Intro

Discover 5 essential LLC agreement tips for a solid operating foundation, including management structures, ownership percentages, and tax obligations, to ensure a successful limited liability company with effective governance and protection.

When forming a Limited Liability Company (LLC), one of the most crucial documents to create is the LLC agreement, also known as the operating agreement. This document outlines the ownership, management, and operational structure of the company, providing a framework for decision-making and dispute resolution. A well-crafted LLC agreement can help prevent misunderstandings and ensure the smooth operation of the business. In this article, we will explore five essential LLC agreement tips to consider when forming your company.

The importance of having a comprehensive LLC agreement cannot be overstated. It serves as a roadmap for the company, outlining the roles and responsibilities of each member, the distribution of profits and losses, and the procedures for making important decisions. A good LLC agreement can also help protect the personal assets of the members by establishing a clear separation between the business and individual finances. Furthermore, it can provide a mechanism for resolving disputes and addressing potential issues that may arise during the life of the company.

In addition to its practical applications, an LLC agreement can also provide tax benefits and flexibility in management structure. By outlining the ownership and management structure of the company, the agreement can help establish the company's tax status and ensure that it is treated as a pass-through entity for tax purposes. This can help reduce the company's tax liability and provide more flexibility in terms of management and ownership. With these benefits in mind, let's dive into the five essential LLC agreement tips to consider when forming your company.

Define Ownership and Membership Structure

- Define the different types of membership, such as voting and non-voting members

- Outline the ownership percentage for each member

- Specify the roles and responsibilities of each member

- Establish the voting rights and procedures for making decisions

Establish Management and Decision-Making Processes

- Define the management structure, such as member-managed or manager-managed

- Outline the roles and responsibilities of managers and members

- Establish the decision-making process, including voting procedures and quorum requirements

- Specify the procedures for resolving disputes and addressing conflicts

Outline Financial Provisions and Distributions

- Define the allocation of profits and losses among members

- Outline the distribution of assets upon dissolution or withdrawal of a member

- Specify the payment of expenses, including taxes and operating costs

- Establish the procedures for accounting and financial reporting

Address Dispute Resolution and Conflict Management

- Define the procedures for dispute resolution, including mediation and arbitration

- Specify the procedures for addressing conflicts, including voting procedures and quorum requirements

- Establish the procedures for resolving deadlocks and impasses

- Outline the consequences of failing to resolve disputes or conflicts

Include Provisions for Amendments and Termination

- Define the procedures for amending the agreement, including voting procedures and quorum requirements

- Specify the procedures for dissolving the company, including the distribution of assets and payment of expenses

- Establish the procedures for winding up operations, including the sale of assets and payment of debts

- Outline the consequences of failing to comply with the provisions for amendments and termination

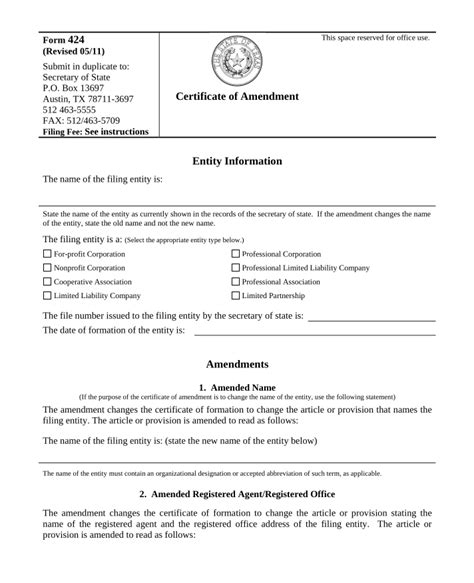

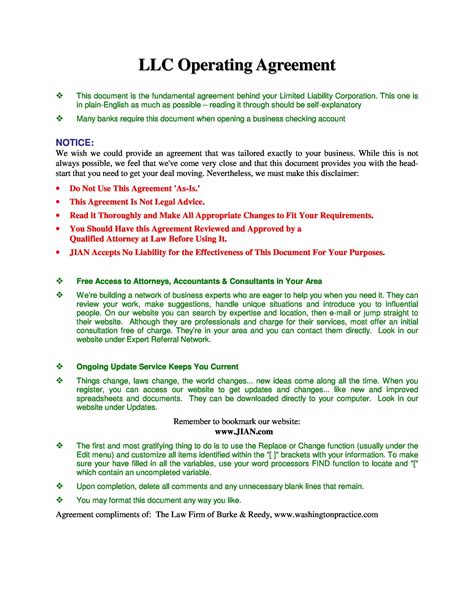

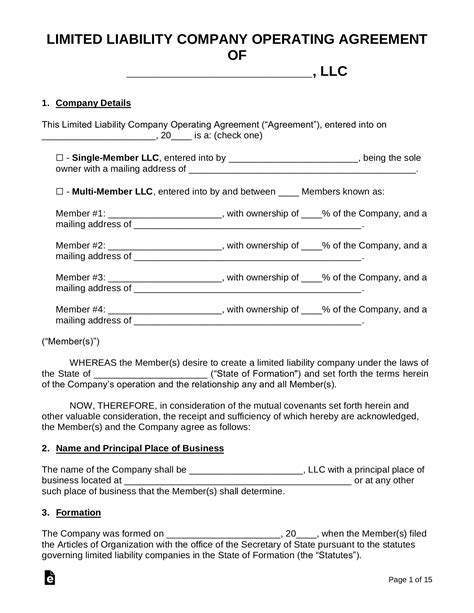

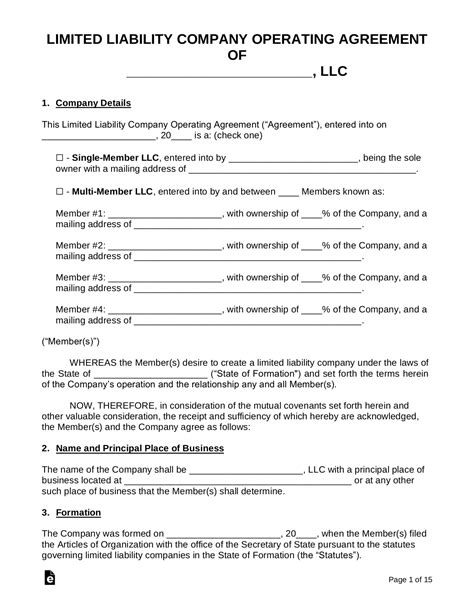

Gallery of LLC Agreement Templates

LLC Agreement Templates Image Gallery

What is an LLC agreement, and why is it important?

+An LLC agreement, also known as an operating agreement, is a document that outlines the ownership, management, and operational structure of a Limited Liability Company (LLC). It is essential for establishing a clear framework for decision-making, dispute resolution, and financial management, and for protecting the personal assets of the members.

What should be included in an LLC agreement?

+An LLC agreement should include provisions for ownership and membership structure, management and decision-making processes, financial provisions and distributions, dispute resolution and conflict management, and amendments and termination. It should also outline the roles and responsibilities of each member, the voting procedures, and the procedures for resolving disputes and addressing conflicts.

How can I create an LLC agreement?

+You can create an LLC agreement by working with an attorney or using an online template. It's essential to tailor the agreement to your specific business needs and to ensure that it complies with the laws and regulations of your state. You should also review and update the agreement regularly to reflect changes in your business or membership structure.

What are the consequences of not having an LLC agreement?

+Not having an LLC agreement can lead to disputes and conflicts among members, and can also expose the personal assets of the members to risk. It can also lead to uncertainty and confusion about the management and decision-making processes, and can make it difficult to resolve disputes or address conflicts. In addition, not having an LLC agreement can lead to tax and financial complications, and can also affect the credibility and reputation of the business.

Can I amend an LLC agreement?

+Yes, you can amend an LLC agreement. The process for amending an LLC agreement typically involves proposing the amendment, voting on the amendment, and updating the agreement. It's essential to follow the procedures outlined in the agreement and to ensure that the amendment complies with the laws and regulations of your state. You should also review and update the agreement regularly to reflect changes in your business or membership structure.

In conclusion, creating a comprehensive LLC agreement is essential for establishing a clear framework for decision-making, dispute resolution, and financial management, and for protecting the personal assets of the members. By following the five essential LLC agreement tips outlined in this article, you can create an effective agreement that meets the needs of your business and helps you achieve your goals. Remember to review and update the agreement regularly to reflect changes in your business or membership structure, and to ensure that it complies with the laws and regulations of your state. If you have any questions or need further guidance, don't hesitate to reach out to a qualified attorney or business advisor. Share your thoughts and experiences with LLC agreements in the comments below, and don't forget to share this article with your friends and colleagues who may be interested in learning more about LLC agreements.