Intro

Discover 5 ways loan amortization simplifies debt repayment, including mortgage amortization, loan schedules, and repayment strategies, to manage finances effectively and achieve financial freedom through structured payment plans.

The concept of loan amortization is crucial for individuals and businesses alike, as it helps in understanding how loan payments are structured and how they impact the overall financial health. Loan amortization refers to the process of gradually paying off a debt through regular payments, which cover both the principal amount and the interest accrued. In this article, we will delve into the world of loan amortization, exploring its importance, benefits, and different methods. Whether you're a homeowner, a student, or an entrepreneur, grasping the fundamentals of loan amortization can help you make informed decisions about your financial obligations.

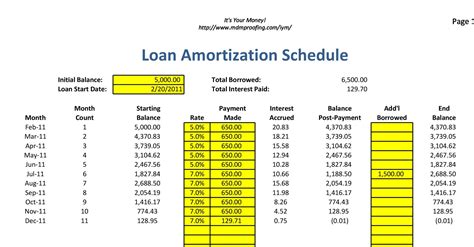

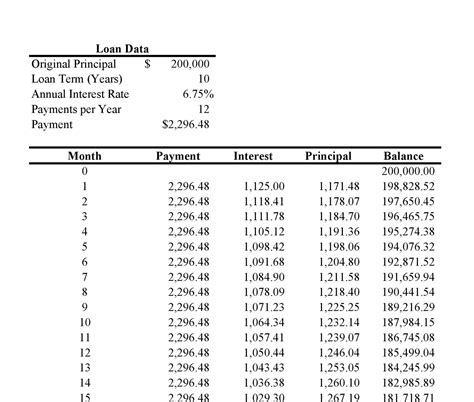

Understanding loan amortization is key to managing debt effectively. It allows borrowers to see how much of their monthly payment goes towards the principal and how much towards interest. This transparency is vital for planning and budgeting, as it helps individuals and businesses understand the true cost of borrowing. Moreover, loan amortization schedules can provide insights into how changes in interest rates or payment amounts can affect the loan term and total interest paid. This knowledge empowers borrowers to make strategic decisions about their loans, such as whether to refinance or make extra payments.

The significance of loan amortization cannot be overstated. It's not just about paying off a loan; it's about managing your financial future. By understanding how loan amortization works, individuals can avoid common pitfalls like accumulating too much debt or choosing loan terms that are not in their best interest. For businesses, effective loan management through amortization can be the difference between profitability and insolvency. It allows companies to allocate resources more efficiently, invest in growth opportunities, and navigate financial challenges with confidence.

Introduction to Loan Amortization

Loan amortization is a fundamental concept in finance that involves the gradual repayment of a loan through regular installments. Each payment typically includes both interest and principal components. The interest part covers the cost of borrowing, while the principal portion reduces the outstanding loan balance. Over time, as the loan balance decreases, the interest component of each payment also decreases, allowing more of the payment to go towards the principal. This process continues until the loan is fully paid off.

Benefits of Understanding Loan Amortization

Understanding loan amortization offers several benefits, including better financial planning, reduced debt, and improved credit scores. By knowing how much of each payment goes towards interest and principal, borrowers can make informed decisions about their loans. For instance, making extra payments towards the principal can significantly reduce the total interest paid over the life of the loan. Additionally, understanding loan amortization helps in choosing the right loan product, considering factors such as interest rates, loan terms, and payment schedules.Types of Loan Amortization

There are several types of loan amortization, each with its own characteristics and applications. The most common types include fixed-rate loans, adjustable-rate loans, and interest-only loans. Fixed-rate loans offer predictable monthly payments, as the interest rate remains constant throughout the loan term. Adjustable-rate loans, on the other hand, have interest rates that can fluctuate based on market conditions, potentially affecting monthly payments. Interest-only loans require borrowers to pay only the interest for a specified period, after which the loan converts to a principal-and-interest loan.

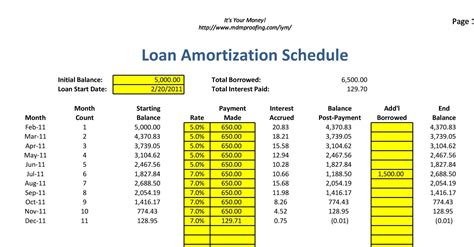

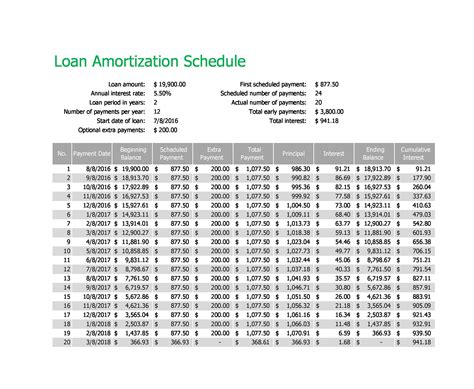

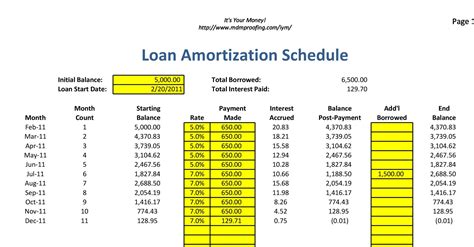

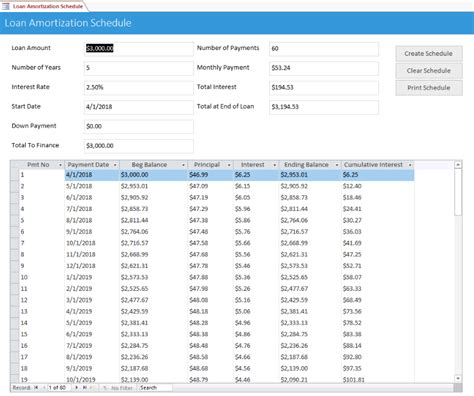

Calculating Loan Amortization

Calculating loan amortization involves determining the monthly payment amount, the total interest paid over the loan term, and the breakdown of each payment into interest and principal components. This can be done using a loan amortization calculator or creating a custom amortization schedule. The formula for calculating the monthly payment (M) is M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1], where P is the principal loan amount, i is the monthly interest rate, and n is the number of payments. Understanding how to calculate loan amortization empowers borrowers to analyze different loan scenarios and make the best decisions for their financial situation.Strategies for Managing Loan Amortization

Effective management of loan amortization is crucial for minimizing debt and maximizing financial health. Strategies include making extra payments, refinancing to a lower interest rate, and considering bi-weekly payments instead of monthly payments. Making extra payments towards the principal can significantly reduce the total interest paid and shorten the loan term. Refinancing a loan to a lower interest rate can lower monthly payments and reduce the total interest paid over the life of the loan. Bi-weekly payments can also reduce the total interest paid by increasing the number of payments made in a year.

Common Mistakes in Loan Amortization

Common mistakes in loan amortization include not understanding the loan terms, failing to make timely payments, and not taking advantage of opportunities to reduce the loan balance. Not fully comprehending the loan terms can lead to unexpected increases in monthly payments or accumulating more debt than intended. Missing payments can result in late fees, negative credit reporting, and increased interest rates. Failing to make extra payments or refinance when possible can mean paying more in interest over the life of the loan than necessary.Loan Amortization in Different Industries

Loan amortization plays a critical role in various industries, including real estate, education, and automotive. In real estate, understanding loan amortization is essential for homeowners and investors, as it affects the affordability and profitability of properties. In education, students and parents must navigate loan amortization when considering student loans, weighing the benefits of different repayment plans and interest rates. The automotive industry also relies on loan amortization, as car buyers need to understand the terms of their auto loans to make informed purchasing decisions.

Future of Loan Amortization

The future of loan amortization is likely to be shaped by technological advancements, regulatory changes, and shifting consumer preferences. Digital platforms and financial tools are making it easier for borrowers to understand and manage their loans, with personalized advice and automated payment systems. Regulatory changes may impact interest rates, loan terms, and consumer protections, affecting how loans are amortized. As consumers become more financially savvy, there may be a greater demand for flexible and transparent loan products that cater to individual needs and financial goals.Conclusion and Next Steps

In conclusion, loan amortization is a vital aspect of personal and business finance, offering a structured approach to debt repayment. By understanding how loan amortization works and applying strategies to manage it effectively, individuals and businesses can achieve financial stability and growth. The next steps for those looking to optimize their loan amortization include reviewing current loan terms, exploring options for refinancing or making extra payments, and utilizing financial tools and resources to make informed decisions.

Loan Amortization Image Gallery

What is loan amortization?

+Loan amortization is the process of gradually paying off a debt through regular payments, which cover both the principal amount and the interest accrued.

How does loan amortization work?

+Loan amortization works by applying each payment towards both interest and principal. Over time, as the loan balance decreases, the interest component of each payment also decreases, allowing more of the payment to go towards the principal.

What are the benefits of understanding loan amortization?

+Understanding loan amortization offers several benefits, including better financial planning, reduced debt, and improved credit scores. It helps in making informed decisions about loans and can lead to saving money on interest over the life of the loan.

How can I calculate loan amortization?

+Loan amortization can be calculated using a loan amortization calculator or by creating a custom amortization schedule. The formula for calculating the monthly payment involves the principal loan amount, the monthly interest rate, and the number of payments.

What strategies can I use to manage loan amortization effectively?

+Strategies for managing loan amortization include making extra payments, refinancing to a lower interest rate, and considering bi-weekly payments. These strategies can help reduce the total interest paid and shorten the loan term.

We invite you to share your thoughts and experiences with loan amortization. Have you successfully managed your loan payments and reduced your debt? What strategies worked best for you? Your insights can help others navigate the complex world of loan amortization. Feel free to comment below, and don't forget to share this article with anyone who might benefit from understanding the power of loan amortization. Together, we can empower each other to make smarter financial decisions and achieve our goals.