Intro

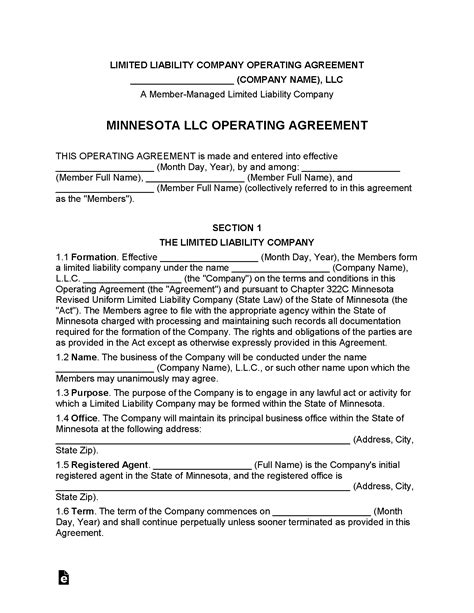

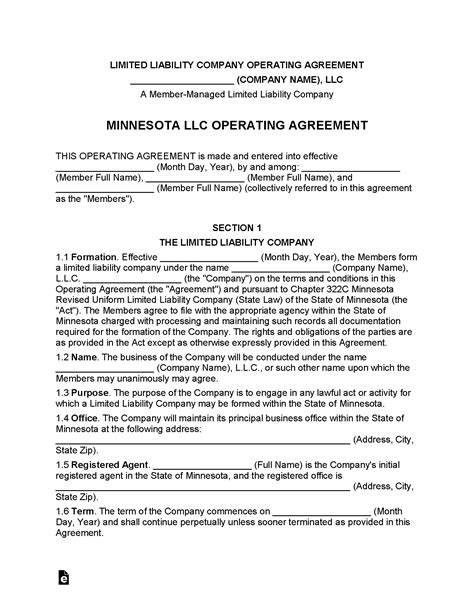

Create a solid foundation for your business with a Minnesota LLC Operating Agreement Template, outlining ownership, management, and operational terms, ensuring compliance and protecting member interests in a limited liability company.

In the realm of business, particularly for those venturing into the state of Minnesota, understanding the legal frameworks that govern various business structures is crucial. For Limited Liability Companies (LLCs), which have become a popular choice due to their flexibility and protection of personal assets, having a well-drafted operating agreement is essential. This document outlines the roles, responsibilities, and relationships among the members, as well as the operational procedures of the LLC. Here, we delve into the importance and components of a Minnesota LLC operating agreement template, providing insights for entrepreneurs and small business owners.

The foundation of any successful LLC is a comprehensive operating agreement. This document serves as the backbone of the company, detailing everything from the distribution of profits and losses to the process for making significant business decisions. For Minnesota LLCs, the operating agreement is not mandated by state law, but it is highly recommended. Without it, the LLC would be governed by the default rules set forth in the Minnesota Limited Liability Company Act, which might not align with the specific needs or intentions of the business owners.

Importance of an Operating Agreement for Minnesota LLCs

The importance of an operating agreement for Minnesota LLCs cannot be overstated. It provides clarity and protection in several key areas:

- Governance Structure: Defines the management structure, whether member-managed or manager-managed, and outlines the roles and responsibilities of each member or manager.

- Financial Provisions: Spells out how profits and losses will be distributed, the procedure for contributions, and any restrictions on distributions.

- Decision-Making Process: Establishes how decisions will be made, including voting rights and any requirements for unanimous consent on certain matters.

- Dispute Resolution: Offers a framework for resolving disputes among members, potentially reducing the risk of litigation.

- Buy-Sell Provisions: Includes terms for the transfer of ownership interests, such as in the event of a member's death, retirement, or expulsion.

Key Components of a Minnesota LLC Operating Agreement Template

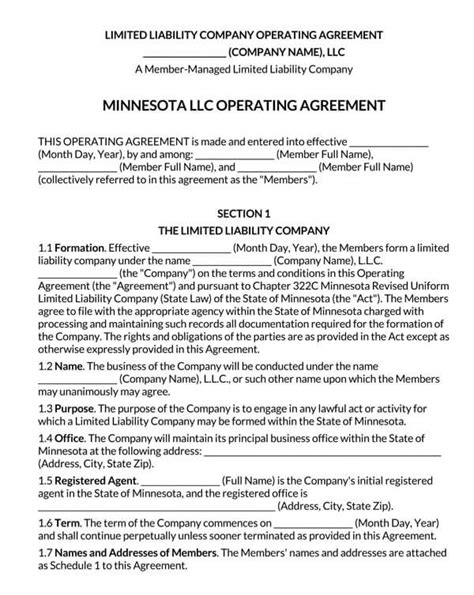

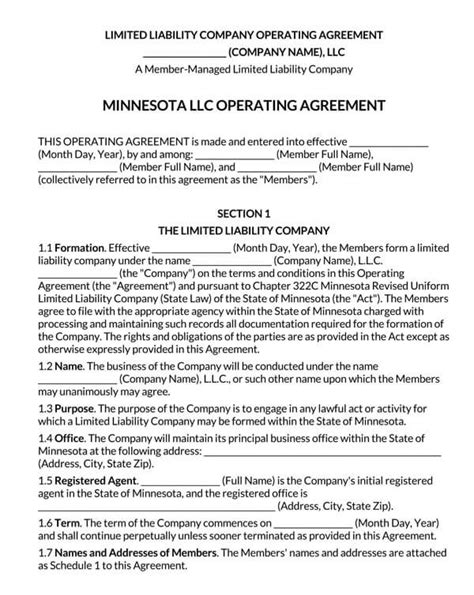

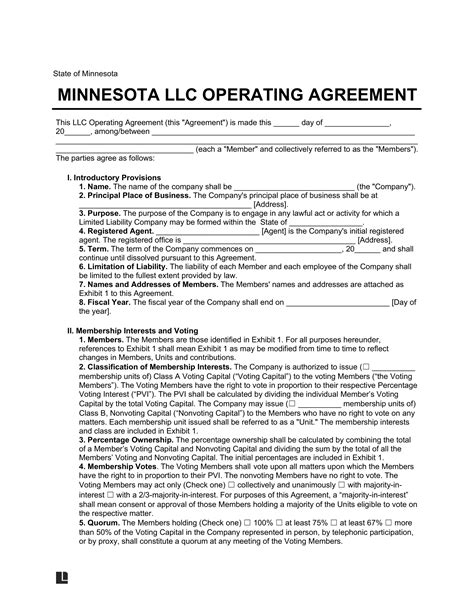

When drafting a Minnesota LLC operating agreement template, several key components must be included:

- Introduction and Definitions: Provides an overview of the LLC, its purpose, and defines key terms used throughout the agreement.

- Formation: Details the formation of the LLC, including its name, address, and the date of formation.

- Membership: Lists the members, their ownership percentages, and their roles within the LLC.

- Management and Voting: Outlines the management structure, whether member-managed or manager-managed, and describes the voting rights of members.

- Capital Contributions: Specifies the initial and any subsequent capital contributions of members, including the terms for additional contributions.

- Distributions: Explains how profits and losses will be distributed among members.

- Accounting and Record-Keeping: Requires the maintenance of accurate financial records and may specify the accounting method and fiscal year.

- Meetings and Decision-Making: Describes the procedures for holding meetings, including notice requirements, and how decisions will be made.

- Amendments: Provides a process for amending the operating agreement.

- Dispute Resolution: Offers a mechanism for resolving disputes, which could include mediation or arbitration.

Steps to Create a Minnesota LLC Operating Agreement

Creating a Minnesota LLC operating agreement involves several steps:

- Consult with an Attorney: While not required, consulting with a business attorney can ensure the agreement meets all legal requirements and suits the LLC's specific needs.

- Choose a Template: Select a Minnesota LLC operating agreement template that meets the state's requirements and the LLC's structure.

- Customize the Agreement: Fill in the template with the LLC's specific information, such as member names, addresses, and ownership percentages.

- Review and Revise: Carefully review the agreement, making any necessary revisions to ensure it accurately reflects the intentions of the members.

- Sign the Agreement: All members must sign the operating agreement, and it's a good practice to have the signatures notarized.

Benefits of Having a Comprehensive Operating Agreement

A comprehensive operating agreement offers numerous benefits to Minnesota LLCs, including:

- Protection of Personal Assets: By clearly defining the business structure and operations, members can better protect their personal assets.

- Reduced Risk of Disputes: A detailed agreement can reduce the risk of misunderstandings and disputes among members.

- Increased Credibility: Having a formal operating agreement can increase the credibility of the LLC with banks, investors, and other businesses.

- Flexibility: Allows for the customization of the business structure and operations to meet the specific needs of the members.

Gallery of Minnesota LLC Operating Agreement Templates

Minnesota LLC Operating Agreement Templates Gallery

Frequently Asked Questions

Is an operating agreement required for a Minnesota LLC?

+No, Minnesota state law does not require an operating agreement for an LLC. However, it is highly recommended to have one to outline the roles, responsibilities, and relationships among members and to protect personal assets.

What should be included in a Minnesota LLC operating agreement?

+A comprehensive operating agreement should include the formation of the LLC, membership details, management structure, capital contributions, distribution of profits and losses, meeting procedures, and a process for amending the agreement.

Can I use a template for my Minnesota LLC operating agreement?

+Yes, you can use a template as a starting point. However, it's advisable to customize it according to your LLC's specific needs and to consult with an attorney to ensure it meets all legal requirements and protects your interests.

In conclusion, a well-crafted operating agreement is indispensable for any Minnesota LLC, serving as a guide for the business's operations, management, and member relationships. By understanding the importance and components of such an agreement, entrepreneurs can better navigate the complexities of forming and running a successful LLC in Minnesota. Whether you're just starting out or looking to solidify your business structure, taking the time to develop a comprehensive operating agreement will pay dividends in the long run, providing clarity, protection, and a foundation for growth. We invite you to share your thoughts on the importance of operating agreements for LLCs and any experiences you may have with drafting or utilizing these documents in your business ventures.