Intro

Discover 7 budget templates to manage finances efficiently, including expense trackers, income statements, and financial planners, for effective budgeting and money management strategies.

Creating a budget is an essential step in managing personal finances effectively. It helps individuals track their income and expenses, making it easier to achieve financial stability and work towards long-term goals. One of the most effective ways to create a budget is by using budget templates. These templates provide a structured format that guides users in organizing their financial data, categorizing expenses, and setting realistic financial objectives. In this article, we will explore seven budget templates that can help individuals manage their finances more efficiently.

Budgeting is a critical aspect of personal finance that involves planning how to allocate financial resources to meet specific needs and goals. It requires a thorough understanding of one's income and expenses, as well as the ability to make informed decisions about how to utilize available funds. Budget templates simplify this process by offering pre-designed spreadsheets or forms that can be tailored to suit individual financial situations. Whether you are looking to reduce debt, build savings, or invest in the future, using a budget template can provide the clarity and control needed to make progress towards your financial objectives.

Effective budgeting is not just about cutting expenses or increasing income; it's about achieving a balance that supports your lifestyle while moving closer to your long-term financial goals. Budget templates help in identifying areas where costs can be optimized, prioritizing spending based on needs versus wants, and ensuring that savings and investments are adequately considered. Moreover, they offer a systematic approach to financial planning, which can reduce financial stress and improve overall well-being. By leveraging the right budget template, individuals can develop a personalized financial plan that is both realistic and achievable.

Introduction to Budget Templates

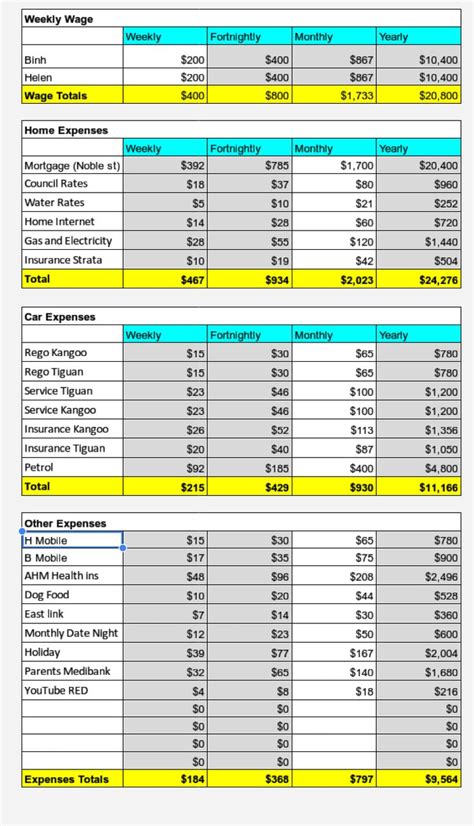

Budget templates come in various forms and can be categorized based on their complexity, the specific financial goals they are designed to address, and the user's level of financial literacy. From simple spreadsheets that track basic income and expenses to more complex models that incorporate investment strategies and long-term financial planning, there is a budget template available for every financial situation. The key to selecting the right template is understanding your financial goals, the level of detail you need to track, and your comfort with financial planning tools.

Types of Budget Templates

There are several types of budget templates, each designed to serve different purposes or cater to various user preferences. Some of the most common include: - **Zero-Based Budgeting Templates:** These templates require users to justify every expense, starting from a "zero base." This approach ensures that every dollar is accounted for and is particularly useful for those looking to minimize waste and maximize savings. - **50/30/20 Budget Templates:** This template allocates 50% of the income towards necessary expenses like rent and utilities, 30% towards discretionary spending, and 20% towards saving and debt repayment. It's a straightforward and balanced approach to budgeting. - **Envelope Budgeting Templates:** Inspired by the traditional envelope system where expenses are categorized and funds are allocated to each category in separate envelopes, these templates help in visualizing and controlling expenses more effectively.Seven Budget Templates for Effective Financial Planning

-

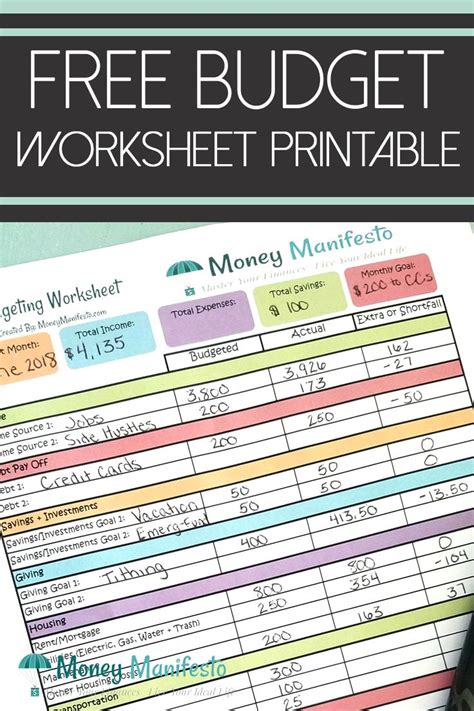

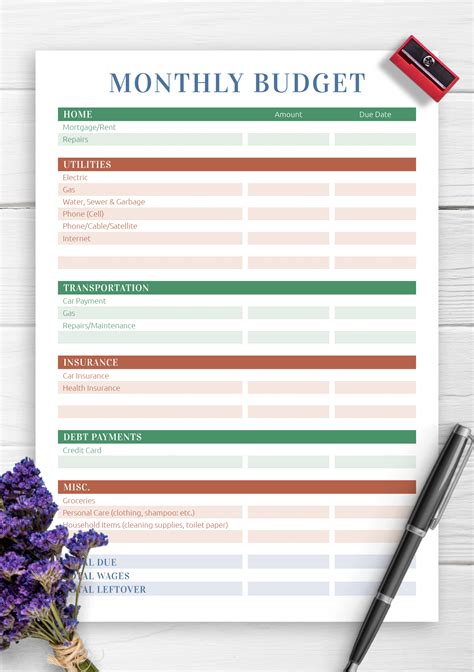

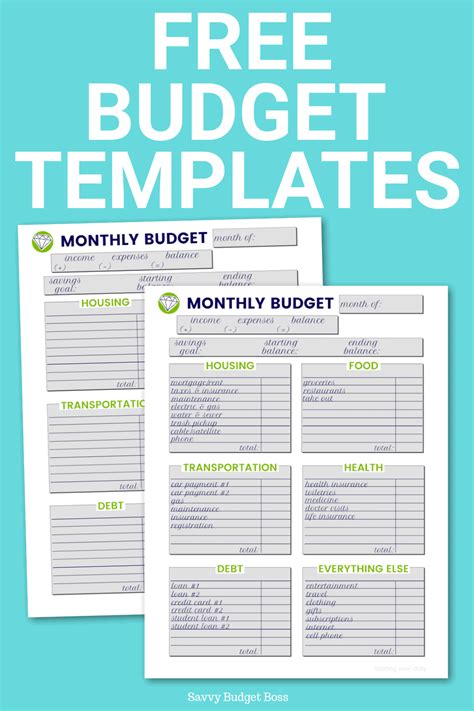

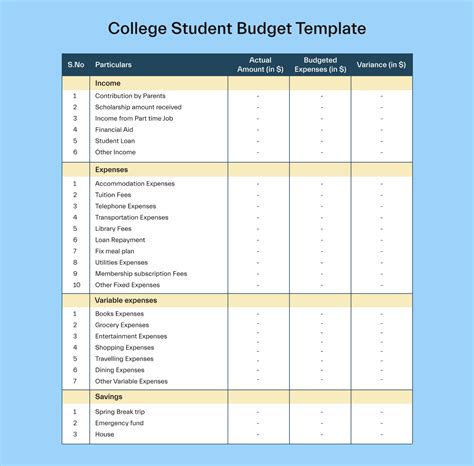

Basic Budget Template: Ideal for those new to budgeting, this template provides a simple and easy-to-understand format for tracking income and expenses. It categorizes expenses into broad categories such as housing, transportation, and food, making it easy to identify areas for cost reduction.

-

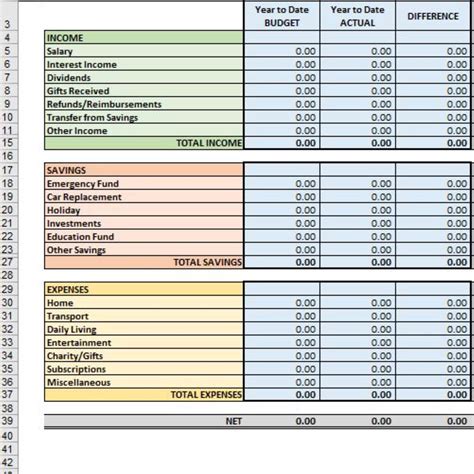

Detailed Budget Template: For individuals who prefer a more granular approach to budgeting, a detailed template that breaks down expenses into subcategories can be highly beneficial. This template helps in understanding where every dollar is going and can reveal opportunities for savings that might be overlooked in a more general budget.

-

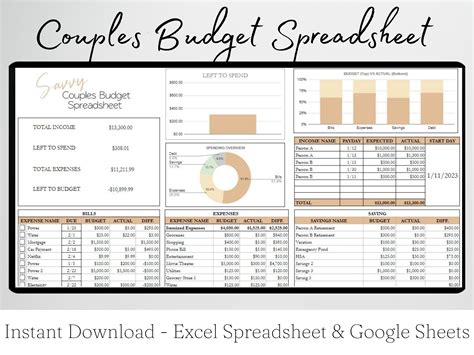

Budgeting for Couples Template: Designed for couples, this template takes into account the combined income and expenses of both partners. It's particularly useful for managing shared financial goals, such as saving for a wedding or a down payment on a house.

-

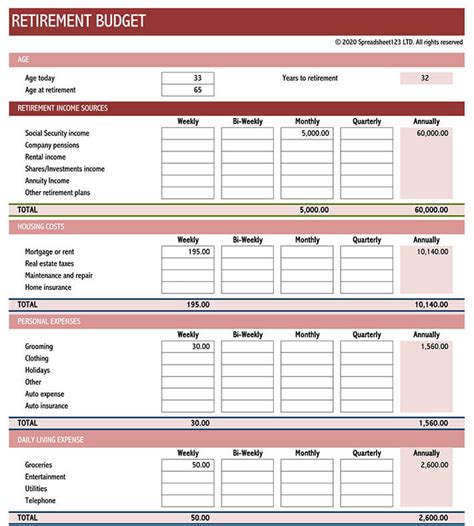

Retirement Budget Template: Focused on planning for retirement, this template helps individuals estimate their retirement expenses and income, ensuring they are on track to meet their post-work financial goals. It considers factors such as pension, social security, and retirement savings.

-

Debt Repayment Budget Template: For those struggling with debt, this template prioritizes debt repayment by allocating a significant portion of the income towards paying off loans and credit cards. It's an effective tool for becoming debt-free and improving credit scores.

-

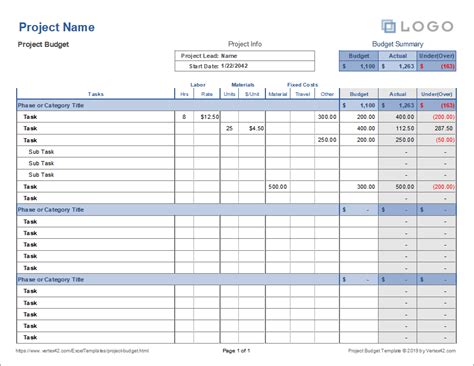

Investment Budget Template: Geared towards investors, this template integrates investment strategies into the budgeting process. It helps in allocating funds for investments, tracking investment income, and making informed decisions about investment portfolios.

-

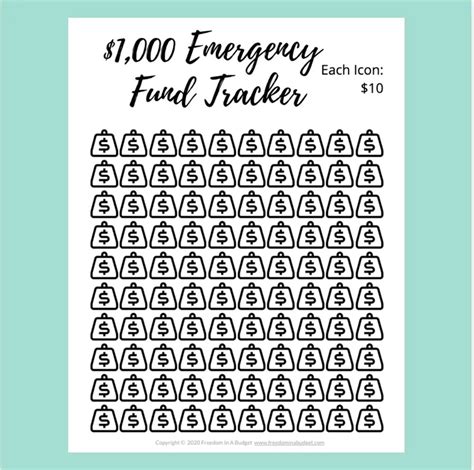

Emergency Fund Budget Template: Emphasizing the importance of having a safety net, this template focuses on building an emergency fund that can cover 3-6 months of living expenses. It's crucial for weathering financial storms, such as job loss or unexpected medical expenses.

Benefits of Using Budget Templates

The benefits of using budget templates are multifaceted, offering a range of advantages that can significantly improve one's financial situation. Some of the key benefits include: - **Improved Financial Awareness:** Budget templates provide a clear picture of income and expenses, helping individuals understand where their money is going. - **Enhanced Budgeting Accuracy:** By systematically tracking financial data, users can make more accurate budgeting decisions, reducing the risk of financial mismanagement. - **Increased Savings:** Budget templates help in identifying areas for cost savings, enabling users to allocate more funds towards savings and investments. - **Better Debt Management:** For those with debt, budget templates can prioritize debt repayment, leading to faster debt elimination and improved credit health.Implementing Budget Templates Effectively

Implementing a budget template effectively requires commitment, discipline, and regular review. Here are some steps to ensure you get the most out of your budget template:

- Choose the Right Template: Select a template that aligns with your financial goals and complexity level. Whether you prefer a simple or detailed approach, there's a template designed to meet your needs.

- Set Realistic Goals: Your budget should reflect achievable goals, whether it's saving for a big purchase, paying off debt, or building an emergency fund. Setting realistic objectives helps in maintaining motivation and tracking progress.

- Regularly Review and Adjust: Financial situations can change, and so should your budget. Regularly reviewing your budget template and making adjustments as needed ensures that your financial plan remains relevant and effective.

Common Mistakes to Avoid

When using budget templates, there are several common mistakes that can hinder their effectiveness. Being aware of these pitfalls can help you maximize the benefits of budgeting: - **Underestimating Expenses:** Failing to account for all expenses, including occasional or seasonal costs, can lead to budgeting shortfalls. - **Not Accounting for Inflation:** Inflation can erode the purchasing power of your money over time. Failing to adjust your budget for inflation can impact your long-term financial goals. - **Lack of Emergency Funding:** Not prioritizing an emergency fund can leave you vulnerable to financial shocks, such as car repairs or medical bills.Conclusion and Next Steps

In conclusion, budget templates are powerful tools for achieving financial stability and success. By selecting the right template and using it consistently, individuals can better manage their finances, reduce debt, and work towards their long-term goals. Whether you're a beginner looking for a simple budgeting solution or an experienced investor seeking to optimize your financial plan, there's a budget template available to meet your needs.

For those looking to take their financial planning to the next level, consider exploring additional resources such as financial planning books, online courses, or consulting with a financial advisor. Remember, budgeting is a journey, and it's okay to start small and evolve your approach as your financial literacy and goals change.

Final Thoughts

Budgeting is not a one-size-fits-all solution; it's about finding a method that works for you and sticking to it. With the right budget template and a commitment to regular review and adjustment, you can achieve a better balance between spending and saving, ultimately securing a more stable financial future.Budget Templates Image Gallery

What is the best budget template for beginners?

+The best budget template for beginners is often one that is simple and easy to understand, such as the 50/30/20 budget template. This template allocates 50% of the income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

How do I choose the right budget template for my needs?

+Choosing the right budget template involves considering your financial goals, the complexity level you're comfortable with, and your specific financial situation. For example, if you're trying to pay off debt, a debt repayment budget template might be the most suitable.

Can budget templates help with investment planning?

+Yes, budget templates can help with investment planning. Investment budget templates are designed to integrate investment strategies into your financial plan, helping you allocate funds for investments and track investment income effectively.

We hope this comprehensive guide to budget templates has provided you with the insights and tools needed to take control of your finances. Whether you're just starting out or looking to refine your financial strategy, remember that budgeting is a flexible and ongoing process. By staying committed to your financial goals and regularly reviewing your budget, you can achieve financial stability and success. Share your experiences with budget templates in the comments below, and don't hesitate to reach out if you have any questions or need further guidance on your financial journey.