Intro

Discover 5 ways import invoice management improves trade finance, reducing errors and increasing efficiency with automated invoicing, payment terms, and customs clearance, optimizing international shipping and logistics operations.

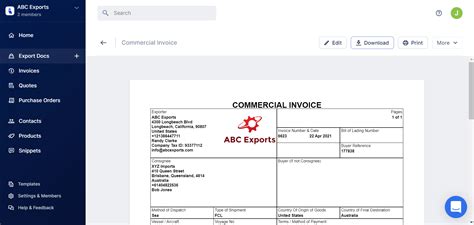

The importance of understanding import invoices cannot be overstated, especially for businesses that rely heavily on international trade. An import invoice is a document that outlines the details of a shipment of goods from a foreign supplier to a domestic buyer. It serves as a critical component in the import process, providing essential information for customs clearance, payment, and record-keeping purposes. In this article, we will delve into the world of import invoices, exploring their significance, components, and the various ways they can be utilized.

For businesses involved in international trade, navigating the complexities of import invoices is crucial for ensuring compliance with regulations, managing finances effectively, and maintaining smooth operations. The import invoice plays a pivotal role in facilitating communication between the buyer, seller, and relevant authorities, making it an indispensable tool in global commerce. Whether you are a seasoned importer or just starting to venture into international trade, understanding the intricacies of import invoices is vital for success.

The process of creating and using import invoices involves several key steps and considerations. From accurately listing the goods being imported to ensuring compliance with customs regulations, the importance of attention to detail cannot be emphasized enough. Moreover, the method of payment, shipping details, and insurance coverage are all critical components that must be carefully managed. As we explore the different aspects of import invoices, it becomes clear that their role extends beyond mere documentation, influencing the efficiency and profitability of import operations.

Understanding Import Invoices

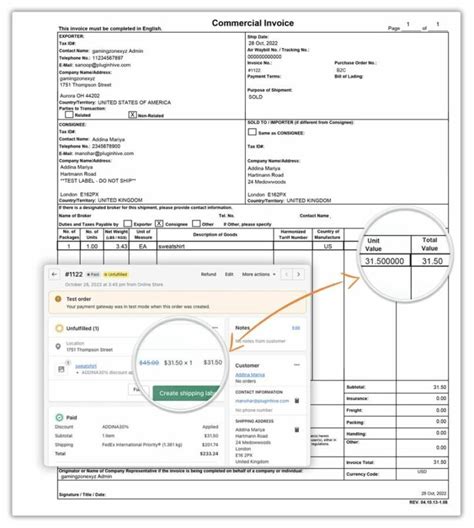

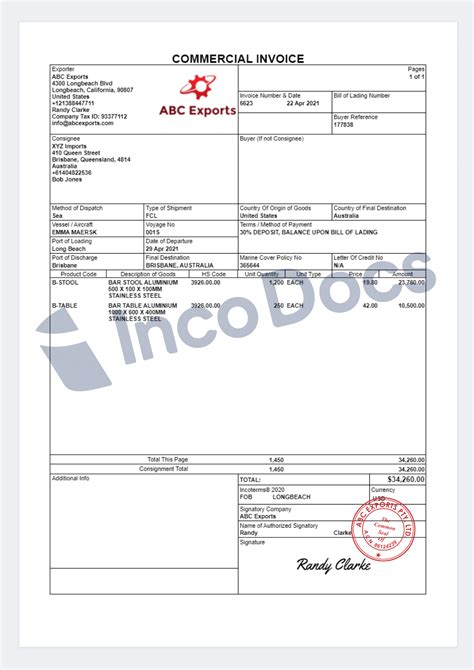

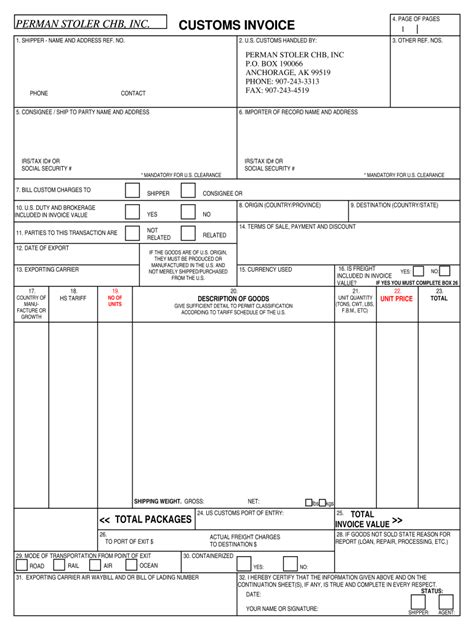

To fully grasp the significance of import invoices, it's essential to understand their components and how they are used. A typical import invoice includes details such as the description of goods, quantity, unit price, total cost, shipping terms, and payment methods. This information is crucial for calculating duties and taxes, facilitating payment, and ensuring that the shipment complies with all relevant regulations. Furthermore, import invoices often serve as the basis for preparing customs declarations, making their accuracy paramount for avoiding delays or legal issues.

Components of an Import Invoice

The components of an import invoice can be broken down into several key categories: - **Goods Description**: A detailed description of the goods being imported, including their type, model, and any relevant specifications. - **Quantity and Unit Price**: The quantity of each item and its corresponding unit price, which are used to calculate the total value of the shipment. - **Shipping Terms**: Details regarding the shipping method, including the port of departure, port of arrival, and the terms of delivery (e.g., FOB, CIF). - **Payment Terms**: Information on how the buyer will pay for the goods, including the payment method (e.g., letter of credit, bank transfer) and any payment deadlines. - **Insurance and Freight**: Details on insurance coverage for the shipment and freight charges, which can significantly impact the total cost of importing the goods.Preparing an Import Invoice

Preparing an import invoice involves several steps, from gathering necessary information to ensuring compliance with all relevant regulations. The seller or exporter is typically responsible for creating the import invoice, although the buyer may also be involved in the process to ensure accuracy and compliance with their requirements. Key steps include:

- Gathering Information: Collecting all necessary details about the shipment, including the goods being imported, quantities, prices, shipping terms, and payment methods.

- Calculating Costs: Determining the total cost of the goods, including any additional charges for shipping, insurance, and duties.

- Compliance Check: Ensuring that the shipment complies with all relevant laws and regulations, including those related to customs, taxation, and product safety.

- Invoice Creation: Using the gathered information to create the import invoice, which must be accurate, complete, and compliant with all regulatory requirements.

Best Practices for Import Invoices

To ensure that import invoices are effective and compliant, several best practices should be followed: - **Accuracy and Completeness**: Ensuring that all information on the invoice is accurate and complete. - **Compliance**: Verifying that the shipment complies with all relevant regulations and laws. - **Clear Communication**: Maintaining open and clear communication between the buyer, seller, and any third-party providers (e.g., freight forwarders, customs brokers). - **Record Keeping**: Keeping detailed records of all import invoices and related documentation for future reference and auditing purposes.Using Import Invoices for Customs Clearance

Import invoices play a critical role in the customs clearance process. They provide the necessary information for customs authorities to assess duties, taxes, and other charges, and to ensure that the shipment complies with all relevant regulations. The process involves submitting the import invoice, along with other required documents (e.g., commercial invoice, bill of lading, certificate of origin), to the customs authorities. The accuracy and completeness of the import invoice are crucial for avoiding delays or additional costs during customs clearance.

Documents Required for Customs Clearance

The documents required for customs clearance can vary depending on the country and the specific shipment, but typically include: - **Commercial Invoice**: A detailed invoice that includes information about the goods, their value, and the seller and buyer. - **Bill of Lading**: A document issued by the carrier that details the shipment, including the goods, their quantity, and the shipping route. - **Certificate of Origin**: A document that certifies the country of origin of the goods, which can affect the duties and taxes applied. - **Import Invoice**: The document that outlines the details of the shipment for customs purposes.Managing Import Invoices Electronically

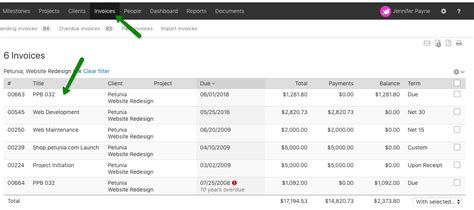

The use of electronic import invoices is becoming increasingly prevalent, offering several benefits over traditional paper-based invoices. Electronic invoices can streamline the import process, reduce errors, and enhance security. They also provide real-time visibility into the status of shipments and can facilitate faster customs clearance. Moreover, electronic invoicing can help reduce the environmental impact of international trade by minimizing the use of paper.

Advantages of Electronic Invoicing

The advantages of using electronic import invoices include: - **Efficiency**: Faster processing and reduced manual errors. - **Cost Savings**: Lower costs associated with paper, printing, and storage. - **Security**: Enhanced security features to protect against fraud and unauthorized changes. - **Environmental Benefits**: Reduced paper usage contributes to a more sustainable trade practice.Conclusion and Future Directions

As international trade continues to evolve, the role of import invoices will remain vital. Advances in technology, such as blockchain and artificial intelligence, are expected to further streamline the invoicing process, enhance security, and improve compliance. The future of import invoicing will likely be characterized by increased digitization, automation, and integration with other trade facilitation tools. Understanding these trends and adapting to changes in import invoicing practices will be crucial for businesses seeking to remain competitive in the global market.

Emerging Trends in Import Invoicing

Emerging trends that are expected to shape the future of import invoicing include: - **Digitalization**: The increased use of electronic and digital invoices to enhance efficiency and reduce costs. - **Automation**: The automation of invoicing processes through the use of technology, such as AI and machine learning. - **Integration**: The integration of import invoicing with other trade facilitation tools and platforms to create seamless trade processes.Import Invoice Image Gallery

What is an import invoice, and why is it important?

+An import invoice is a document that outlines the details of a shipment of goods from a foreign supplier to a domestic buyer. It is important because it serves as a critical component in the import process, providing essential information for customs clearance, payment, and record-keeping purposes.

What are the key components of an import invoice?

+The key components of an import invoice include the description of goods, quantity, unit price, total cost, shipping terms, and payment methods. This information is crucial for calculating duties and taxes, facilitating payment, and ensuring that the shipment complies with all relevant regulations.

How do I prepare an import invoice?

+Preparing an import invoice involves gathering necessary information about the shipment, calculating costs, ensuring compliance with regulations, and creating the invoice. The seller or exporter is typically responsible for creating the import invoice, although the buyer may also be involved to ensure accuracy and compliance.

What are the benefits of using electronic import invoices?

+The benefits of using electronic import invoices include increased efficiency, cost savings, enhanced security, and environmental benefits. Electronic invoices can streamline the import process, reduce errors, and provide real-time visibility into the status of shipments.

What trends are shaping the future of import invoicing?

+Emerging trends that are expected to shape the future of import invoicing include digitalization, automation, and integration with other trade facilitation tools and platforms. These trends aim to enhance efficiency, reduce costs, and improve compliance in international trade.

We hope this comprehensive guide to import invoices has provided you with valuable insights and practical information to navigate the complexities of international trade. Whether you are a seasoned importer or just starting out, understanding the role and best practices of import invoicing is crucial for success. We invite you to share your thoughts, experiences, and questions regarding import invoices in the comments below. Your engagement and feedback are invaluable in helping us create more informative and relevant content for our readers.