Intro

Discover 5 ways to create a budget template, including expense tracking, financial planning, and money management tools to optimize your personal finance and achieve fiscal stability with effective budgeting strategies.

Creating a budget is an essential step in managing your finances effectively. It helps you track your income and expenses, make informed financial decisions, and achieve your long-term financial goals. A well-crafted budget template can simplify this process, providing a clear and organized framework for allocating your resources. In this article, we will explore five ways a budget template can benefit your financial planning and provide guidance on how to create and use one effectively.

Budgeting is a crucial aspect of personal finance, and it's essential to understand its importance in maintaining financial stability. A budget template serves as a tool to help you manage your finances, ensuring that you're making the most of your money. With a budget template, you can easily track your income and expenses, identify areas where you can cut back, and make adjustments to achieve your financial goals. Whether you're looking to save money, pay off debt, or build wealth, a budget template is an indispensable resource.

Effective budgeting requires a thorough understanding of your financial situation, including your income, expenses, debts, and financial goals. A budget template provides a structured approach to managing your finances, enabling you to prioritize your spending, make smart financial decisions, and stay on track with your financial objectives. By using a budget template, you can gain control over your finances, reduce stress, and achieve financial peace of mind. In the following sections, we will delve into the benefits of using a budget template and provide guidance on how to create and use one effectively.

Benefits of Using a Budget Template

A budget template offers several benefits, including simplifying the budgeting process, providing a clear picture of your financial situation, and helping you achieve your financial goals. With a budget template, you can easily track your income and expenses, identify areas where you can cut back, and make adjustments to optimize your financial performance. Additionally, a budget template enables you to prioritize your spending, make smart financial decisions, and stay on track with your financial objectives.

Some of the key benefits of using a budget template include:

- Simplifying the budgeting process

- Providing a clear picture of your financial situation

- Helping you achieve your financial goals

- Enabling you to prioritize your spending

- Assisting you in making smart financial decisions

- Helping you stay on track with your financial objectives

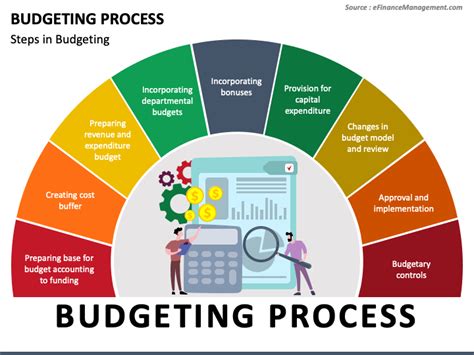

How to Create a Budget Template

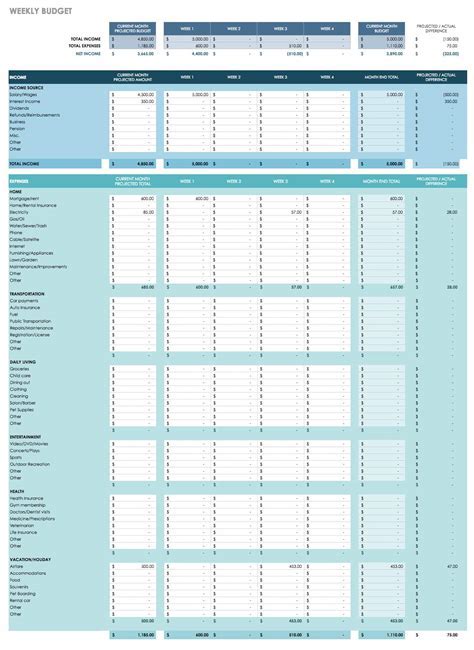

Creating a budget template is a straightforward process that involves identifying your income and expenses, categorizing your spending, and setting financial goals. To create a budget template, follow these steps:

- Identify your income and expenses: Start by tracking your income and expenses over a month to get an accurate picture of your financial situation.

- Categorize your spending: Divide your expenses into categories, such as housing, transportation, food, and entertainment.

- Set financial goals: Determine what you want to achieve with your budget, such as saving money, paying off debt, or building wealth.

- Choose a budgeting method: Select a budgeting method that works for you, such as the 50/30/20 rule or zero-based budgeting.

- Create a budget template: Use a spreadsheet or budgeting software to create a budget template that outlines your income, expenses, and financial goals.

Types of Budget Templates

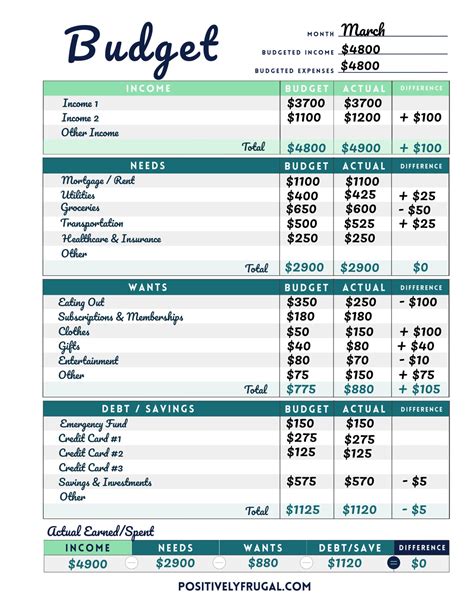

There are several types of budget templates available, each with its own unique features and benefits. Some common types of budget templates include:

- Zero-based budget template: This type of template requires you to account for every dollar of your income, ensuring that you're making the most of your money.

- 50/30/20 budget template: This template allocates 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- Envelope budget template: This template uses a cash-based system, where you divide your expenses into categories and allocate a specific amount of cash for each category.

- Priority-based budget template: This template prioritizes your spending based on your financial goals, ensuring that you're allocating your resources effectively.

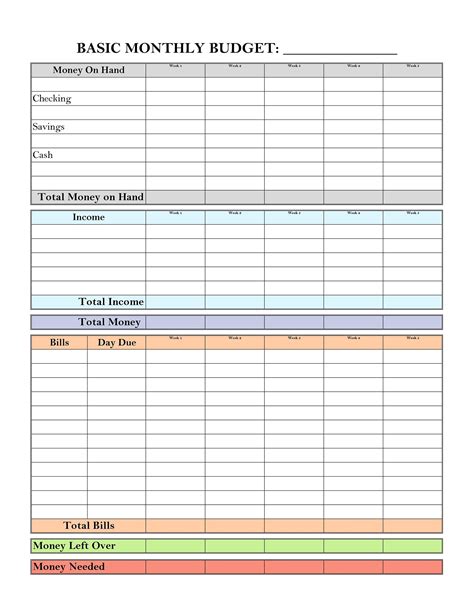

How to Use a Budget Template

Using a budget template is a straightforward process that involves tracking your income and expenses, categorizing your spending, and making adjustments to optimize your financial performance. To use a budget template effectively, follow these steps:

- Track your income and expenses: Regularly update your budget template with your income and expenses to ensure that you're staying on track with your financial goals.

- Categorize your spending: Divide your expenses into categories to identify areas where you can cut back and make adjustments to optimize your financial performance.

- Make adjustments: Regularly review your budget template and make adjustments as needed to ensure that you're achieving your financial goals.

- Monitor your progress: Track your progress over time to see how far you've come and make adjustments to stay on track with your financial objectives.

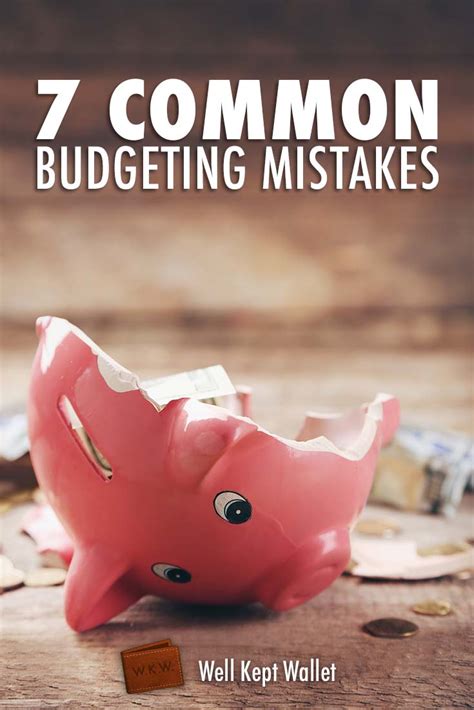

Common Budgeting Mistakes

When creating and using a budget template, it's essential to avoid common budgeting mistakes that can derail your financial progress. Some common budgeting mistakes include:

- Not tracking expenses: Failing to track your expenses can lead to overspending and make it challenging to stay on track with your financial goals.

- Not prioritizing needs over wants: Failing to prioritize your needs over your wants can lead to overspending and make it challenging to achieve your financial goals.

- Not having an emergency fund: Failing to have an emergency fund can leave you vulnerable to financial shocks and make it challenging to stay on track with your financial objectives.

- Not regularly reviewing and adjusting your budget: Failing to regularly review and adjust your budget can lead to stagnation and make it challenging to achieve your financial goals.

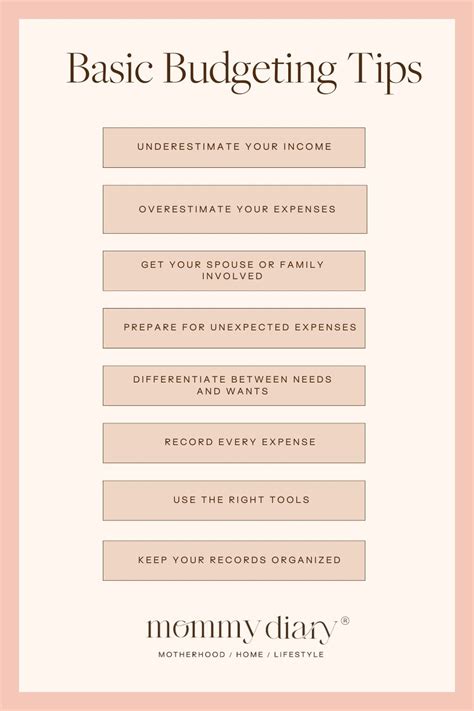

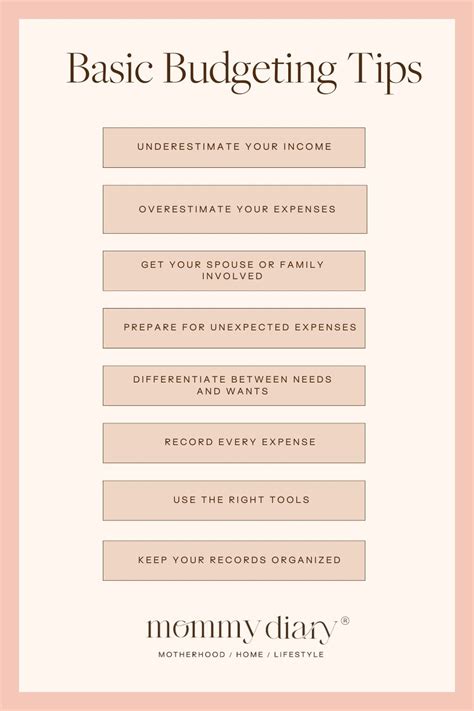

Best Practices for Budgeting

To get the most out of your budget template, it's essential to follow best practices for budgeting. Some best practices for budgeting include:

- Regularly tracking your income and expenses

- Categorizing your spending to identify areas where you can cut back

- Prioritizing your needs over your wants

- Having an emergency fund to protect against financial shocks

- Regularly reviewing and adjusting your budget to ensure that you're achieving your financial goals

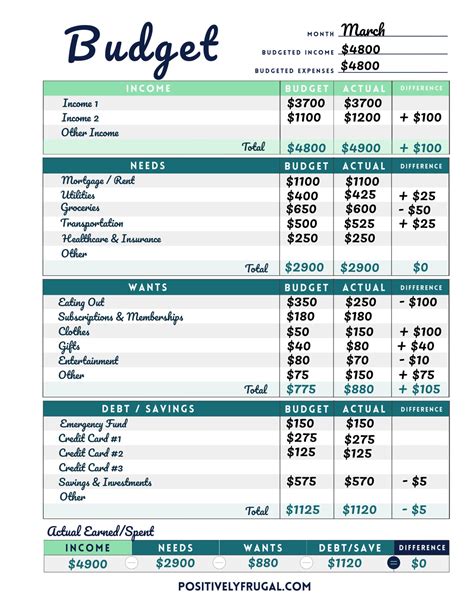

Budget Template Image Gallery

What is a budget template?

+A budget template is a tool used to manage your finances, providing a structured approach to tracking your income and expenses, categorizing your spending, and achieving your financial goals.

Why is budgeting important?

+Budgeting is essential for managing your finances effectively, achieving financial stability, and securing your financial future. It helps you track your income and expenses, make informed financial decisions, and achieve your long-term financial goals.

How do I create a budget template?

+To create a budget template, identify your income and expenses, categorize your spending, set financial goals, choose a budgeting method, and use a spreadsheet or budgeting software to create a budget template that outlines your income, expenses, and financial goals.

What are some common budgeting mistakes?

+Common budgeting mistakes include not tracking expenses, not prioritizing needs over wants, not having an emergency fund, and not regularly reviewing and adjusting your budget.

How often should I review and adjust my budget?

+It's essential to regularly review and adjust your budget to ensure that you're achieving your financial goals. Review your budget at least once a month, and make adjustments as needed to stay on track with your financial objectives.

In conclusion, a budget template is a valuable tool for managing your finances effectively. By understanding the benefits of using a budget template, creating a budget template, and using it effectively, you can achieve financial stability, secure your financial future, and make progress towards your long-term financial goals. Remember to avoid common budgeting mistakes, follow best practices for budgeting, and regularly review and adjust your budget to ensure that you're on track with your financial objectives. With the right budget template and a commitment to financial discipline, you can achieve financial success and enjoy a more secure and prosperous financial future. We invite you to share your thoughts on budgeting and budget templates in the comments below, and don't forget to share this article with anyone who may benefit from it.