Intro

Streamline policy termination with an Insurance Cancellation Request Form Template, facilitating easy policy cancellation, termination, and refund processes, while ensuring compliance with insurance regulations and provider requirements.

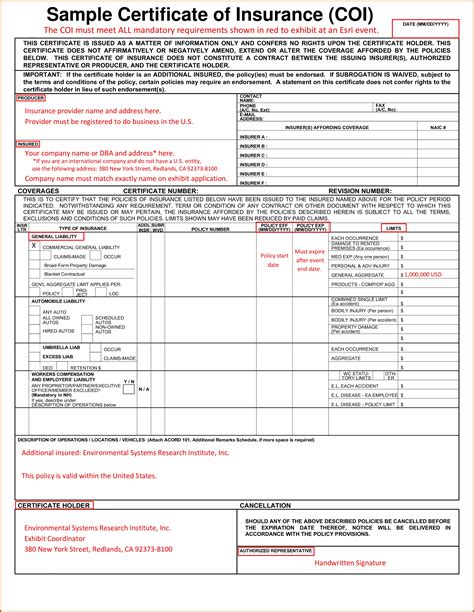

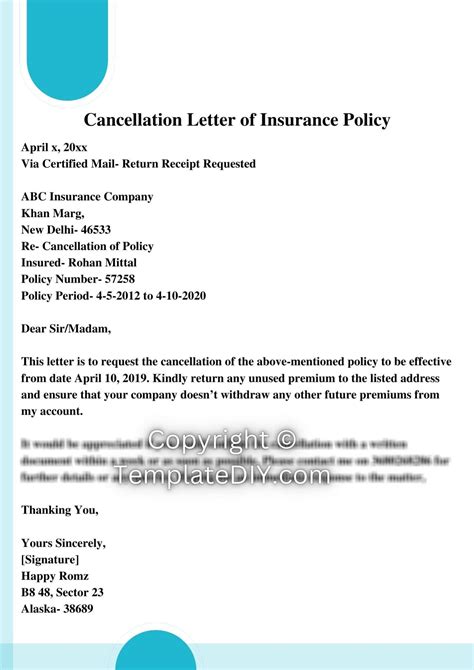

The process of canceling an insurance policy can be complex and often requires specific documentation to ensure that the request is processed correctly. One of the key documents in this process is the insurance cancellation request form. This form serves as a formal notice to the insurance provider that the policyholder wishes to terminate their coverage. In this article, we will delve into the importance of the insurance cancellation request form, its components, and provide guidance on how to fill it out effectively.

Canceling an insurance policy can be necessary for various reasons, such as finding a better rate with another provider, no longer needing the coverage, or financial constraints. Regardless of the reason, it's crucial to follow the proper procedures to avoid any potential issues, such as unwanted premiums deductions or policy lapses. The insurance cancellation request form is a vital tool in this process, as it provides a clear and formal way to communicate the policyholder's intention to cancel their policy.

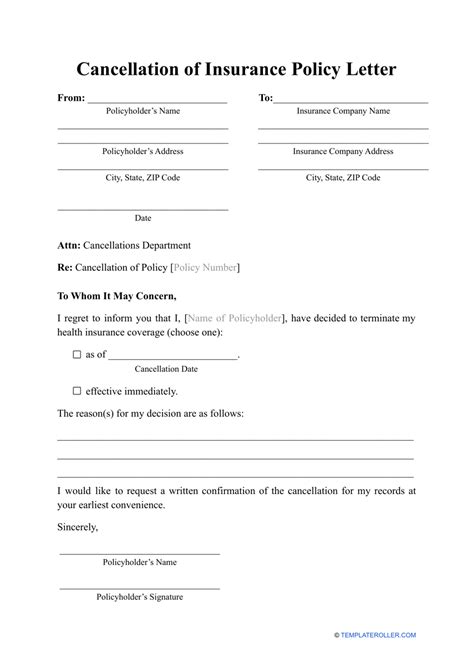

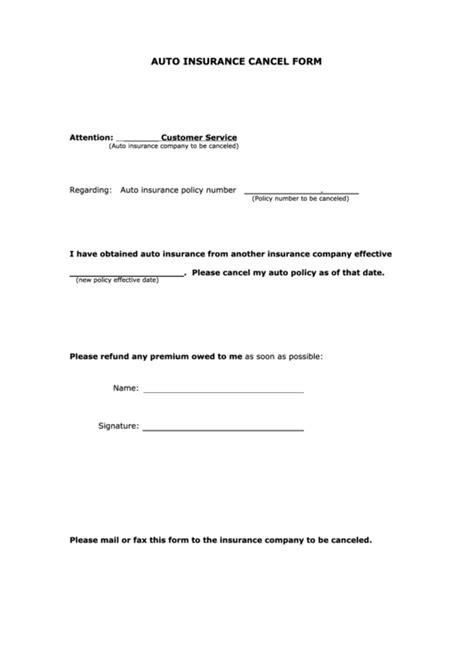

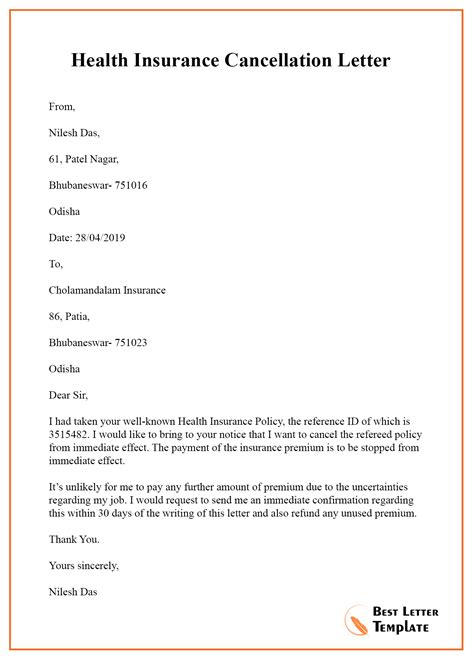

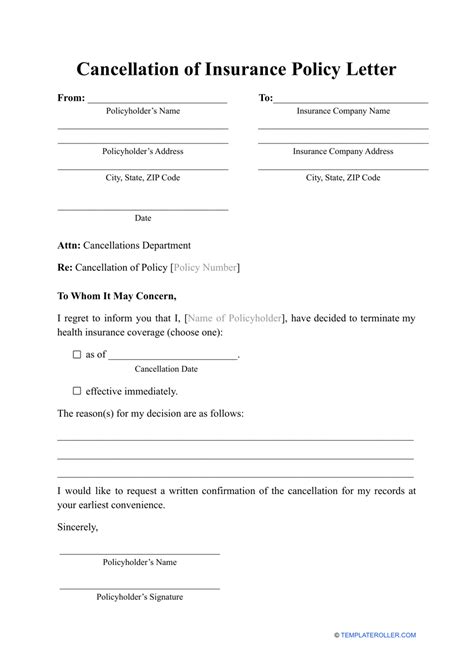

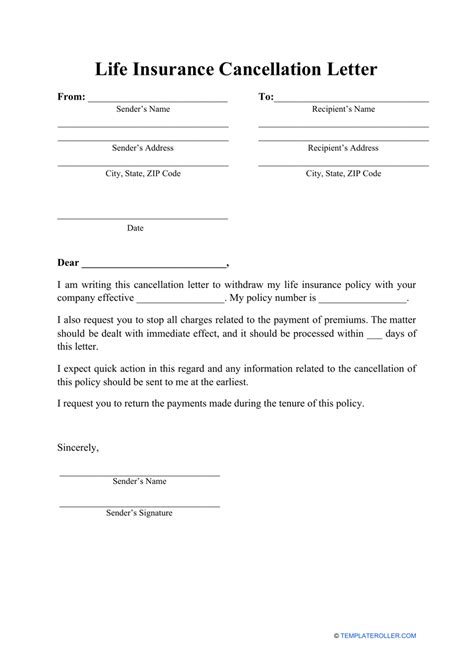

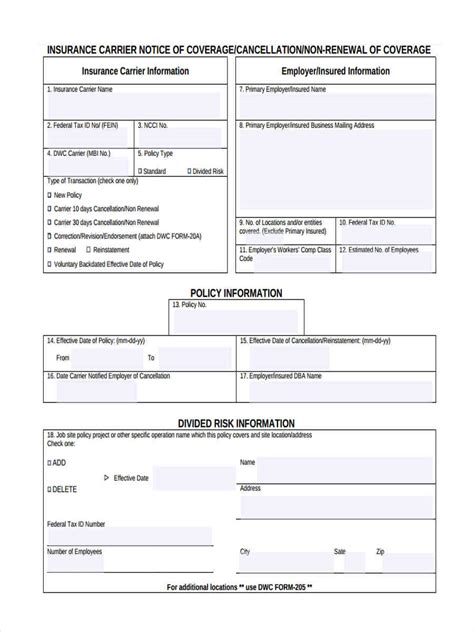

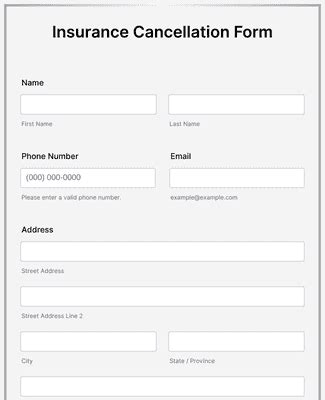

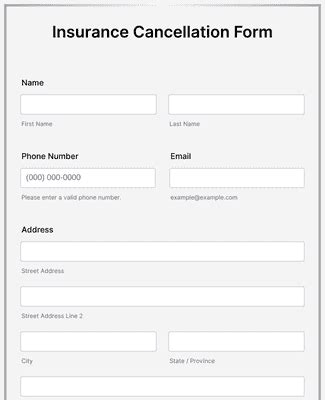

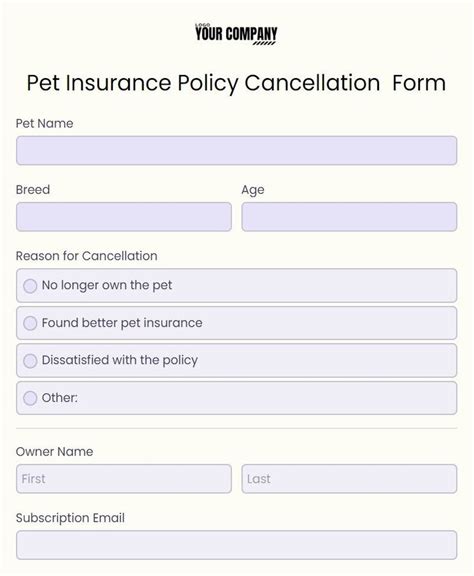

Understanding the components of the insurance cancellation request form is essential for policyholders. Typically, this form will require basic policy information, such as the policy number and type of insurance, as well as the policyholder's personal details, including their name, address, and contact information. Additionally, the form will usually ask for the reason for cancellation, although this may not always be required. The effective date of cancellation is also a critical piece of information, as it determines when the policy will officially be terminated.

Importance of Insurance Cancellation Request Forms

The importance of using an insurance cancellation request form cannot be overstated. It provides a formal record of the policyholder's intention to cancel their policy, which can protect them from further premium payments and potential lapses in coverage. Moreover, this form helps in maintaining a clear line of communication between the policyholder and the insurance provider, reducing the likelihood of misunderstandings or disputes.

Components of Insurance Cancellation Request Forms

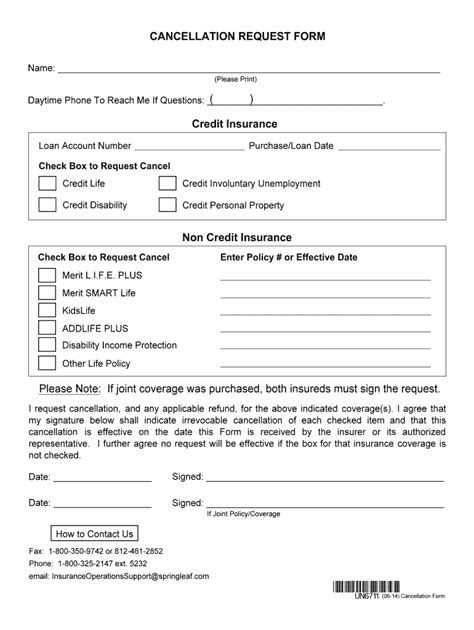

When filling out an insurance cancellation request form, policyholders should ensure they have all the necessary information readily available. This typically includes:

- Policy number and type

- Policyholder's name and contact information

- Reason for cancellation (if required)

- Effective date of cancellation

- Signature of the policyholder (or authorized representative)

It's also important to review the policy documents to understand any potential implications of cancellation, such as refund policies for pre-paid premiums or any penalties associated with early termination.

Steps to Fill Out an Insurance Cancellation Request Form

Filling out an insurance cancellation request form involves several steps:

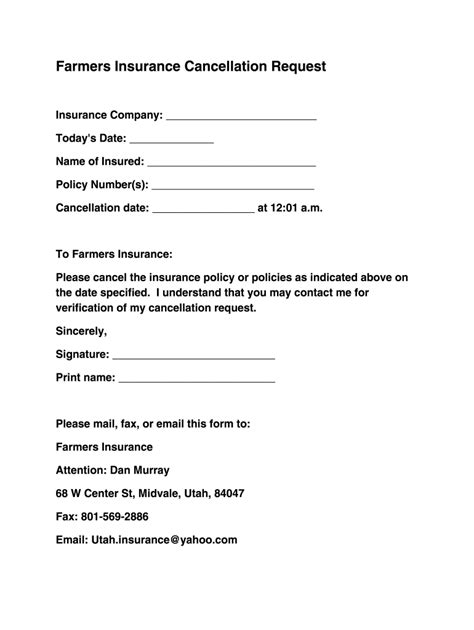

- Obtain the Form: First, policyholders need to obtain the insurance cancellation request form. This can usually be found on the insurance provider's website, or by contacting their customer service department.

- Review Policy Documents: Before filling out the form, it's advisable to review the policy documents to understand the terms and conditions related to cancellation.

- Fill Out the Form: Carefully fill out the form, ensuring all required fields are completed accurately.

- Submit the Form: Once completed, the form should be submitted to the insurance provider according to their specified procedures, which might include mailing, faxing, or emailing the form.

- Follow Up: After submitting the form, it's a good idea to follow up with the insurance provider to confirm receipt of the cancellation request and to inquire about the status of the cancellation process.

Benefits of Using Insurance Cancellation Request Forms

Using an insurance cancellation request form offers several benefits to policyholders:

- Formal Record: It provides a formal record of the cancellation request, which can be useful in case of disputes.

- Clear Communication: It ensures clear communication between the policyholder and the insurance provider, reducing misunderstandings.

- Protection from Unwanted Charges: By formally canceling the policy, policyholders can avoid unwanted premium payments.

Common Mistakes to Avoid

When canceling an insurance policy, there are several common mistakes that policyholders should avoid:

- Not Reviewing Policy Documents: Failing to understand the terms and conditions related to cancellation can lead to unexpected penalties or issues.

- Incomplete Forms: Submitting an incomplete form can delay the cancellation process.

- Not Following Up: Failing to confirm the receipt and processing of the cancellation request can lead to continued premium payments.

Gallery of Insurance Cancellation Request Forms

Insurance Cancellation Request Forms Gallery

Frequently Asked Questions

What is the purpose of an insurance cancellation request form?

+The purpose of an insurance cancellation request form is to formally notify the insurance provider of the policyholder's intention to cancel their policy, ensuring a clear and documented process.

How do I obtain an insurance cancellation request form?

+Policyholders can usually obtain the form from the insurance provider's website or by contacting their customer service department.

What information is typically required on an insurance cancellation request form?

+The form typically requires the policy number, policyholder's name and contact information, reason for cancellation (if required), and the effective date of cancellation.

Why is it important to follow up after submitting the cancellation request form?

+Following up ensures that the form has been received and processed, helping to avoid any potential issues such as continued premium payments.

Can I cancel my insurance policy at any time?

+Policies can usually be canceled at any time, but it's essential to review the policy documents to understand any potential penalties or implications of early termination.

In conclusion, the insurance cancellation request form is a crucial document for policyholders looking to terminate their insurance coverage. By understanding the importance, components, and steps involved in filling out this form, policyholders can ensure a smooth and formal cancellation process. Whether you're canceling due to a change in circumstances or finding a better deal elsewhere, using an insurance cancellation request form protects your interests and helps maintain a clear relationship with your insurance provider. If you have any further questions or need assistance with the cancellation process, don't hesitate to reach out to your insurance provider or seek professional advice.