Intro

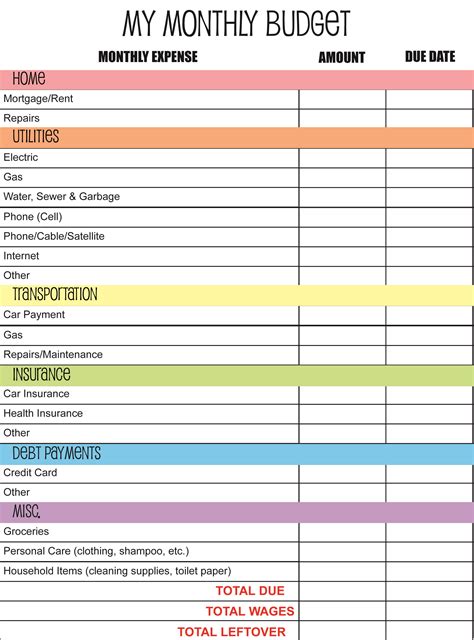

Get a free monthly budget template for Goodnotes, featuring expense tracking, financial planning, and budgeting tools to manage finances effectively and achieve financial stability with ease.

Creating a budget is an essential step in managing your finances effectively. With the rise of digital note-taking apps, using a free monthly budget template in Goodnotes can be a convenient and organized way to track your expenses and stay on top of your financial goals. In this article, we will explore the importance of budgeting, how to use a monthly budget template in Goodnotes, and provide tips on managing your finances.

Budgeting is crucial for achieving financial stability and security. It helps you understand where your money is going, identify areas for cost reduction, and make informed decisions about your financial resources. A well-planned budget can also reduce financial stress and anxiety, allowing you to enjoy a more peaceful and secure life. Whether you're a student, a working professional, or a retiree, having a budget in place is essential for achieving your long-term financial objectives.

Using a free monthly budget template in Goodnotes can simplify the budgeting process. Goodnotes is a popular digital note-taking app that offers a range of features, including templates, tables, and customizable layouts. With a monthly budget template, you can easily track your income and expenses, categorize your spending, and set financial goals. The template can be tailored to suit your specific needs, allowing you to focus on the areas that matter most to you.

Benefits of Using a Monthly Budget Template

Using a monthly budget template in Goodnotes offers several benefits. Firstly, it helps you stay organized and focused on your financial goals. The template provides a clear and structured format for tracking your income and expenses, making it easier to identify areas for improvement. Secondly, it saves time and effort, as you don't need to create a budget from scratch. The template can be easily customized to suit your needs, and you can reuse it every month to track your progress.

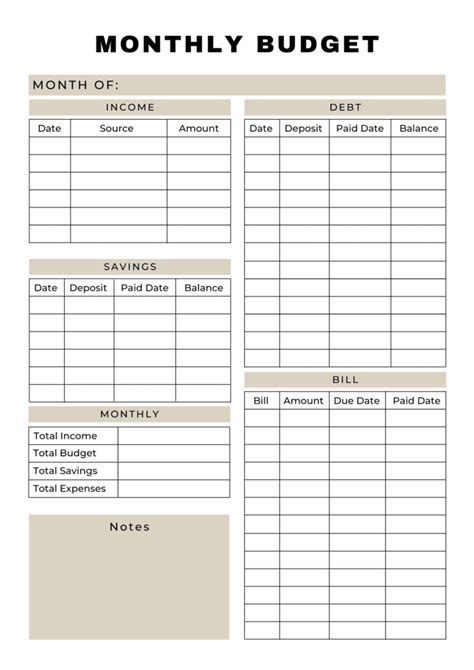

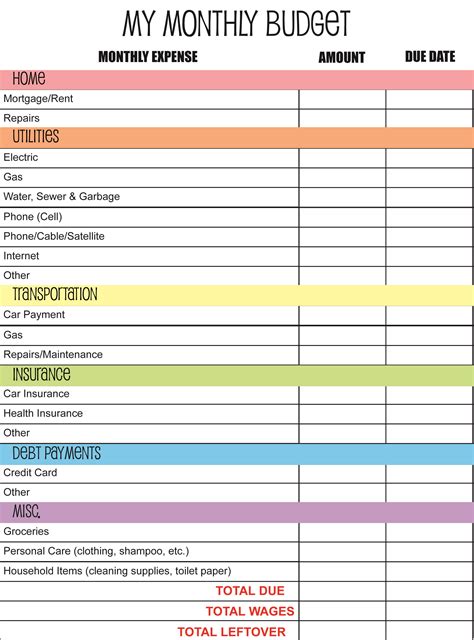

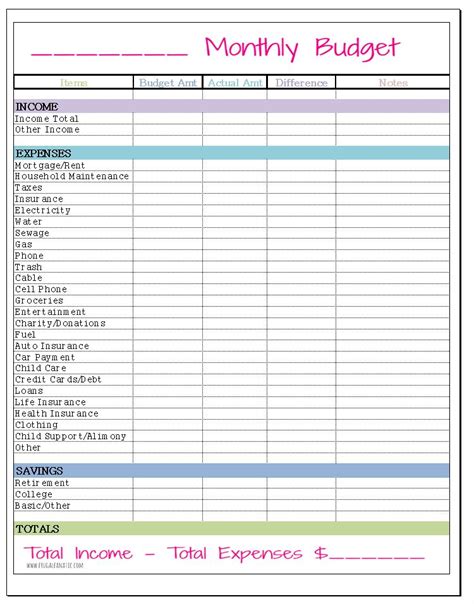

Key Features of a Monthly Budget Template

A good monthly budget template should include the following key features: * Income tracking: A section to record your monthly income from all sources. * Expense categorization: A system to categorize your expenses, such as housing, transportation, food, and entertainment. * Budgeting goals: A section to set financial goals, such as saving for a emergency fund or paying off debt. * Expense tracking: A table or spreadsheet to track your monthly expenses. * Analysis and review: A section to review and analyze your budget, identifying areas for improvement.How to Use a Monthly Budget Template in Goodnotes

Using a monthly budget template in Goodnotes is straightforward. Firstly, download a template from the Goodnotes template library or create your own using the app's table and layout features. Secondly, customize the template to suit your needs, adding or removing sections as required. Thirdly, fill in your income and expenses, using the template's tables and spreadsheets to track your spending. Finally, review and analyze your budget regularly, making adjustments as needed to stay on track with your financial goals.

Tips for Managing Your Finances

Here are some tips for managing your finances effectively: * Track your expenses: Keep a record of everything you spend, using a budget template or a spreadsheet. * Categorize your spending: Divide your expenses into categories, such as housing, transportation, and food. * Set financial goals: Identify what you want to achieve, such as saving for a emergency fund or paying off debt. * Prioritize needs over wants: Be honest about what you need versus what you want, and prioritize your spending accordingly. * Review and adjust: Regularly review your budget and make adjustments as needed to stay on track with your financial goals.Customizing Your Monthly Budget Template

Customizing your monthly budget template is essential to making it effective. Here are some tips for customizing your template:

- Add or remove sections: Tailor the template to suit your needs, adding or removing sections as required.

- Use formulas and calculations: Use Goodnotes' formula and calculation features to automate tasks, such as calculating totals and percentages.

- Use tables and spreadsheets: Use tables and spreadsheets to track your income and expenses, making it easier to identify trends and patterns.

- Use colors and icons: Use colors and icons to highlight important information, such as deadlines and priorities.

Common Budgeting Mistakes to Avoid

Here are some common budgeting mistakes to avoid: * Not tracking expenses: Failing to track your expenses can lead to overspending and financial stress. * Not prioritizing needs over wants: Failing to prioritize your spending can lead to financial instability and insecurity. * Not reviewing and adjusting: Failing to review and adjust your budget regularly can lead to stagnation and lack of progress.Conclusion and Next Steps

In conclusion, using a free monthly budget template in Goodnotes can be a powerful tool for managing your finances effectively. By customizing the template to suit your needs, tracking your income and expenses, and reviewing and adjusting your budget regularly, you can achieve financial stability and security. Remember to avoid common budgeting mistakes, such as not tracking expenses and not prioritizing needs over wants. With a well-planned budget and a commitment to financial discipline, you can achieve your long-term financial objectives and enjoy a more peaceful and secure life.

Free Monthly Budget Template Gallery

What is a monthly budget template?

+A monthly budget template is a tool used to track and manage your income and expenses over a month.

How do I use a monthly budget template in Goodnotes?

+Using a monthly budget template in Goodnotes involves downloading a template, customizing it to suit your needs, and filling in your income and expenses.

What are the benefits of using a monthly budget template?

+The benefits of using a monthly budget template include staying organized and focused on your financial goals, saving time and effort, and achieving financial stability and security.

How do I customize my monthly budget template?

+Customizing your monthly budget template involves adding or removing sections, using formulas and calculations, and using tables and spreadsheets to track your income and expenses.

What are some common budgeting mistakes to avoid?

+Common budgeting mistakes to avoid include not tracking expenses, not prioritizing needs over wants, and not reviewing and adjusting your budget regularly.

We hope this article has provided you with a comprehensive guide to using a free monthly budget template in Goodnotes. By following the tips and advice outlined in this article, you can create a effective budget that helps you achieve your financial goals. Remember to stay disciplined, review and adjust your budget regularly, and avoid common budgeting mistakes. With a well-planned budget and a commitment to financial discipline, you can enjoy a more peaceful and secure life. Share your thoughts and experiences with budgeting in the comments below, and don't forget to share this article with your friends and family who may benefit from it.