Intro

Form a successful LLC in Maryland with 5 expert tips, covering business registration, tax compliance, and liability protection, to ensure a seamless startup experience.

Forming a Limited Liability Company (LLC) in Maryland can be a complex process, but with the right guidance, it can be a straightforward and efficient way to establish your business. Maryland is known for its business-friendly environment, making it an attractive location for entrepreneurs and small business owners. In this article, we will explore the importance of forming an LLC in Maryland, the benefits it provides, and the steps you need to take to get started.

Maryland offers a unique blend of urban and rural landscapes, providing a diverse range of opportunities for businesses to thrive. From the bustling streets of Baltimore to the scenic coastal towns of the Eastern Shore, Maryland is home to a wide range of industries, including biotechnology, cybersecurity, and tourism. By forming an LLC in Maryland, you can take advantage of the state's pro-business climate and establish a strong foundation for your company's success.

Forming an LLC in Maryland provides numerous benefits, including personal liability protection, tax advantages, and flexibility in management structure. An LLC is a hybrid business structure that combines the liability protection of a corporation with the tax benefits and flexibility of a partnership. By forming an LLC, you can protect your personal assets from business debts and liabilities, while also enjoying pass-through taxation and flexible management options.

Benefits of Forming an LLC in Maryland

Steps to Form an LLC in Maryland

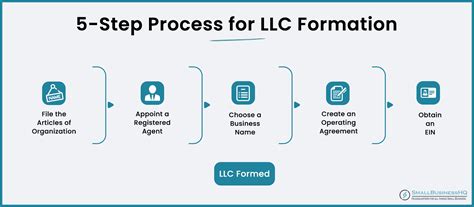

To form an LLC in Maryland, you need to follow these steps: 1. Choose a business name: Your business name must be unique and comply with Maryland's naming requirements. 2. File the Articles of Organization: You need to file the Articles of Organization with the Maryland State Department of Assessments and Taxation (SDAT). 3. Obtain an EIN: You need to obtain an Employer Identification Number (EIN) from the IRS. 4. Create an operating agreement: An operating agreement outlines the management structure and rules of your LLC. 5. Comply with licensing and registration requirements: You need to comply with Maryland's licensing and registration requirements, including obtaining any necessary business licenses and permits.5 Tips for Forming an LLC in Maryland

Common Mistakes to Avoid When Forming an LLC in Maryland

When forming an LLC in Maryland, there are several common mistakes to avoid, including: * Failing to choose a unique and compliant business name. * Failing to file the Articles of Organization correctly and on time. * Failing to obtain an EIN and comply with tax requirements. * Failing to create a comprehensive operating agreement. * Failing to comply with licensing and registration requirements.LLC Formation Services in Maryland

Cost of Forming an LLC in Maryland

The cost of forming an LLC in Maryland varies depending on the services you need and the provider you choose. The basic cost of forming an LLC in Maryland includes: * Filing fee for the Articles of Organization: $100 * Business name registration fee: $25 * EIN obtainment fee: $0 (free from the IRS) * Registered agent services: $100-$300 per year * Operating agreement preparation: $100-$500Gallery of Maryland LLC Formation

Maryland LLC Formation Image Gallery

What is the cost of forming an LLC in Maryland?

+The cost of forming an LLC in Maryland varies depending on the services you need and the provider you choose. The basic cost of forming an LLC in Maryland includes the filing fee for the Articles of Organization, business name registration fee, EIN obtainment fee, registered agent services, and operating agreement preparation.

How long does it take to form an LLC in Maryland?

+The timeframe for forming an LLC in Maryland varies depending on the speed of the filing process and the workload of the Maryland State Department of Assessments and Taxation (SDAT). Typically, it takes around 4-6 weeks to form an LLC in Maryland, but expedited services are available for an additional fee.

Do I need to obtain a business license to operate an LLC in Maryland?

+Yes, you may need to obtain a business license to operate an LLC in Maryland, depending on the type of business you are conducting and the location of your business. You should check with the Maryland State Department of Assessments and Taxation (SDAT) and your local government to determine if any licenses or permits are required.

We hope this article has provided you with a comprehensive guide to forming an LLC in Maryland. By following the steps outlined in this article and avoiding common mistakes, you can establish a strong foundation for your business and take advantage of the benefits that Maryland has to offer. If you have any further questions or need additional guidance, please don't hesitate to reach out. Share this article with your friends and family who may be interested in forming an LLC in Maryland, and leave a comment below with your thoughts and experiences.