Intro

Create a Non Profit Budget Template with ease, utilizing financial planning tools and charity budgeting strategies to manage donations, grants, and fundraising expenses efficiently.

Creating a budget for a non-profit organization is crucial for ensuring the effective management of resources and the achievement of its mission. A well-structured budget template can help non-profits allocate their funds efficiently, prioritize their spending, and make informed financial decisions. In this article, we will explore the importance of budgeting for non-profits, discuss the key components of a non-profit budget template, and provide guidance on how to create a comprehensive budget plan.

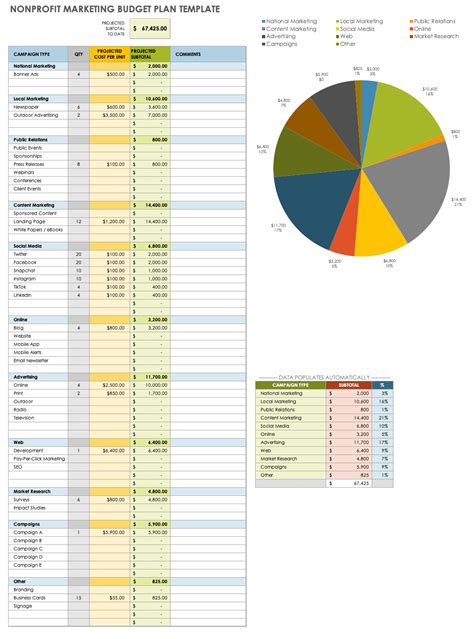

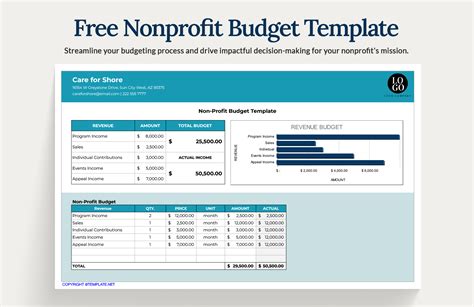

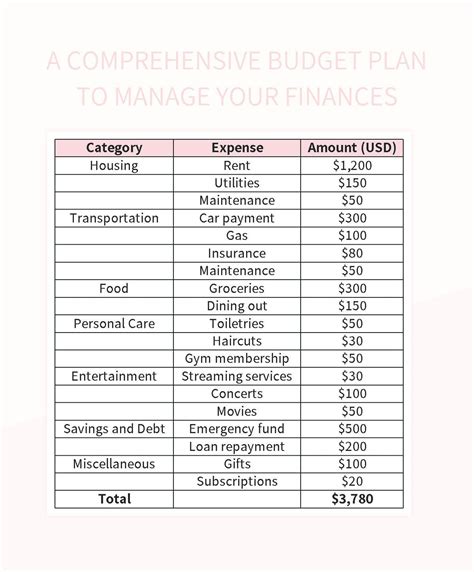

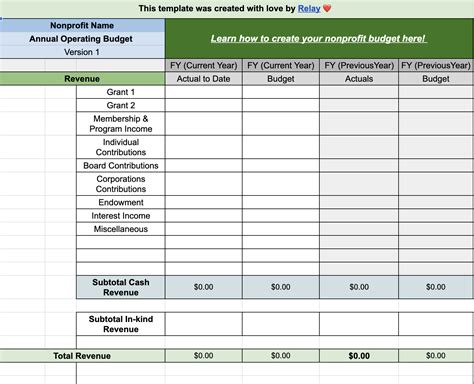

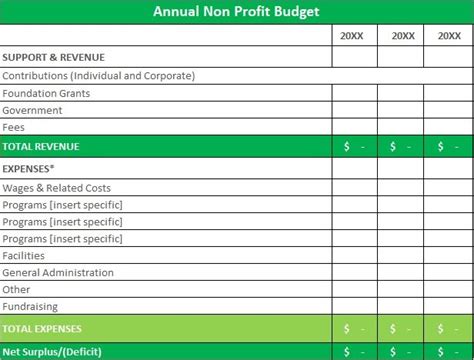

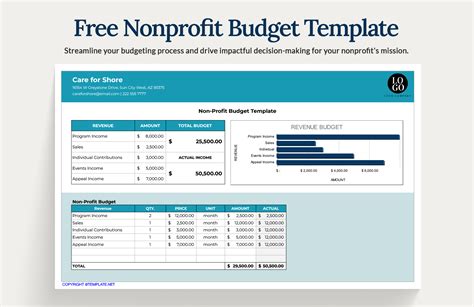

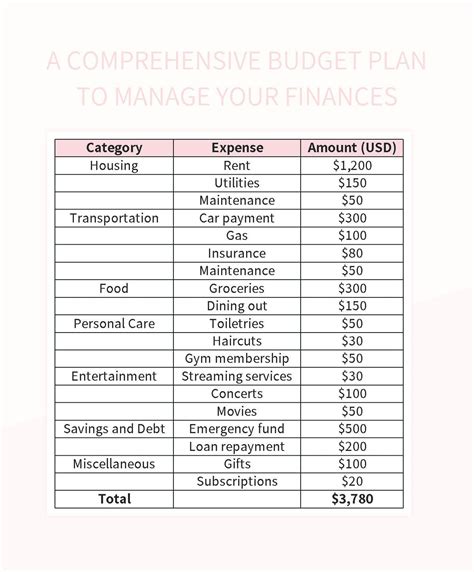

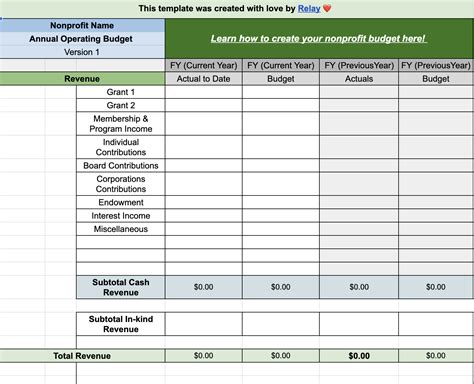

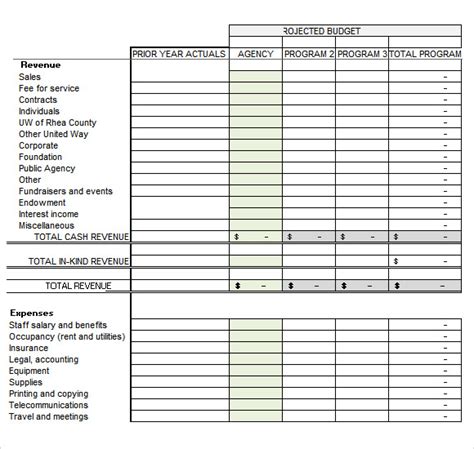

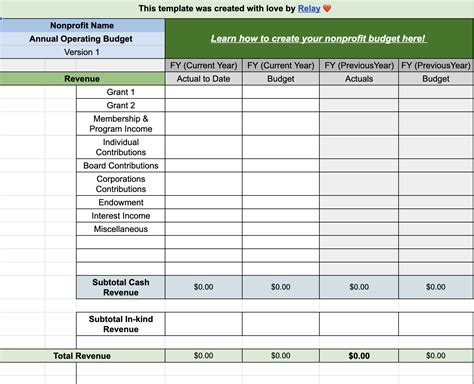

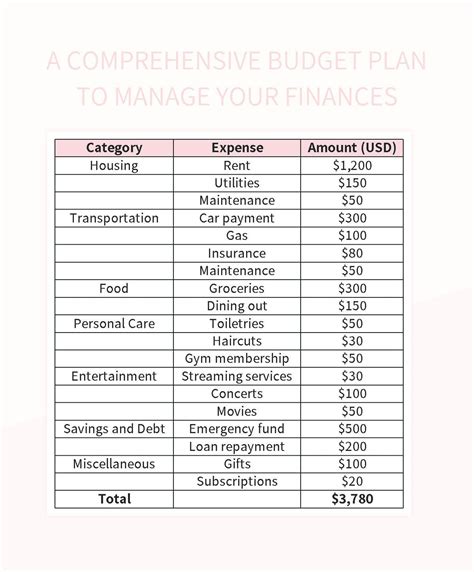

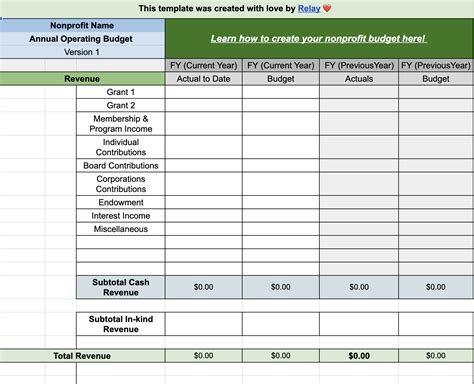

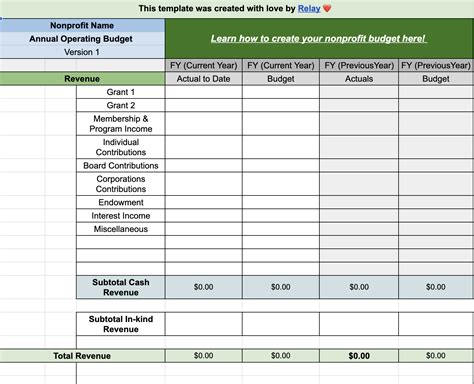

A non-profit budget template typically includes several key components, such as income, expenses, assets, liabilities, and equity. The income section outlines the organization's revenue streams, including donations, grants, and fundraising events. The expenses section categorizes the organization's spending into different areas, such as program services, administration, and fundraising. The assets, liabilities, and equity sections provide a snapshot of the organization's financial position at a given point in time.

To create a non-profit budget template, organizations should start by identifying their financial goals and objectives. This involves determining the organization's mission, vision, and strategic priorities, as well as assessing its financial resources and constraints. Next, organizations should gather historical financial data and conduct a thorough analysis of their income and expenses. This will help identify trends, patterns, and areas for improvement.

Introduction to Non-Profit Budgeting

Non-profit budgeting is a critical component of an organization's financial management system. It involves creating a comprehensive plan that outlines projected income and expenses over a specific period, usually a fiscal year. A well-crafted budget helps non-profits allocate their resources effectively, prioritize their spending, and make informed decisions about their programs and services.

Effective budgeting enables non-profits to achieve their mission and objectives, while also ensuring their long-term sustainability. By creating a budget, organizations can identify areas where they can reduce costs, optimize their resources, and improve their overall financial performance. A budget also provides a framework for monitoring and evaluating an organization's financial progress, allowing for timely adjustments and corrections.

Benefits of Non-Profit Budgeting

The benefits of non-profit budgeting are numerous and significant. Some of the key advantages include: * Improved financial management and planning * Enhanced transparency and accountability * Better decision-making and resource allocation * Increased efficiency and effectiveness * Improved relationships with stakeholders, including donors, funders, and creditorsKey Components of a Non-Profit Budget Template

A non-profit budget template typically includes several key components, such as:

- Income statement: outlines projected revenue and expenses over a specific period

- Balance sheet: provides a snapshot of the organization's financial position at a given point in time

- Cash flow statement: outlines projected cash inflows and outflows over a specific period

- Budget narrative: provides a detailed explanation of the organization's budget and financial plans

These components work together to provide a comprehensive picture of an organization's financial situation and plans. By including these elements in a budget template, non-profits can ensure that their financial management system is complete, accurate, and effective.

Income Statement

The income statement is a critical component of a non-profit budget template. It outlines projected revenue and expenses over a specific period, usually a fiscal year. The income statement includes several key categories, such as: * Revenue: includes donations, grants, fundraising events, and other sources of income * Expenses: includes program services, administration, fundraising, and other categories of spending * Net income: represents the difference between revenue and expensesBy creating an accurate and comprehensive income statement, non-profits can ensure that their budget is realistic, achievable, and aligned with their mission and objectives.

Creating a Comprehensive Budget Plan

Creating a comprehensive budget plan involves several steps, including:

- Identifying financial goals and objectives

- Gathering historical financial data

- Conducting a thorough analysis of income and expenses

- Developing a budget narrative and financial projections

- Reviewing and revising the budget plan

By following these steps, non-profits can create a comprehensive budget plan that is tailored to their unique needs and circumstances. This plan will serve as a roadmap for the organization's financial management system, ensuring that resources are allocated effectively and efficiently.

Best Practices for Non-Profit Budgeting

Some best practices for non-profit budgeting include: * Creating a comprehensive and detailed budget plan * Regularly reviewing and revising the budget * Ensuring transparency and accountability in financial management * Providing training and support for staff and board members * Using budgeting software and other tools to streamline financial managementBy following these best practices, non-profits can ensure that their budgeting process is effective, efficient, and aligned with their mission and objectives.

Challenges and Opportunities in Non-Profit Budgeting

Non-profit budgeting presents several challenges and opportunities, including:

- Managing uncertainty and risk in financial planning

- Ensuring sustainability and long-term viability

- Balancing competing priorities and demands

- Leveraging technology and other tools to improve financial management

- Building relationships with stakeholders, including donors, funders, and creditors

By understanding these challenges and opportunities, non-profits can develop strategies to overcome obstacles and achieve their financial goals.

Strategies for Overcoming Budgeting Challenges

Some strategies for overcoming budgeting challenges include: * Creating a comprehensive and detailed budget plan * Regularly reviewing and revising the budget * Diversifying revenue streams and reducing dependence on a single source of funding * Building relationships with stakeholders, including donors, funders, and creditors * Using budgeting software and other tools to streamline financial managementBy following these strategies, non-profits can overcome budgeting challenges and achieve their financial goals.

Non Profit Budget Template Image Gallery

What is a non-profit budget template?

+A non-profit budget template is a tool used to create a comprehensive budget plan for a non-profit organization. It includes several key components, such as income statement, balance sheet, and cash flow statement.

Why is budgeting important for non-profits?

+Budgeting is important for non-profits because it enables them to allocate their resources effectively, prioritize their spending, and make informed decisions about their programs and services.

What are the key components of a non-profit budget template?

+The key components of a non-profit budget template include income statement, balance sheet, cash flow statement, and budget narrative.

How can non-profits create a comprehensive budget plan?

+Non-profits can create a comprehensive budget plan by identifying their financial goals and objectives, gathering historical financial data, conducting a thorough analysis of income and expenses, developing a budget narrative and financial projections, and reviewing and revising the budget plan.

What are some best practices for non-profit budgeting?

+Some best practices for non-profit budgeting include creating a comprehensive and detailed budget plan, regularly reviewing and revising the budget, ensuring transparency and accountability in financial management, providing training and support for staff and board members, and using budgeting software and other tools to streamline financial management.

In conclusion, creating a non-profit budget template is a critical step in ensuring the financial sustainability and effectiveness of a non-profit organization. By understanding the key components of a budget template, creating a comprehensive budget plan, and following best practices for non-profit budgeting, organizations can allocate their resources effectively, prioritize their spending, and achieve their mission and objectives. We hope this article has provided valuable insights and guidance for non-profits looking to create a comprehensive budget plan. If you have any further questions or would like to share your experiences with non-profit budgeting, please don't hesitate to comment below.