Intro

Streamline payroll management with 5 customizable payroll ledger templates, featuring employee payroll records, salary details, and tax deductions, for efficient payroll processing and accounting.

The importance of maintaining accurate and up-to-date payroll records cannot be overstated. A payroll ledger is a crucial tool for businesses to track employee compensation, deductions, and taxes. It helps ensure compliance with labor laws and regulations, facilitates accurate financial reporting, and enables employers to make informed decisions about their workforce. In this article, we will delve into the world of payroll ledger templates, exploring their benefits, types, and uses. We will also provide guidance on how to choose the right template for your business needs.

Effective payroll management is essential for any organization, regardless of its size or industry. A well-organized payroll system helps prevent errors, reduces the risk of non-compliance, and improves employee satisfaction. A payroll ledger template is a valuable resource for businesses, as it provides a structured framework for recording and tracking payroll data. With a payroll ledger template, employers can easily monitor employee earnings, deductions, and benefits, making it easier to manage their workforce and make strategic decisions.

Payroll ledger templates offer numerous benefits, including improved accuracy, increased efficiency, and enhanced compliance. By using a template, employers can reduce the risk of errors and ensure that all payroll data is accurately recorded and up-to-date. This, in turn, helps prevent costly mistakes and ensures that employees are paid correctly and on time. Additionally, payroll ledger templates can help businesses streamline their payroll processes, reducing the time and effort required to manage payroll data. With a template, employers can quickly and easily generate reports, track employee benefits, and analyze payroll trends.

Introduction to Payroll Ledger Templates

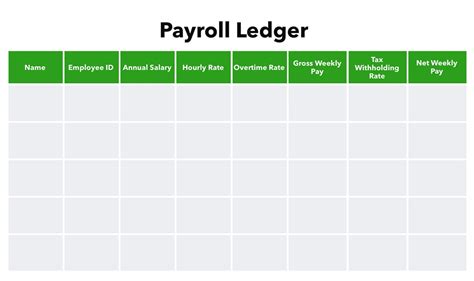

A payroll ledger template is a pre-designed spreadsheet or document that provides a structured framework for recording and tracking payroll data. These templates typically include columns for employee information, earnings, deductions, taxes, and benefits, making it easy to track and manage payroll data. Payroll ledger templates can be customized to meet the specific needs of a business, allowing employers to add or remove columns as needed. This flexibility makes payroll ledger templates a valuable resource for businesses of all sizes and industries.

Benefits of Using Payroll Ledger Templates

The benefits of using payroll ledger templates are numerous. Some of the most significant advantages include: * Improved accuracy: Payroll ledger templates help reduce errors by providing a structured framework for recording payroll data. * Increased efficiency: With a template, employers can quickly and easily generate reports, track employee benefits, and analyze payroll trends. * Enhanced compliance: Payroll ledger templates help ensure that all payroll data is accurately recorded and up-to-date, reducing the risk of non-compliance. * Streamlined payroll processes: Payroll ledger templates can help businesses automate their payroll processes, reducing the time and effort required to manage payroll data.Types of Payroll Ledger Templates

There are several types of payroll ledger templates available, each designed to meet the specific needs of a business. Some of the most common types of payroll ledger templates include:

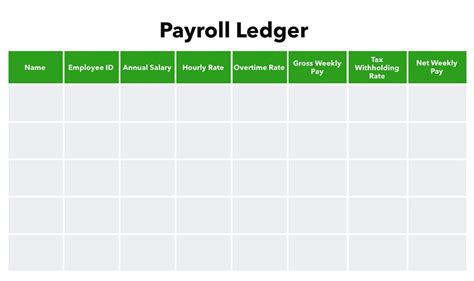

- Basic payroll ledger templates: These templates provide a simple framework for recording payroll data, including columns for employee information, earnings, and deductions.

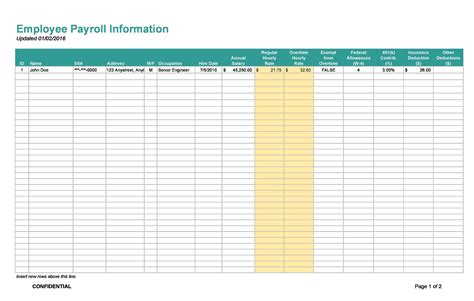

- Advanced payroll ledger templates: These templates offer more complex features, such as automated calculations and reporting capabilities.

- Customizable payroll ledger templates: These templates can be tailored to meet the specific needs of a business, allowing employers to add or remove columns as needed.

- Industry-specific payroll ledger templates: These templates are designed for specific industries, such as construction or healthcare, and include columns and features tailored to the unique needs of that industry.

Choosing the Right Payroll Ledger Template

Choosing the right payroll ledger template depends on several factors, including the size and type of business, the complexity of payroll data, and the level of customization required. Employers should consider the following factors when selecting a payroll ledger template: * Ease of use: The template should be easy to use and understand, even for those without extensive payroll experience. * Customization: The template should be customizable to meet the specific needs of the business. * Automation: The template should offer automated features, such as calculations and reporting capabilities, to streamline payroll processes. * Compliance: The template should ensure compliance with labor laws and regulations.Using Payroll Ledger Templates Effectively

To use payroll ledger templates effectively, employers should follow these best practices:

- Regularly update payroll data: Payroll data should be updated regularly to ensure accuracy and compliance.

- Use automated features: Automated features, such as calculations and reporting capabilities, can help streamline payroll processes and reduce errors.

- Customize the template: The template should be customized to meet the specific needs of the business, including adding or removing columns as needed.

- Train employees: Employees responsible for managing payroll data should be trained on the use of the payroll ledger template to ensure accuracy and compliance.

Common Mistakes to Avoid

When using payroll ledger templates, employers should avoid the following common mistakes: * Failing to regularly update payroll data * Not customizing the template to meet the specific needs of the business * Not using automated features * Not training employees on the use of the payroll ledger templatePayroll Ledger Template Examples

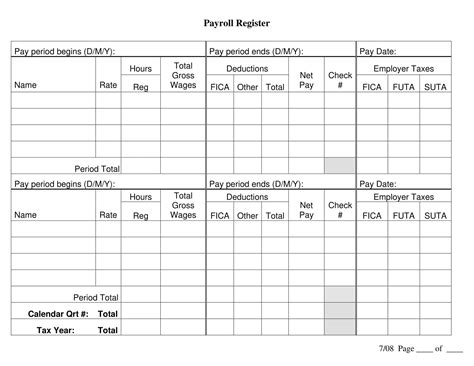

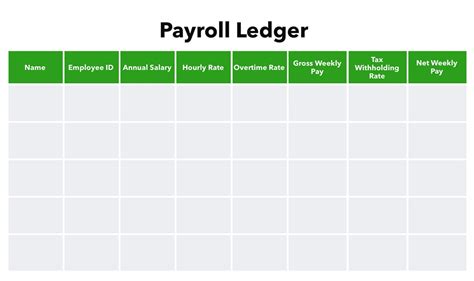

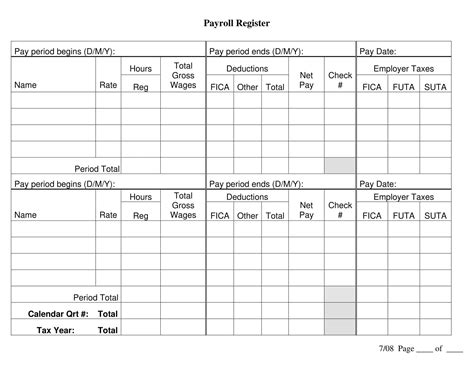

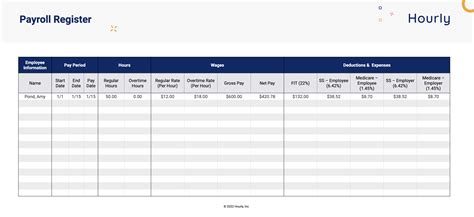

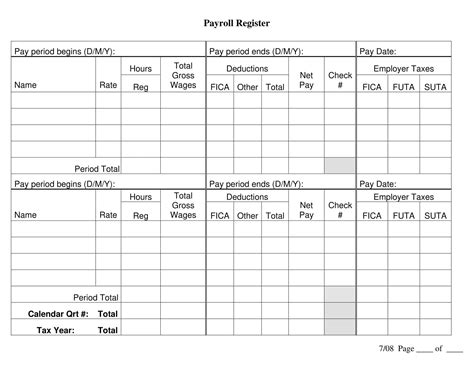

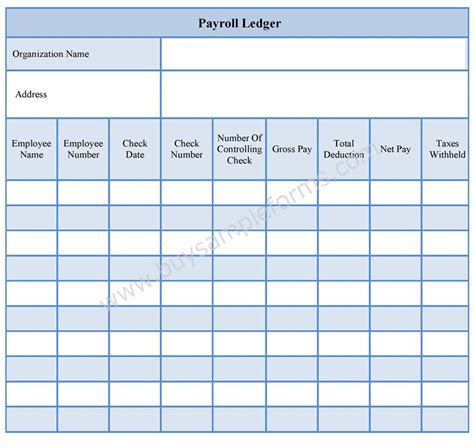

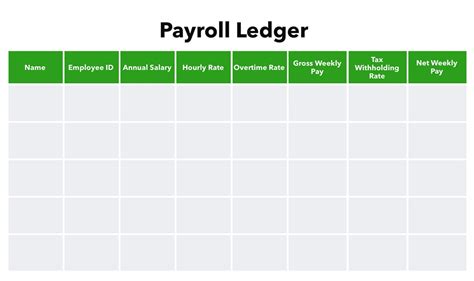

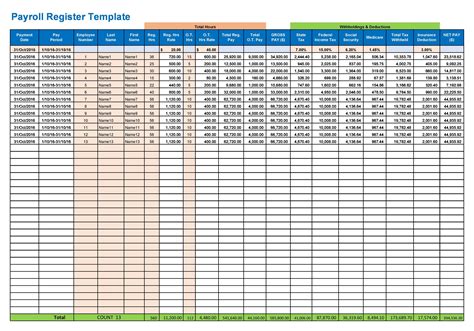

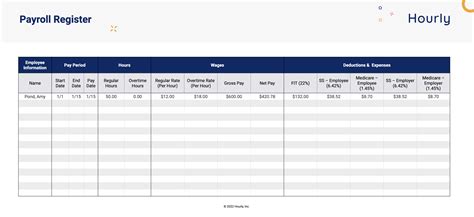

Here are a few examples of payroll ledger templates:

- Basic payroll ledger template: This template includes columns for employee information, earnings, and deductions.

- Advanced payroll ledger template: This template offers more complex features, such as automated calculations and reporting capabilities.

- Customizable payroll ledger template: This template can be tailored to meet the specific needs of a business, allowing employers to add or remove columns as needed.

Creating a Payroll Ledger Template

Creating a payroll ledger template can be a straightforward process. Employers can use a spreadsheet program, such as Microsoft Excel, to create a template from scratch. Alternatively, they can use a pre-designed template and customize it to meet their specific needs. When creating a payroll ledger template, employers should consider the following factors: * Ease of use: The template should be easy to use and understand, even for those without extensive payroll experience. * Customization: The template should be customizable to meet the specific needs of the business. * Automation: The template should offer automated features, such as calculations and reporting capabilities, to streamline payroll processes. * Compliance: The template should ensure compliance with labor laws and regulations.Payroll Ledger Template Image Gallery

What is a payroll ledger template?

+A payroll ledger template is a pre-designed spreadsheet or document that provides a structured framework for recording and tracking payroll data.

Why is it important to use a payroll ledger template?

+Using a payroll ledger template is important because it helps ensure accuracy and compliance, streamlines payroll processes, and provides a clear and organized record of payroll data.

How do I choose the right payroll ledger template for my business?

+Choosing the right payroll ledger template depends on several factors, including the size and type of business, the complexity of payroll data, and the level of customization required. Employers should consider ease of use, customization, automation, and compliance when selecting a payroll ledger template.

Can I create my own payroll ledger template?

+Yes, employers can create their own payroll ledger template using a spreadsheet program, such as Microsoft Excel. However, it is often more efficient and effective to use a pre-designed template and customize it to meet the specific needs of the business.

What are the common mistakes to avoid when using a payroll ledger template?

+Common mistakes to avoid when using a payroll ledger template include failing to regularly update payroll data, not customizing the template to meet the specific needs of the business, not using automated features, and not training employees on the use of the payroll ledger template.

In

Final Thoughts

In conclusion, payroll ledger templates are a valuable resource for businesses, providing a structured framework for recording and tracking payroll data. By using a payroll ledger template, employers can improve accuracy, increase efficiency, and enhance compliance. When choosing a payroll ledger template, employers should consider ease of use, customization, automation, and compliance. By following best practices and avoiding common mistakes, employers can use payroll ledger templates effectively to manage their workforce and make strategic decisions. We invite you to share your thoughts and experiences with payroll ledger templates in the comments below. If you found this article helpful, please share it with others who may benefit from this information.