Intro

Discover 5 ways NPV calculator boosts investment decisions with net present value analysis, cash flow forecasting, and ROI evaluation, streamlining financial planning and portfolio management.

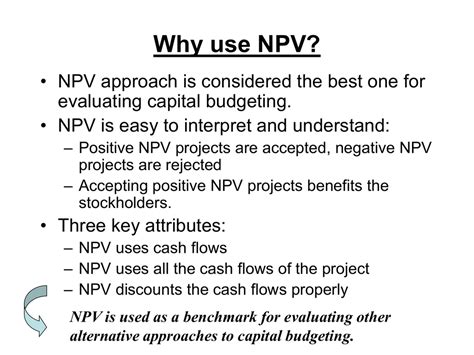

The Net Present Value (NPV) calculator is a vital tool in the world of finance and investing, allowing individuals and businesses to assess the potential profitability of a project or investment by calculating the difference between the present value of cash inflows and the present value of cash outflows. Understanding how to use an NPV calculator effectively can significantly enhance decision-making processes. Here are 5 ways an NPV calculator can be utilized, along with explanations of its benefits and working mechanisms.

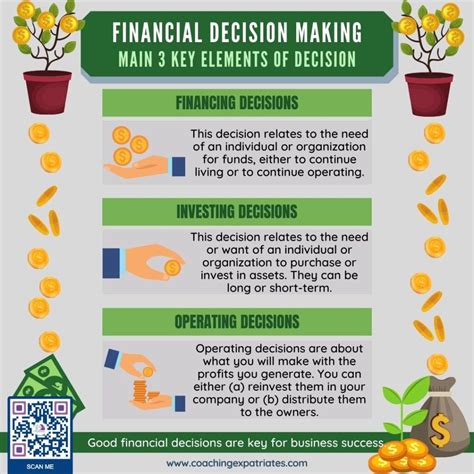

The importance of NPV calculators lies in their ability to provide a clear, quantitative analysis of investment opportunities. By considering the time value of money, NPV calculations help investors and businesses understand whether a project is likely to generate a return greater than the cost of capital. This insight is crucial for making informed decisions that can impact the financial health and growth of an organization.

In today's fast-paced business environment, having the right tools to evaluate investment opportunities quickly and accurately is paramount. The NPV calculator stands out as a key instrument in this regard, offering a straightforward method to assess the viability of projects. Its application spans various sectors, from real estate investments to corporate expansion projects, underscoring its versatility and utility.

Introduction to NPV Calculators

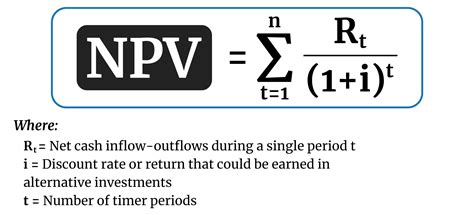

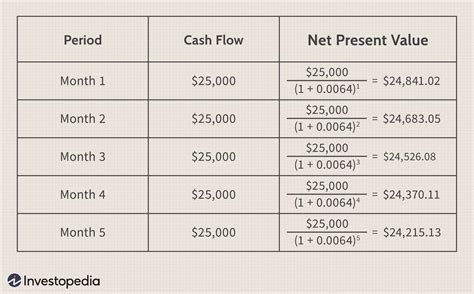

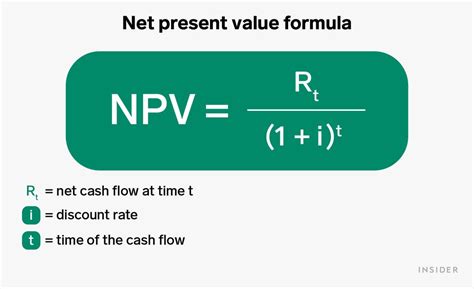

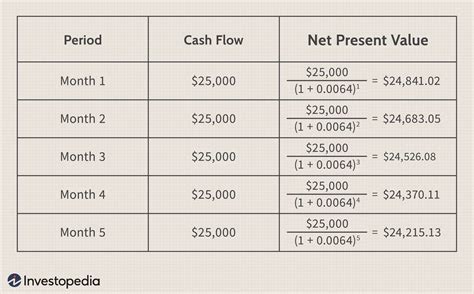

An NPV calculator works by discounting future cash flows to their present value using a discount rate, which reflects the cost of capital or the expected return on alternative investments. The formula for NPV is NPV = ∑ (CFt / (1 + r)^t), where CFt is the cash flow at time t, r is the discount rate, and t is the time period. This calculation provides a snapshot of the investment's potential, helping decision-makers to compare different projects and choose the ones that are most likely to yield positive returns.

Benefits of Using NPV Calculators

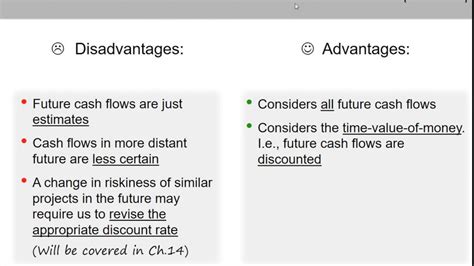

The benefits of using NPV calculators are multifaceted. They offer a standardized method for evaluating investments, allowing for easier comparison between different projects. Additionally, NPV calculations take into account the time value of money, providing a more realistic view of an investment's potential return than methods that do not consider this factor.Understanding NPV Calculator Components

To effectively use an NPV calculator, it's essential to understand its components. These include the initial investment, future cash flows, the discount rate, and the time period of the investment. Each of these elements plays a crucial role in the NPV calculation, and small changes can significantly impact the result.

Steps to Use an NPV Calculator

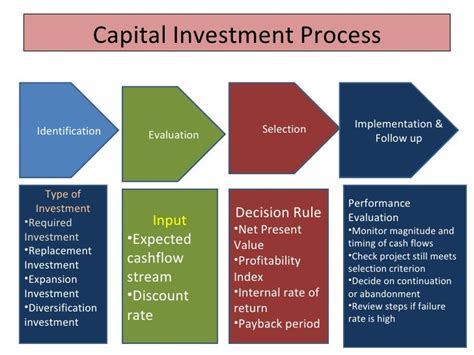

Using an NPV calculator involves several steps: 1. **Determine the Initial Investment**: This is the amount of money required to start the project or investment. 2. **Estimate Future Cash Flows**: These are the inflows of cash that the project is expected to generate over its lifespan. 3. **Choose a Discount Rate**: This rate reflects the cost of capital or the expected return on alternative investments. 4. **Specify the Time Period**: This is the duration over which the investment will generate cash flows. 5. **Calculate the NPV**: Plug the values into the NPV formula or use an NPV calculator tool to find the result.Practical Applications of NPV Calculators

NPV calculators have numerous practical applications across various industries. They are used in evaluating real estate investments, assessing the viability of business expansion plans, and comparing different investment opportunities. For instance, a company considering two different projects can use NPV calculations to determine which project is likely to provide the higher return on investment.

Real-World Examples of NPV Calculator Use

- **Investing in Stocks**: An investor can use an NPV calculator to evaluate the potential return on a stock purchase by estimating future dividend payments and capital appreciation. - **Business Expansion**: A company can calculate the NPV of expanding into a new market by considering the initial investment, projected revenue, and costs. - **Real Estate**: Investors can assess the profitability of a real estate investment by calculating the NPV of future rental income and potential resale value.Limitations and Considerations of NPV Calculators

While NPV calculators are powerful tools, they also have limitations. The accuracy of the NPV calculation depends on the accuracy of the inputs, particularly the discount rate and future cash flows. Additionally, NPV does not account for risk, which can be a significant factor in investment decisions. Therefore, it's essential to consider these limitations when interpreting NPV results.

Risk Assessment in NPV Calculations

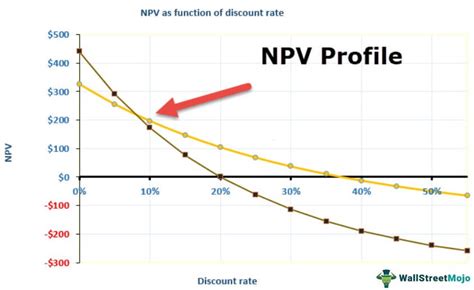

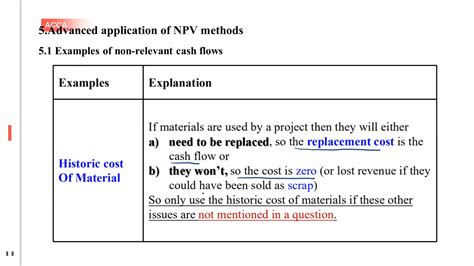

Risk assessment is a critical aspect of investment analysis that is not directly accounted for in NPV calculations. Investors can adjust the discount rate to reflect the perceived risk of an investment, with riskier investments requiring a higher discount rate. However, this method has its limitations, and other risk assessment tools, such as sensitivity analysis and scenario planning, may also be necessary.Advanced Uses of NPV Calculators

Beyond basic investment analysis, NPV calculators can be used in more advanced contexts, such as evaluating the impact of different financing options on a project's NPV or assessing the value of intangible assets. These advanced applications require a deeper understanding of financial principles and the ability to adapt the NPV calculation to unique scenarios.

Integrating NPV with Other Financial Tools

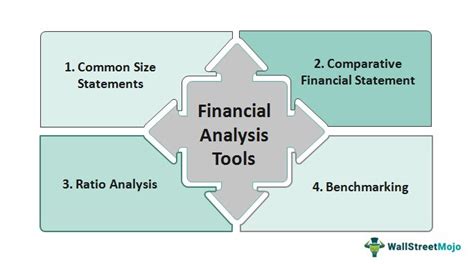

NPV calculations can be integrated with other financial tools, such as the Internal Rate of Return (IRR) and the Payback Period, to provide a comprehensive view of an investment's potential. This integrated approach allows for a more nuanced understanding of the investment's strengths and weaknesses.Future of NPV Calculators

The future of NPV calculators is likely to involve increased sophistication and accessibility. With advancements in technology, NPV calculators will become more integrated into financial planning software and more accessible to a wider range of users. Additionally, there may be developments in how risk and uncertainty are incorporated into NPV calculations, leading to more accurate and reliable investment analyses.

Evolving Role of Technology in NPV Calculations

Technology plays a significant role in the evolution of NPV calculators, from simple spreadsheet templates to complex financial modeling software. As technology advances, we can expect to see more automated and user-friendly NPV calculation tools that can handle complex scenarios and provide instant results.NPV Calculator Image Gallery

What is the main purpose of an NPV calculator?

+The main purpose of an NPV calculator is to evaluate the potential profitability of a project or investment by calculating the difference between the present value of cash inflows and the present value of cash outflows.

How does the NPV calculator account for the time value of money?

+The NPV calculator accounts for the time value of money by using a discount rate to discount future cash flows to their present value. This process reflects the fact that money received today is worth more than the same amount received in the future.

What are some limitations of using NPV calculators for investment decisions?

+Some limitations of using NPV calculators include the sensitivity of the calculation to the accuracy of the inputs, particularly the discount rate and future cash flows, and the inability to directly account for risk. Additionally, NPV calculations may not capture all aspects of an investment's potential, such as intangible benefits.

In conclusion, NPV calculators are indispensable tools for investment analysis, offering a systematic approach to evaluating the potential return on investment. By understanding how to use these calculators effectively and being aware of their limitations, investors and businesses can make more informed decisions. As technology continues to evolve, we can expect NPV calculators to become even more sophisticated and accessible, further enhancing their role in financial planning and investment analysis. We invite readers to share their experiences with NPV calculators and explore how these tools can be applied in various contexts to facilitate better investment decisions.