Intro

Master IRS mail with 5 expert tips, including tax return guidance, payment procedures, and correspondence best practices to avoid audits and penalties, ensuring compliant and stress-free interactions with the Internal Revenue Service.

The importance of mail tips, particularly when it comes to the Internal Revenue Service (IRS), cannot be overstated. As the IRS is responsible for collecting taxes and enforcing tax laws, it's crucial for individuals and businesses to understand how to navigate the system efficiently. In today's digital age, mail is still a primary means of communication between taxpayers and the IRS. Effective mail management can help prevent delays, reduce errors, and ensure compliance with tax regulations. With the ever-increasing complexity of tax laws and the potential for costly penalties, mastering IRS mail tips is essential for anyone dealing with the tax system.

Understanding the basics of IRS mail is the first step towards a smoother experience. The IRS receives millions of pieces of mail every year, ranging from tax returns and payments to requests for transcripts and notices. Given the volume, it's not surprising that errors can occur, and mail can get lost or misdirected. However, by following specific guidelines and best practices, individuals and businesses can minimize the risk of issues and ensure their mail is processed correctly and efficiently. From using the correct mailing addresses to including all required documentation, every detail counts when it comes to IRS mail.

The IRS continually updates its processes and guidelines to improve efficiency and reduce errors. Staying informed about these changes is vital for anyone who regularly interacts with the IRS. This includes being aware of the different types of IRS notices, understanding how to respond to them, and knowing the best ways to send mail to the IRS. Moreover, with the advancement in technology, the IRS has introduced electronic options for submitting tax returns, making payments, and communicating with them. However, traditional mail still plays a significant role, especially for those who prefer or require a physical record of their interactions.

Understanding IRS Mail Basics

Types of IRS Mail

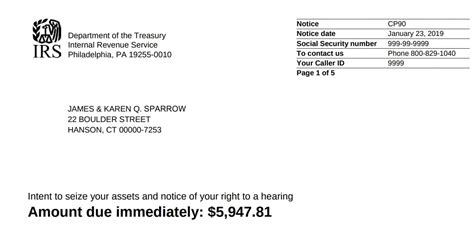

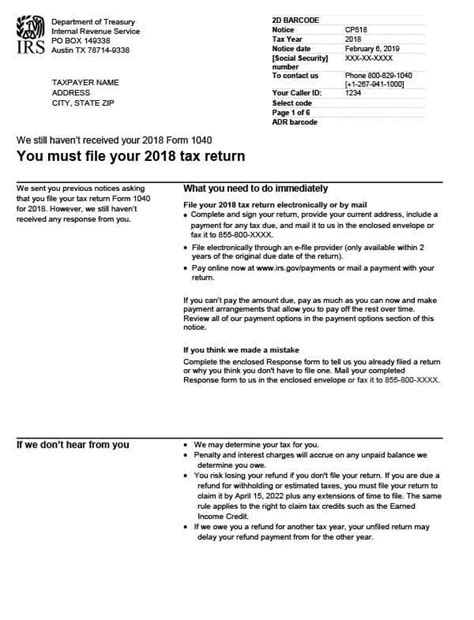

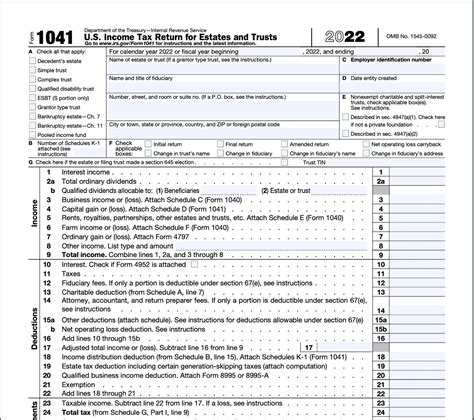

The IRS sends various types of mail to taxpayers, including notices, letters, and forms. Notices are used to inform taxpayers of actions taken or required, such as audits, payments due, or changes to their account. Letters may request additional information or explain IRS decisions. Forms are used for tax returns, payments, and other tax-related purposes. Understanding the purpose and content of each type of mail is crucial for responding appropriately and avoiding potential issues.IRS Mail Tips for Individuals

Electronic Options

While traditional mail is still widely used, the IRS offers electronic options for many services, including filing tax returns, making payments, and requesting transcripts. Using these electronic services can expedite processing, reduce errors, and provide a convenient way to interact with the IRS. For example, the IRS's online account tool allows taxpayers to view their account information, make payments, and access tax documents online.IRS Mail Tips for Businesses

Common Errors to Avoid

Both individuals and businesses can fall into common traps when dealing with IRS mail, such as missing deadlines, using incorrect addresses, or failing to include required documentation. Being aware of these potential pitfalls and taking steps to avoid them can significantly reduce the risk of issues with the IRS.Gallery of IRS Mail Tips

IRS Mail Tips Image Gallery

Frequently Asked Questions About IRS Mail

What is the best way to send mail to the IRS?

+The best way to send mail to the IRS is to use the correct mailing address for your specific purpose and to include all required documentation. Consider using certified mail or a tracking service to ensure your mail is received.

How long does it take for the IRS to process mail?

+The processing time for IRS mail can vary significantly depending on the type of mail and the current workload of the IRS. It's generally recommended to allow several weeks for processing and to plan accordingly.

Can I use electronic services instead of mail for IRS communications?

+Yes, the IRS offers a range of electronic services for filing tax returns, making payments, and communicating with them. These services can often expedite processing and reduce the risk of errors.

What should I do if I receive an IRS notice?

+If you receive an IRS notice, read it carefully and respond promptly. Ensure you understand what action is required and seek professional advice if necessary.

How can I avoid common errors when dealing with IRS mail?

+To avoid common errors, always use the correct mailing address, include all required documentation, and respond to notices promptly. Consider seeking professional advice for complex tax issues.

In conclusion, mastering IRS mail tips is crucial for both individuals and businesses to navigate the tax system efficiently. By understanding the basics of IRS mail, using the correct mailing addresses, including all required documentation, and leveraging electronic services, taxpayers can minimize the risk of errors and delays. Whether you're dealing with tax returns, payments, or notices, being informed and proactive can make a significant difference in your experience with the IRS. We invite you to share your experiences or tips regarding IRS mail in the comments below and to consider sharing this article with others who may benefit from this information.