Intro

Get the Illinois St-1 Form printable template for sales tax returns, including instructions and filing requirements, to streamline your state tax compliance and avoid penalties, with easy access to download and print.

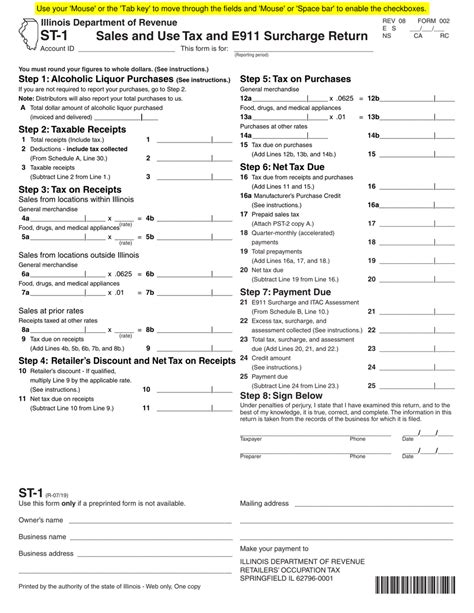

The Illinois St-1 form is a crucial document for businesses operating in the state, as it serves as the Sales and Use Tax Return. This form is used to report and remit sales and use taxes to the Illinois Department of Revenue. For businesses, having access to a printable template of this form can simplify the process of filing taxes, making it easier to manage financial obligations to the state.

Understanding the importance of accurate and timely tax filings is key for any business. The Illinois St-1 form requires detailed information about the business, including its name, address, and registration number, as well as specific details about the sales and purchases made during the reporting period. This includes calculating the total amount of sales, deducting any exempt sales, and determining the amount of tax due.

For businesses looking to streamline their tax reporting process, utilizing a printable Illinois St-1 form template can be highly beneficial. These templates are designed to mirror the official form, providing spaces for all required information. They can be filled out manually or, in some cases, completed digitally before being printed and submitted. This not only saves time but also reduces the likelihood of errors, as the template ensures that all necessary fields are addressed.

Benefits of Using an Illinois St-1 Form Printable Template

Using a printable template for the Illinois St-1 form offers several benefits to businesses. Firstly, it simplifies the tax filing process, making it easier for businesses to comply with state tax regulations. The template ensures that all necessary information is included, reducing the risk of incomplete submissions that could lead to delays or penalties.

Moreover, a printable template can be particularly useful for small businesses or those with limited experience in tax preparation. It provides a clear and structured format, guiding the user through the process of calculating sales and use taxes. This can be invaluable for businesses that do not have the resources to invest in specialized tax software or to hire a tax professional.

Steps to Complete the Illinois St-1 Form

Completing the Illinois St-1 form requires careful attention to detail to ensure accuracy. Here are the general steps to follow:

-

Gather Necessary Information: Before starting, make sure you have all the required documents and information. This includes your business's registration number, total sales for the period, exempt sales, and any deductions or credits you are eligible for.

-

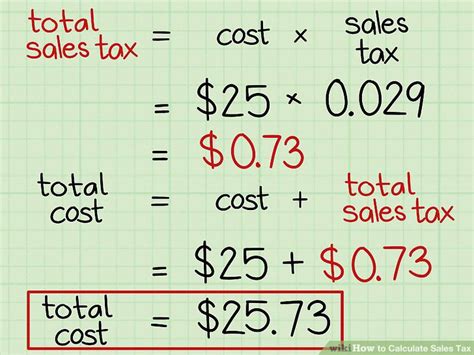

Calculate Total Sales: Determine the total amount of sales made during the reporting period. This includes all sales subject to Illinois sales and use tax.

-

Deduct Exempt Sales: Identify any sales that are exempt from tax and subtract these from your total sales to find your taxable sales.

-

Calculate Tax Due: Use the taxable sales figure to calculate the amount of sales tax due. The tax rate will depend on the location of your business and the type of products or services sold.

-

Complete the Form: Fill out the Illinois St-1 form with the calculated information. Ensure all fields are completed accurately and legibly.

-

Submit the Form: Once completed, submit the form to the Illinois Department of Revenue by the specified deadline. This can usually be done online, by mail, or in person, depending on the department's current guidelines.

Importance of Timely Filing

Filing the Illinois St-1 form on time is crucial for businesses to avoid penalties and interest on late payments. The Illinois Department of Revenue imposes strict deadlines for tax filings, and missing these deadlines can result in significant fines. Furthermore, timely filing helps in maintaining a good compliance record, which can be beneficial in future audits or when applying for business licenses.

For businesses that are struggling to meet the deadline, it may be possible to file for an extension. However, this should be done before the original deadline, and it's essential to understand that an extension of time to file is not an extension of time to pay. Any tax due is still payable by the original deadline to avoid penalties and interest.

Common Mistakes to Avoid

When completing the Illinois St-1 form, there are several common mistakes that businesses should be aware of to avoid. These include:

- Inaccurate Calculations: Double-check all calculations for total sales, exempt sales, and tax due to ensure accuracy.

- Incomplete Information: Ensure all required fields on the form are completed. Missing information can lead to delays or the form being rejected.

- Late Filing: Always file the form by the deadline to avoid penalties and interest.

- Incorrect Tax Rate: Use the correct tax rate for your business location and type of sales.

By being aware of these potential pitfalls, businesses can ensure a smooth tax filing process and maintain compliance with Illinois state tax laws.

Conclusion and Next Steps

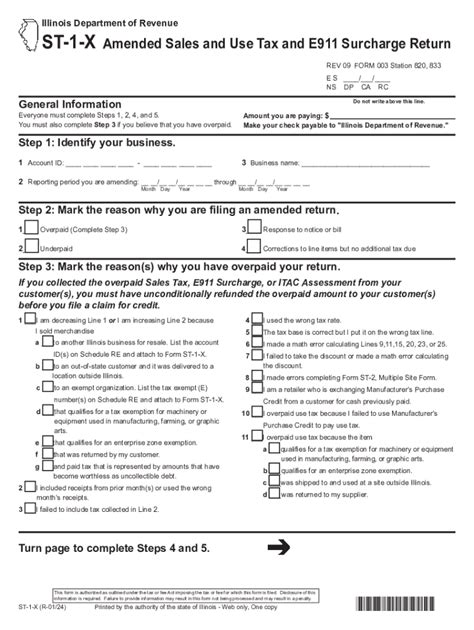

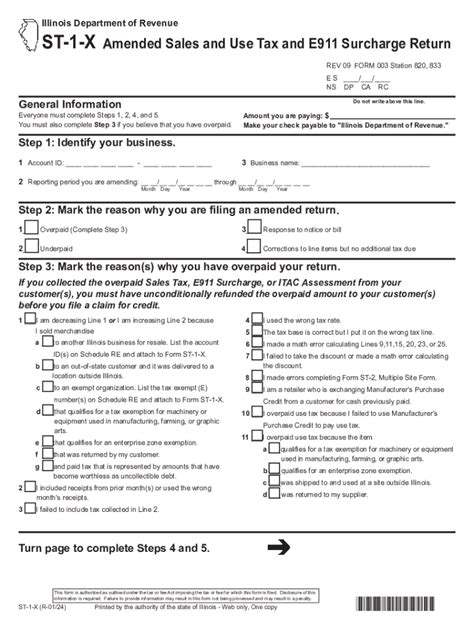

In conclusion, the Illinois St-1 form is a vital component of tax compliance for businesses operating in Illinois. Utilizing a printable template can simplify the filing process, reduce errors, and save time. By understanding the benefits, steps to complete the form, importance of timely filing, and common mistakes to avoid, businesses can ensure they are meeting their tax obligations effectively.

For those looking to learn more about the Illinois St-1 form or seeking assistance with tax preparation, there are numerous resources available. The Illinois Department of Revenue website provides detailed guides, FAQs, and contact information for support. Additionally, tax professionals and accounting firms can offer personalized advice and services tailored to the specific needs of your business.

Illinois St-1 Form Image Gallery

What is the Illinois St-1 form used for?

+The Illinois St-1 form is used for reporting and remitting sales and use taxes to the Illinois Department of Revenue.

How often do I need to file the Illinois St-1 form?

+The filing frequency depends on your business's tax liability. Most businesses file monthly, but some may file quarterly or annually if their tax liability is smaller.

Can I file the Illinois St-1 form online?

+Yes, the Illinois Department of Revenue allows online filing of the St-1 form through their website. This method is convenient and reduces the chance of errors.

We hope this comprehensive guide to the Illinois St-1 form has been informative and helpful. Whether you're a seasoned business owner or just starting out, understanding and complying with tax regulations is essential for success. If you have any further questions or need assistance with tax preparation, don't hesitate to reach out to a tax professional. Share your thoughts and experiences with tax filings in the comments below, and consider sharing this article with others who might find it useful.