Intro

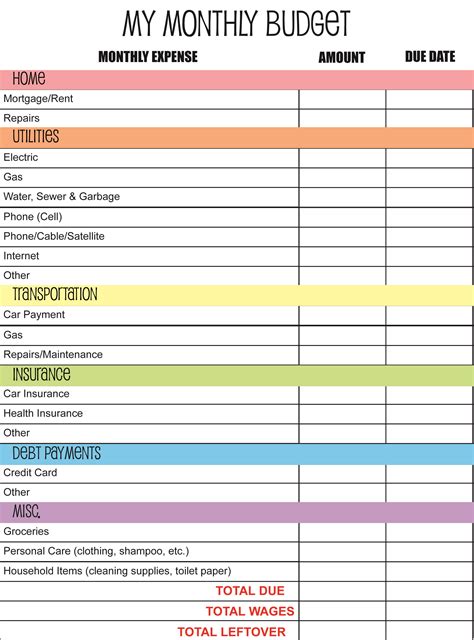

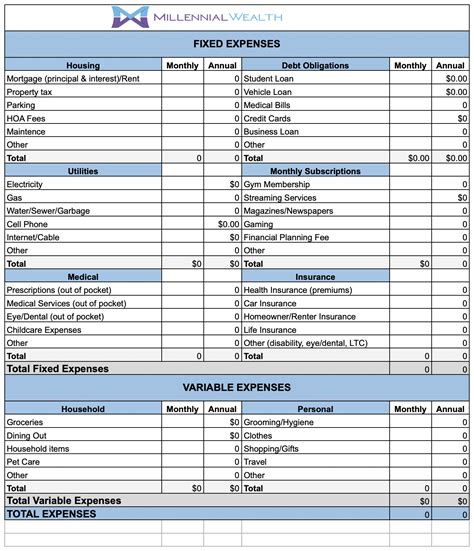

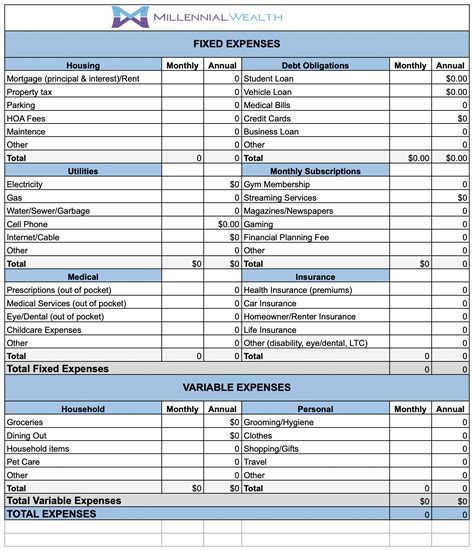

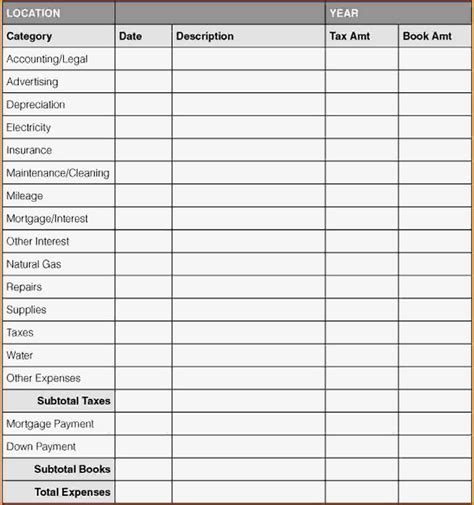

Track finances with a monthly expenses worksheet printable template, featuring budgeting tools, expense trackers, and financial planners to manage spending, savings, and debt.

Managing monthly expenses is a crucial aspect of personal finance that helps individuals track their spending, create budgets, and make informed financial decisions. A well-structured monthly expenses worksheet can be a valuable tool in achieving financial stability and security. In this article, we will delve into the importance of using a monthly expenses worksheet printable template, its benefits, and how it can be effectively utilized to manage personal finances.

Creating a budget and tracking expenses can seem like a daunting task, especially for those who are new to managing their finances. However, with the right tools and a bit of discipline, anyone can take control of their financial situation. A monthly expenses worksheet printable template is designed to simplify the process of tracking expenses, making it easier for individuals to understand where their money is going and identify areas where they can cut back.

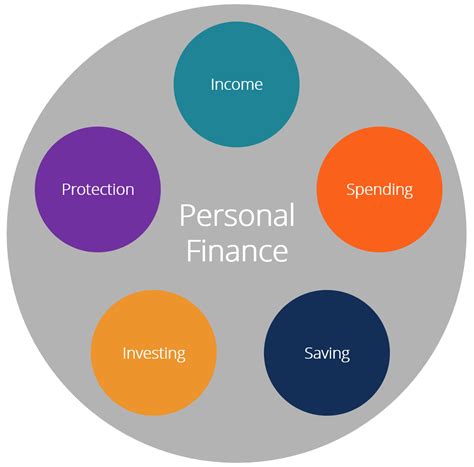

The key to successfully managing monthly expenses is to have a clear understanding of income and expenditures. This involves categorizing expenses into needs and wants, prioritizing essential expenses such as rent/mortgage, utilities, and food, and allocating funds accordingly. A monthly expenses worksheet helps in organizing this information in a structured and accessible format, making it easier to review and adjust spending habits as needed.

Understanding Monthly Expenses

Understanding monthly expenses involves more than just listing down every transaction. It requires a deep dive into spending habits, financial goals, and the overall financial health of an individual. Monthly expenses can be broadly categorized into fixed expenses, such as rent and car payments, and variable expenses, like entertainment and groceries. Identifying these categories and tracking them over time can provide valuable insights into where adjustments can be made to optimize financial performance.

Benefits of Using a Monthly Expenses Worksheet

The benefits of using a monthly expenses worksheet are multifaceted. Firstly, it helps in creating a clear picture of one's financial situation, making it easier to identify areas of improvement. Secondly, it aids in budgeting by allocating funds to different expense categories based on priority and need. This structured approach to financial management can lead to reduced debt, increased savings, and a more stable financial future.

Moreover, a monthly expenses worksheet can help in setting and achieving long-term financial goals. By regularly tracking expenses and income, individuals can make informed decisions about investments, retirement savings, and other financial objectives. It also fosters a sense of accountability and discipline, encouraging individuals to stick to their financial plans and avoid unnecessary expenses.

How to Use a Monthly Expenses Worksheet

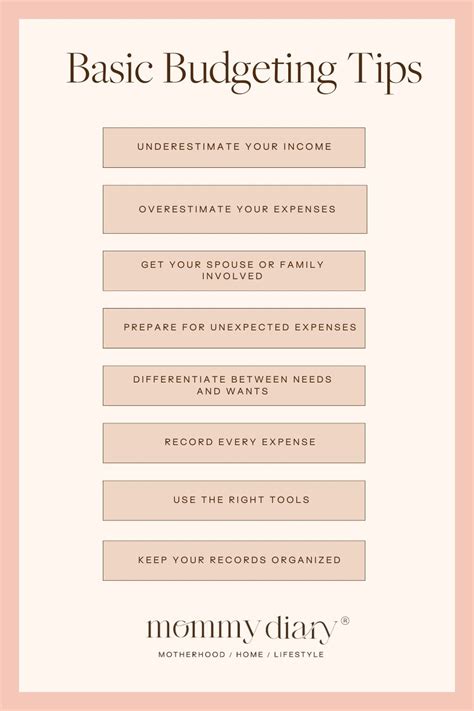

Using a monthly expenses worksheet is straightforward. The first step involves downloading and printing the template. Most worksheets are designed with categories for income, fixed expenses, variable expenses, and savings. The next step is to fill in the income section, including all sources of monthly income.

Following this, individuals should list down their fixed expenses, such as rent, utilities, and loan payments. Variable expenses, including groceries, entertainment, and travel, should also be accounted for. It's essential to be as detailed as possible, including even small purchases, to get an accurate picture of spending habits.

Step-by-Step Guide

- Identify Income Sources: Start by listing all monthly income sources.

- Categorize Expenses: Divide expenses into fixed and variable categories.

- Track Expenses: Throughout the month, track every expense, no matter how small.

- Review and Adjust: At the end of the month, review expenses and adjust the budget as necessary.

Customizing Your Monthly Expenses Worksheet

While a standard monthly expenses worksheet can be highly effective, customizing it to fit individual needs can enhance its usefulness. This might involve adding specific categories for unique expenses, such as pet care or home maintenance, or adjusting the layout to better suit personal preferences.

Customization can also involve setting financial goals and incorporating them into the worksheet. For example, if an individual aims to save a certain amount each month for a down payment on a house, they can include a category for this savings goal and track progress over time.

Common Challenges and Solutions

One of the common challenges individuals face when using a monthly expenses worksheet is staying consistent. It can be easy to fall behind on tracking expenses, especially during busy periods. A solution to this is to set reminders or allocate a specific time each week to update the worksheet.

Another challenge is accurately estimating expenses, especially for variable costs like groceries or entertainment. Keeping receipts and regularly reviewing spending patterns can help in making more accurate estimates over time.

Overcoming Procrastination

- Set Realistic Goals: Start with small, achievable goals.

- Create a Routine: Incorporate expense tracking into your daily or weekly routine.

- Seek Support: Share your financial goals with a friend or family member and ask for their support.

Technological Alternatives

While a printable monthly expenses worksheet can be highly effective, technological alternatives are also available. Mobile apps and digital spreadsheets can offer additional features such as automatic expense tracking, budgeting advice, and investment tracking.

These digital tools can be particularly useful for individuals who prefer the convenience of managing their finances on their smartphones or who have complex financial situations that require more advanced tracking and analysis.

Conclusion and Next Steps

In conclusion, a monthly expenses worksheet printable template is a powerful tool for managing personal finances. By understanding monthly expenses, categorizing them, and tracking them over time, individuals can make informed financial decisions, reduce debt, and work towards long-term financial goals.

The next steps involve implementing the strategies outlined in this article, whether through a traditional printable worksheet or a digital alternative. Consistency and patience are key, as developing healthy financial habits takes time.

Final Thoughts

- Stay Consistent: Regularly track and review your expenses.

- Be Patient: Financial stability is a long-term goal.

- Seek Professional Advice: If needed, consult with a financial advisor.

Monthly Expenses Worksheet Image Gallery

What is the importance of tracking monthly expenses?

+Tracking monthly expenses helps in understanding where your money is going, making it easier to create a budget, reduce unnecessary spending, and work towards financial goals.

How can I customize my monthly expenses worksheet?

+You can customize your monthly expenses worksheet by adding specific categories for unique expenses, adjusting the layout, and incorporating financial goals.

What are some common challenges in using a monthly expenses worksheet?

+Common challenges include staying consistent, accurately estimating expenses, and overcoming procrastination. Setting realistic goals, creating a routine, and seeking support can help in overcoming these challenges.

We hope this comprehensive guide to using a monthly expenses worksheet printable template has provided you with the insights and tools needed to take control of your financial situation. Remember, managing finances is a journey, and every step towards financial literacy and discipline brings you closer to your goals. Share your experiences, tips, and questions in the comments below, and don't hesitate to reach out for further guidance on your path to financial stability.