Intro

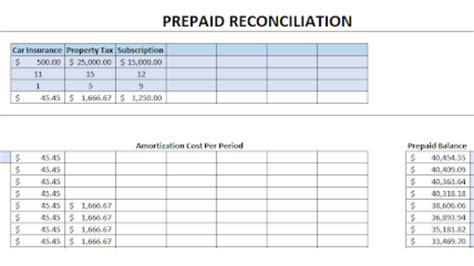

Streamline financial management with a prepaid reconciliation template in Excel, featuring 5 expert tips for accurate accounting, efficient expense tracking, and seamless payment reconciliation processes.

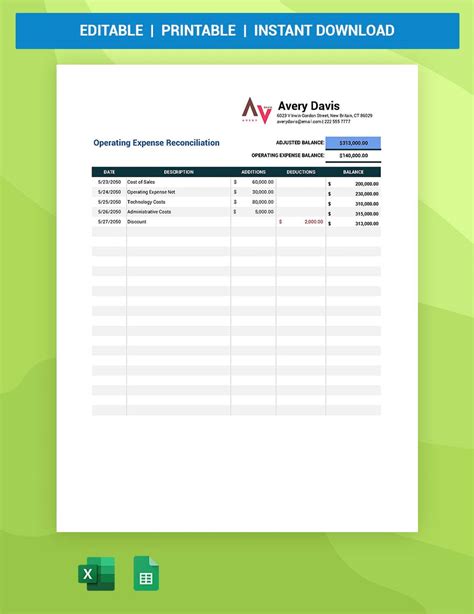

Reconciling prepaid expenses is a crucial task for businesses to ensure accurate financial reporting and compliance with accounting standards. A prepaid reconciliation template in Excel can be a valuable tool to streamline this process. In this article, we will discuss the importance of prepaid reconciliation, the benefits of using a template, and provide five tips for creating an effective prepaid reconciliation template in Excel.

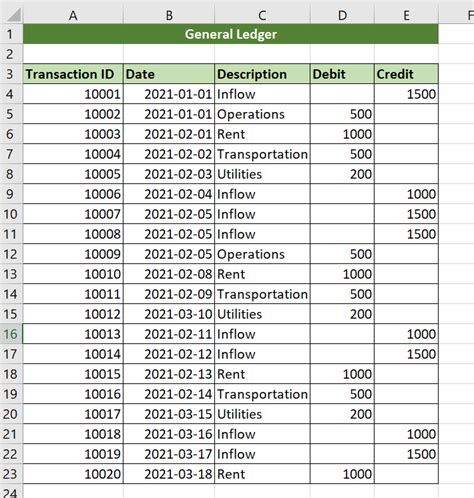

Prepaid expenses are payments made by a business for goods or services that will be received in the future. Examples of prepaid expenses include rent, insurance, and software subscriptions. Reconciling these expenses involves matching the payments made with the actual goods or services received, and adjusting the financial records accordingly. This process helps to prevent errors, ensure compliance with accounting standards, and provide accurate financial reporting.

Using a prepaid reconciliation template in Excel can simplify the reconciliation process, reduce errors, and increase efficiency. A template provides a standardized format for recording and reconciling prepaid expenses, making it easier to track and manage these expenses. Additionally, a template can be customized to meet the specific needs of a business, including the type of prepaid expenses, the frequency of reconciliation, and the level of detail required.

Here are five tips for creating an effective prepaid reconciliation template in Excel:

Tip 1: Define the Scope and Purpose of the Template

Tip 2: Set Up a Clear and Consistent Format

Tip 3: Include All Necessary Columns and Fields

Tip 4: Use Formulas and Functions to Automate Calculations

Tip 5: Test and Refine the Template

Benefits of Using a Prepaid Reconciliation Template

The benefits of using a prepaid reconciliation template include: * Improved accuracy and completeness of financial records * Increased efficiency and reduced errors * Enhanced compliance with accounting standards and regulatory requirements * Better management and tracking of prepaid expenses * Improved decision-making and financial planningCommon Challenges and Solutions

Common challenges when using a prepaid reconciliation template include: * Incomplete or inaccurate data * Difficulty matching payments with invoices * Discrepancies between payment amounts and invoice amounts * Insufficient training or support for users Solutions to these challenges include: * Providing clear instructions and training for users * Implementing data validation and error-checking procedures * Using automated matching and reconciliation tools * Establishing a clear and consistent process for managing prepaid expensesPrepaid Reconciliation Template Image Gallery

What is a prepaid reconciliation template?

+A prepaid reconciliation template is a tool used to record and reconcile prepaid expenses, ensuring accurate financial reporting and compliance with accounting standards.

How do I create a prepaid reconciliation template in Excel?

+To create a prepaid reconciliation template in Excel, define the scope and purpose of the template, set up a clear and consistent format, include all necessary columns and fields, use formulas and functions to automate calculations, and test and refine the template.

What are the benefits of using a prepaid reconciliation template?

+The benefits of using a prepaid reconciliation template include improved accuracy and completeness of financial records, increased efficiency and reduced errors, enhanced compliance with accounting standards and regulatory requirements, better management and tracking of prepaid expenses, and improved decision-making and financial planning.

How often should I reconcile my prepaid expenses?

+The frequency of reconciling prepaid expenses depends on the business and its accounting policies. It is recommended to reconcile prepaid expenses at least monthly, but it may be necessary to reconcile more frequently depending on the volume and complexity of prepaid expenses.

What are some common challenges when using a prepaid reconciliation template?

+Common challenges when using a prepaid reconciliation template include incomplete or inaccurate data, difficulty matching payments with invoices, discrepancies between payment amounts and invoice amounts, and insufficient training or support for users.

In