Intro

Discover the 5 ways to simplify tax filing with the 1040 Sr Form, including senior tax deductions, exemptions, and credits, to minimize taxable income and maximize refunds for seniors and retirees.

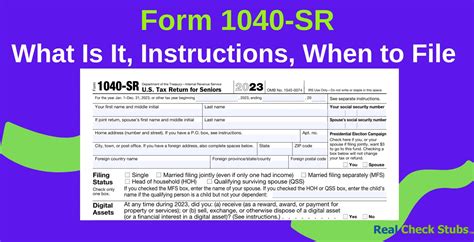

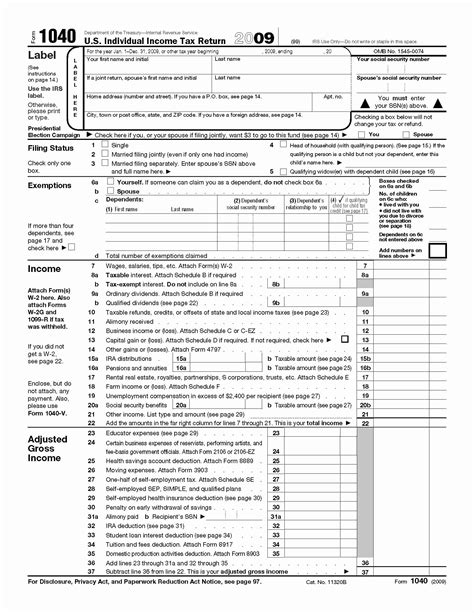

The 1040 SR form, also known as the Senior Income Tax Return, is a simplified tax return designed for seniors who are 65 or older. This form is intended to make it easier for seniors to file their taxes, as it eliminates some of the complexities found in the standard 1040 form. In this article, we will explore 5 ways the 1040 SR form can benefit seniors and provide a comprehensive guide on how to use it.

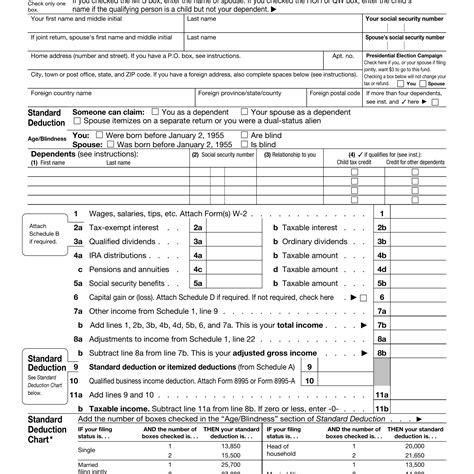

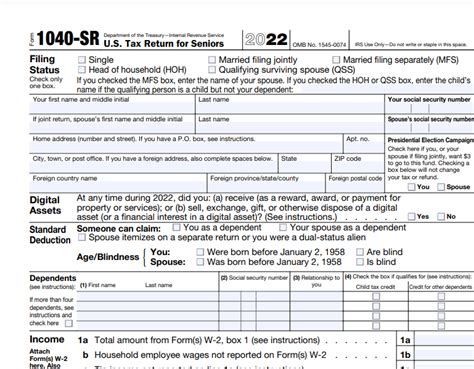

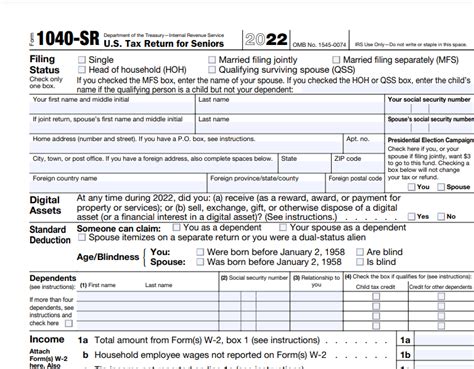

The 1040 SR form is an essential tool for seniors who want to simplify their tax filing process. By using this form, seniors can avoid the complexity of the standard 1040 form and focus on reporting their income and claiming their deductions. The 1040 SR form is also designed to be more user-friendly, with larger print and a simpler layout that makes it easier to read and understand.

One of the main benefits of the 1040 SR form is that it allows seniors to report their income from various sources, including Social Security benefits, pensions, and retirement accounts. The form also provides a simplified way to claim deductions and credits, such as the standard deduction and the credit for the elderly or disabled. By using the 1040 SR form, seniors can ensure that they are taking advantage of all the tax benefits available to them.

Introduction to the 1040 SR Form

Benefits of Using the 1040 SR Form

The 1040 SR form provides several benefits to seniors, including: * Simplified tax filing process * Larger print and simpler layout * Easy to report income from various sources * Simplified way to claim deductions and credits * Reduced risk of errors and auditsWho Can Use the 1040 SR Form

How to Determine if You Qualify to Use the 1040 SR Form

To determine if you qualify to use the 1040 SR form, you can use the following steps: 1. Check your age: You must be 65 or older to qualify to use the 1040 SR form. 2. Review your tax situation: You must have a simple tax situation to qualify to use the 1040 SR form. 3. Check your income: You must not have any self-employment income or income from a business or farm to qualify to use the 1040 SR form. 4. Check your dependents: You must not have any dependents to qualify to use the 1040 SR form.How to Complete the 1040 SR Form

Tips for Completing the 1040 SR Form

Here are some tips to help you complete the 1040 SR form: * Read the instructions carefully: The instructions for the 1040 SR form are designed to help you understand how to complete the form and claim your deductions and credits. * Use the correct forms: You will need to use the correct forms to report your income and claim your deductions and credits. * Keep accurate records: You will need to keep accurate records of your income and expenses to complete the 1040 SR form.Common Mistakes to Avoid When Completing the 1040 SR Form

How to Avoid Common Mistakes When Completing the 1040 SR Form

To avoid common mistakes when completing the 1040 SR form, you can use the following tips: 1. Read the instructions carefully: The instructions for the 1040 SR form are designed to help you understand how to complete the form and claim your deductions and credits. 2. Use the correct forms: You will need to use the correct forms to report your income and claim your deductions and credits. 3. Keep accurate records: You will need to keep accurate records of your income and expenses to complete the 1040 SR form.Conclusion and Next Steps

Final Thoughts

The 1040 SR form is an essential tool for seniors who want to simplify their tax filing process. By using this form, seniors can avoid the complexity of the standard 1040 form and focus on reporting their income and claiming their deductions. The 1040 SR form is also designed to be more user-friendly, with larger print and a simpler layout that makes it easier to read and understand.1040 SR Form Image Gallery

What is the 1040 SR form?

+The 1040 SR form is a simplified tax return designed for seniors who are 65 or older.

Who can use the 1040 SR form?

+The 1040 SR form is designed for seniors who are 65 or older and have a simple tax situation.

How do I complete the 1040 SR form?

+To complete the 1040 SR form, you will need to report your income and claim your deductions and credits.

What are the benefits of using the 1040 SR form?

+The 1040 SR form provides several benefits, including a simplified tax filing process, larger print and simpler layout, and easy to report income from various sources.

How can I avoid common mistakes when completing the 1040 SR form?

+To avoid common mistakes when completing the 1040 SR form, you can read the instructions carefully, use the correct forms, and keep accurate records.

We hope this article has provided you with a comprehensive guide to the 1040 SR form and how to use it. If you have any questions or need further assistance, please don't hesitate to comment below. We would be happy to help you navigate the tax filing process and ensure that you are taking advantage of all the tax benefits available to you. Share this article with your friends and family to help them understand the benefits of using the 1040 SR form.