Intro

Master 5 Chart Patterns: Identify trends with Head and Shoulders, Triangles, and Wedges, and boost trading with technical analysis and market insights.

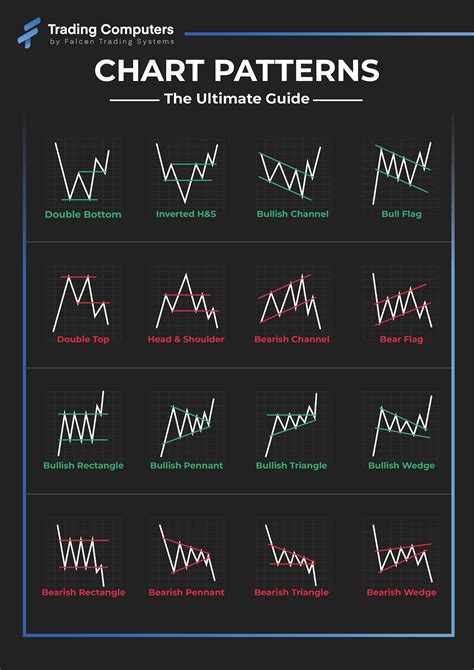

The world of finance and trading is complex and ever-changing, with numerous factors influencing market trends and stock prices. One of the key tools used by traders and investors to navigate this landscape is chart patterns. Chart patterns are visual representations of price movements over time, helping to identify potential trends, reversals, and trading opportunities. Among the myriad of chart patterns, some stand out for their reliability and popularity. In this article, we will delve into five of the most significant chart patterns, exploring their characteristics, implications, and how they can be utilized in trading strategies.

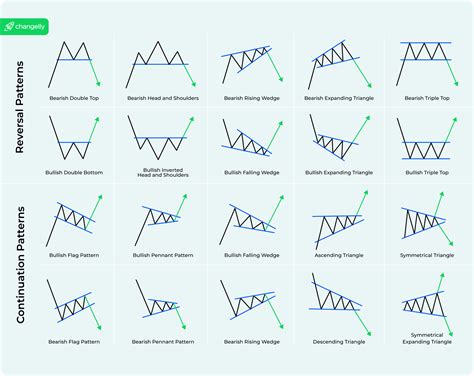

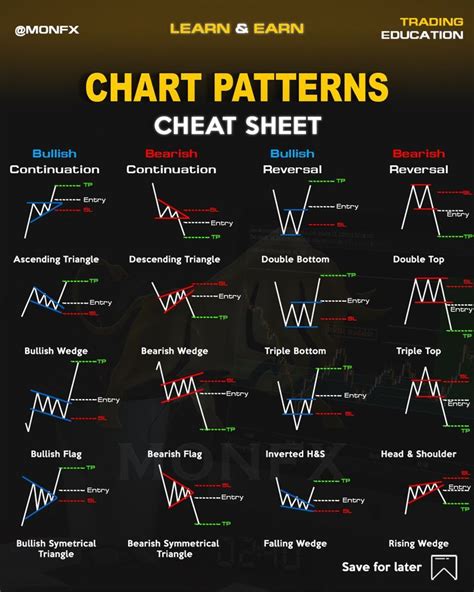

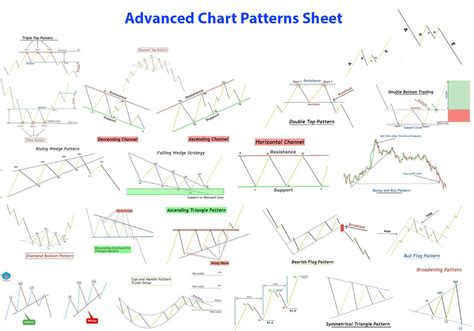

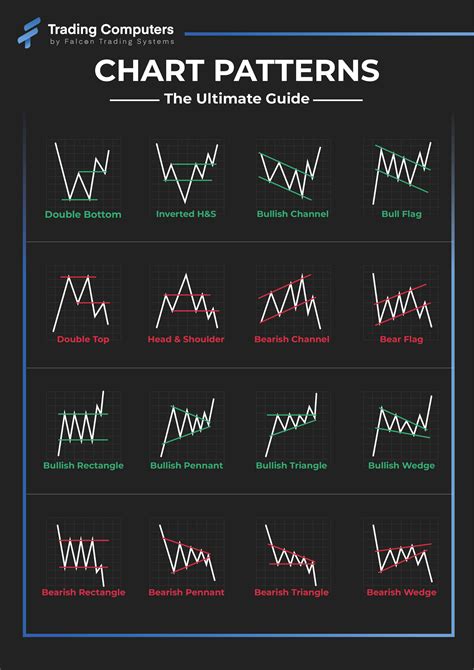

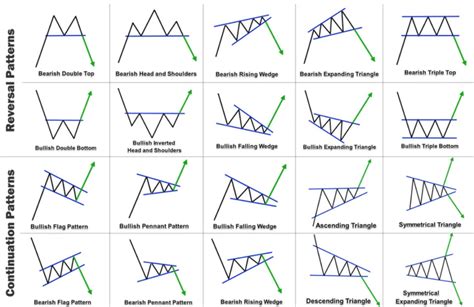

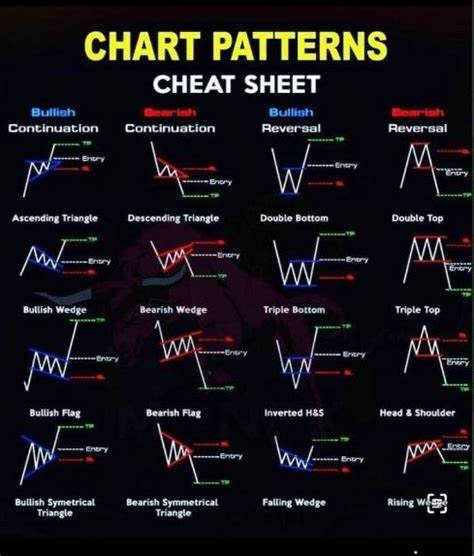

Understanding chart patterns requires a basic knowledge of technical analysis, which involves studying charts and other data to predict future price movements. Technical analysts believe that market psychology and other factors are reflected in the price and volume of a security, making chart patterns a crucial part of their toolkit. Chart patterns can be broadly classified into two categories: continuation patterns, which indicate that the current trend is likely to continue, and reversal patterns, which suggest a change in the direction of the trend.

Introduction to Chart Patterns

The study of chart patterns is based on the premise that history repeats itself in the financial markets. Patterns that have formed in the past and led to certain outcomes are likely to do so again when they appear in the future. This concept is fundamental to technical analysis and underpins the use of chart patterns in trading. By recognizing these patterns, traders can make more informed decisions about when to enter or exit trades, thereby potentially increasing their chances of success.

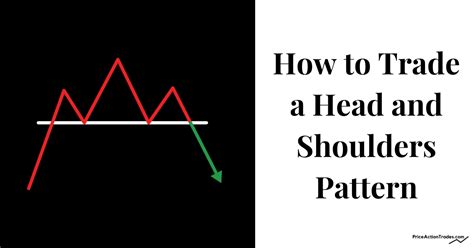

1. Head and Shoulders Pattern

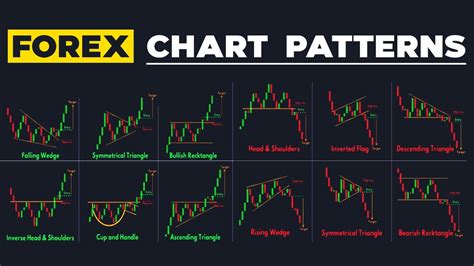

One of the most recognizable and reliable reversal patterns is the Head and Shoulders pattern. It is characterized by a peak (the head) flanked by two smaller peaks (the shoulders), with the peaks being separated by troughs. The pattern is confirmed when the price breaks below the neckline, which is drawn by connecting the two troughs. This pattern is typically seen at the top of an uptrend and indicates a potential reversal, signaling that the price may start to decline.

Characteristics of the Head and Shoulders Pattern

The Head and Shoulders pattern has several key characteristics: - The head is the highest peak and is larger than the shoulders. - The shoulders are roughly equal in height and are separated by the head. - The neckline is drawn across the bottoms of the troughs between the head and shoulders. - A break below the neckline confirms the pattern and suggests a sell signal.2. Inverse Head and Shoulders Pattern

The Inverse Head and Shoulders pattern is the opposite of the Head and Shoulders pattern and is seen at the bottom of a downtrend. It consists of a trough (the head) flanked by two smaller troughs (the shoulders), with the pattern being confirmed when the price breaks above the neckline. This pattern is a bullish reversal signal, indicating that the price may start to rise.

Characteristics of the Inverse Head and Shoulders Pattern

The Inverse Head and Shoulders pattern has several key characteristics: - The head is the lowest trough and is lower than the shoulders. - The shoulders are roughly equal in depth and are separated by the head. - The neckline is drawn across the tops of the peaks between the head and shoulders. - A break above the neckline confirms the pattern and suggests a buy signal.3. Triangle Pattern

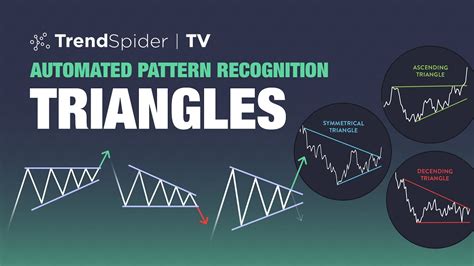

The Triangle pattern is a continuation pattern that can also act as a reversal pattern depending on the context. It is formed when the price action creates a series of higher lows and lower highs, resulting in a triangle shape. There are three types of triangles: ascending, descending, and symmetrical. The ascending triangle is generally considered bullish, the descending triangle bearish, and the symmetrical triangle can be either bullish or bearish depending on the direction of the breakout.

Characteristics of the Triangle Pattern

The Triangle pattern has several key characteristics: - The pattern is formed by a series of higher lows and lower highs. - The ascending triangle has a flat top and an ascending bottom trend line. - The descending triangle has a flat bottom and a descending top trend line. - The symmetrical triangle has both an ascending bottom trend line and a descending top trend line. - A breakout from the triangle in the direction of the prevailing trend is considered a continuation signal, while a breakout against the trend is considered a reversal signal.4. Wedge Pattern

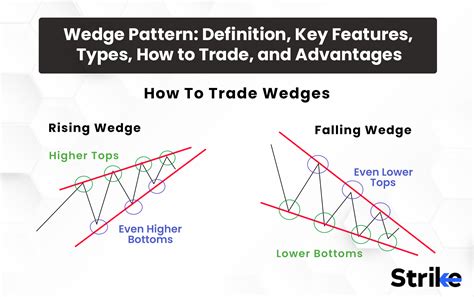

The Wedge pattern is similar to the Triangle pattern but is distinguished by its slanting nature. It can be either rising or falling. A rising wedge is generally bearish, indicating a potential reversal from an uptrend to a downtrend. A falling wedge is bullish, indicating a potential reversal from a downtrend to an uptrend. The pattern is confirmed when the price breaks out of the wedge in the direction opposite to the trend line.

Characteristics of the Wedge Pattern

The Wedge pattern has several key characteristics: - The pattern is formed by two converging trend lines that are slanted. - A rising wedge has an upward slant and is typically bearish. - A falling wedge has a downward slant and is typically bullish. - The pattern is confirmed by a breakout from the wedge.5. Double Top and Double Bottom Patterns

The Double Top and Double Bottom patterns are reversal patterns. The Double Top pattern is formed when the price reaches a high, pulls back, and then reaches the same high again before falling. This pattern is bearish, indicating a potential downtrend. The Double Bottom pattern is the opposite, formed when the price reaches a low, bounces back, and then reaches the same low again before rising. This pattern is bullish, indicating a potential uptrend.

Characteristics of the Double Top and Double Bottom Patterns

These patterns have several key characteristics: - The Double Top pattern consists of two peaks at roughly the same price level, with a trough in between. - The Double Bottom pattern consists of two troughs at roughly the same price level, with a peak in between. - The pattern is confirmed when the price breaks below the trough (in the case of a Double Top) or above the peak (in the case of a Double Bottom).Gallery of Chart Patterns

Chart Patterns Image Gallery

What is the most reliable chart pattern for trading?

+The reliability of chart patterns can vary depending on market conditions and the specific pattern. However, the Head and Shoulders pattern is often considered one of the most reliable reversal patterns.

How do I identify a chart pattern?

+Identifying chart patterns involves looking for specific shapes and trends in price movements. This can be done by visually examining charts or using software that recognizes patterns. It's also important to consider the context and other technical and fundamental analysis tools.

Can chart patterns be used in all markets?

+Yes, chart patterns can be applied to various financial markets, including stocks, forex, futures, and cryptocurrencies. However, the effectiveness of certain patterns may vary between markets and over time.

Do chart patterns guarantee success in trading?

+No, chart patterns do not guarantee success. Trading always involves risk, and numerous factors can influence market movements. Chart patterns are tools that can increase the chances of making successful trades but should be used in conjunction with other forms of analysis and risk management strategies.

How can I learn more about chart patterns and improve my trading skills?

+Learning more about chart patterns involves studying technical analysis, practicing with demo accounts, and staying updated with market news and analysis. Joining trading communities, reading books on technical analysis, and taking courses can also be beneficial.

In conclusion, chart patterns are invaluable tools for traders and investors, offering insights into potential market trends and trading opportunities. By understanding and recognizing these patterns, individuals can make more informed decisions and potentially improve their trading outcomes. Whether you are a beginner or an experienced trader, continuing to learn about and apply chart patterns can be a key component of a successful trading strategy. We invite you to share your experiences with chart patterns, ask questions, and explore how these tools can enhance your approach to the financial markets.