Intro

Discover the 5 ways a balance sheet reveals a companys financial health, including asset management, liability tracking, and equity analysis, to make informed decisions with financial reporting and accounting insights.

The balance sheet is a crucial financial statement that provides a snapshot of a company's financial position at a specific point in time. It is a powerful tool that helps investors, creditors, and other stakeholders assess a company's financial health and make informed decisions. A well-structured balance sheet can help businesses identify areas of strength and weakness, make informed decisions, and achieve their goals. In this article, we will explore 5 ways to balance sheet and how it can benefit your business.

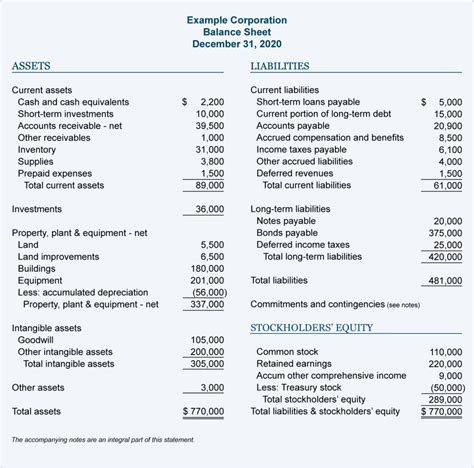

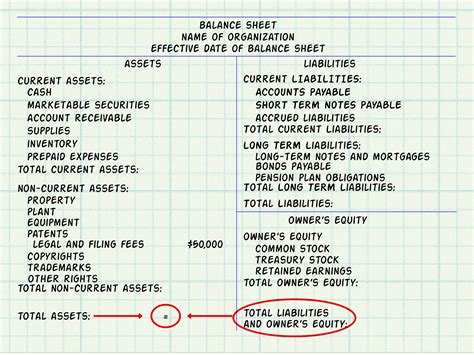

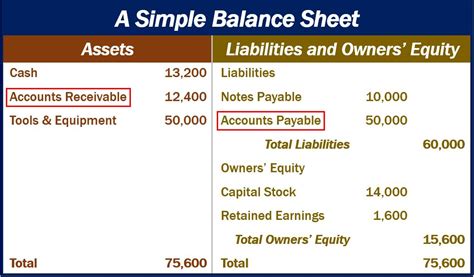

A balance sheet is typically divided into three main categories: assets, liabilities, and equity. Assets represent the resources owned or controlled by the company, such as cash, inventory, and property. Liabilities represent the company's debts or obligations, such as loans and accounts payable. Equity represents the company's net worth, which is the difference between its assets and liabilities. Understanding the balance sheet and its components is essential for making informed decisions and achieving financial success.

The balance sheet is an essential tool for businesses of all sizes and industries. It provides a comprehensive picture of a company's financial position, which can be used to identify areas of strength and weakness, make informed decisions, and achieve financial goals. A well-structured balance sheet can help businesses manage their finances effectively, make informed decisions, and achieve long-term success.

Understanding the Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It is typically divided into three main categories: assets, liabilities, and equity. Assets represent the resources owned or controlled by the company, such as cash, inventory, and property. Liabilities represent the company's debts or obligations, such as loans and accounts payable. Equity represents the company's net worth, which is the difference between its assets and liabilities.

To understand the balance sheet, it is essential to familiarize yourself with its components and how they are calculated. The balance sheet equation is Assets = Liabilities + Equity. This equation means that a company's assets are equal to its liabilities plus its equity. The balance sheet is typically prepared at the end of an accounting period, such as a month, quarter, or year.

Components of the Balance Sheet

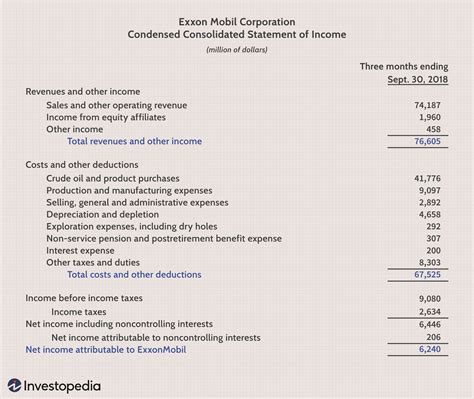

The balance sheet has several components, including: * Assets: These are the resources owned or controlled by the company, such as cash, inventory, and property. * Liabilities: These are the company's debts or obligations, such as loans and accounts payable. * Equity: This represents the company's net worth, which is the difference between its assets and liabilities. * Revenue: This is the income earned by the company from its operations. * Expenses: These are the costs incurred by the company to generate revenue.Importance of the Balance Sheet

The balance sheet is an essential tool for businesses of all sizes and industries. It provides a comprehensive picture of a company's financial position, which can be used to identify areas of strength and weakness, make informed decisions, and achieve financial goals. A well-structured balance sheet can help businesses manage their finances effectively, make informed decisions, and achieve long-term success.

The balance sheet is also used by investors, creditors, and other stakeholders to assess a company's financial health and make informed decisions. It provides a snapshot of a company's financial position at a specific point in time, which can be used to evaluate its creditworthiness, profitability, and liquidity.

Benefits of the Balance Sheet

The balance sheet has several benefits, including: * Provides a comprehensive picture of a company's financial position * Helps businesses identify areas of strength and weakness * Enables businesses to make informed decisions * Helps businesses manage their finances effectively * Provides a snapshot of a company's financial position at a specific point in timePreparing the Balance Sheet

Preparing the balance sheet involves several steps, including:

- Identifying the company's assets, liabilities, and equity

- Calculating the company's revenue and expenses

- Classifying the company's assets, liabilities, and equity into different categories

- Preparing the balance sheet equation

- Reviewing and analyzing the balance sheet

To prepare the balance sheet, it is essential to have accurate and up-to-date financial information. This includes financial statements, such as the income statement and cash flow statement, as well as other financial data, such as accounts payable and accounts receivable.

Steps to Prepare the Balance Sheet

The steps to prepare the balance sheet are: * Identify the company's assets, liabilities, and equity * Calculate the company's revenue and expenses * Classify the company's assets, liabilities, and equity into different categories * Prepare the balance sheet equation * Review and analyze the balance sheetAnalyzing the Balance Sheet

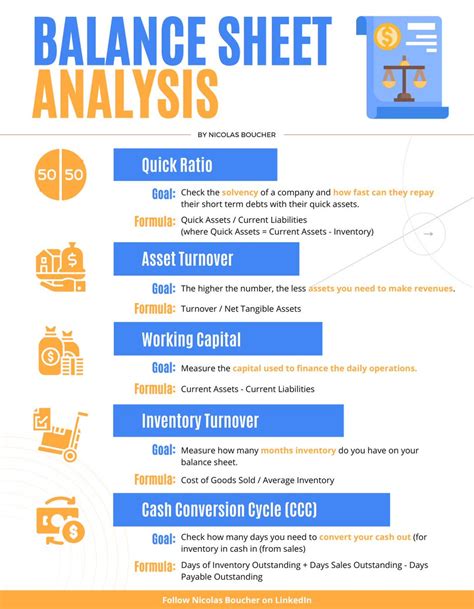

Analyzing the balance sheet involves reviewing and interpreting the financial data presented in the balance sheet. This includes evaluating the company's assets, liabilities, and equity, as well as its revenue and expenses. The balance sheet can be analyzed using various techniques, such as ratio analysis and trend analysis.

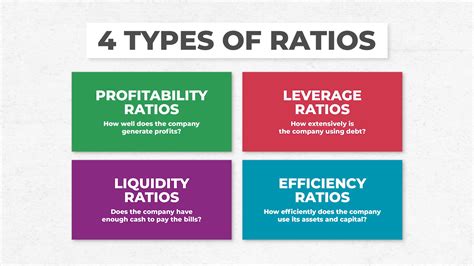

Ratio analysis involves calculating financial ratios, such as the current ratio and debt-to-equity ratio, to evaluate a company's financial performance. Trend analysis involves analyzing the company's financial data over time to identify trends and patterns.

Techniques for Analyzing the Balance Sheet

The techniques for analyzing the balance sheet include: * Ratio analysis * Trend analysis * Horizontal analysis * Vertical analysisUsing the Balance Sheet to Make Informed Decisions

The balance sheet is a powerful tool that can be used to make informed decisions. It provides a comprehensive picture of a company's financial position, which can be used to evaluate its creditworthiness, profitability, and liquidity. The balance sheet can also be used to identify areas of strength and weakness, make informed decisions, and achieve financial goals.

To use the balance sheet to make informed decisions, it is essential to review and analyze the financial data presented in the balance sheet. This includes evaluating the company's assets, liabilities, and equity, as well as its revenue and expenses.

Ways to Use the Balance Sheet

The ways to use the balance sheet include: * Evaluating a company's creditworthiness * Assessing a company's profitability * Evaluating a company's liquidity * Identifying areas of strength and weakness * Making informed decisionsBalance Sheet Image Gallery

What is the purpose of the balance sheet?

+The purpose of the balance sheet is to provide a comprehensive picture of a company's financial position at a specific point in time.

What are the components of the balance sheet?

+The components of the balance sheet include assets, liabilities, and equity.

How is the balance sheet prepared?

+The balance sheet is prepared by identifying the company's assets, liabilities, and equity, and then classifying them into different categories.

In conclusion, the balance sheet is a powerful tool that provides a comprehensive picture of a company's financial position. It is essential for businesses of all sizes and industries, and can be used to make informed decisions, identify areas of strength and weakness, and achieve financial goals. By understanding the balance sheet and its components, businesses can manage their finances effectively, make informed decisions, and achieve long-term success. We hope this article has provided you with a comprehensive understanding of the balance sheet and its importance in business. If you have any questions or comments, please feel free to share them with us.