Intro

Discover 5 ways partial balance sheet analysis boosts financial insight, leveraging accounts payable, accounts receivable, and asset management for informed decision-making and optimized cash flow management.

In the realm of accounting and financial management, understanding the components and presentation of a balance sheet is crucial for businesses and individuals alike. A balance sheet provides a snapshot of a company's financial position at a specific point in time, detailing its assets, liabilities, and equity. While a full balance sheet encompasses all these elements, there are instances where a partial balance sheet might be used, focusing on specific aspects of a company's financial situation. Here, we'll delve into five ways a partial balance sheet can be utilized, exploring its applications, benefits, and how it contributes to financial analysis and decision-making.

The importance of balance sheets, whether full or partial, cannot be overstated. They are fundamental tools for financial reporting, allowing stakeholders to assess a company's financial health, solvency, and liquidity. For investors, creditors, and management, balance sheets are indispensable for making informed decisions. Given the versatility and utility of partial balance sheets, it's essential to understand their role in financial management and analysis. This understanding not only aids in the interpretation of financial data but also in the strategic planning and operational efficiency of a business.

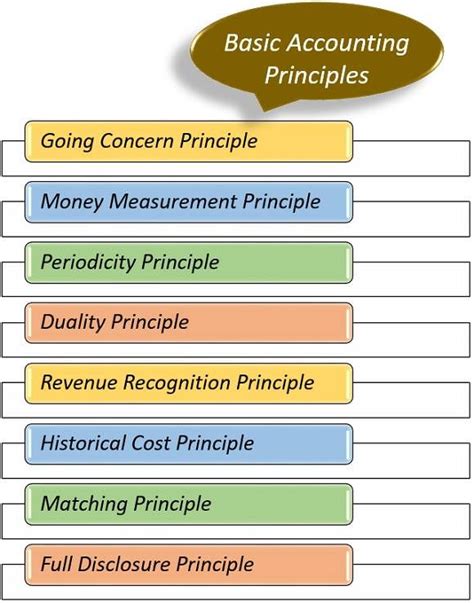

Before diving into the specifics of partial balance sheets, it's worth noting that their preparation and presentation are subject to accounting standards and regulatory requirements. The Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS) provide guidelines on the preparation of financial statements, including balance sheets. Adherence to these standards ensures consistency, comparability, and transparency in financial reporting, which are vital for stakeholders' trust and confidence in a company's financial disclosures.

Introduction to Partial Balance Sheets

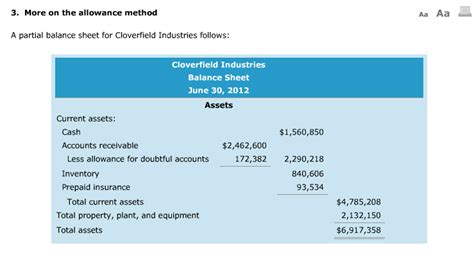

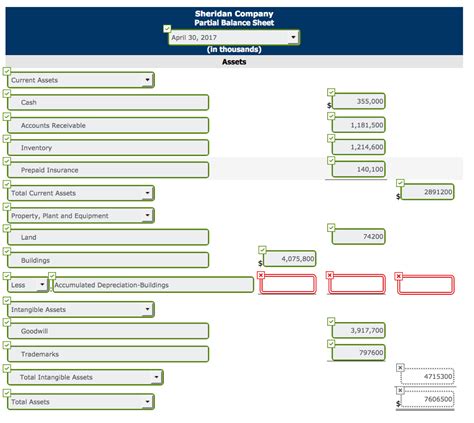

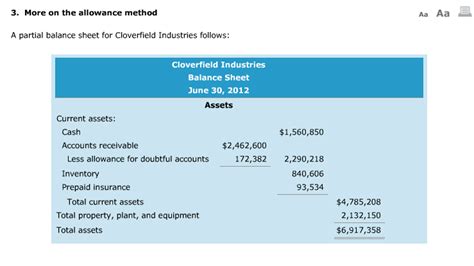

A partial balance sheet, as the name suggests, presents a portion of a company's balance sheet, focusing on specific areas of interest. This could include assets, liabilities, equity, or a combination thereof, depending on the purpose of the partial balance sheet. The decision to prepare a partial balance sheet might be driven by the need to highlight certain financial aspects, simplify complex financial information, or comply with specific regulatory requirements.

Applications of Partial Balance Sheets

Partial balance sheets have various applications in financial analysis and reporting. They can be used to:

- Highlight Specific Assets or Liabilities: For instance, a company might prepare a partial balance sheet to focus on its property, plant, and equipment (PP&E), providing detailed information on these assets without the clutter of other balance sheet items.

- Simplify Complex Financial Information: By isolating specific components of the balance sheet, stakeholders can gain a clearer understanding of a company's financial position and performance in key areas.

- Comply with Regulatory Requirements: Certain regulatory bodies may require the submission of partial balance sheets as part of financial reporting, especially for specific industries or types of transactions.

Benefits of Using Partial Balance Sheets

The use of partial balance sheets offers several benefits, including:

- Enhanced Transparency: By focusing on specific aspects of a company's financial situation, partial balance sheets can provide stakeholders with a more detailed and transparent view of the company's financial health.

- Improved Decision-Making: Stakeholders can make more informed decisions based on the detailed financial information provided in partial balance sheets.

- Simplified Financial Analysis: Partial balance sheets simplify the process of financial analysis by allowing analysts to concentrate on specific areas of interest without being overwhelmed by the complexity of a full balance sheet.

Preparing a Partial Balance Sheet

Preparing a partial balance sheet involves several steps:

- Identify the Purpose: Determine the reason for preparing the partial balance sheet, as this will guide the selection of items to include.

- Select Relevant Items: Choose the assets, liabilities, and equity components that are relevant to the purpose identified.

- Ensure Compliance: Verify that the preparation and presentation of the partial balance sheet comply with relevant accounting standards and regulatory requirements.

- Present Clearly: Ensure that the partial balance sheet is presented in a clear and understandable manner, with appropriate headings and subheadings.

Analysis and Interpretation of Partial Balance Sheets

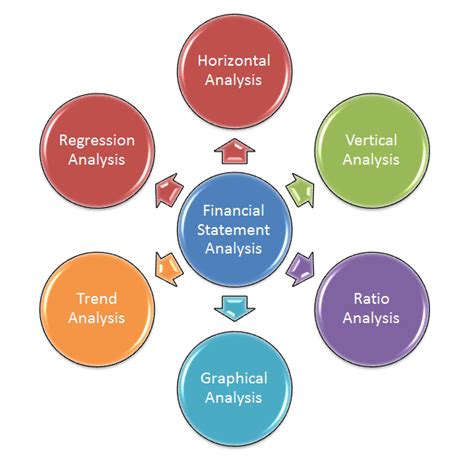

Analyzing and interpreting partial balance sheets require careful consideration of the items included and the context in which they are presented. Key aspects to focus on include:

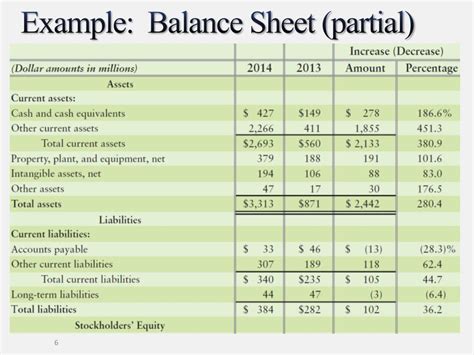

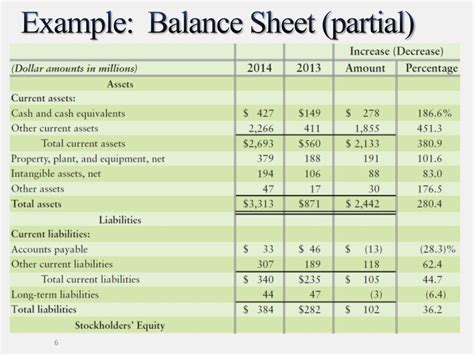

- Trends and Changes: Identify any trends or changes in the items presented on the partial balance sheet over time.

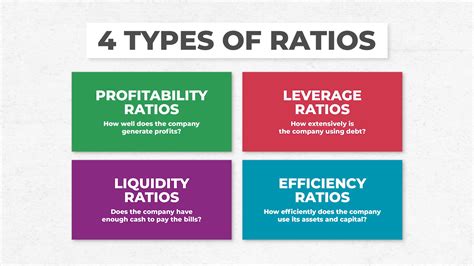

- Ratios and Metrics: Calculate relevant financial ratios and metrics based on the information provided in the partial balance sheet.

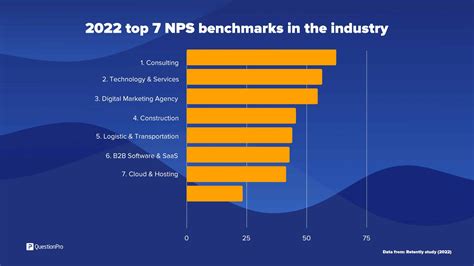

- Comparison: Compare the information presented in the partial balance sheet with that of similar companies or industry benchmarks.

Conclusion and Next Steps

In conclusion, partial balance sheets are valuable tools in financial reporting and analysis, offering a focused view of a company's financial position and performance. By understanding the applications, benefits, and preparation of partial balance sheets, stakeholders can leverage these financial statements to make informed decisions. As financial markets and regulatory environments continue to evolve, the importance of partial balance sheets in providing transparency, simplicity, and relevance in financial reporting will only continue to grow.

Gallery of Partial Balance Sheets

Partial Balance Sheets Image Gallery

What is the primary purpose of a partial balance sheet?

+

The primary purpose of a partial balance sheet is to provide a focused view of specific aspects of a company's financial position and performance, such as certain assets, liabilities, or equity components.

How do partial balance sheets contribute to financial analysis?

+

Partial balance sheets contribute to financial analysis by allowing for a detailed examination of specific financial components, facilitating the calculation of relevant financial ratios and metrics, and enabling comparisons with industry benchmarks.

What are the benefits of using partial balance sheets in financial reporting?

+

The benefits include enhanced transparency, improved decision-making, and simplified financial analysis, as they provide stakeholders with a clear and detailed view of specific financial aspects without the complexity of a full balance sheet.

What is the primary purpose of a partial balance sheet?

+The primary purpose of a partial balance sheet is to provide a focused view of specific aspects of a company's financial position and performance, such as certain assets, liabilities, or equity components.

How do partial balance sheets contribute to financial analysis?

+Partial balance sheets contribute to financial analysis by allowing for a detailed examination of specific financial components, facilitating the calculation of relevant financial ratios and metrics, and enabling comparisons with industry benchmarks.

What are the benefits of using partial balance sheets in financial reporting?

+The benefits include enhanced transparency, improved decision-making, and simplified financial analysis, as they provide stakeholders with a clear and detailed view of specific financial aspects without the complexity of a full balance sheet.

We invite you to share your thoughts and experiences with partial balance sheets in the comments below. Whether you're a financial analyst, an investor, or a business owner, your insights can help others understand the value and applications of partial balance sheets in financial management and decision-making. Feel free to share this article with your network to facilitate a broader discussion on the role of partial balance sheets in enhancing financial transparency and analysis.