Intro

Master expense reconciliation with 5 easy ways, streamlining financial management, accounting, and budgeting processes, reducing errors and increasing accuracy in expense tracking and reporting.

Reconciling expenses is an essential aspect of personal and business finance, ensuring that financial records are accurate and up-to-date. It involves comparing internal financial records against external statements, such as bank statements, to identify any discrepancies or inconsistencies. Effective expense reconciliation helps in detecting fraud, preventing errors, and making informed financial decisions. In this article, we will explore the importance of reconciling expenses and provide a comprehensive guide on how to do it efficiently.

Reconciling expenses is crucial for maintaining the integrity of financial records. It helps in identifying and correcting errors, such as incorrect transactions, missing deposits, or unauthorized charges. By regularly reconciling expenses, individuals and businesses can ensure that their financial statements accurately reflect their financial position. This, in turn, enables them to make informed decisions about investments, budgeting, and financial planning. Furthermore, reconciling expenses helps in detecting fraud and preventing financial losses. By identifying suspicious transactions or discrepancies, individuals and businesses can take prompt action to prevent further losses and protect their financial assets.

The process of reconciling expenses involves several steps, including gathering financial statements, identifying transactions, and comparing records. It requires attention to detail, organizational skills, and a basic understanding of financial concepts. With the advent of technology, reconciling expenses has become more efficient and convenient. Automated tools and software can help streamline the process, reduce errors, and provide real-time updates. However, it is essential to understand the underlying principles and concepts to ensure accurate and effective expense reconciliation.

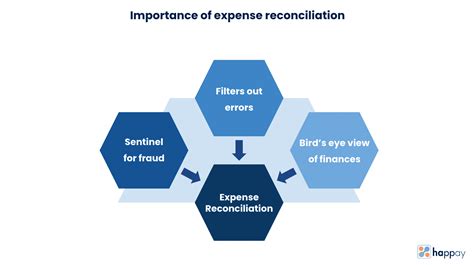

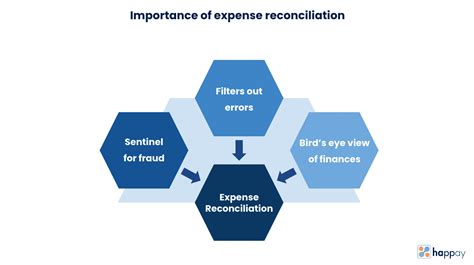

Understanding the Importance of Expense Reconciliation

Expense reconciliation is vital for maintaining accurate financial records and preventing financial losses. It helps in identifying errors, detecting fraud, and ensuring compliance with financial regulations. By reconciling expenses regularly, individuals and businesses can ensure that their financial statements accurately reflect their financial position. This, in turn, enables them to make informed decisions about investments, budgeting, and financial planning. Furthermore, expense reconciliation helps in building trust and credibility with stakeholders, such as investors, creditors, and regulatory bodies.

Benefits of Expense Reconciliation

The benefits of expense reconciliation are numerous and significant. Some of the key advantages include: * Improved financial accuracy and reliability * Enhanced fraud detection and prevention * Better financial planning and decision-making * Increased transparency and accountability * Compliance with financial regulations and standards5 Ways to Reconcile Expenses

Reconciling expenses involves several steps and techniques. Here are five ways to reconcile expenses efficiently and effectively:

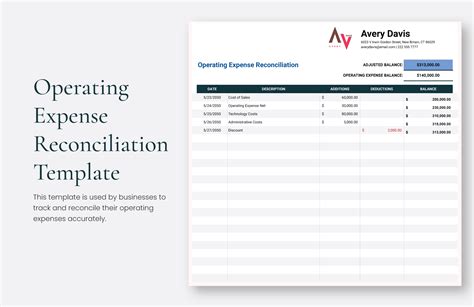

- Manual Reconciliation: This involves manually comparing internal financial records against external statements, such as bank statements. It requires attention to detail, organizational skills, and a basic understanding of financial concepts.

- Automated Reconciliation: This involves using automated tools and software to reconcile expenses. Automated reconciliation can help streamline the process, reduce errors, and provide real-time updates.

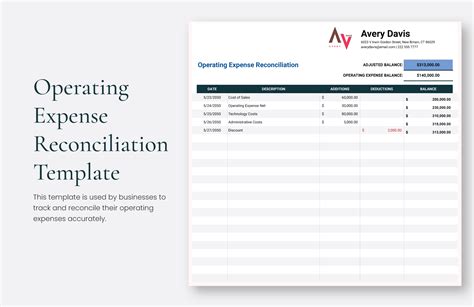

- Reconciliation Software: This involves using specialized software to reconcile expenses. Reconciliation software can help automate the process, identify discrepancies, and provide detailed reports.

- Spreadsheet Reconciliation: This involves using spreadsheets to reconcile expenses. Spreadsheet reconciliation can help organize data, identify patterns, and provide visual insights.

- Outsourced Reconciliation: This involves outsourcing the reconciliation process to a third-party provider. Outsourced reconciliation can help reduce costs, improve efficiency, and provide expertise.

Best Practices for Expense Reconciliation

To ensure effective and efficient expense reconciliation, it is essential to follow best practices. Some of the key best practices include: * Reconciling expenses regularly and consistently * Using automated tools and software to streamline the process * Maintaining accurate and up-to-date financial records * Identifying and addressing discrepancies promptly * Providing training and support to staff and stakeholdersCommon Challenges in Expense Reconciliation

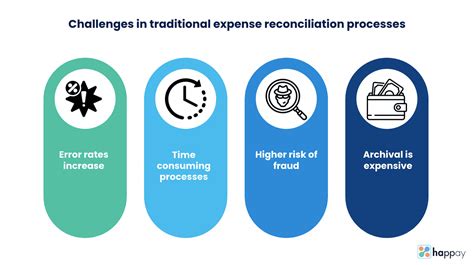

Expense reconciliation can be challenging, especially for individuals and businesses with complex financial transactions. Some of the common challenges include:

- Inaccurate or incomplete financial records

- Insufficient training and support

- Limited resources and budget

- Complexity of financial transactions

- Risk of fraud and error

Overcoming Challenges in Expense Reconciliation

To overcome challenges in expense reconciliation, it is essential to identify the root causes and develop strategies to address them. Some of the key strategies include: * Implementing automated tools and software * Providing training and support to staff and stakeholders * Maintaining accurate and up-to-date financial records * Identifying and addressing discrepancies promptly * Outsourcing the reconciliation process to a third-party providerFuture of Expense Reconciliation

The future of expense reconciliation is likely to be shaped by technological advancements, changing regulatory requirements, and evolving business needs. Some of the key trends and developments include:

- Increased use of artificial intelligence and machine learning

- Greater emphasis on automation and efficiency

- Growing demand for real-time updates and instant reconciliation

- Increased focus on security and risk management

- Greater adoption of cloud-based solutions and mobile apps

Preparing for the Future of Expense Reconciliation

To prepare for the future of expense reconciliation, it is essential to stay informed about the latest trends and developments. Some of the key strategies include: * Investing in automated tools and software * Providing training and support to staff and stakeholders * Maintaining accurate and up-to-date financial records * Identifying and addressing discrepancies promptly * Outsourcing the reconciliation process to a third-party providerExpense Reconciliation Image Gallery

What is expense reconciliation?

+Expense reconciliation is the process of comparing internal financial records against external statements, such as bank statements, to identify any discrepancies or inconsistencies.

Why is expense reconciliation important?

+Expense reconciliation is important because it helps in maintaining accurate financial records, detecting fraud, and preventing financial losses.

How often should I reconcile my expenses?

+It is recommended to reconcile expenses regularly, such as monthly or quarterly, to ensure that financial records are accurate and up-to-date.

What are the benefits of automated expense reconciliation?

+The benefits of automated expense reconciliation include increased efficiency, reduced errors, and improved accuracy.

How can I overcome challenges in expense reconciliation?

+To overcome challenges in expense reconciliation, it is essential to identify the root causes and develop strategies to address them, such as implementing automated tools and software, providing training and support, and maintaining accurate and up-to-date financial records.

In conclusion, reconciling expenses is a critical aspect of personal and business finance. By understanding the importance of expense reconciliation, following best practices, and using automated tools and software, individuals and businesses can ensure accurate and efficient expense reconciliation. As technology continues to evolve, it is essential to stay informed about the latest trends and developments in expense reconciliation to prepare for the future. We hope this article has provided you with valuable insights and information on expense reconciliation. If you have any further questions or comments, please do not hesitate to share them with us.