Intro

Discover 5 essential tips for Form 8840, including foreign earned income, substantial presence test, and closer connection exemption, to navigate tax obligations and claim foreign earned income exclusions with ease.

The Closer Connection Exception to the Foreign Earned Income Exclusion, also known as Form 8840, is a crucial document for individuals who have been physically present in the United States for a substantial period but claim to be non-resident aliens. This form helps determine whether an individual qualifies for the foreign earned income exclusion, which can significantly impact their tax obligations. Understanding the nuances of Form 8840 is essential for avoiding unnecessary tax complications and ensuring compliance with U.S. tax laws.

For individuals navigating the complexities of international taxation, particularly those who work abroad or have recently moved to the United States, the process of filing Form 8840 can seem daunting. The form requires detailed information about the individual's ties to their home country and their activities in the United States, making it a challenging task to complete accurately without guidance. Moreover, the implications of incorrectly filing Form 8840 can be severe, ranging from additional tax liabilities to penalties for non-compliance.

Given the importance of accurately completing Form 8840, it's crucial to approach the process with a clear understanding of the requirements and potential pitfalls. This involves not only grasping the technical aspects of the form but also being aware of the strategies and best practices that can streamline the filing process and minimize the risk of errors. Whether you're an individual dealing with international tax complexities or a professional advising clients on these matters, having the right insights can make a significant difference in navigating the challenges associated with Form 8840.

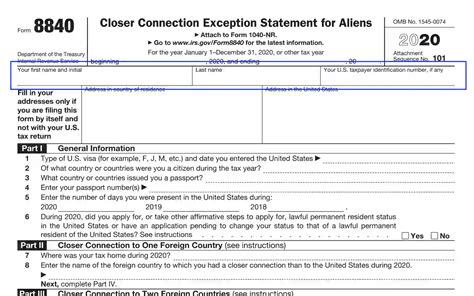

Introduction to Form 8840

Form 8840, also known as the Closer Connection Exception Statement for Aliens, is a statement that certain aliens must file to establish that they have a closer connection to a foreign country than to the United States. This form is crucial for individuals who wish to be treated as non-resident aliens for tax purposes, particularly those who have been in the United States for a significant period but do not intend to stay permanently. By filing Form 8840, these individuals can avoid being classified as resident aliens, which would subject them to U.S. taxation on their worldwide income.

Who Needs to File Form 8840?

The necessity to file Form 8840 typically arises for individuals who meet certain criteria related to their physical presence in the United States. Generally, aliens who have been in the U.S. for at least 31 days during the current year and meet the substantial presence test must file Form 8840 if they wish to claim the closer connection exception. This exception is essential for avoiding the classification as a resident alien, which would have significant tax implications.Benefits of Filing Form 8840

Filing Form 8840 can provide several benefits to eligible aliens, primarily related to their tax status in the United States. By establishing a closer connection to a foreign country, individuals can avoid being treated as U.S. tax residents, which means they would not be subject to U.S. taxation on their worldwide income. This can lead to significant tax savings, especially for individuals with substantial income from foreign sources.

Moreover, correctly filing Form 8840 helps individuals comply with U.S. tax laws, avoiding potential penalties and complications that could arise from incorrect tax status classification. Compliance is key to maintaining a clean tax record and avoiding unnecessary interactions with the IRS.

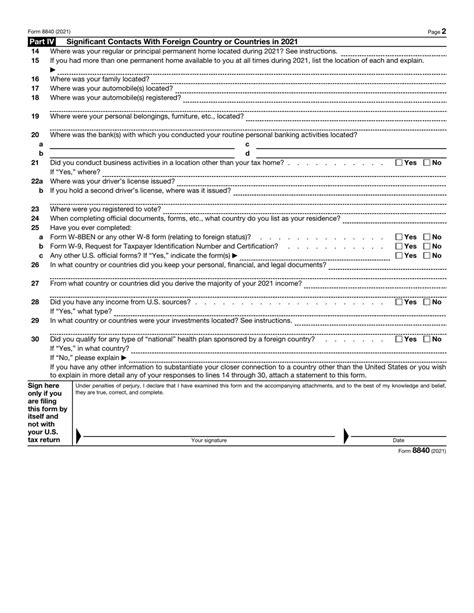

Steps to Complete Form 8840

Completing Form 8840 involves several steps, including gathering necessary documents, filling out the form accurately, and submitting it to the IRS. Here are some key steps to consider: - **Gather Required Documents:** Before starting the form, it's essential to have all necessary documents and information readily available. This includes a valid passport, documentation of foreign residence, and details about the individual's activities in the United States. - **Fill Out the Form Accurately:** The form requires detailed information about the individual's connections to their home country and the United States. It's crucial to answer all questions honestly and accurately to avoid any issues with the IRS. - **Submit the Form:** Once completed, the form should be submitted to the IRS by the specified deadline. It's recommended to keep a copy of the submitted form for personal records.Common Mistakes to Avoid

When completing Form 8840, there are several common mistakes that individuals should avoid to ensure their application is processed smoothly. One of the most critical errors is failing to provide sufficient documentation to support the claim of a closer connection to a foreign country. Without adequate evidence, the IRS may reject the application, leading to unintended tax consequences.

Another mistake is not filing the form on time. Missing the deadline can result in the individual being treated as a U.S. tax resident, subjecting them to taxation on their worldwide income. It's also important to ensure that all information provided on the form is accurate and truthful, as any discrepancies can lead to further complications.

Tips for a Smooth Filing Process

To ensure a smooth filing process, individuals should consider the following tips: - **Seek Professional Advice:** If unsure about any aspect of the form, it's advisable to seek help from a tax professional who is experienced in international taxation. - **Keep Detailed Records:** Maintaining detailed records of all activities, both in the United States and abroad, can help support the application and avoid any potential issues. - **Plan Ahead:** Filing Form 8840 should not be left to the last minute. Planning ahead and allowing sufficient time for preparation and submission can help avoid unnecessary stress and complications.Gallery of Form 8840 Related Topics

Form 8840 Image Gallery

Frequently Asked Questions

What is the purpose of Form 8840?

+Form 8840 is used to establish that an alien has a closer connection to a foreign country than to the United States, which can affect their tax status.

Who needs to file Form 8840?

+Aliens who have been in the U.S. for at least 31 days during the current year and meet the substantial presence test may need to file Form 8840 to claim the closer connection exception.

What are the benefits of filing Form 8840?

+Filing Form 8840 can help aliens avoid being treated as U.S. tax residents, which means they would not be subject to U.S. taxation on their worldwide income, leading to potential tax savings.

How do I complete Form 8840?

+To complete Form 8840, gather all necessary documents, fill out the form accurately, and submit it to the IRS by the specified deadline. It's recommended to seek professional advice if unsure about any aspect of the form.

What are the common mistakes to avoid when filing Form 8840?

+

In conclusion, navigating the complexities of Form 8840 requires a thorough understanding of the form's purpose, who needs to file it, and the benefits of filing. By avoiding common mistakes and following the tips outlined for a smooth filing process, individuals can ensure compliance with U.S. tax laws and potentially avoid significant tax liabilities. Whether you're an individual dealing with international tax complexities or a professional advising clients on these matters, staying informed about the nuances of Form 8840 is crucial for making informed decisions and avoiding unnecessary complications. We invite you to share your experiences or ask questions about Form 8840 in the comments below, and don't forget to share this article with anyone who might benefit from this information.