Intro

Discover the 5 ways to utilize the 8840 form, including tax exemptions, deductions, and credits, to minimize tax liability and maximize refunds with accurate filing and compliance strategies.

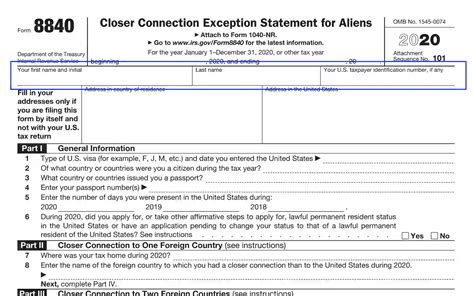

The 8840 form, also known as the Closer Connection Exception Statement for Aliens, is a crucial document for individuals who are not U.S. citizens but have earned income from sources within the United States. Filing this form correctly is essential to avoid unnecessary taxation and to claim the benefits of a reduced tax rate under certain tax treaties between the U.S. and foreign countries. Understanding the 8840 form and its implications is vital for both individuals and businesses that operate internationally.

The process of completing and filing the 8840 form can seem daunting, especially for those who are not familiar with U.S. tax laws and regulations. However, with the right guidance, it can be navigated efficiently. The key to successfully filing the 8840 form lies in understanding its purpose, the eligibility criteria, and the steps involved in the filing process. Additionally, being aware of the common pitfalls and how to avoid them can save time and resources.

For individuals who are required to file the 8840 form, it is essential to be aware of the deadlines and the penalties for late filing. The form must be filed by the due date of the individual's tax return, which is typically April 15th for most taxpayers. Failure to file the 8840 form on time can result in the loss of benefits under the tax treaties, leading to a higher tax liability.

Given the complexity of international tax laws and the specific requirements of the 8840 form, seeking professional advice is often recommended. Tax professionals can provide guidance on eligibility, help with the preparation of the form, and ensure that it is filed correctly and on time. They can also assist in navigating the tax treaties and ensuring that all necessary documentation is in order.

In the context of international taxation, the 8840 form plays a significant role in facilitating compliance with U.S. tax laws for non-resident aliens. It is a tool that helps in reducing tax liabilities and avoiding double taxation, which is a common issue in cross-border transactions. By understanding the purpose and the process of filing the 8840 form, individuals and businesses can better manage their tax obligations and take advantage of the available tax benefits.

Understanding the 8840 Form

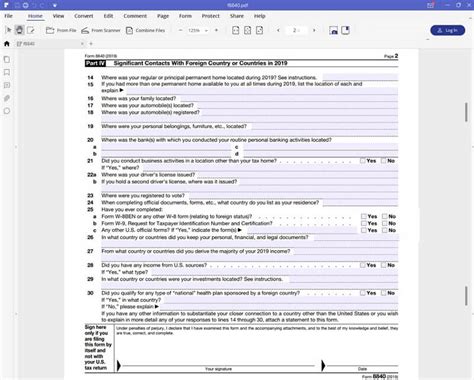

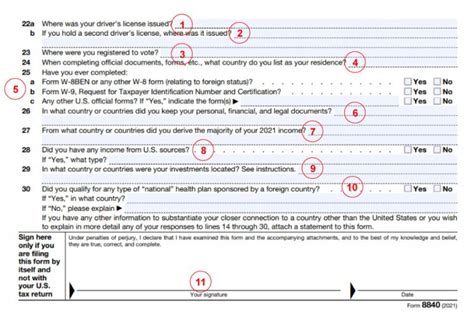

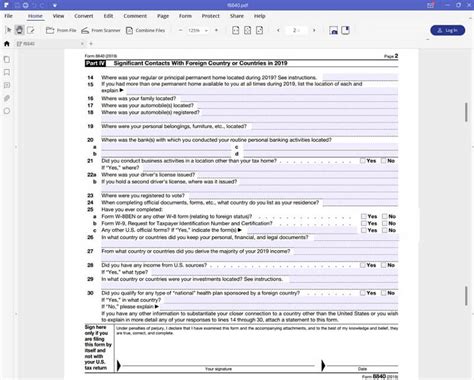

The 8840 form is used by the Internal Revenue Service (IRS) to determine whether a non-resident alien has a closer connection to the United States or to a foreign country. This determination is crucial for tax purposes, as it affects the individual's tax residency status and, consequently, their tax obligations. The form requires detailed information about the individual's ties to both the U.S. and their country of residence, including factors such as permanent home, family, and business connections.

To file the 8840 form, individuals must first determine their eligibility. Generally, the form is required for non-resident aliens who have income from U.S. sources and claim a closer connection to a foreign country. The eligibility criteria are outlined in the form's instructions and include specific requirements regarding the individual's physical presence in the U.S. and their connections to a foreign country.

Benefits of Filing the 8840 Form

Filing the 8840 form can provide several benefits to non-resident aliens, including reduced tax rates under tax treaties and avoidance of double taxation. Tax treaties between the U.S. and foreign countries are designed to alleviate the double taxation of income earned by residents of either country. By filing the 8840 form and claiming a closer connection to a foreign country, individuals can qualify for reduced tax rates or exemptions on certain types of income, such as dividends, interest, and royalties.

Another significant benefit of filing the 8840 form is the potential to reduce or eliminate withholding taxes on U.S.-source income. The U.S. generally requires withholding of taxes on certain types of income paid to non-resident aliens, such as dividends and interest. However, tax treaties can reduce or eliminate these withholding taxes if the recipient is a resident of a treaty country. By filing the 8840 form and establishing a closer connection to a treaty country, individuals can claim the benefits of reduced withholding taxes.

Steps to File the 8840 Form

The process of filing the 8840 form involves several steps, starting with determining eligibility and gathering the necessary documentation. Individuals must carefully review the instructions for the form and ensure they meet the eligibility criteria before proceeding. The form itself requires detailed information about the individual's connections to both the U.S. and their foreign country of residence, including their physical presence, family ties, and business connections.

Once the form is completed, it must be filed with the IRS by the due date of the individual's tax return. The form can be filed electronically or by mail, depending on the individual's preference and the specific requirements of their situation. It is essential to ensure that the form is filed correctly and on time to avoid any penalties or loss of benefits under tax treaties.

Common Pitfalls to Avoid

When filing the 8840 form, there are several common pitfalls that individuals should be aware of to avoid unnecessary complications. One of the most critical mistakes is failing to file the form on time. The deadline for filing the 8840 form is the same as the deadline for the individual's tax return, and late filing can result in the loss of benefits under tax treaties.

Another common mistake is incomplete or inaccurate information on the form. The 8840 form requires detailed and specific information about the individual's connections to both the U.S. and their foreign country of residence. Inaccurate or incomplete information can lead to delays in processing the form or even rejection of the claim for a closer connection to a foreign country.

Seeking Professional Advice

Given the complexity of international tax laws and the specific requirements of the 8840 form, seeking professional advice is often the best course of action. Tax professionals who specialize in international taxation can provide guidance on eligibility, help with the preparation of the form, and ensure that it is filed correctly and on time. They can also assist in navigating the tax treaties and ensuring that all necessary documentation is in order.

Professional advice can be particularly valuable for individuals who have complex tax situations, such as those with multiple sources of income or those who have lived in several countries. Tax professionals can help these individuals understand their tax obligations and ensure that they are taking advantage of all the available tax benefits.

Gallery of 8840 Form Images

8840 Form Image Gallery

Frequently Asked Questions

What is the purpose of the 8840 form?

+The 8840 form is used to determine whether a non-resident alien has a closer connection to the United States or to a foreign country for tax purposes.

Who is required to file the 8840 form?

+Non-resident aliens who have income from U.S. sources and claim a closer connection to a foreign country are generally required to file the 8840 form.

What are the benefits of filing the 8840 form?

+Filing the 8840 form can provide benefits such as reduced tax rates under tax treaties and avoidance of double taxation.

How do I file the 8840 form?

+The 8840 form can be filed electronically or by mail, and it must be filed by the due date of the individual's tax return.

Why is it important to seek professional advice when filing the 8840 form?

+Seeking professional advice can help ensure that the form is filed correctly and on time, and that all necessary documentation is in order.

In conclusion, the 8840 form is a critical document for non-resident aliens who have earned income from sources within the United States. Understanding the purpose, eligibility criteria, and benefits of filing the 8840 form is essential for navigating the complexities of international taxation. By following the steps outlined in this article and seeking professional advice when needed, individuals can ensure that they are in compliance with U.S. tax laws and taking advantage of all available tax benefits. We invite you to share your thoughts and experiences with the 8840 form in the comments below, and to share this article with anyone who may find it helpful.