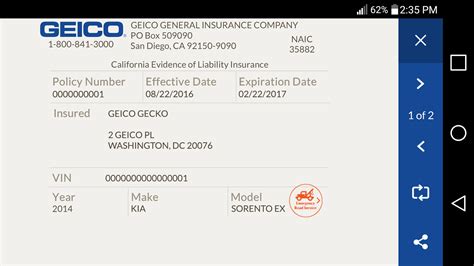

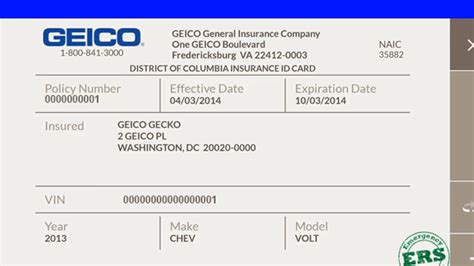

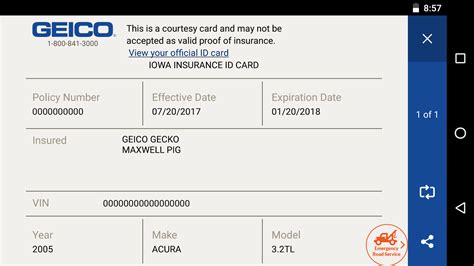

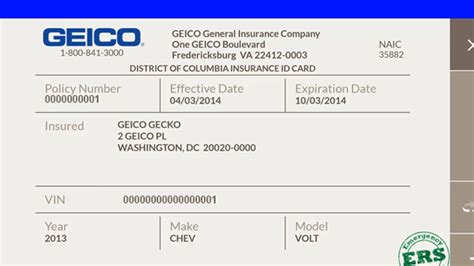

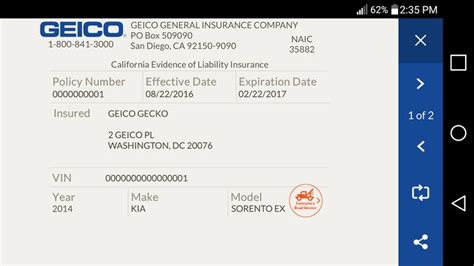

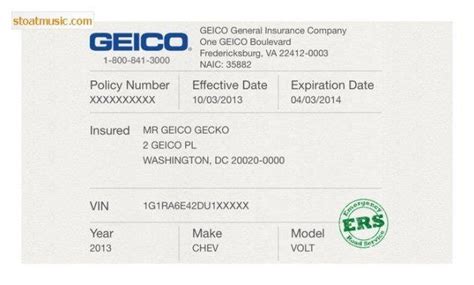

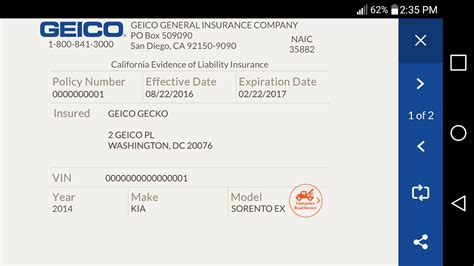

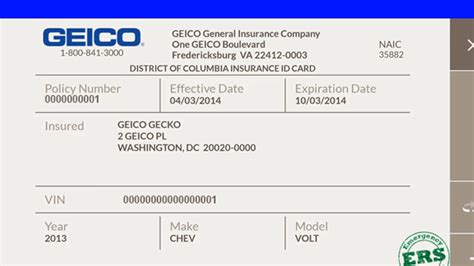

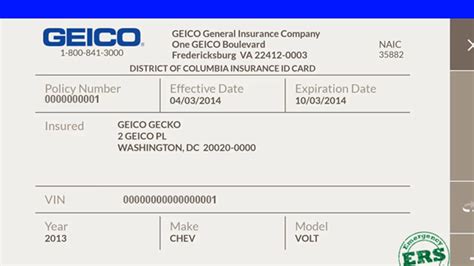

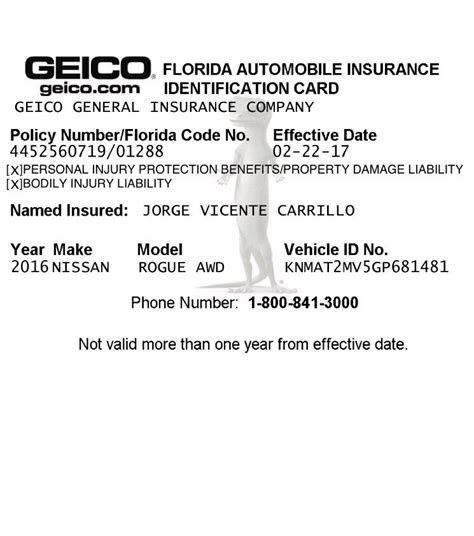

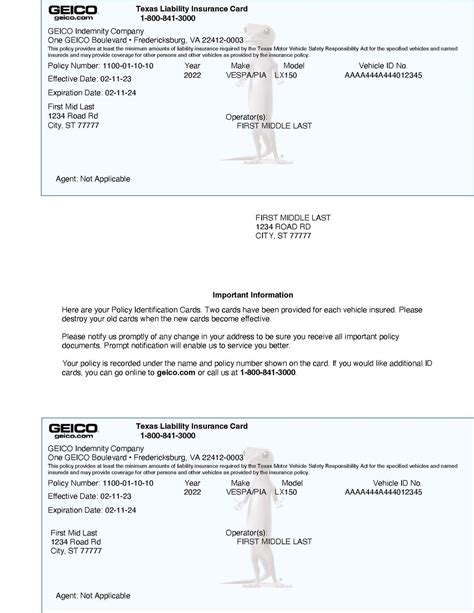

The Geico insurance card is a vital document that contains essential information about your policy, including the policy number, vehicle details, and the effective dates of your coverage. It's typically issued in a pair, with one card for the policyholder and another for any additional drivers listed on the policy. This card serves as proof of insurance and must be carried in the vehicle at all times. In the event of an accident or traffic stop, presenting a valid Geico insurance card can help resolve the situation more efficiently.

Key Components of a Geico Insurance Card

- Policy Number: A unique identifier for your insurance policy.

- Vehicle Information: Includes the make, model, year, and Vehicle Identification Number (VIN) of the insured vehicle.

- Policyholder and Driver Information: Names and addresses of the policyholder and any listed drivers.

- Coverage Dates: The start and end dates of your insurance coverage.

- Insurance Company Information: Geico's contact details, including their address and phone number.

Accessing Your Geico Insurance Card

In today's digital age, accessing your Geico insurance card is easier than ever. Policyholders can obtain their insurance cards through various methods, ensuring they always have proof of insurance when needed. Here are a few ways to access your Geico insurance card:

- Geico Website: By logging into your account on the Geico website, you can view, download, and print your insurance cards.

- Geico Mobile App: The Geico mobile app allows users to access their insurance cards digitally, eliminating the need for physical copies.

- Request by Mail: If preferred, policyholders can request that Geico mail them physical copies of their insurance cards.

- Agent or Broker: For those who prefer personal interaction, visiting a Geico agent or broker can provide immediate access to insurance cards.

Benefits of Digital Insurance Cards

- Convenience: Always have your insurance card with you, as long as you have your mobile device.

- Environmentally Friendly: Reduces the need for paper, contributing to a more sustainable environment.

- Easy Updates: Digital cards can be updated in real-time, ensuring you always have the most current version.

Using Your Geico Insurance Card

Your Geico insurance card is not just a piece of plastic or a digital file; it's a critical tool in various situations. Here are some scenarios where your Geico insurance card plays a vital role:

- Traffic Stops: If you're pulled over by law enforcement, your insurance card, along with your driver's license and vehicle registration, will be required.

- Accidents: In the event of an accident, exchanging insurance information with the other parties involved is crucial. Your Geico insurance card provides all the necessary details.

- Vehicle Registration: Some states require proof of insurance when registering a vehicle or renewing its registration.

Best Practices for Insurance Cards

- Keep It Accessible: Ensure your insurance card is easily accessible, whether it's in your vehicle or on your mobile device.

- Update Information: Notify Geico of any changes to your policy, such as new vehicles or drivers, to ensure your insurance card reflects the most current information.

- Check Expiration Dates: Be aware of your policy's expiration date to avoid any lapses in coverage.

Maintaining Your Geico Insurance Card

Maintaining your Geico insurance card is straightforward but essential for ensuring continuous coverage and compliance with legal requirements. Here are some tips for maintaining your insurance card:

- Regularly Check for Updates: Log into your Geico account periodically to check for any updates or changes to your policy.

- Report Changes: Inform Geico immediately of any changes, such as a new address, vehicle, or additional drivers.

- Renewal Reminders: Set reminders for policy renewals to avoid lapses in coverage.

Consequences of Not Having Insurance

- Legal Penalties: Driving without insurance can result in fines, license suspension, and even vehicle impoundment.

- Financial Risks: Without insurance, you're personally responsible for all costs resulting from an accident, which can be financially devastating.

Conclusion and Final Thoughts

In conclusion, a Geico insurance card is more than just a requirement; it's a safeguard that protects you legally and financially. By understanding its components, accessing it conveniently, and maintaining it properly, you can ensure you're always covered and compliant with the law. Whether you're a new policyholder or have been with Geico for years, recognizing the value and importance of your insurance card can provide peace of mind and protect you from unforeseen circumstances.

Final Reminders

- Stay Informed: Keep up-to-date with your policy details and any changes.

- Be Prepared: Always carry your insurance card and know how to access it digitally.

- Review and Adjust: Periodically review your policy to ensure it still meets your needs and adjust as necessary.

Geico Insurance Card Image Gallery

What is a Geico insurance card?

+A Geico insurance card is a document provided by Geico that serves as proof of insurance. It contains essential information about your policy, including the policy number, vehicle details, and coverage dates.

How do I access my Geico insurance card?

+You can access your Geico insurance card through the Geico website, the Geico mobile app, by requesting it via mail, or by visiting a Geico agent or broker.

What information is included on a Geico insurance card?

+A Geico insurance card includes your policy number, vehicle information, policyholder and driver details, coverage dates, and Geico's contact information.

Why is it important to carry my Geico insurance card?

+Carrying your Geico insurance card is crucial for providing proof of insurance in the event of an accident or traffic stop. It also helps in verifying your insurance status and can be required for vehicle registration.

How often should I review my Geico insurance policy and card?

+It's a good practice to review your Geico insurance policy and card periodically to ensure all information is up-to-date and accurate. This also helps in identifying any changes or adjustments needed in your coverage.

We hope this comprehensive guide to Geico insurance cards has been informative and helpful. Whether you're navigating the complexities of insurance for the first time or seeking to understand your current policy better, knowing the ins and outs of your Geico insurance card can make all the difference. Feel free to share your thoughts, ask questions, or seek further clarification on any aspects of Geico insurance cards in the comments below. Your engagement and feedback are invaluable to us, and we look forward to hearing from you.