Intro

Get IRS B Notice template to correct payee errors, ensuring compliance with IRS regulations, and avoiding penalties through accurate backup withholding and tax reporting, using a sample B Notice letter.

The IRS B Notice is a crucial document that helps businesses and financial institutions verify the accuracy of taxpayer identification numbers (TINs) and names. In this article, we will delve into the world of IRS B Notices, exploring their importance, benefits, and steps to create an effective template.

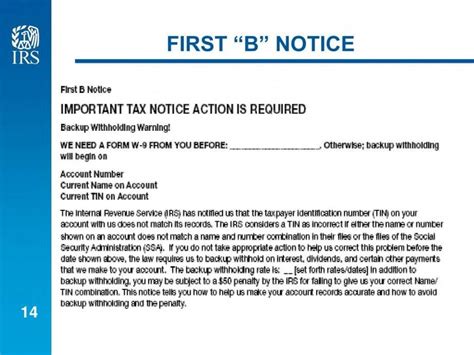

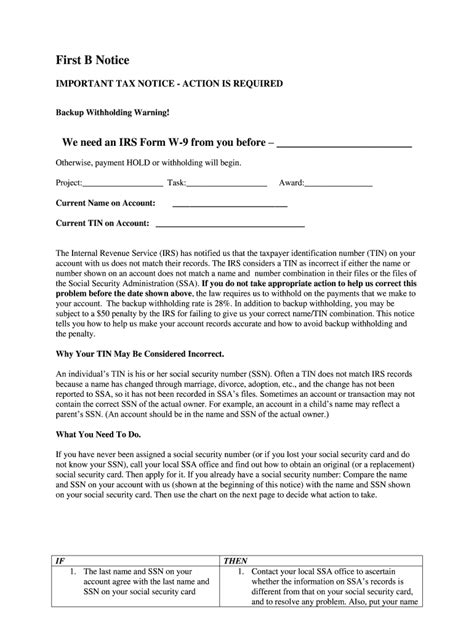

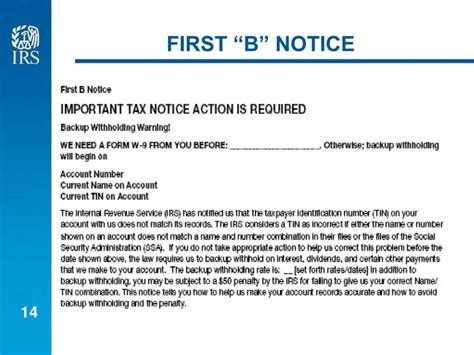

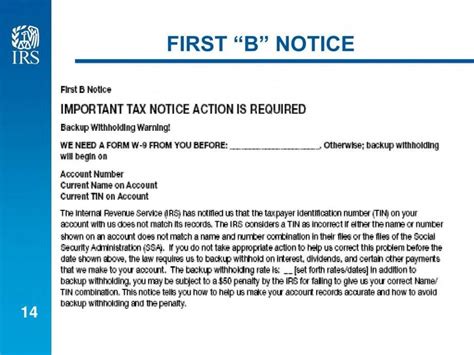

Receiving an IRS B Notice can be a daunting experience, especially for those who are unfamiliar with tax laws and regulations. However, understanding the purpose and requirements of this notice can help alleviate concerns and ensure compliance with IRS rules. The IRS B Notice is typically sent to businesses and financial institutions when there is a mismatch between the TIN and name reported on tax returns or other documents. This discrepancy can lead to backup withholding, which can result in significant financial losses.

To avoid such consequences, it is essential to respond promptly and accurately to an IRS B Notice. This is where an IRS B Notice template comes into play. A well-crafted template can help businesses and financial institutions respond efficiently and effectively, reducing the risk of errors and potential penalties. In the following sections, we will discuss the key elements of an IRS B Notice template and provide guidance on how to create one.

Understanding the IRS B Notice

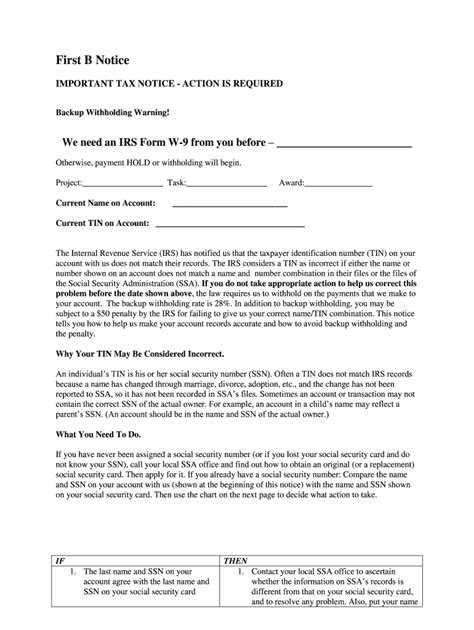

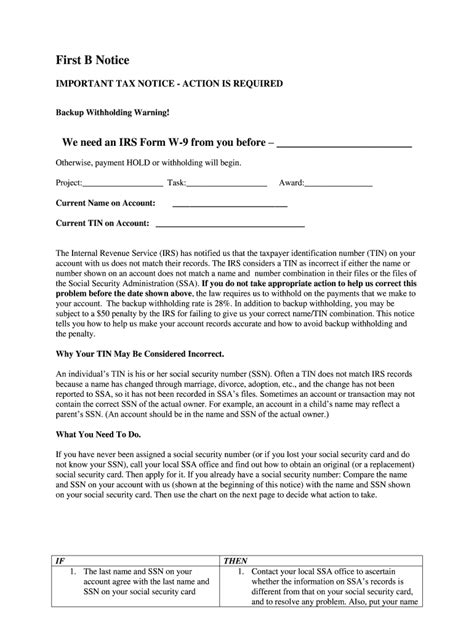

Before creating an IRS B Notice template, it is crucial to understand the purpose and requirements of this document. The IRS B Notice is designed to verify the accuracy of TINs and names reported on tax returns or other documents. This notice is typically sent to businesses and financial institutions when there is a mismatch between the TIN and name reported. The notice will usually include the following information: the name and TIN of the taxpayer, the type of tax return or document that triggered the notice, and the deadline for responding to the notice.

Benefits of Responding to an IRS B Notice

Responding to an IRS B Notice can have several benefits, including avoiding backup withholding, reducing the risk of errors and potential penalties, and ensuring compliance with IRS rules. By responding promptly and accurately, businesses and financial institutions can verify the accuracy of TINs and names, avoiding potential discrepancies that can lead to backup withholding. Additionally, responding to an IRS B Notice can help reduce the risk of errors and potential penalties, as it demonstrates a commitment to compliance with IRS rules.Creating an IRS B Notice Template

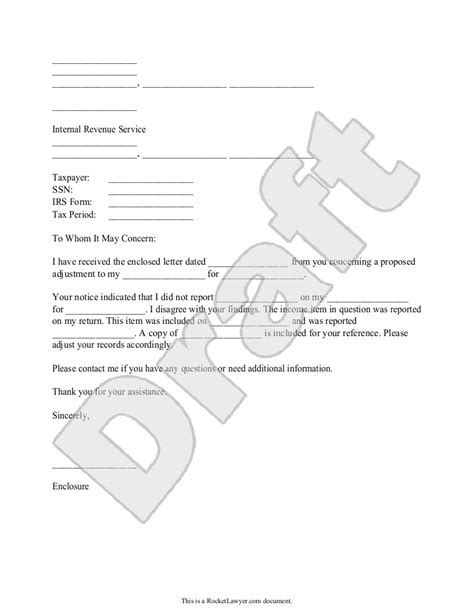

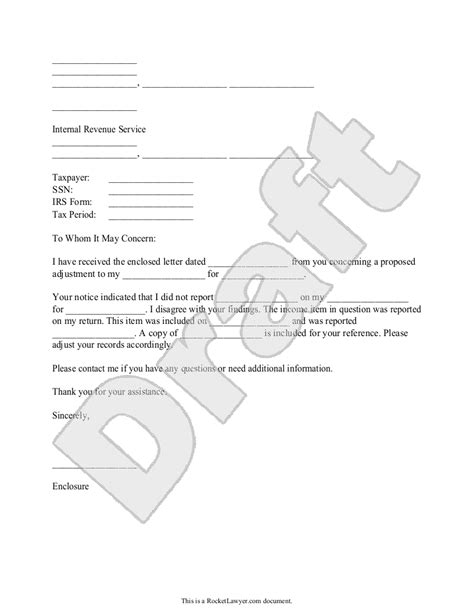

Creating an IRS B Notice template involves several steps, including gathering necessary information, verifying TINs and names, and responding to the notice. The following are the key elements of an IRS B Notice template:

- Introduction: A brief introduction that explains the purpose of the response and the relevant tax laws and regulations.

- Identification: The name and TIN of the taxpayer, as well as the type of tax return or document that triggered the notice.

- Verification: A statement verifying the accuracy of the TIN and name reported on the tax return or document.

- Supporting documentation: Any supporting documentation, such as a copy of the tax return or document, that verifies the accuracy of the TIN and name.

- Conclusion: A conclusion that summarizes the response and reiterates the commitment to compliance with IRS rules.

Steps to Create an IRS B Notice Template

To create an effective IRS B Notice template, follow these steps: 1. Gather necessary information: Collect all relevant information, including the name and TIN of the taxpayer, the type of tax return or document that triggered the notice, and any supporting documentation. 2. Verify TINs and names: Verify the accuracy of the TIN and name reported on the tax return or document. 3. Respond to the notice: Use the gathered information to respond to the IRS B Notice, including a statement verifying the accuracy of the TIN and name, and any supporting documentation. 4. Review and revise: Review the response for accuracy and completeness, and revise as necessary.Benefits of Using an IRS B Notice Template

Using an IRS B Notice template can have several benefits, including increased efficiency, reduced risk of errors, and improved compliance. By using a template, businesses and financial institutions can respond to IRS B Notices more efficiently, reducing the time and resources required to verify TINs and names. Additionally, a template can help reduce the risk of errors, as it provides a standardized format for responding to the notice.

Common Mistakes to Avoid

When creating an IRS B Notice template, there are several common mistakes to avoid, including: * Failing to verify TINs and names: Verifying the accuracy of TINs and names is crucial to responding to an IRS B Notice. * Failing to provide supporting documentation: Supporting documentation, such as a copy of the tax return or document, is essential to verifying the accuracy of TINs and names. * Failing to respond promptly: Responding promptly to an IRS B Notice is crucial to avoiding backup withholding and reducing the risk of errors and potential penalties.Best Practices for Responding to an IRS B Notice

Responding to an IRS B Notice requires careful attention to detail and a commitment to compliance with IRS rules. The following are some best practices for responding to an IRS B Notice:

- Respond promptly: Responding promptly to an IRS B Notice is crucial to avoiding backup withholding and reducing the risk of errors and potential penalties.

- Verify TINs and names: Verifying the accuracy of TINs and names is essential to responding to an IRS B Notice.

- Provide supporting documentation: Supporting documentation, such as a copy of the tax return or document, is essential to verifying the accuracy of TINs and names.

Conclusion and Next Steps

In conclusion, responding to an IRS B Notice requires careful attention to detail and a commitment to compliance with IRS rules. By using an IRS B Notice template, businesses and financial institutions can respond more efficiently and effectively, reducing the risk of errors and potential penalties. The next steps involve reviewing and revising the response, as well as following up with the IRS to ensure that the issue has been resolved.IRS B Notice Image Gallery

What is an IRS B Notice?

+An IRS B Notice is a document sent by the IRS to verify the accuracy of taxpayer identification numbers (TINs) and names reported on tax returns or other documents.

Why is it important to respond to an IRS B Notice?

+Responding to an IRS B Notice is crucial to avoiding backup withholding and reducing the risk of errors and potential penalties.

What information is required to respond to an IRS B Notice?

+To respond to an IRS B Notice, you will need to provide the name and TIN of the taxpayer, as well as any supporting documentation, such as a copy of the tax return or document.

We hope this article has provided valuable insights into the world of IRS B Notices and the importance of responding promptly and accurately. By using an IRS B Notice template, businesses and financial institutions can respond more efficiently and effectively, reducing the risk of errors and potential penalties. If you have any questions or concerns about IRS B Notices or would like to share your experiences, please feel free to comment below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.