Intro

Discover essential Arizona will tips, including estate planning, probate, inheritance, and asset protection, to ensure a smooth transfer of assets and minimize legal issues for beneficiaries and heirs.

When it comes to estate planning, having a will is a crucial step in ensuring that your assets are distributed according to your wishes after you pass away. In Arizona, there are specific laws and regulations that govern wills, and it's essential to be aware of these guidelines to create a valid and effective will. Here are five Arizona will tips to consider:

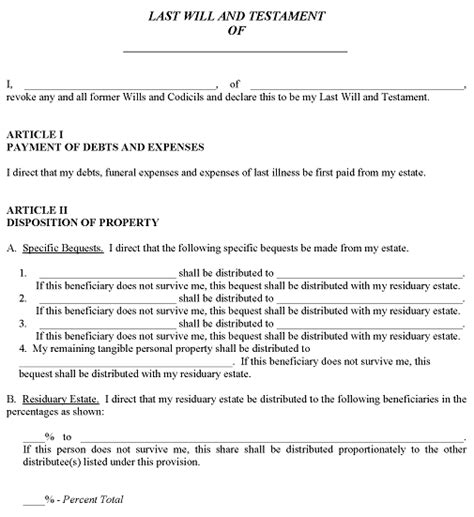

Arizona's laws regarding wills are designed to protect the rights of individuals and their beneficiaries. Understanding these laws can help you create a will that accurately reflects your intentions and avoids potential disputes. For instance, Arizona requires that a will be in writing, signed by the testator (the person creating the will), and witnessed by at least two individuals. This ensures that the will is genuine and not created under duress.

It's also important to note that Arizona recognizes two types of wills: formal wills and holographic wills. A formal will is the most common type and is created with the help of an attorney. A holographic will, on the other hand, is a handwritten will that is signed by the testator. While holographic wills are recognized in Arizona, they can be more challenging to validate, and it's generally recommended to create a formal will to avoid potential issues.

Understanding Arizona's Will Requirements

To create a valid will in Arizona, you must meet certain requirements. These include being at least 18 years old, having the mental capacity to create a will, and signing the document in the presence of at least two witnesses. The witnesses must also sign the will, confirming that they witnessed the testator's signature. It's essential to choose witnesses who are not beneficiaries of the will, as this can create a conflict of interest.

In addition to these requirements, Arizona law also specifies how wills should be executed. The testator must sign the will in the presence of the witnesses, and the witnesses must sign the will in the presence of the testator and each other. This ensures that the will is executed properly and reduces the risk of disputes.

Choosing the Right Executor

When creating a will, one of the most critical decisions you'll make is choosing the right executor. The executor, also known as the personal representative, is responsible for carrying out the instructions in your will. This includes managing your estate, paying debts, and distributing assets to beneficiaries. It's essential to choose an executor who is trustworthy, responsible, and has the necessary skills to manage your estate.

Some factors to consider when choosing an executor include their ability to manage financial affairs, their knowledge of your assets and wishes, and their willingness to take on the role. You may also want to consider naming an alternate executor in case your primary choice is unable to serve.

Updating Your Will

Once you've created a will, it's essential to review and update it periodically. This ensures that your will remains relevant and accurate, reflecting any changes in your life or assets. You may need to update your will if you experience a significant life event, such as a marriage, divorce, or the birth of a child.

Other reasons to update your will include changes in your assets, such as acquiring new property or selling existing assets. You may also want to update your will if you've changed your mind about how you want to distribute your assets or if you've appointed a new executor.

Considering a Trust

In addition to creating a will, you may also want to consider establishing a trust. A trust is a separate entity that holds assets on behalf of your beneficiaries, and it can provide several benefits, including avoiding probate, reducing taxes, and protecting assets from creditors.

There are several types of trusts, including revocable living trusts, irrevocable trusts, and special needs trusts. Each type of trust has its own unique characteristics and benefits, and it's essential to consult with an attorney to determine which type of trust is right for you.

Seeking Professional Advice

While it's possible to create a will on your own, it's generally recommended to seek the advice of an attorney. An attorney can help you create a valid and effective will, ensuring that your assets are distributed according to your wishes. They can also provide guidance on more complex issues, such as establishing a trust or creating a guardianship for minor children.

When choosing an attorney, look for someone who is experienced in estate planning and familiar with Arizona's laws and regulations. They should be able to provide personalized advice and guidance, helping you create a will that reflects your unique circumstances and wishes.

Benefits of Working with an Attorney

Some benefits of working with an attorney include: * Expert knowledge of Arizona's laws and regulations * Personalized advice and guidance * Assistance with complex issues, such as establishing a trust * Help with creating a valid and effective will * Peace of mind, knowing that your assets are protected and your wishes are respectedArizona Will Image Gallery

What are the requirements for creating a will in Arizona?

+To create a valid will in Arizona, you must be at least 18 years old, have the mental capacity to create a will, and sign the document in the presence of at least two witnesses.

How often should I update my will?

+You should review and update your will periodically, especially if you experience significant life events, such as a marriage, divorce, or the birth of a child.

What is the difference between a formal will and a holographic will?

+A formal will is created with the help of an attorney, while a holographic will is a handwritten will that is signed by the testator. While holographic wills are recognized in Arizona, they can be more challenging to validate.

Can I create a will on my own, or should I seek the advice of an attorney?

+While it's possible to create a will on your own, it's generally recommended to seek the advice of an attorney. An attorney can help you create a valid and effective will, ensuring that your assets are distributed according to your wishes.

What are the benefits of establishing a trust?

+Establishing a trust can provide several benefits, including avoiding probate, reducing taxes, and protecting assets from creditors. There are several types of trusts, and an attorney can help you determine which type is right for you.

In conclusion, creating a will is a crucial step in estate planning, and it's essential to be aware of Arizona's laws and regulations. By following these five Arizona will tips, you can create a valid and effective will that reflects your wishes and protects your assets. Remember to review and update your will periodically, consider establishing a trust, and seek the advice of an attorney to ensure that your estate is managed according to your intentions. If you have any questions or concerns about creating a will in Arizona, don't hesitate to reach out to an attorney or leave a comment below. Share this article with your friends and family to help them understand the importance of estate planning and creating a will.