Intro

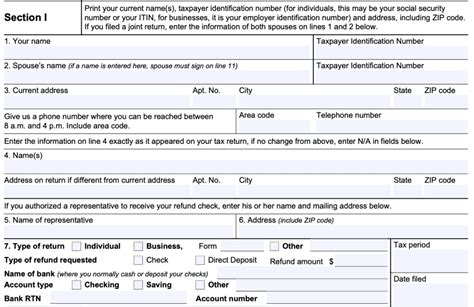

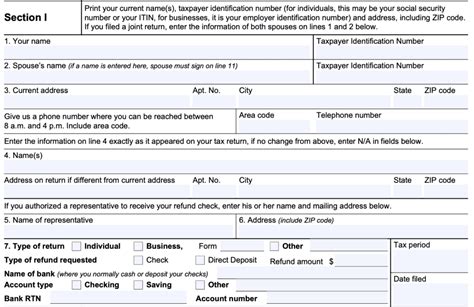

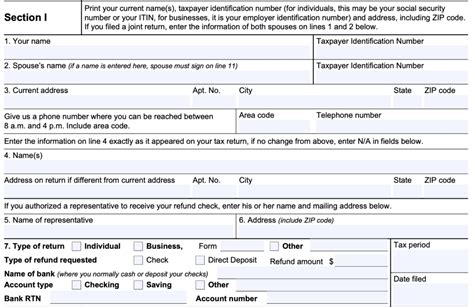

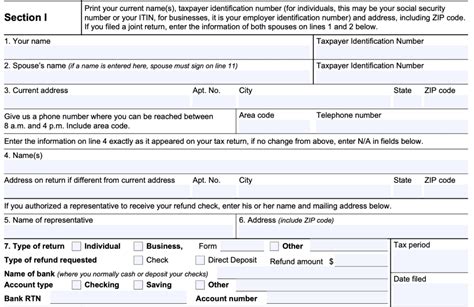

Get the IRS Form 3911 printable template for tax refund inquiries, featuring a fillable layout and instructions for submitting a Taxpayer Statement Regarding Refund.

The IRS Form 3911, also known as the Taxpayer Statement Regarding Refund, is a crucial document for individuals who have not received their tax refund or have concerns about their refund amount. This form allows taxpayers to report any discrepancies or issues with their refund, enabling the IRS to investigate and resolve the matter promptly. In this article, we will delve into the importance of the IRS Form 3911, its uses, and provide a step-by-step guide on how to complete it.

The IRS Form 3911 is an essential tool for taxpayers who have not received their refund or have questions about their refund amount. By filling out this form, taxpayers can provide the IRS with the necessary information to investigate and resolve any issues related to their refund. It is crucial to note that the IRS Form 3911 should only be used for tax-related refund issues and not for other tax-related problems.

Understanding the IRS Form 3911

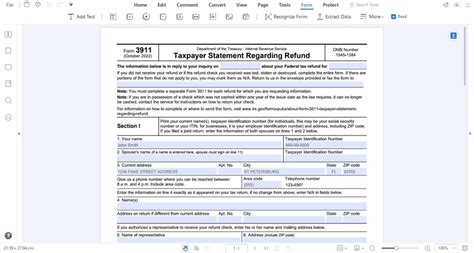

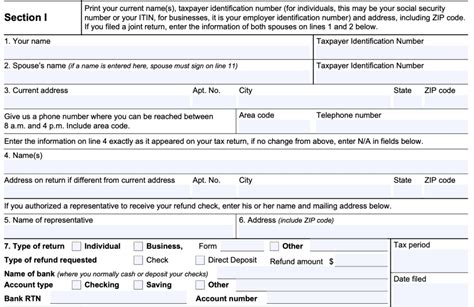

The IRS Form 3911 is a straightforward document that requires taxpayers to provide their personal and tax-related information. The form consists of several sections, including the taxpayer's name, address, social security number, and tax year. Taxpayers must also provide details about their refund, such as the expected refund amount and the date they filed their tax return.

Uses of the IRS Form 3911

The IRS Form 3911 has several uses, including:

- Reporting a missing or lost refund

- Requesting an investigation into a refund discrepancy

- Providing additional information to support a refund claim

- Notifying the IRS of a change in address or other contact information

Step-by-Step Guide to Completing the IRS Form 3911

To complete the IRS Form 3911, follow these steps:

- Download and print the form from the IRS website or obtain a copy from your local IRS office.

- Fill out the form legibly and accurately, using black ink.

- Provide your personal and tax-related information, including your name, address, social security number, and tax year.

- Complete the refund information section, including the expected refund amount and the date you filed your tax return.

- Sign and date the form.

- Attach any supporting documentation, such as a copy of your tax return or proof of identity.

- Mail the completed form to the address listed on the IRS website or take it to your local IRS office.

Tips for Completing the IRS Form 3911

When completing the IRS Form 3911, keep the following tips in mind:

- Use black ink and print legibly to avoid errors or delays.

- Ensure you provide accurate and complete information to facilitate the investigation process.

- Attach all required supporting documentation to avoid requests for additional information.

- Keep a copy of the completed form for your records.

Common Mistakes to Avoid When Completing the IRS Form 3911

When completing the IRS Form 3911, avoid the following common mistakes:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Insufficient supporting documentation

- Using the wrong form or version

IRS Form 3911 FAQs

Some frequently asked questions about the IRS Form 3911 include:

- What is the purpose of the IRS Form 3911?

- How do I obtain a copy of the IRS Form 3911?

- What information do I need to provide on the form?

- How long does it take to process the form?

Gallery of IRS Form 3911 Templates

IRS Form 3911 Image Gallery

What is the purpose of the IRS Form 3911?

+The IRS Form 3911 is used to report a missing or lost refund, request an investigation into a refund discrepancy, or provide additional information to support a refund claim.

How do I obtain a copy of the IRS Form 3911?

+You can download and print the form from the IRS website or obtain a copy from your local IRS office.

What information do I need to provide on the form?

+You will need to provide your personal and tax-related information, including your name, address, social security number, and tax year, as well as details about your refund.

In

Final Thoughts

we hope this article has provided you with a comprehensive understanding of the IRS Form 3911 and its uses. By following the step-by-step guide and tips outlined in this article, you can ensure that you complete the form accurately and efficiently. If you have any further questions or concerns, please do not hesitate to comment below or share this article with others who may find it helpful. Remember to always keep a copy of your completed form for your records and to follow up with the IRS if you have not received a response within a reasonable timeframe.