Intro

Streamline finances with a Petty Cash Reconciliation Template, ensuring accurate cash handling, reducing discrepancies, and simplifying accounting processes with easy-to-use spreadsheets and automated tracking.

Petty cash reconciliation is an essential process for businesses to ensure that their petty cash funds are accurately accounted for and managed. Petty cash is a small amount of cash that is kept on hand for minor expenses, such as office supplies, travel expenses, and entertainment. Reconciling petty cash involves verifying that the amount of cash on hand matches the amount recorded in the company's financial records.

The importance of petty cash reconciliation cannot be overstated. It helps to prevent errors, theft, and mismanagement of company funds. By regularly reconciling petty cash, businesses can identify and address any discrepancies or irregularities, ensuring that their financial records are accurate and reliable. In this article, we will discuss the petty cash reconciliation template, its benefits, and how to use it effectively.

Reconciling petty cash is a straightforward process that involves comparing the actual cash on hand with the recorded balance. This process should be performed regularly, ideally on a monthly basis, to ensure that any discrepancies are identified and addressed promptly. The petty cash reconciliation template is a useful tool that can help businesses to streamline this process and ensure that their petty cash funds are accurately accounted for.

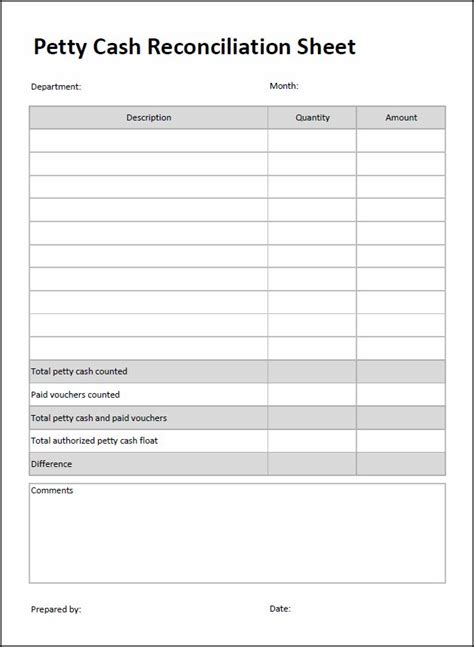

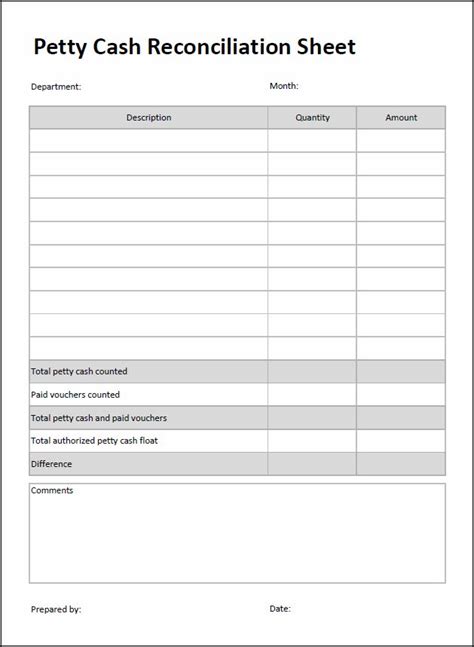

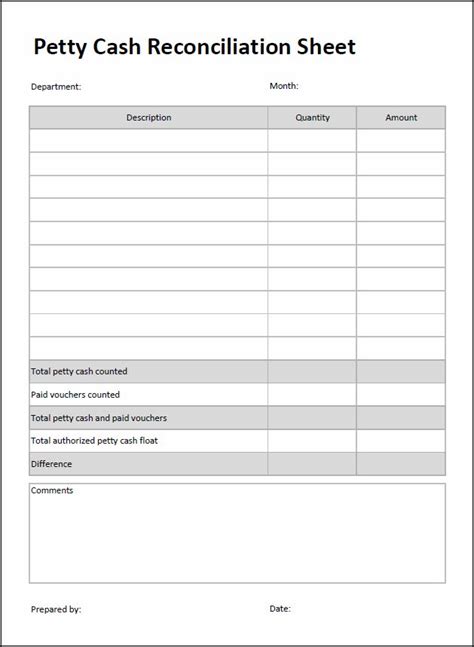

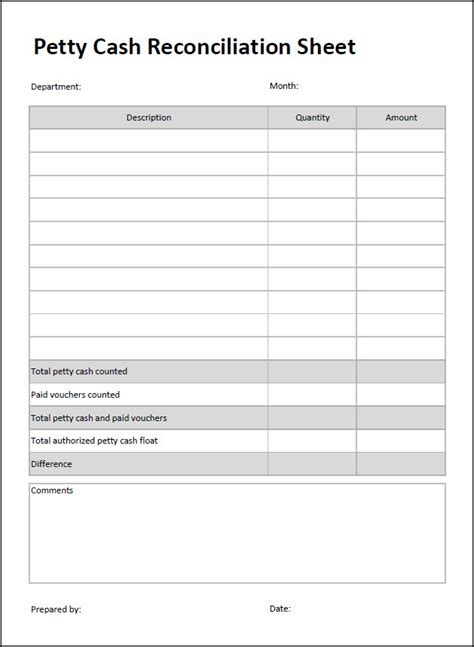

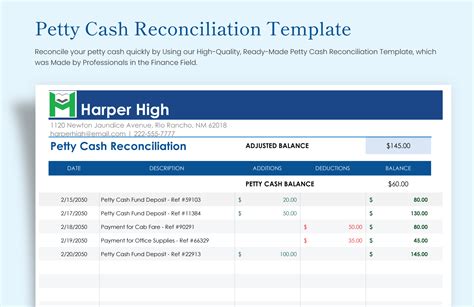

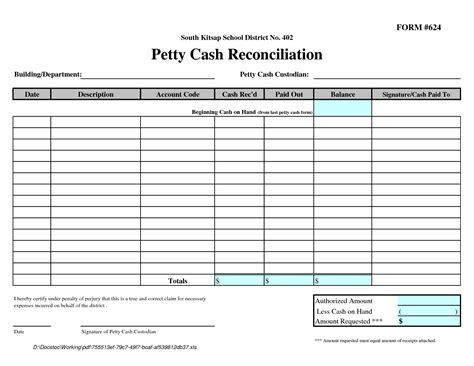

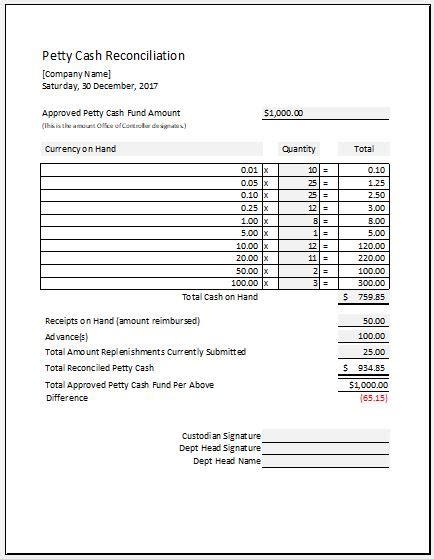

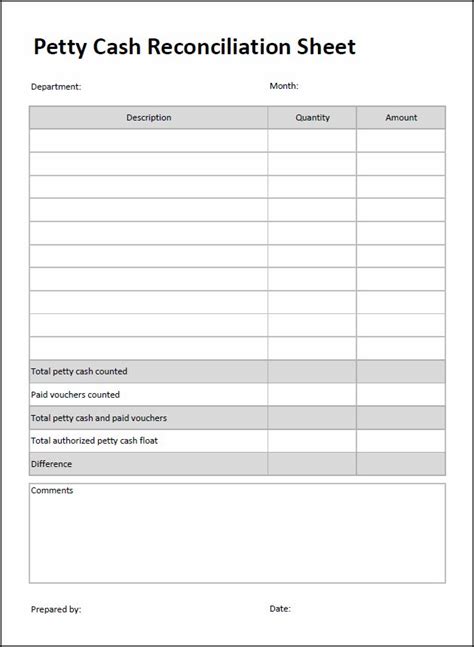

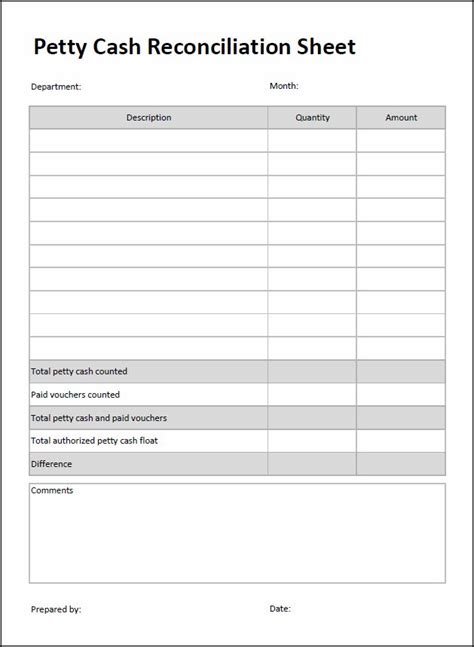

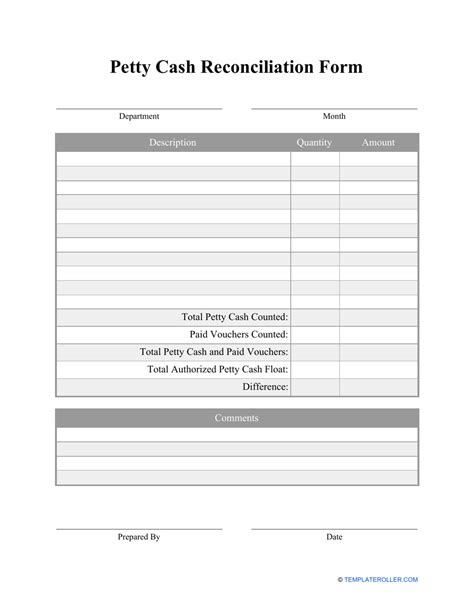

The petty cash reconciliation template typically includes the following columns: date, description, debit, credit, and balance. The date column records the date of each transaction, while the description column provides a brief description of the transaction. The debit and credit columns record the amount of each transaction, with debits representing cash outflows and credits representing cash inflows. The balance column shows the running balance of the petty cash fund.

To use the petty cash reconciliation template effectively, businesses should follow these steps:

- Record all petty cash transactions in the template, including the date, description, debit, and credit.

- Calculate the running balance of the petty cash fund by adding or subtracting each transaction from the previous balance.

- Verify that the actual cash on hand matches the recorded balance by counting the cash and comparing it to the template.

- Investigate and resolve any discrepancies or irregularities that are identified during the reconciliation process.

Benefits of Petty Cash Reconciliation Template

The petty cash reconciliation template offers several benefits to businesses, including:

- Improved accuracy: The template helps to ensure that petty cash transactions are accurately recorded and reconciled, reducing the risk of errors and discrepancies.

- Increased transparency: The template provides a clear and transparent record of all petty cash transactions, making it easier to track and manage company funds.

- Enhanced security: The template helps to prevent theft and mismanagement of company funds by providing a clear audit trail of all transactions.

- Simplified accounting: The template simplifies the accounting process by providing a standardized format for recording and reconciling petty cash transactions.

How to Create a Petty Cash Reconciliation Template

Creating a petty cash reconciliation template is a straightforward process that can be completed using a spreadsheet program such as Microsoft Excel. The template should include the following columns: * Date: This column records the date of each transaction. * Description: This column provides a brief description of each transaction. * Debit: This column records the amount of each cash outflow. * Credit: This column records the amount of each cash inflow. * Balance: This column shows the running balance of the petty cash fund.To create the template, follow these steps:

- Open a new spreadsheet and create a table with the required columns.

- Format the columns to ensure that they are wide enough to accommodate the required data.

- Add a header row to the table to provide a title for each column.

- Save the template as a spreadsheet file, such as an Excel file.

Best Practices for Petty Cash Reconciliation

To ensure that petty cash reconciliation is performed effectively, businesses should follow these best practices:

- Reconcile petty cash regularly: Petty cash should be reconciled on a regular basis, ideally monthly, to ensure that any discrepancies are identified and addressed promptly.

- Use a standardized template: A standardized template should be used to record and reconcile petty cash transactions, ensuring that all transactions are recorded consistently and accurately.

- Verify cash on hand: The actual cash on hand should be verified by counting the cash and comparing it to the recorded balance.

- Investigate discrepancies: Any discrepancies or irregularities that are identified during the reconciliation process should be investigated and resolved promptly.

Petty Cash Reconciliation Tips and Tricks

Here are some tips and tricks to help businesses to reconcile petty cash effectively: * Use a petty cash box: A petty cash box should be used to store the petty cash fund, ensuring that the cash is kept secure and separate from other company funds. * Assign a petty cash custodian: A petty cash custodian should be assigned to manage the petty cash fund, ensuring that all transactions are recorded and reconciled accurately. * Use a receipt book: A receipt book should be used to record all petty cash transactions, providing a clear audit trail of all transactions.Petty Cash Reconciliation Common Mistakes to Avoid

When reconciling petty cash, businesses should avoid the following common mistakes:

- Failing to reconcile petty cash regularly: Petty cash should be reconciled regularly to ensure that any discrepancies are identified and addressed promptly.

- Using an incorrect template: A standardized template should be used to record and reconcile petty cash transactions, ensuring that all transactions are recorded consistently and accurately.

- Failing to verify cash on hand: The actual cash on hand should be verified by counting the cash and comparing it to the recorded balance.

Petty Cash Reconciliation Tools and Resources

There are several tools and resources available to help businesses to reconcile petty cash effectively, including: * Petty cash reconciliation software: There are several software programs available that can help businesses to reconcile petty cash, including QuickBooks and Xero. * Petty cash reconciliation templates: There are several templates available that can be used to record and reconcile petty cash transactions, including Excel templates and Google Sheets templates. * Petty cash reconciliation guides: There are several guides available that can provide step-by-step instructions on how to reconcile petty cash, including guides from the American Institute of Certified Public Accountants (AICPA) and the Financial Accounting Standards Board (FASB).Gallery of Petty Cash Reconciliation Templates

Petty Cash Reconciliation Template Gallery

What is petty cash reconciliation?

+Petty cash reconciliation is the process of verifying that the actual cash on hand matches the recorded balance in the company's financial records.

Why is petty cash reconciliation important?

+Petty cash reconciliation is important because it helps to prevent errors, theft, and mismanagement of company funds.

How often should petty cash be reconciled?

+Petty cash should be reconciled on a regular basis, ideally monthly, to ensure that any discrepancies are identified and addressed promptly.

In summary, petty cash reconciliation is an essential process for businesses to ensure that their petty cash funds are accurately accounted for and managed. The petty cash reconciliation template is a useful tool that can help businesses to streamline this process and ensure that their petty cash funds are accurately accounted for. By following the best practices and tips outlined in this article, businesses can ensure that their petty cash reconciliation is performed effectively and efficiently. We encourage readers to share their experiences and tips on petty cash reconciliation in the comments below. Additionally, we invite readers to share this article with others who may benefit from learning about petty cash reconciliation. By working together, we can help to promote good financial management practices and ensure that businesses are well-equipped to manage their finances effectively.