Intro

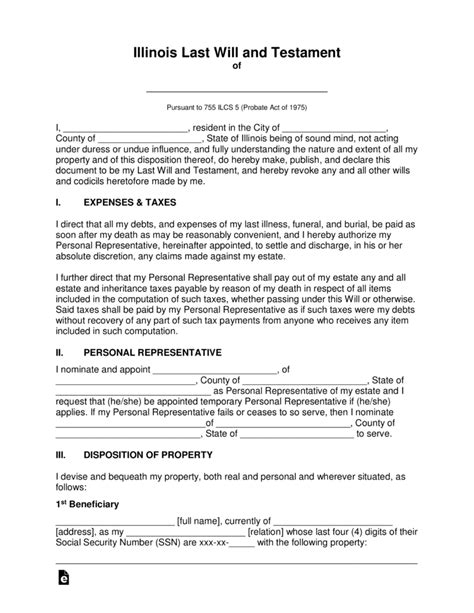

Create a valid Illinois Last Will Template to ensure estate planning, inheritances, and asset distribution are managed according to state laws and probate rules, securing your legacy with a legally binding will.

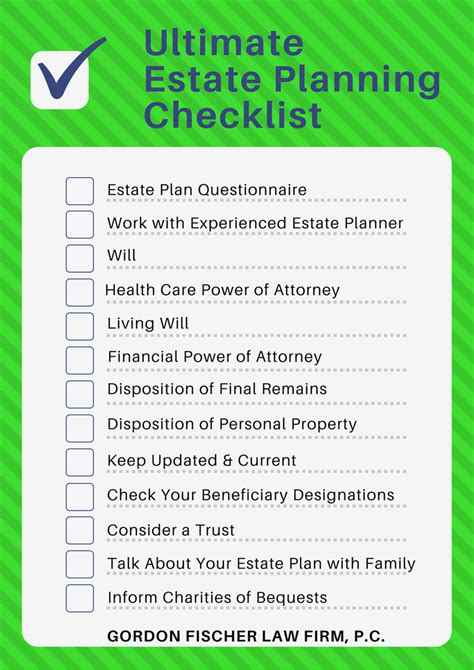

Creating a last will and testament is a crucial step in estate planning, allowing individuals to dictate how their assets will be distributed after their passing. In Illinois, as in other states, having a valid will can help ensure that one's wishes are respected and that loved ones are protected. For residents of Illinois, utilizing an Illinois last will template can be a straightforward and efficient way to create a legally binding document. However, it's essential to understand the basics of wills, the requirements for a will to be valid in Illinois, and how to use a template effectively.

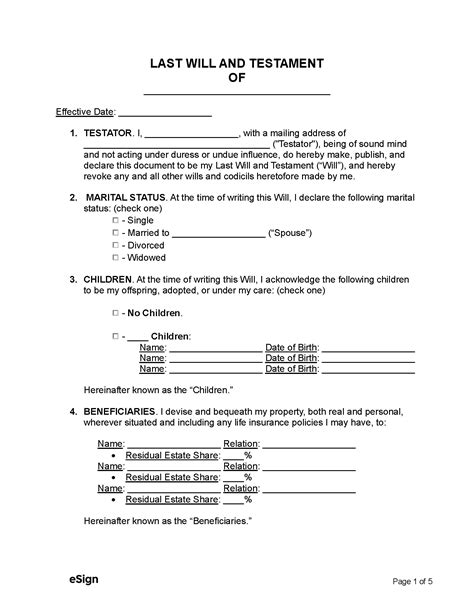

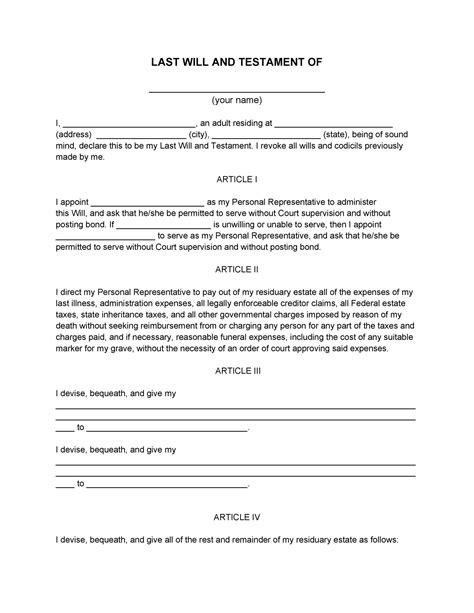

A last will and testament, often simply called a will, is a legal document that outlines how a person wants their property and assets to be distributed after they die. It can also be used to appoint guardians for minor children, name an executor to manage the estate, and specify any final wishes regarding funeral arrangements or other personal matters. Without a will, the distribution of one's estate is determined by the state's intestacy laws, which may not align with one's personal preferences.

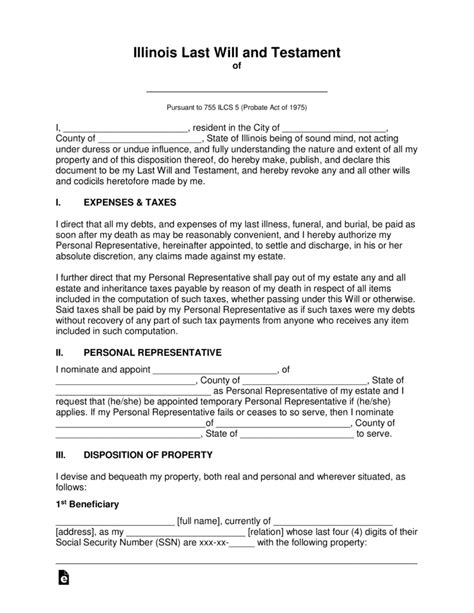

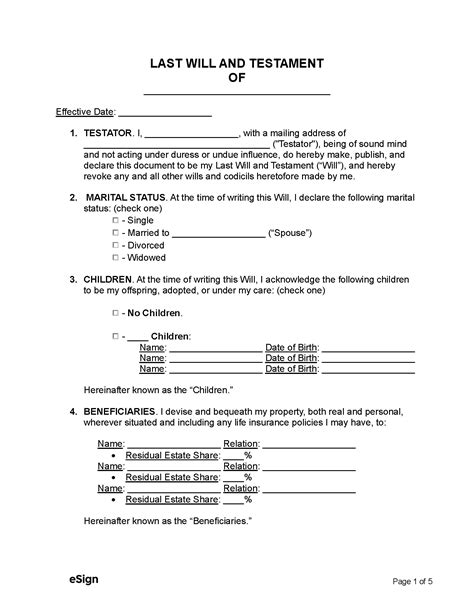

In Illinois, for a will to be considered valid, it must comply with the state's laws and regulations. This typically involves the following steps: the will must be in writing, signed by the testator (the person making the will), and witnessed by two individuals who are not beneficiaries of the will. The witnesses must also sign the will in the presence of each other. It's crucial that the will is created when the testator has the mental capacity to understand the nature of the document and the property being distributed.

Using an Illinois last will template can simplify the process of creating a will. These templates provide a basic structure and the necessary legal language to ensure the document meets Illinois state requirements. They can be particularly useful for individuals with straightforward estate plans, such as those with limited assets or a clear idea of how they want their property distributed. However, for more complex estates or unique situations, consulting with an attorney may be advisable to ensure all aspects are properly addressed.

Benefits of Using an Illinois Last Will Template

The benefits of using an Illinois last will template are numerous. Firstly, it provides a cost-effective way to create a will, especially when compared to hiring an attorney to draft the document from scratch. Templates are widely available online and can be downloaded or completed directly on a website. This accessibility makes it easier for individuals to take control of their estate planning without significant upfront costs.

Another benefit is the speed at which a will can be created. With a template, individuals can fill out the necessary information and print the document, potentially completing the process in a matter of hours. This efficiency is particularly appealing to those who have put off estate planning due to the perceived complexity or time commitment required.

Furthermore, using a template can help ensure that the will includes all necessary elements. Illinois last will templates are designed with the state's specific laws in mind, prompting the user to include important details such as the appointment of an executor, guardians for minor children, and a thorough inventory of assets to be distributed.

How to Use an Illinois Last Will Template

Using an Illinois last will template involves several steps to ensure the document is valid and effective. The first step is to select a template that is specific to Illinois, as laws regarding wills can vary significantly from state to state. It's also a good idea to choose a template from a reputable source to ensure it includes all the necessary legal language and prompts for required information.

Once the template is selected, the next step is to fill it out carefully and thoroughly. This includes providing a complete inventory of assets, such as real estate, vehicles, bank accounts, and personal property. It's also essential to clearly state how these assets are to be distributed among beneficiaries.

After filling out the template, it's crucial to review the document for accuracy and completeness. This step can help catch any mistakes or omissions that could potentially invalidate the will or lead to disputes among beneficiaries.

The completed will then needs to be signed and witnessed according to Illinois law. This means the testator must sign the will in the presence of two witnesses, who also sign the document in each other's presence. Witnesses should not be beneficiaries of the will to avoid any potential conflicts of interest.

Common Mistakes to Avoid

When using an Illinois last will template, there are several common mistakes to avoid. One of the most significant errors is not having the will properly witnessed. If the witnessing process does not comply with Illinois state law, the will could be deemed invalid, leading to the estate being distributed according to intestacy laws rather than the testator's wishes.

Another mistake is failing to update the will after significant life changes. Events such as marriage, divorce, the birth of children, or the acquisition of new assets can all impact how one wants their estate to be distributed. Failing to reflect these changes in the will can lead to unintended consequences.

Using a template that is not specific to Illinois is also a critical mistake. Laws regarding wills and estates vary by state, and using a template designed for another state could result in a document that does not comply with Illinois law, potentially rendering it invalid.

Alternatives to Using a Template

For some individuals, using an Illinois last will template may not be the best approach. Those with complex estates, significant assets, or unique family situations may find it beneficial to consult with an attorney who specializes in estate planning. An attorney can provide personalized advice and ensure that the will is tailored to the individual's specific needs and circumstances.

Another alternative is to use online estate planning services that offer more customized solutions than a basic template. These services often provide interactive interviews to gather information and then generate a will based on the user's input. Some services also offer review by an attorney, which can provide an added layer of assurance that the document is valid and effective.

Gallery of Illinois Last Will Templates

Last Will and Testament Templates

Frequently Asked Questions

What is the purpose of a last will and testament?

+The purpose of a last will and testament is to outline how a person wants their assets and property to be distributed after their death, as well as to appoint guardians for minor children and an executor for the estate.

Do I need an attorney to create a will?

+While it's possible to create a will without an attorney, using a lawyer can help ensure that the document is valid and meets all legal requirements, especially for complex estates or unique situations.

How often should I update my will?

+You should update your will after any significant life changes, such as marriage, divorce, the birth or adoption of children, the acquisition of new assets, or a change in your wishes regarding the distribution of your estate.

In conclusion, creating a last will and testament is a vital part of estate planning, and using an Illinois last will template can be a straightforward and cost-effective way to ensure one's wishes are respected. However, it's crucial to understand the importance of complying with Illinois state laws and to consider alternatives, such as consulting with an attorney, for more complex situations. By taking the time to create a valid will, individuals can provide peace of mind for themselves and their loved ones, knowing that their estate will be managed according to their desires. If you have found this information helpful, please consider sharing it with others who may be in the process of estate planning. Your feedback and questions are also welcome, as they can help us improve our content and provide more relevant information to our readers.