Intro

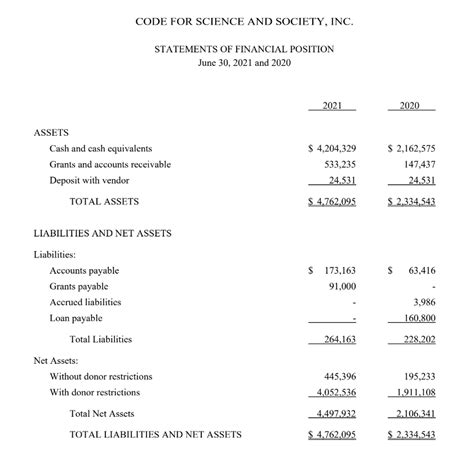

Create a clear financial picture with a Nonprofit Balance Sheet Template Excel, featuring assets, liabilities, and equity, to streamline financial reporting and budgeting, and enhance nonprofit management and accounting transparency.

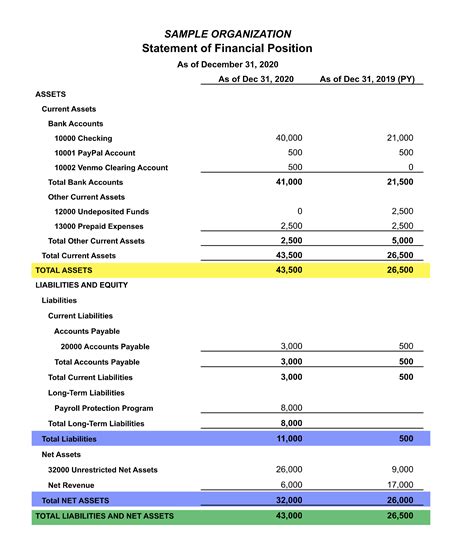

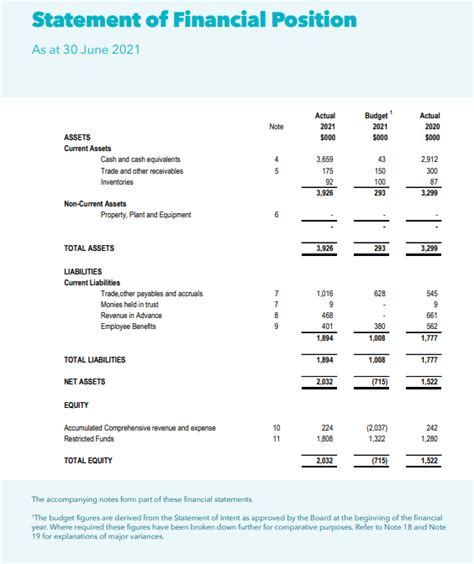

A nonprofit balance sheet is a crucial financial document that provides a snapshot of an organization's financial position at a specific point in time. It is essential for nonprofits to maintain accurate and up-to-date financial records, including a balance sheet, to ensure transparency, accountability, and compliance with regulatory requirements. In this article, we will discuss the importance of a nonprofit balance sheet template in Excel and provide a comprehensive guide on how to create and use it.

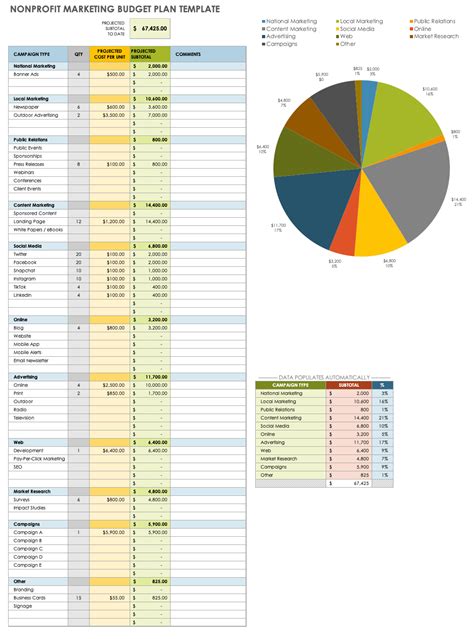

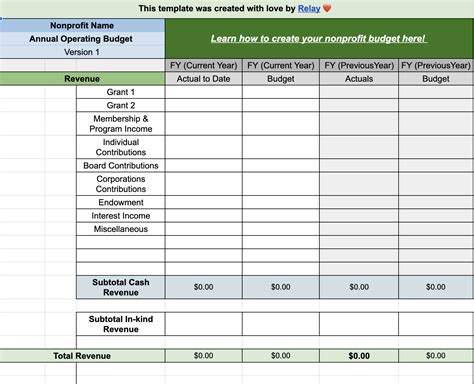

A nonprofit balance sheet template in Excel is a pre-designed spreadsheet that helps organizations create a balance sheet quickly and easily. It typically includes pre-formatted columns and rows for assets, liabilities, and equity, as well as formulas and functions to calculate totals and percentages. Using a template can save time and reduce errors, allowing nonprofits to focus on their core mission and activities.

The importance of a nonprofit balance sheet cannot be overstated. It provides stakeholders, including donors, grantors, and regulatory agencies, with a clear picture of an organization's financial health and stability. A balance sheet helps nonprofits to:

- Track their assets, including cash, investments, and property

- Manage their liabilities, such as loans and accounts payable

- Monitor their equity, including retained earnings and net assets

- Make informed decisions about resource allocation and budgeting

- Demonstrate transparency and accountability to stakeholders

Components of a Nonprofit Balance Sheet

A nonprofit balance sheet typically includes the following components:

- Assets: Cash, investments, property, equipment, and other resources owned by the organization

- Liabilities: Loans, accounts payable, and other debts owed by the organization

- Equity: Retained earnings, net assets, and other equity accounts that represent the organization's net worth

Asset Classification

Assets can be classified into several categories, including:- Current assets: Cash, accounts receivable, and other assets that can be converted into cash within one year

- Non-current assets: Property, equipment, and other assets that are not expected to be converted into cash within one year

- Restricted assets: Assets that are restricted for specific purposes, such as endowments or grants

Liability Classification

Liabilities can be classified into several categories, including:- Current liabilities: Accounts payable, loans, and other debts that are due within one year

- Non-current liabilities: Long-term loans and other debts that are not due within one year

- Restricted liabilities: Liabilities that are restricted for specific purposes, such as loan covenants or grant requirements

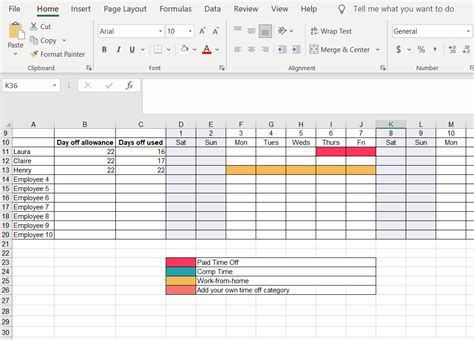

Creating a Nonprofit Balance Sheet Template in Excel

Creating a nonprofit balance sheet template in Excel is a straightforward process. Here are the steps to follow:

- Open a new Excel spreadsheet and create a table with the following columns:

- Asset/Liability/Equity

- Account Name

- Debit/Credit

- Balance

- Set up the asset section by listing all the organization's assets, including cash, investments, property, and equipment.

- Set up the liability section by listing all the organization's liabilities, including loans, accounts payable, and other debts.

- Set up the equity section by listing all the organization's equity accounts, including retained earnings and net assets.

- Use formulas and functions to calculate totals and percentages.

- Format the template to make it easy to read and understand.

Using Formulas and Functions

Excel provides a range of formulas and functions that can be used to calculate totals and percentages on a nonprofit balance sheet. Some common formulas and functions include:- SUM: Used to calculate the total of a range of cells

- AVERAGE: Used to calculate the average of a range of cells

- PERCENTAGE: Used to calculate the percentage of a range of cells

- IF: Used to test a condition and return a value if true or false

Benefits of Using a Nonprofit Balance Sheet Template in Excel

Using a nonprofit balance sheet template in Excel provides several benefits, including:

- Increased accuracy and efficiency

- Improved transparency and accountability

- Enhanced decision-making and resource allocation

- Simplified financial reporting and compliance

- Reduced errors and mistakes

Best Practices for Using a Nonprofit Balance Sheet Template

To get the most out of a nonprofit balance sheet template in Excel, follow these best practices:- Regularly update the template to reflect changes in the organization's financial position

- Use clear and concise account names and descriptions

- Ensure that all formulas and functions are accurate and up-to-date

- Use formatting to make the template easy to read and understand

- Review and reconcile the balance sheet regularly to ensure accuracy and completeness

Common Mistakes to Avoid

When using a nonprofit balance sheet template in Excel, there are several common mistakes to avoid, including:

- Inaccurate or incomplete data

- Incorrect formulas or functions

- Inconsistent account naming and classification

- Failure to regularly update the template

- Inadequate review and reconciliation of the balance sheet

Conclusion and Next Steps

In conclusion, a nonprofit balance sheet template in Excel is a valuable tool for organizations to manage their financial resources and ensure transparency and accountability. By following the steps outlined in this article, nonprofits can create a comprehensive and accurate balance sheet that provides a clear picture of their financial position. To take the next step, download a nonprofit balance sheet template in Excel and start using it to manage your organization's finances today.Nonprofit Balance Sheet Image Gallery

What is a nonprofit balance sheet?

+A nonprofit balance sheet is a financial document that provides a snapshot of an organization's financial position at a specific point in time.

Why is a nonprofit balance sheet important?

+A nonprofit balance sheet is important because it provides stakeholders with a clear picture of an organization's financial health and stability.

How do I create a nonprofit balance sheet template in Excel?

+To create a nonprofit balance sheet template in Excel, follow the steps outlined in this article, including setting up the asset, liability, and equity sections, using formulas and functions, and formatting the template.

What are some common mistakes to avoid when using a nonprofit balance sheet template?

+Some common mistakes to avoid when using a nonprofit balance sheet template include inaccurate or incomplete data, incorrect formulas or functions, and failure to regularly update the template.

How often should I review and reconcile my nonprofit balance sheet?

+You should review and reconcile your nonprofit balance sheet regularly, at least quarterly, to ensure accuracy and completeness.

We hope this article has provided you with a comprehensive guide to creating and using a nonprofit balance sheet template in Excel. If you have any further questions or would like to share your experiences with using a nonprofit balance sheet template, please leave a comment below. Additionally, if you found this article helpful, please share it with your colleagues and friends who may also benefit from it. Thank you for reading!