Intro

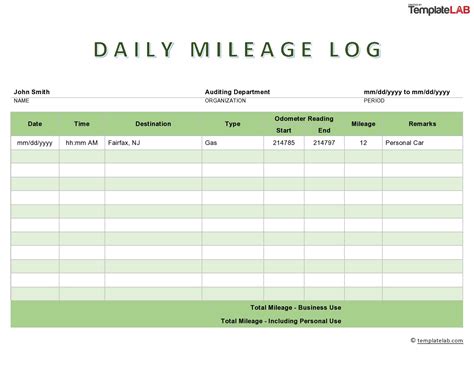

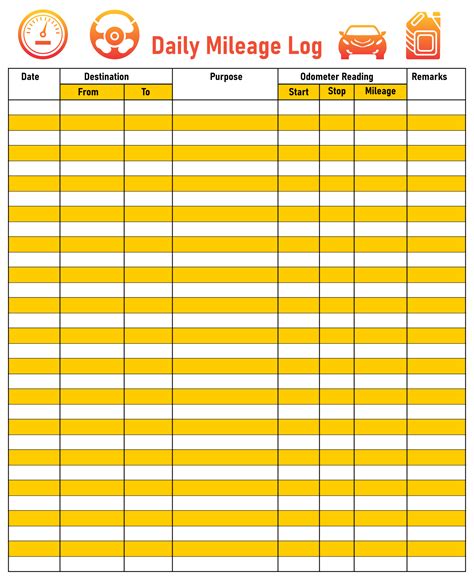

Track business miles with an IRS approved mileage log printable template, featuring odometer readings, dates, and trip purposes, to simplify tax deductions and reimbursements, ensuring accurate mileage tracking and compliance.

The importance of maintaining a mileage log for tax purposes cannot be overstated. For individuals who use their personal vehicles for business, charitable, or medical purposes, keeping an accurate record of miles driven can result in significant tax deductions. The Internal Revenue Service (IRS) has specific guidelines for what constitutes a valid mileage log, and using an IRS-approved mileage log printable template can help ensure that your records are accurate and compliant. In this article, we will explore the benefits of using a mileage log, how to choose the right template, and provide tips for maintaining accurate records.

For many individuals, the process of tracking mileage can seem daunting, especially for those who are new to the practice. However, with the right tools and a bit of planning, it can be a straightforward and rewarding process. By using an IRS-approved mileage log printable template, individuals can ensure that their records are accurate and compliant, which can result in significant tax savings. In addition to the financial benefits, maintaining a mileage log can also help individuals track their vehicle's maintenance and repair needs, which can help extend the life of the vehicle.

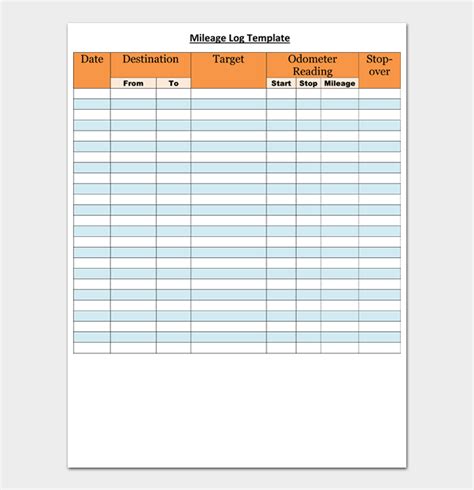

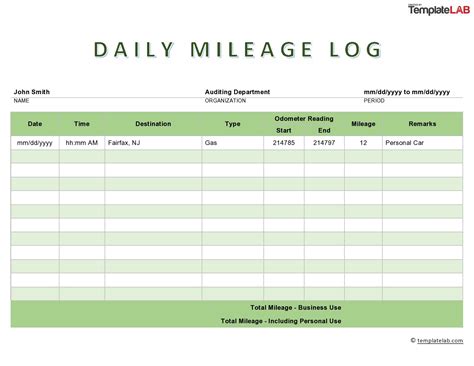

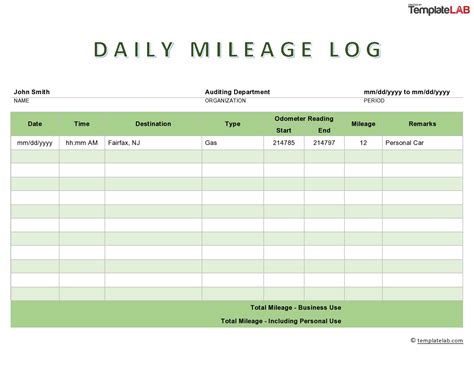

The IRS requires that mileage logs be accurate, complete, and maintained on a regular basis. This means that individuals must keep a record of every trip, including the date, destination, and number of miles driven. The log must also include a description of the business, charitable, or medical purpose of each trip. By using an IRS-approved mileage log printable template, individuals can ensure that their records meet these requirements and are easy to understand and review. In the event of an audit, a well-maintained mileage log can provide valuable evidence to support tax deductions, which can help reduce the risk of penalties and fines.

Benefits of Using a Mileage Log

Some of the key benefits of using a mileage log include:

- Accurate tracking of miles driven for business, charitable, or medical purposes

- Significant tax savings through deductions for miles driven

- Improved vehicle maintenance and repair tracking

- Increased productivity and efficiency

- Reduced risk of penalties and fines in the event of an audit

Choosing the Right Mileage Log Template

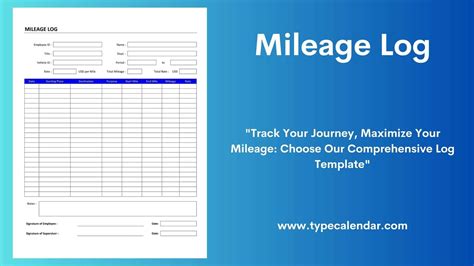

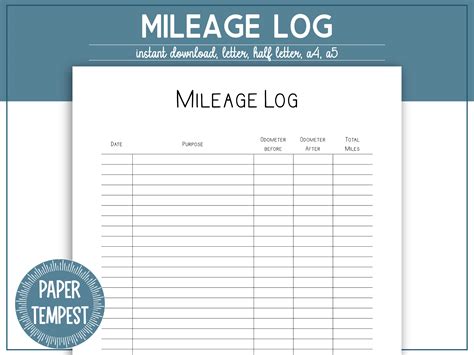

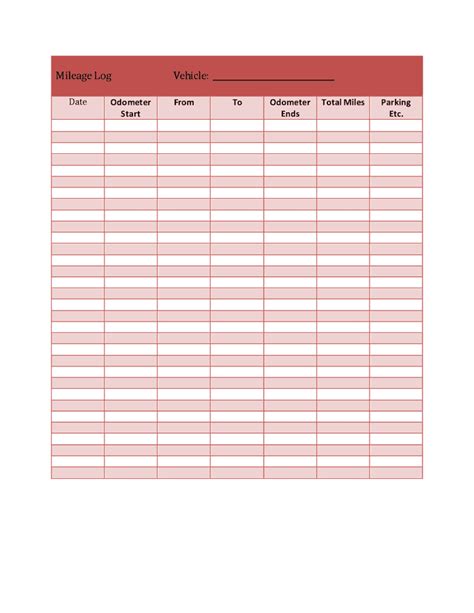

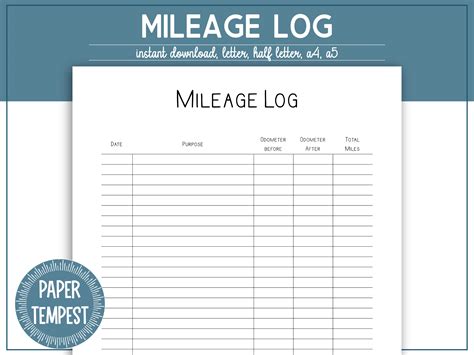

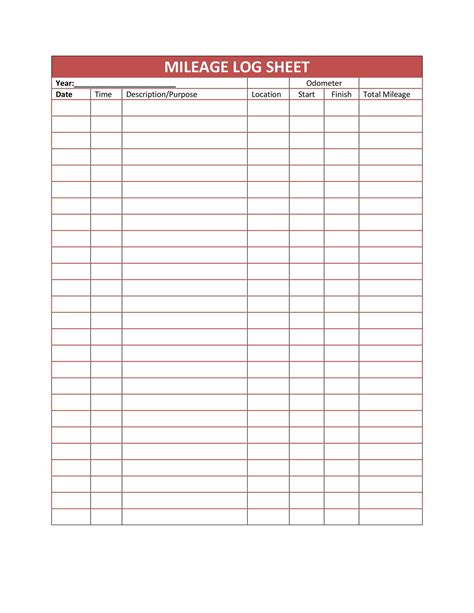

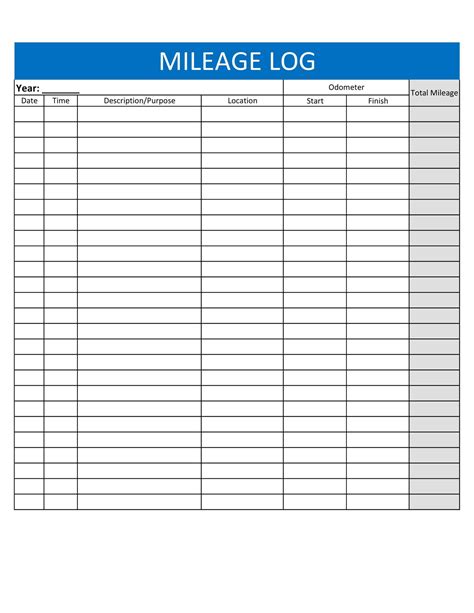

Some key features to consider when choosing a mileage log template include:

- Accuracy and compliance with IRS guidelines

- Ease of use and simplicity

- Space for tracking expenses, such as fuel and tolls

- Space for tracking volunteer hours or medical appointments

- Customization options to meet specific needs and requirements

How to Maintain Accurate Records

By following these tips and using an IRS-approved mileage log printable template, individuals can ensure that their records are accurate and compliant, which can result in significant tax savings and improved vehicle maintenance.

Common Mistakes to Avoid

By avoiding these common mistakes, individuals can ensure that their mileage log is accurate and compliant, which can result in significant tax savings and improved vehicle maintenance.

Tips for Maximizing Tax Savings

By following these tips and using an IRS-approved mileage log printable template, individuals can maximize their tax savings and improve their overall financial situation.

Gallery of Mileage Log Templates

Mileage Log Templates Image Gallery

FAQs

What is a mileage log?

+A mileage log is a record of the miles driven for business, charitable, or medical purposes.

Why do I need to keep a mileage log?

+Keeping a mileage log can help you track your miles driven and provide evidence for tax deductions.

How do I choose the right mileage log template?

+When choosing a mileage log template, consider your specific needs and requirements, such as space for tracking expenses or volunteer hours.

What are some common mistakes to avoid when using a mileage log?

+Common mistakes to avoid include failing to keep the log up to date and accurate, failing to include all required information, and failing to review the log regularly.

How can I maximize my tax savings using a mileage log?

+To maximize your tax savings, keep your mileage log up to date and accurate, and consider consulting with a tax professional or accountant to ensure that all eligible deductions are claimed.

In conclusion, maintaining a mileage log is an important part of tracking miles driven for business, charitable, or medical purposes. By using an IRS-approved mileage log printable template and following the tips outlined in this article, individuals can ensure that their records are accurate and compliant, which can result in significant tax savings and improved vehicle maintenance. We encourage readers to share their experiences with using mileage logs and to ask any questions they may have in the comments below. Additionally, we invite readers to share this article with others who may benefit from using a mileage log, and to explore our other resources and templates for tracking miles driven.