Intro

Create custom pay stubs with Paychex pay stub template, featuring payroll details, deductions, and earnings, ideal for employee record-keeping and compliance.

The importance of pay stubs cannot be overstated, as they serve as a crucial document for both employees and employers. A pay stub, also known as a payslip, is a document that outlines the details of an employee's salary payment, including the gross pay, deductions, and net pay. For companies like Paychex, a well-structured pay stub template is essential for maintaining transparency and compliance with labor laws. In this article, we will delve into the world of pay stub templates, with a focus on Paychex pay stub templates, and explore their significance, components, and benefits.

Pay stubs are a vital tool for employees to track their earnings, deductions, and taxes. They provide a clear breakdown of the employee's compensation, helping them understand how their salary is calculated and what deductions are being made. For employers, pay stubs serve as a record of payment, ensuring that they are meeting their obligations to their employees and complying with relevant laws and regulations. With the rise of digital payroll systems, pay stub templates have become more accessible and easier to use, making it simpler for companies to manage their payroll processes.

The use of pay stub templates, such as those offered by Paychex, can streamline payroll operations and reduce errors. Paychex is a leading provider of payroll, human resource, and benefits outsourcing solutions, and their pay stub templates are designed to cater to the diverse needs of businesses. By utilizing a Paychex pay stub template, companies can ensure that their payroll processes are efficient, accurate, and compliant with relevant laws and regulations. In the following sections, we will explore the components of a Paychex pay stub template, its benefits, and how it can be used to improve payroll management.

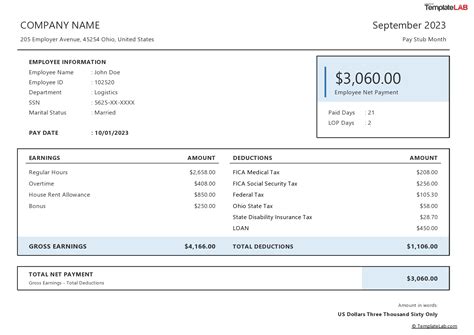

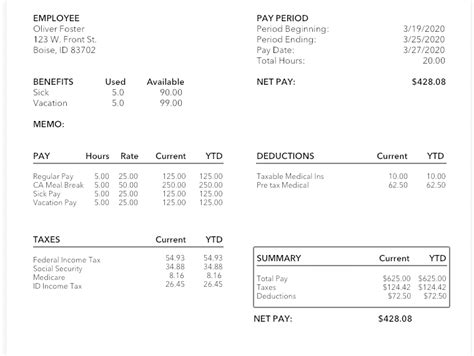

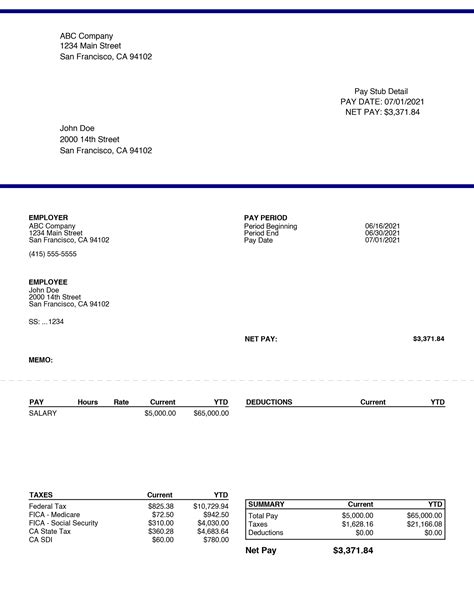

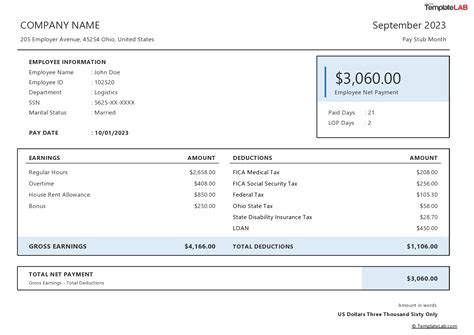

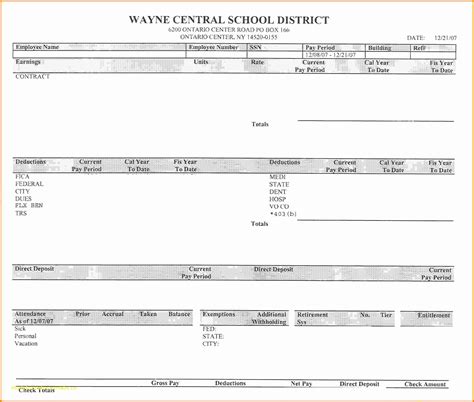

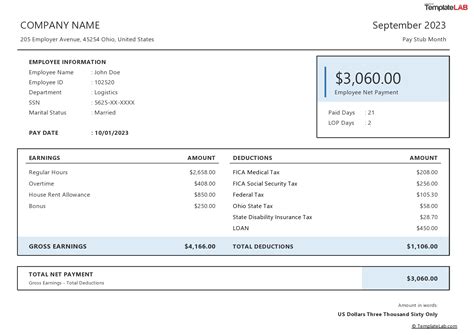

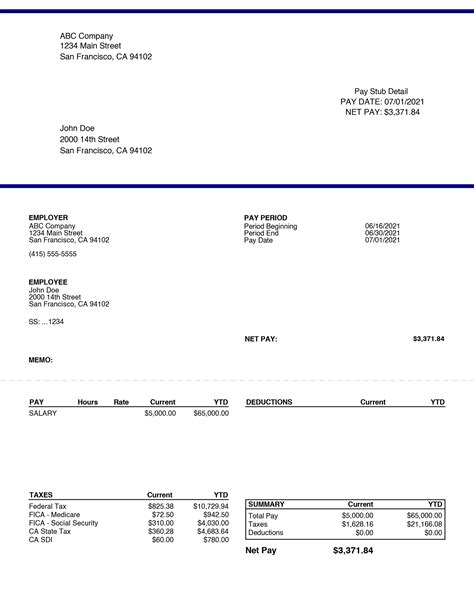

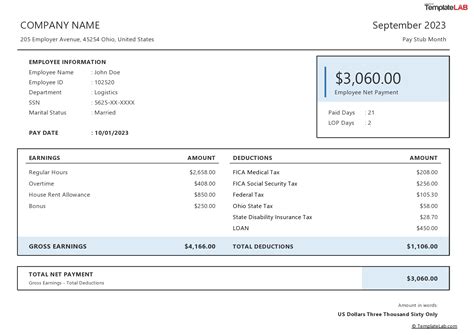

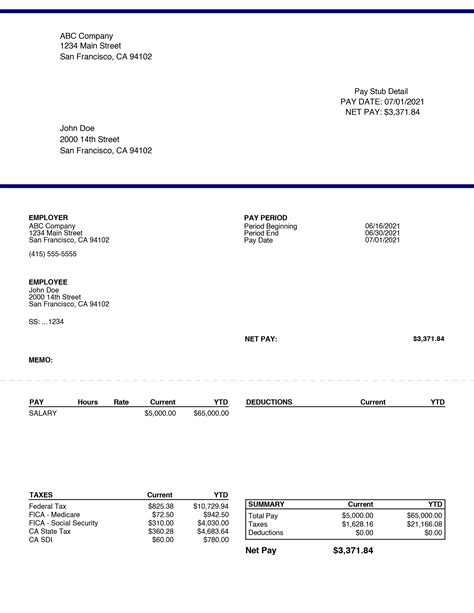

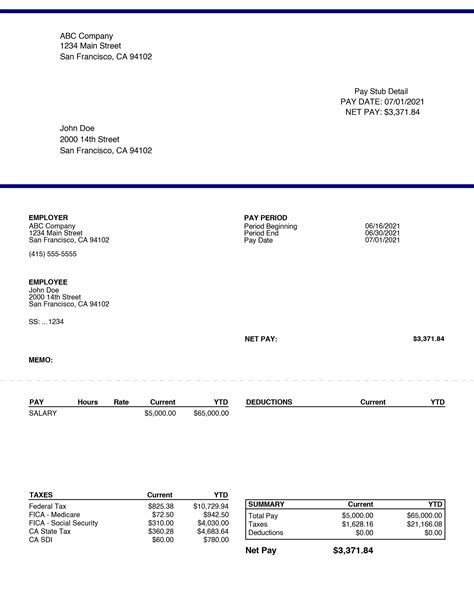

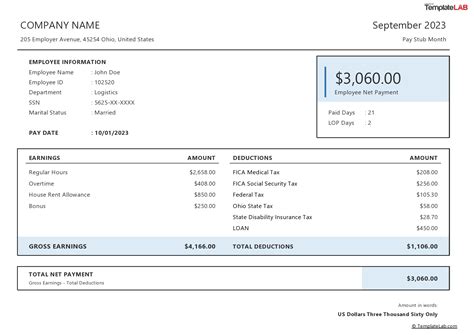

Components of a Paychex Pay Stub Template

A Paychex pay stub template typically includes the following components:

- Employee information: name, address, and employee ID number

- Pay period: the dates for which the employee is being paid

- Gross pay: the total amount earned by the employee before deductions

- Deductions: taxes, health insurance, 401(k) contributions, and other deductions

- Net pay: the amount of money the employee takes home after deductions

- Taxes: federal, state, and local taxes withheld from the employee's pay

- Benefits: details of any benefits the employee is receiving, such as health insurance or retirement plans

- Leave balances: the amount of paid time off, sick leave, or vacation time available to the employee

These components are essential for ensuring that employees are paid accurately and that employers are meeting their obligations. By using a Paychex pay stub template, companies can ensure that their payroll processes are transparent, efficient, and compliant with relevant laws and regulations.

Benefits of Using a Paychex Pay Stub Template

The benefits of using a Paychex pay stub template are numerous. Some of the advantages include:

- Improved accuracy: pay stub templates help reduce errors and ensure that employees are paid accurately

- Increased efficiency: automated pay stub templates can save time and streamline payroll processes

- Enhanced transparency: pay stub templates provide a clear breakdown of an employee's compensation, helping to build trust and transparency between employees and employers

- Compliance: pay stub templates can help employers comply with relevant laws and regulations, reducing the risk of fines and penalties

- Cost savings: automated pay stub templates can reduce the need for manual processing, saving companies time and money

By using a Paychex pay stub template, companies can improve their payroll management, reduce errors, and increase efficiency. In the following sections, we will explore how to use a Paychex pay stub template and its applications in different industries.

How to Use a Paychex Pay Stub Template

Using a Paychex pay stub template is relatively straightforward. Here are the steps to follow:

- Choose a template: select a pay stub template that meets your company's needs

- Enter employee information: add the employee's name, address, and employee ID number

- Enter pay period: specify the dates for which the employee is being paid

- Calculate gross pay: calculate the employee's gross pay based on their hourly wage or salary

- Calculate deductions: calculate any deductions, such as taxes, health insurance, or 401(k) contributions

- Calculate net pay: calculate the employee's net pay by subtracting deductions from gross pay

- Review and approve: review the pay stub for accuracy and approve it for payment

By following these steps, companies can use a Paychex pay stub template to streamline their payroll processes and improve accuracy.

Applications of Paychex Pay Stub Templates

Paychex pay stub templates have a wide range of applications across different industries. Some of the industries that can benefit from using pay stub templates include:

- Healthcare: pay stub templates can help healthcare providers manage their payroll processes and ensure compliance with relevant laws and regulations

- Finance: pay stub templates can help financial institutions manage their payroll processes and reduce errors

- Manufacturing: pay stub templates can help manufacturing companies manage their payroll processes and improve efficiency

- Retail: pay stub templates can help retail companies manage their payroll processes and reduce costs

By using a Paychex pay stub template, companies across these industries can improve their payroll management, reduce errors, and increase efficiency.

Best Practices for Using Paychex Pay Stub Templates

To get the most out of a Paychex pay stub template, companies should follow best practices, such as:

- Regularly reviewing and updating pay stub templates to ensure compliance with relevant laws and regulations

- Ensuring that pay stub templates are accurate and complete

- Providing employees with access to their pay stubs and explaining the information contained in them

- Using pay stub templates to track employee leave balances and other benefits

- Integrating pay stub templates with other payroll systems to streamline processes

By following these best practices, companies can ensure that they are using their pay stub templates effectively and efficiently.

Common Mistakes to Avoid When Using Paychex Pay Stub Templates

When using a Paychex pay stub template, companies should avoid common mistakes, such as:

- Failing to update pay stub templates regularly to reflect changes in laws and regulations

- Not providing employees with access to their pay stubs

- Not explaining the information contained in pay stubs to employees

- Not tracking employee leave balances and other benefits

- Not integrating pay stub templates with other payroll systems

By avoiding these mistakes, companies can ensure that they are using their pay stub templates effectively and efficiently.

Gallery of Pay Stub Templates

Pay Stub Template Image Gallery

What is a pay stub template?

+A pay stub template is a document that outlines the details of an employee's salary payment, including the gross pay, deductions, and net pay.

Why is a pay stub template important?

+A pay stub template is important because it provides a clear breakdown of an employee's compensation, helping to build trust and transparency between employees and employers.

How do I use a pay stub template?

+To use a pay stub template, simply enter the employee's information, pay period, gross pay, deductions, and net pay, and review the template for accuracy.

What are the benefits of using a pay stub template?

+The benefits of using a pay stub template include improved accuracy, increased efficiency, enhanced transparency, compliance, and cost savings.

Can I customize a pay stub template?

+Yes, you can customize a pay stub template to meet your company's specific needs and requirements.

In conclusion, pay stub templates are an essential tool for companies to manage their payroll processes efficiently and accurately. By using a Paychex pay stub template, companies can improve their payroll management, reduce errors, and increase efficiency. Whether you are a small business or a large corporation, a pay stub template can help you streamline your payroll processes and ensure compliance with relevant laws and regulations. We encourage you to share your thoughts and experiences with pay stub templates in the comments below and explore how you can implement them in your business to improve your payroll management.