Intro

Discover 5 Kentucky tobacco tax templates, including cigarette and vaping excise tax forms, to simplify tax calculations and compliance with state regulations, featuring tobacco tax rates and revenue reporting.

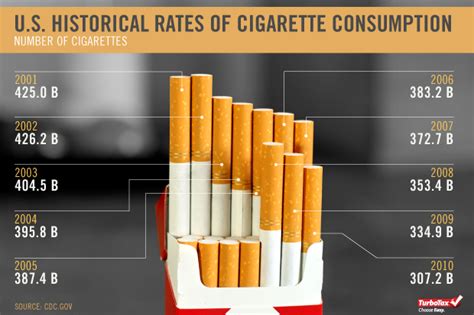

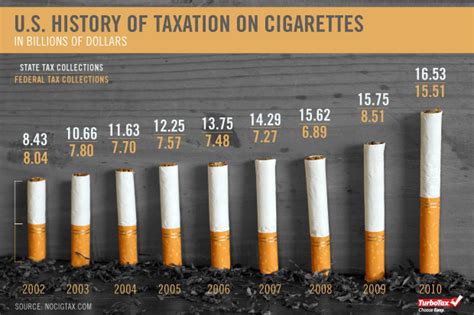

The importance of understanding and managing taxes on tobacco products cannot be overstated, particularly in a state like Kentucky, which has historically been a major producer of tobacco. For individuals and businesses involved in the tobacco industry, having the right tools and information is crucial for compliance with tax regulations and for minimizing the financial impact of these taxes. One such tool that can be invaluable is a Kentucky tobacco tax template. These templates are designed to help simplify the process of calculating and reporting tobacco taxes, making it easier for those in the industry to navigate the complex landscape of tax laws and regulations.

Tobacco tax templates can serve a variety of purposes, from calculating the amount of tax owed on tobacco products to helping ensure that all necessary tax forms are completed accurately and submitted on time. For businesses, these templates can be especially useful, as they can help streamline accounting and tax preparation processes, reducing the risk of errors and the potential for penalties associated with late or incorrect tax filings. Moreover, by providing a structured format for organizing and calculating tobacco taxes, these templates can help businesses and individuals better understand their tax obligations and plan more effectively for tax payments.

The use of Kentucky tobacco tax templates is also reflective of a broader trend towards leveraging technology and digital tools to manage and comply with tax requirements. As tax laws and regulations continue to evolve, the need for accurate, efficient, and reliable methods of tax calculation and reporting grows. Templates and other digital tools can play a significant role in meeting this need, offering users the ability to quickly and easily calculate taxes, complete tax forms, and submit tax payments, all while minimizing the risk of errors and ensuring compliance with the latest tax laws and regulations.

Kentucky Tobacco Tax Overview

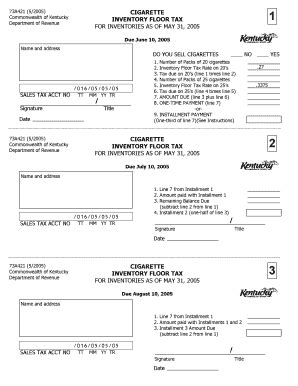

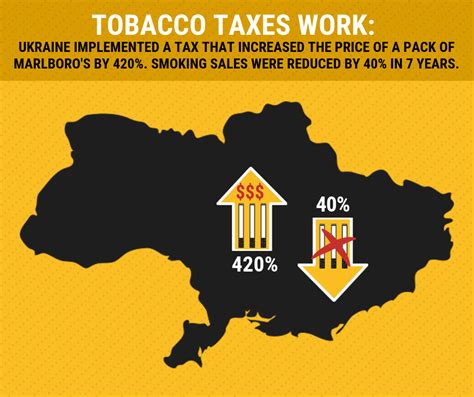

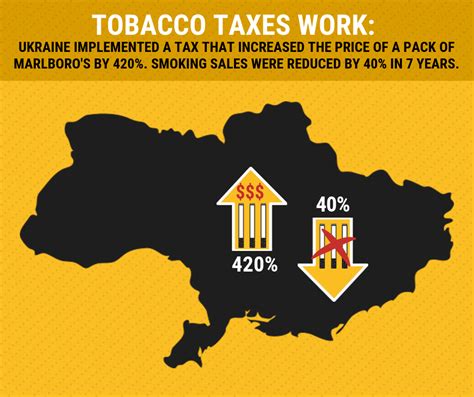

Understanding the specifics of Kentucky's tobacco tax laws is essential for anyone involved in the production, distribution, or sale of tobacco products within the state. Kentucky imposes taxes on various tobacco products, including cigarettes, smokeless tobacco, and vaping products. The tax rates for these products can vary, with cigarettes typically being taxed at a higher rate per pack than other tobacco products. Additionally, Kentucky's tax laws may provide for exemptions or reduced tax rates under certain circumstances, such as for tobacco products sold to qualified entities or used for specific purposes.

Benefits of Using Tobacco Tax Templates

The benefits of using Kentucky tobacco tax templates are numerous. For one, these templates can significantly reduce the time and effort required to calculate and report tobacco taxes. By providing a pre-formatted structure for organizing and calculating tax information, templates can help users quickly and accurately determine their tax liability, reducing the risk of errors and the potential for associated penalties. Furthermore, templates can be easily updated to reflect changes in tax laws or regulations, ensuring that users have access to the most current and accurate tax calculation methods.Steps to Create a Kentucky Tobacco Tax Template

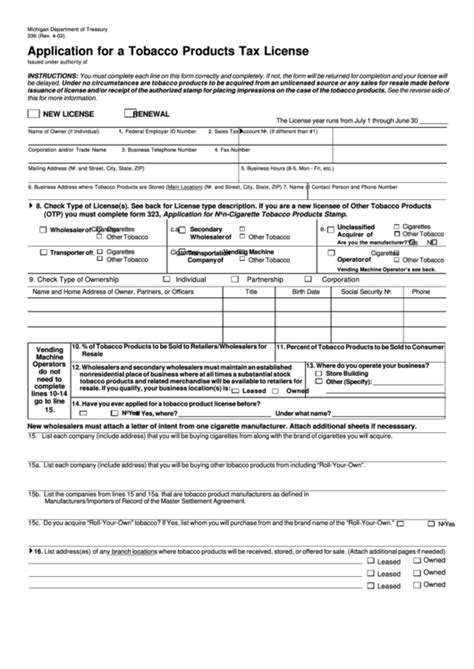

Creating a Kentucky tobacco tax template involves several key steps. First, it is essential to understand the current tax laws and regulations in Kentucky as they apply to tobacco products. This includes knowing the tax rates for different types of tobacco products, as well as any exemptions or special provisions that may apply. Next, the template should be designed to collect all necessary information for calculating tobacco taxes, such as the quantity and type of tobacco products sold or distributed. The template should then use this information to calculate the total tax owed, taking into account any applicable exemptions or reduced tax rates.

Key Components of a Tobacco Tax Template

A comprehensive Kentucky tobacco tax template should include several key components. These may include: - A section for entering the quantity and type of tobacco products, allowing for the calculation of taxes based on the current tax rates. - A mechanism for applying any relevant exemptions or reduced tax rates, ensuring that the template accurately reflects the user's tax liability. - A calculation section that determines the total tax owed based on the entered information. - Space for noting any additional tax-related information, such as payment due dates or tax filing requirements.Practical Applications of Tobacco Tax Templates

The practical applications of Kentucky tobacco tax templates are varied and significant. For businesses involved in the tobacco industry, these templates can be an indispensable tool for managing tax obligations. By streamlining the tax calculation and reporting process, businesses can reduce administrative burdens and minimize the risk of tax-related errors or penalties. Additionally, templates can help businesses plan more effectively for tax payments, ensuring that they have sufficient funds set aside to meet their tax obligations.

Common Challenges and Solutions

Despite the benefits of using Kentucky tobacco tax templates, there are common challenges that users may encounter. One of the primary challenges is keeping the template up to date with the latest tax laws and regulations. To address this, it is essential to regularly review and update the template to reflect any changes in tax rates, exemptions, or filing requirements. Another challenge is ensuring the accuracy of the information entered into the template, as errors can lead to incorrect tax calculations and potential penalties. To mitigate this risk, users should carefully review all information entered into the template and consider having a second party verify the calculations.Gallery of Kentucky Tobacco Tax Templates

Kentucky Tobacco Tax Templates Gallery

Frequently Asked Questions About Kentucky Tobacco Tax Templates

What is the purpose of a Kentucky tobacco tax template?

+A Kentucky tobacco tax template is used to simplify the process of calculating and reporting tobacco taxes, helping individuals and businesses comply with tax regulations and minimize the financial impact of these taxes.

How do I create a Kentucky tobacco tax template?

+Creating a Kentucky tobacco tax template involves understanding current tax laws and regulations, designing the template to collect necessary information, and including a mechanism for calculating taxes and applying exemptions or reduced tax rates.

What are the benefits of using a Kentucky tobacco tax template?

+The benefits include reduced time and effort for tax calculations, improved accuracy, and the ability to plan more effectively for tax payments, ensuring compliance with tax laws and regulations.

How often should I update my Kentucky tobacco tax template?

+You should update your template regularly to reflect any changes in tax laws, regulations, or rates, ensuring that your tax calculations and reporting are always accurate and compliant.

Can I use a Kentucky tobacco tax template for all types of tobacco products?

+Yes, a comprehensive template can be designed to accommodate various types of tobacco products, including cigarettes, smokeless tobacco, and vaping products, taking into account different tax rates and regulations for each.

As the tobacco industry continues to evolve, the importance of effective tax management tools like Kentucky tobacco tax templates will only continue to grow. By providing a clear, efficient, and accurate means of calculating and reporting tobacco taxes, these templates can play a vital role in helping individuals and businesses navigate the complexities of tax compliance. Whether you are a seasoned professional in the tobacco industry or just starting out, understanding and leveraging the benefits of Kentucky tobacco tax templates can be a key factor in achieving success and minimizing the financial impact of tobacco taxes.

We invite you to share your thoughts and experiences with Kentucky tobacco tax templates in the comments below. Have you used these templates in your business or personal tax management? What benefits or challenges have you encountered? Your insights can help others better understand the role and value of these templates in managing tobacco tax obligations. Additionally, if you found this article informative and helpful, please consider sharing it with others who may benefit from this information. Together, we can work towards a better understanding of tax management strategies and tools, ultimately leading to more efficient and compliant tax practices across the tobacco industry.