Intro

Discover expert tips for completing IRS Form 8857, including request for innocent spouse relief, separation of liability, and equitable relief, to navigate tax debt and alleviate financial burden.

Requesting Innocent Spouse Relief can be a complex and daunting process, especially when dealing with the IRS. The IRS Form 8857 is a crucial document for individuals seeking relief from joint tax liabilities. Understanding the intricacies of this form and the process involved is essential for a successful application. In this article, we will delve into the world of IRS Form 8857, exploring its significance, the benefits of filing, and providing valuable tips to guide you through the process.

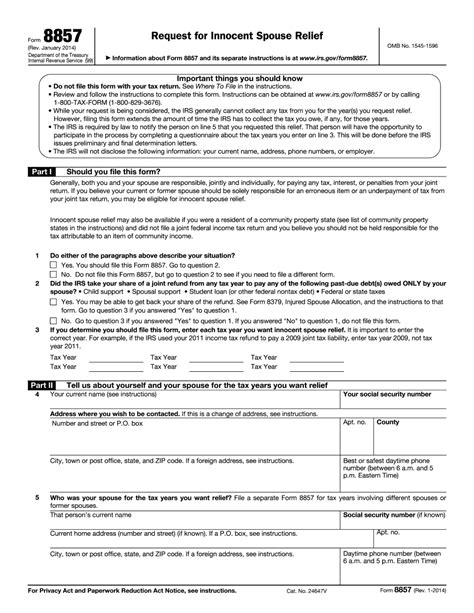

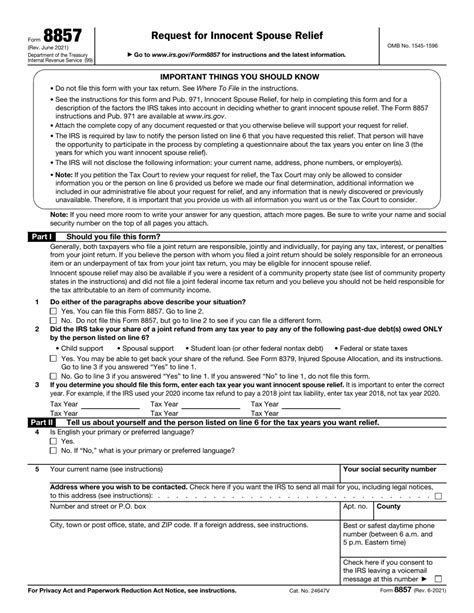

The IRS Form 8857, also known as the Request for Innocent Spouse Relief, is used by individuals who believe they should not be held responsible for the tax debts of their current or former spouse. This form is a vital tool for those who have been unfairly burdened with tax liabilities due to the actions of their partner. By filing Form 8857, individuals can request relief from joint and several liabilities, potentially saving themselves from significant financial hardship.

Filing for Innocent Spouse Relief can have numerous benefits, including the reduction or elimination of tax debts, penalties, and interest. It can also provide peace of mind, knowing that you are not solely responsible for the tax mistakes of your spouse. However, the process of filing Form 8857 can be complex and time-consuming, requiring careful attention to detail and a thorough understanding of the eligibility criteria.

Understanding the Eligibility Criteria

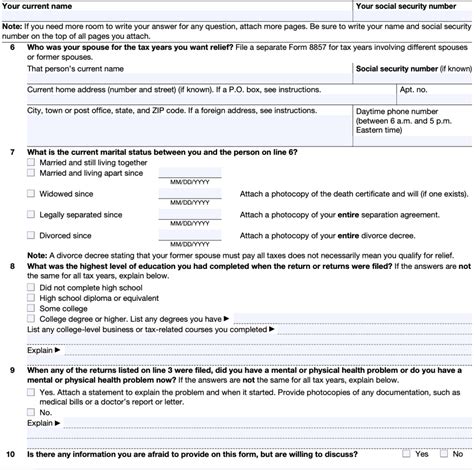

To be eligible for Innocent Spouse Relief, you must meet specific criteria, including filing a joint tax return, having an unpaid tax liability, and being able to demonstrate that you had no knowledge of the erroneous items on the return. You must also show that it would be unfair to hold you liable for the tax debt. Understanding these criteria is essential to determining whether you qualify for relief.

Benefits of Filing Form 8857

The benefits of filing Form 8857 are numerous, including the potential reduction or elimination of tax debts, penalties, and interest. By filing for Innocent Spouse Relief, you can also avoid the financial burden of paying for your spouse's tax mistakes. Additionally, the process of filing Form 8857 can help you regain control of your financial situation, providing a sense of relief and peace of mind.

5 Tips for Filing IRS Form 8857

Here are five valuable tips to consider when filing IRS Form 8857:

- Gather all necessary documentation, including tax returns, receipts, and records of communication with your spouse.

- Complete the form accurately and thoroughly, ensuring that all required information is provided.

- Submit the form in a timely manner, as delays can result in the denial of your request.

- Be prepared to provide additional information or documentation, as requested by the IRS.

- Consider seeking the assistance of a tax professional or attorney, who can guide you through the process and ensure that your rights are protected.

Common Mistakes to Avoid

When filing Form 8857, it is essential to avoid common mistakes that can result in the denial of your request. These mistakes include incomplete or inaccurate information, failure to submit required documentation, and missed deadlines. By being aware of these potential pitfalls, you can ensure that your application is processed efficiently and effectively.

The Importance of Seeking Professional Help

Filing for Innocent Spouse Relief can be a complex and overwhelming process, especially for those without experience in tax law. Seeking the assistance of a tax professional or attorney can be incredibly beneficial, as they can guide you through the process, ensure that your rights are protected, and help you navigate the complexities of the IRS.

Benefits of Hiring a Tax Professional

The benefits of hiring a tax professional include expert knowledge of tax law, assistance with completing Form 8857, and representation in communications with the IRS. A tax professional can also help you gather required documentation, ensure that your application is submitted in a timely manner, and provide valuable guidance throughout the process.What to Expect from the IRS

When filing Form 8857, it is essential to understand what to expect from the IRS. The IRS will review your application, verify the information provided, and determine whether you qualify for Innocent Spouse Relief. This process can take several months, and you may be required to provide additional information or documentation. By being aware of the process and what to expect, you can better prepare yourself for the outcome.Innocent Spouse Relief Image Gallery

What is Innocent Spouse Relief?

+Innocent Spouse Relief is a provision that allows individuals to be relieved of tax liabilities resulting from the actions of their spouse.

How do I qualify for Innocent Spouse Relief?

+To qualify for Innocent Spouse Relief, you must meet specific criteria, including filing a joint tax return, having an unpaid tax liability, and being able to demonstrate that you had no knowledge of the erroneous items on the return.

What is the process for filing Form 8857?

+The process for filing Form 8857 involves gathering required documentation, completing the form accurately and thoroughly, and submitting it to the IRS in a timely manner.

How long does it take to process Form 8857?

+The processing time for Form 8857 can vary, but it typically takes several months for the IRS to review and determine the outcome of your application.

Can I appeal the decision if my application is denied?

+Yes, if your application for Innocent Spouse Relief is denied, you can appeal the decision by filing a petition with the Tax Court or by requesting a reconsideration of your application.

In conclusion, filing for Innocent Spouse Relief using IRS Form 8857 can be a complex and overwhelming process, but with the right guidance and support, you can navigate the intricacies of tax law and achieve a successful outcome. By understanding the eligibility criteria, benefits, and process involved, you can take the first step towards regaining control of your financial situation and finding relief from the burden of joint tax liabilities. If you have any questions or concerns about the process, we encourage you to share them in the comments below or to reach out to a tax professional for personalized guidance and support. Additionally, if you found this article helpful, please consider sharing it with others who may be struggling with similar issues. Together, we can work towards a better understanding of tax law and the resources available to those in need.