Intro

Discover expert Kentucky Will Tips for creating a valid last will, including estate planning, probate avoidance, and inheritance strategies to secure your legacy.

In the state of Kentucky, having a comprehensive will is essential for ensuring that your assets are distributed according to your wishes after you pass away. A well-crafted will can help prevent disputes among family members, reduce the risk of costly probate proceedings, and provide peace of mind for you and your loved ones. Here are five Kentucky will tips to consider when planning your estate.

Creating a will is a crucial step in estate planning, as it allows you to specify how you want your assets to be divided, who will care for your minor children, and who will manage your estate after you're gone. Without a will, the state of Kentucky will determine how your assets are distributed, which may not align with your desires. This is why it's essential to take the time to create a will that reflects your wishes and provides for your loved ones.

When it comes to creating a will in Kentucky, there are several key considerations to keep in mind. First, you'll need to decide who will serve as the executor of your estate, which is the person responsible for carrying out the instructions in your will. You'll also need to determine who will inherit your assets, including your real estate, personal property, and financial assets. Additionally, if you have minor children, you'll need to appoint a guardian to care for them in the event of your passing.

Understanding Kentucky Will Laws

When creating a will in Kentucky, it's essential to understand the state's laws regarding inheritance and estate taxes. Kentucky has a relatively low estate tax exemption, which means that larger estates may be subject to state taxes. However, there are strategies that can be used to minimize estate taxes, such as establishing trusts or making charitable donations. It's also important to consider the potential impact of federal estate taxes, which can be significant for larger estates.

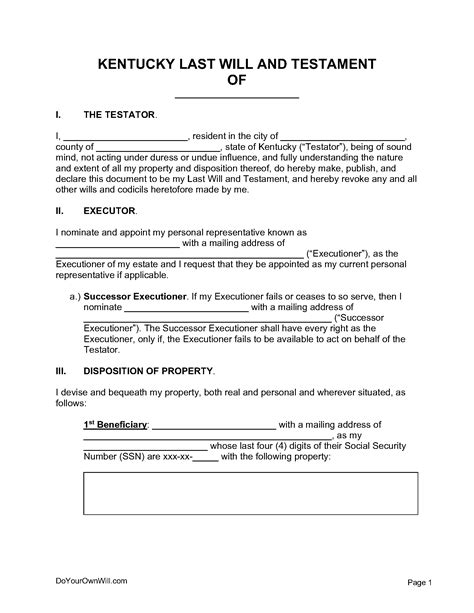

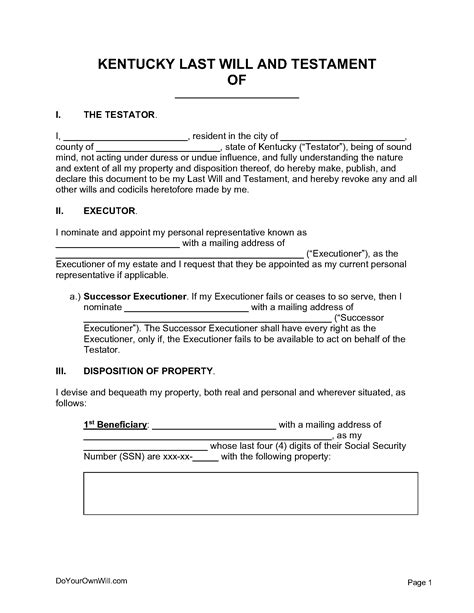

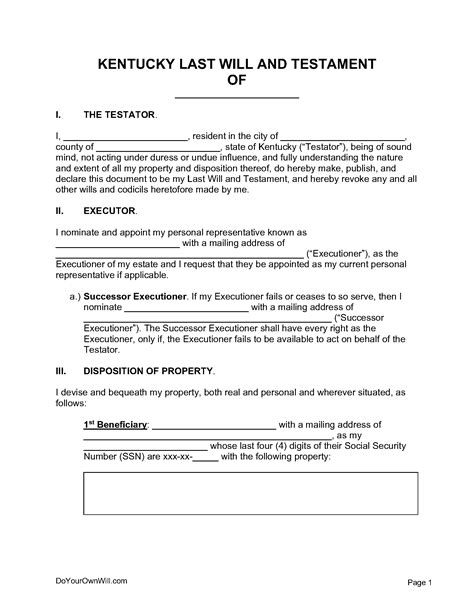

Key Components of a Kentucky Will

A comprehensive Kentucky will should include several key components, including: * A statement of intent, which specifies that the document is the testator's will * A designation of the executor, who will be responsible for carrying out the instructions in the will * A description of the assets being distributed, including real estate, personal property, and financial assets * A statement of how the assets will be distributed, including any specific bequests or gifts * A designation of a guardian for minor children, if applicable * A statement regarding funeral arrangements and burial instructionsBenefits of Having a Kentucky Will

In addition to these benefits, having a Kentucky will can also help you avoid the costs and complexities associated with intestate succession, which is the process of distributing assets without a will. When someone dies without a will, the state of Kentucky will determine how their assets are distributed, which can lead to unexpected outcomes and potential conflicts among family members.

Common Mistakes to Avoid

When creating a Kentucky will, there are several common mistakes to avoid, including: * Failing to sign the will in the presence of two witnesses * Failing to have the witnesses sign the will in the presence of the testator and each other * Failing to include a statement of intent or a designation of the executor * Failing to provide a clear description of the assets being distributed * Failing to consider the potential impact of estate taxesUpdating Your Kentucky Will

When updating your Kentucky will, it's essential to follow the same formalities as when creating the original will, including signing the will in the presence of two witnesses and having the witnesses sign the will in the presence of the testator and each other.

Seeking Professional Advice

While it's possible to create a Kentucky will on your own, it's highly recommended that you seek the advice of a qualified estate planning attorney. An attorney can help you navigate the complexities of Kentucky will laws and ensure that your will is valid and effective. They can also help you identify potential issues and develop strategies to minimize estate taxes and ensure that your assets are distributed according to your wishes.In addition to seeking professional advice, it's also essential to keep your Kentucky will in a safe and secure location, such as a fireproof safe or a safe deposit box. You should also provide a copy of your will to your executor and any other relevant parties, such as your attorney or financial advisor.

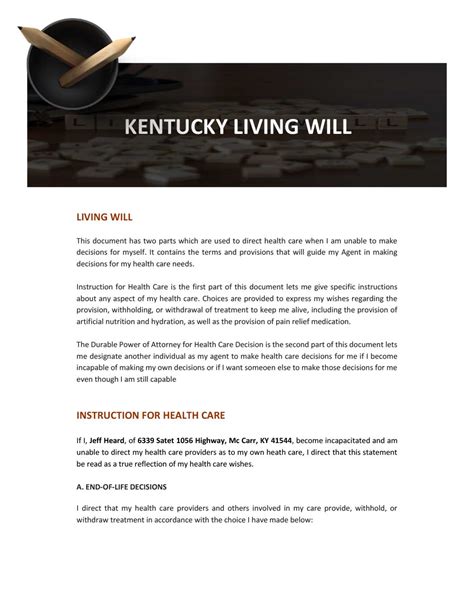

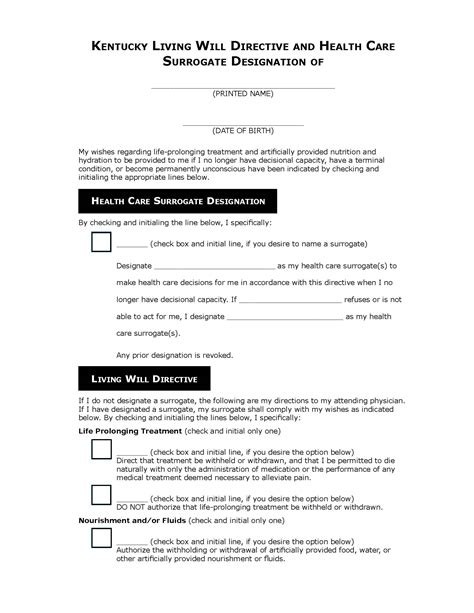

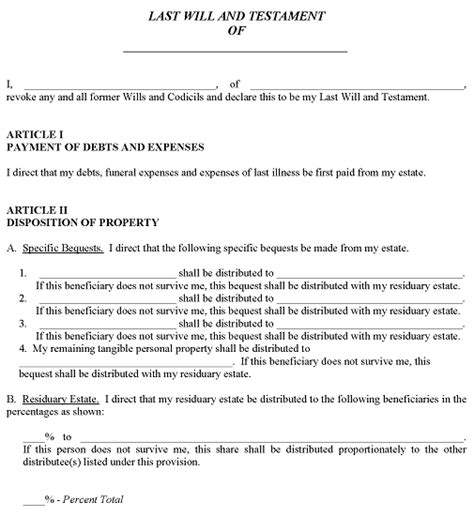

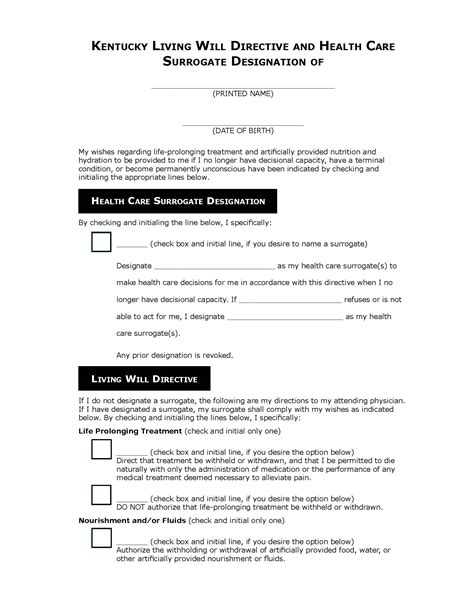

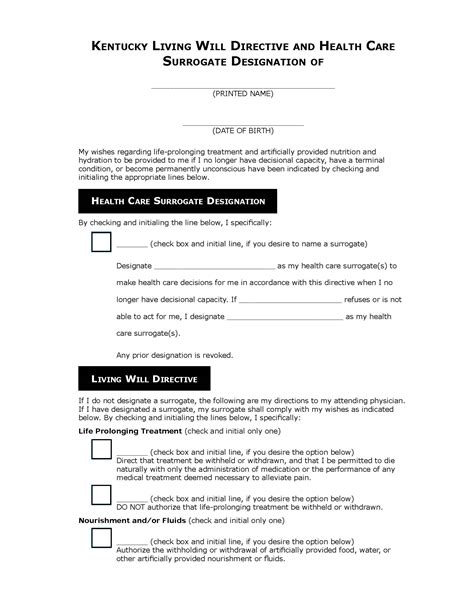

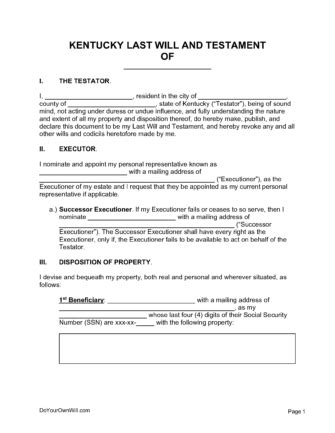

Kentucky Will Forms and Templates

When using Kentucky will forms and templates, it's essential to carefully review the language and provisions to ensure that they align with your wishes and comply with Kentucky will laws. You should also consider seeking the advice of a qualified estate planning attorney to review and customize the forms and templates to meet your specific needs.

DIY Kentucky Will Kits

DIY Kentucky will kits are available online and can provide a cost-effective solution for creating a will. However, it's essential to note that these kits may not provide the same level of customization and expertise as working with a qualified estate planning attorney. Additionally, DIY will kits may not comply with Kentucky will laws, which can lead to unintended consequences and potential disputes among family members.When using a DIY Kentucky will kit, it's essential to carefully follow the instructions and ensure that you comply with all the necessary formalities, including signing the will in the presence of two witnesses and having the witnesses sign the will in the presence of the testator and each other.

Kentucky Will Image Gallery

What is the purpose of a Kentucky will?

+The purpose of a Kentucky will is to specify how you want your assets to be distributed after you pass away, and to appoint an executor to carry out your wishes.

Do I need to have a Kentucky will if I have a small estate?

+Yes, it's still important to have a Kentucky will, even if you have a small estate. A will can help ensure that your assets are distributed according to your wishes, and can prevent disputes among family members.

Can I create a Kentucky will on my own, or do I need to hire an attorney?

+While it's possible to create a Kentucky will on your own, it's highly recommended that you hire an attorney to ensure that your will is valid and effective. An attorney can help you navigate the complexities of Kentucky will laws and ensure that your will complies with all the necessary formalities.

How often should I review and update my Kentucky will?

+You should review and update your Kentucky will periodically, such as every 5-10 years, or whenever there are significant changes in your life, such as a change in marital status or the birth of a child.

What happens if I die without a Kentucky will?

+If you die without a Kentucky will, the state of Kentucky will determine how your assets are distributed, which may not align with your wishes. This can lead to unintended consequences and potential disputes among family members.

In conclusion, creating a Kentucky will is an essential step in estate planning, as it allows you to specify how you want your assets to be distributed after you pass away. By following these five Kentucky will tips, you can ensure that your will is valid, effective, and reflects your wishes. Remember to seek the advice of a qualified estate planning attorney to navigate the complexities of Kentucky will laws and ensure that your will complies with all the necessary formalities. Don't hesitate to reach out to us with any questions or concerns you may have about creating a Kentucky will. Share this article with your friends and family to help them understand the importance of having a comprehensive estate plan.