Intro

Discover 5 ways Excel reconciliation simplifies financial analysis, data matching, and account reconciliation, using tools like formulas, pivot tables, and macros for efficient financial reporting and audit trails.

Reconciliation is a crucial process in accounting and finance that involves comparing two sets of records to ensure they match and are accurate. Excel, being a powerful spreadsheet software, offers various tools and techniques to facilitate reconciliation. In this article, we will explore five ways Excel can be used for reconciliation, highlighting the benefits, working mechanisms, and steps involved in each method.

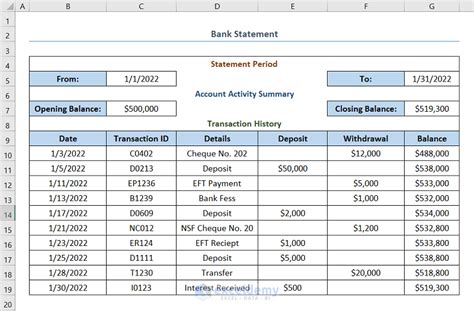

Reconciliation is essential in maintaining the integrity of financial records, detecting errors, and preventing fraud. It involves comparing internal records, such as general ledgers or sub-ledgers, with external statements, like bank statements or vendor invoices. Excel provides an efficient platform for performing reconciliation due to its flexibility, calculation capabilities, and data analysis features. By leveraging Excel for reconciliation, businesses can streamline their financial processes, reduce manual errors, and increase transparency.

The importance of reconciliation cannot be overstated. It helps in identifying discrepancies, ensuring compliance with financial regulations, and making informed business decisions. With Excel, users can create customized reconciliation templates, automate calculations, and visualize data to better understand financial trends and anomalies. Whether it's reconciling bank statements, credit card transactions, or payroll, Excel offers a range of functions and formulas that can be tailored to specific reconciliation needs.

Introduction to Excel Reconciliation

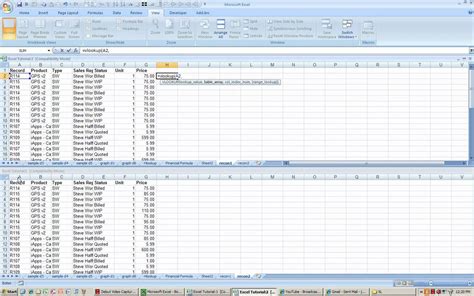

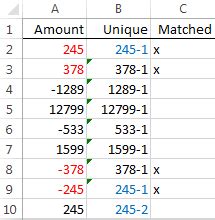

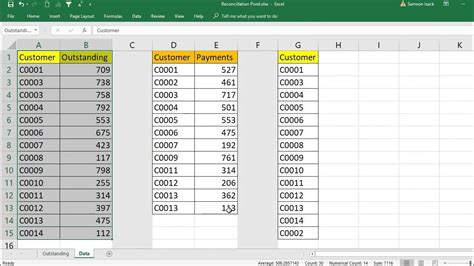

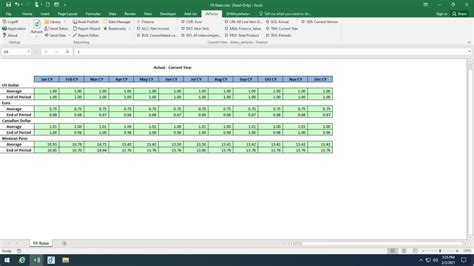

Method 1: Using Excel Formulas for Reconciliation

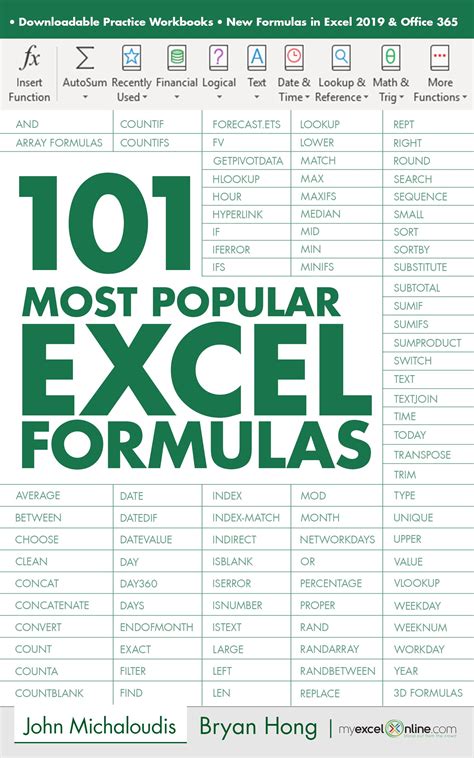

To use Excel formulas for reconciliation, follow these steps:

- Set up two spreadsheets or tables containing the data to be reconciled.

- Use VLOOKUP or INDEX/MATCH to match corresponding entries between the two datasets.

- Employ IF statements to compare the matched entries and identify discrepancies.

- Summarize the reconciliation results using formulas like SUMIF or COUNTIF to quantify the differences.

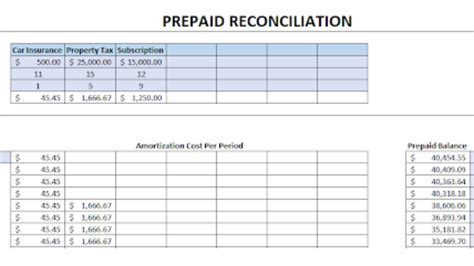

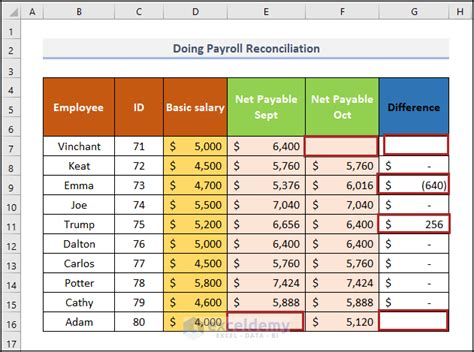

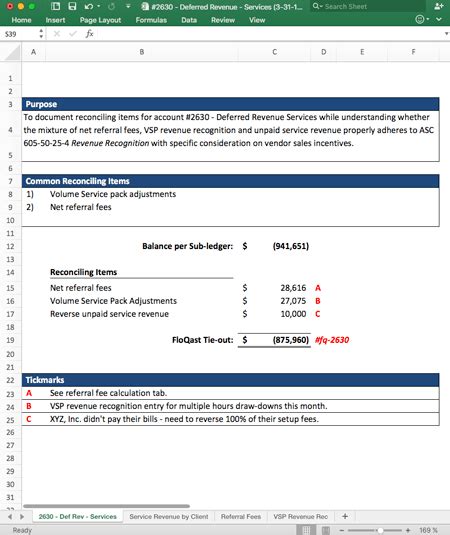

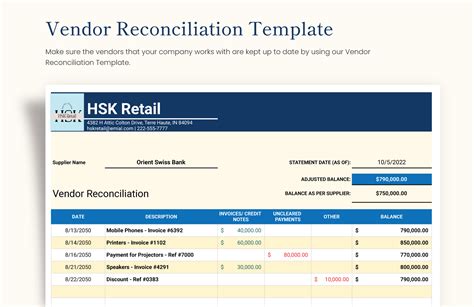

Method 2: Creating a Reconciliation Template in Excel

Steps to create a reconciliation template in Excel include:

- Designing the template layout to match the structure of the financial data.

- Inserting formulas to automate calculations, such as summing debits and credits.

- Formatting the template to highlight discrepancies and make it user-friendly.

- Testing the template with sample data to ensure it functions as intended.

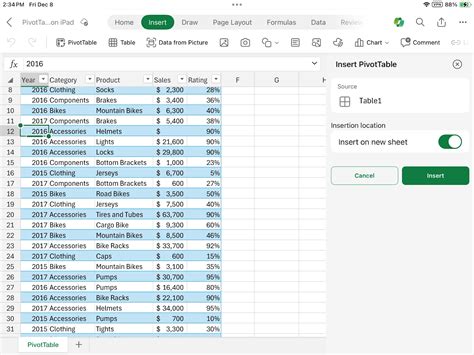

Method 3: Utilizing Excel PivotTables for Reconciliation

To utilize Excel PivotTables for reconciliation:

- Prepare the data by ensuring it is well-organized and suitable for PivotTable analysis.

- Create a PivotTable and select the fields to be analyzed, such as date, category, and amount.

- Customize the PivotTable layout to focus on the reconciliation aspects, such as comparing totals or identifying missing transactions.

- Use PivotTable filters and sorting options to drill down into specific data points and discrepancies.

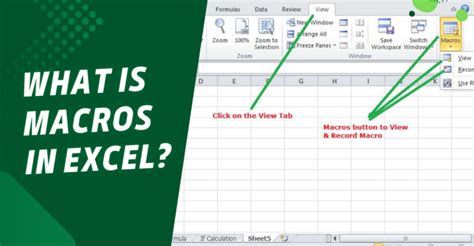

Method 4: Automating Reconciliation with Excel Macros

To automate reconciliation with Excel macros:

- Record a macro that performs the desired reconciliation tasks, such as importing data, running formulas, and formatting the output.

- Test the macro to ensure it works correctly and makes the intended changes.

- Assign the macro to a button or shortcut for easy access and execution.

- Periodically review and update the macro to accommodate changes in the reconciliation process or data structure.

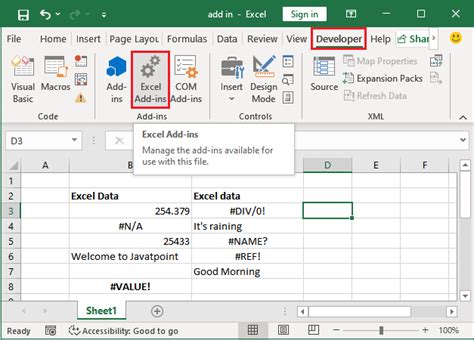

Method 5: Using Excel Add-ins for Advanced Reconciliation

To use Excel add-ins for advanced reconciliation:

- Research and select an appropriate add-in that meets the specific reconciliation needs.

- Install and configure the add-in according to the provider's instructions.

- Explore the add-in's features and functionalities to understand how they can be applied to the reconciliation process.

- Integrate the add-in into the existing reconciliation workflow to enhance efficiency and accuracy.

Excel Reconciliation Image Gallery

What is Excel reconciliation and why is it important?

+Excel reconciliation refers to the process of using Excel to compare and reconcile financial data. It is important because it helps in identifying discrepancies, ensuring compliance with financial regulations, and making informed business decisions.

How can I automate reconciliation tasks in Excel?

+You can automate reconciliation tasks in Excel by using macros, which are sequences of actions that can be recorded and played back to perform tasks. Additionally, Excel add-ins can provide advanced automation capabilities for complex reconciliation tasks.

What are the benefits of using Excel for reconciliation?

+The benefits of using Excel for reconciliation include increased efficiency, reduced manual errors, improved accuracy, and enhanced transparency. Excel also offers flexibility and customization options, allowing users to tailor the reconciliation process to their specific needs.

In conclusion, Excel offers a versatile and powerful platform for reconciliation, providing various methods and tools to streamline the process. By understanding and leveraging these methods, businesses can improve the accuracy and efficiency of their financial processes, ultimately contributing to better decision-making and financial health. We invite readers to share their experiences and tips on using Excel for reconciliation, and to explore the resources and templates available for enhancing their reconciliation practices. Whether you're a seasoned accountant or a small business owner, Excel reconciliation can be a valuable asset in maintaining the integrity and accuracy of your financial records.