Intro

Discover 5 IOU templates for effortless debt tracking, featuring customizable promissory notes, loan agreements, and payment plans, making it easy to manage personal loans and debts with friends, family, or colleagues.

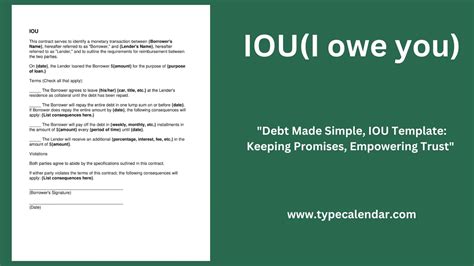

The concept of IOU templates has become increasingly popular in recent years, particularly among individuals and small businesses. An IOU, which stands for "I Owe You," is a document that acknowledges a debt owed by one party to another. In this article, we will delve into the importance of IOU templates, their benefits, and provide examples of how to use them effectively.

IOU templates are essential in various situations, such as lending money to friends or family members, borrowing from a business partner, or even in formal business transactions. Having a written record of the debt can help prevent misunderstandings and ensure that both parties are on the same page. Moreover, IOU templates can be customized to suit specific needs, making them a versatile tool for individuals and businesses alike.

The use of IOU templates can also help to establish trust and credibility between parties. By providing a clear and concise document that outlines the terms of the loan, including the amount, interest rate, and repayment schedule, both parties can feel confident that their agreement is binding and enforceable. Furthermore, IOU templates can be used as a reference point in case of disputes or disagreements, helping to resolve issues quickly and efficiently.

Benefits of Using IOU Templates

The benefits of using IOU templates are numerous. Some of the most significant advantages include:

- Providing a clear and concise record of the debt

- Establishing trust and credibility between parties

- Helping to prevent misunderstandings and disputes

- Allowing for customization to suit specific needs

- Serving as a reference point in case of disagreements

In addition to these benefits, IOU templates can also help to reduce the risk of non-payment. By having a written agreement in place, lenders can feel more confident that they will be repaid, and borrowers can avoid the risk of forgetting or disputing the terms of the loan.

Types of IOU Templates

There are several types of IOU templates available, each with its own unique features and benefits. Some of the most common types include:

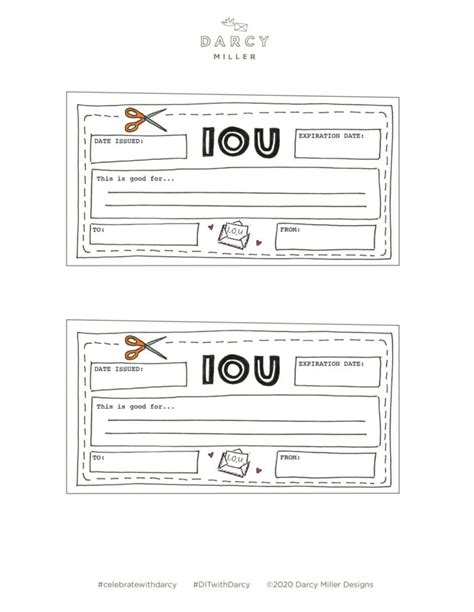

- Simple IOU Template: This is a basic template that outlines the amount of the loan, the interest rate, and the repayment schedule.

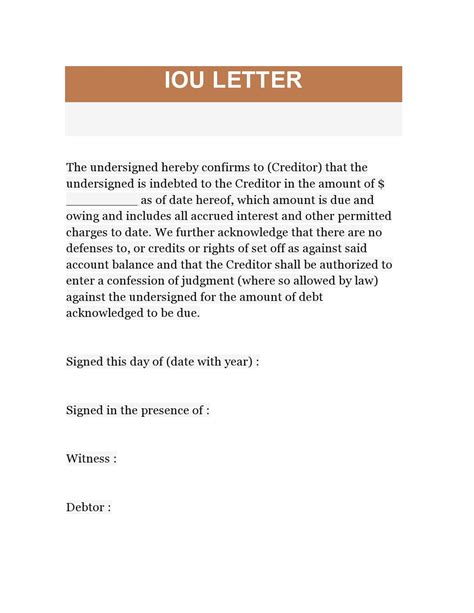

- Promissory Note Template: This template is more formal and includes additional details, such as the borrower's credit information and the lender's contact information.

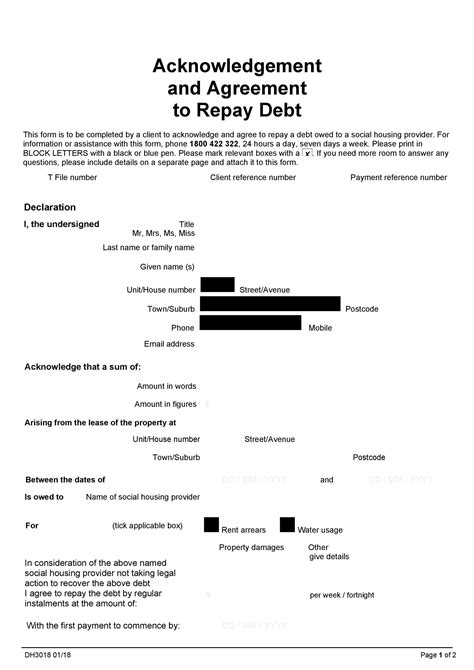

- Loan Agreement Template: This template is used for more complex loans and includes provisions for collateral, default, and dispute resolution.

- Personal Loan Template: This template is used for loans between friends or family members and includes provisions for interest rates and repayment schedules.

- Business Loan Template: This template is used for loans between businesses and includes provisions for collateral, default, and dispute resolution.

How to Use IOU Templates Effectively

Using IOU templates effectively requires careful consideration of several factors. Some of the most important tips include:

- Clearly outline the terms of the loan: Make sure to include all relevant details, such as the amount, interest rate, and repayment schedule.

- Establish a repayment schedule: This can help to prevent misunderstandings and ensure that both parties are on the same page.

- Include provisions for default: This can help to protect the lender in case the borrower fails to repay the loan.

- Keep a record of payments: This can help to prevent disputes and ensure that both parties are aware of the current balance.

By following these tips and using IOU templates effectively, individuals and businesses can help to ensure that their loans are repaid on time and in full.

Examples of IOU Templates

Here are a few examples of IOU templates:

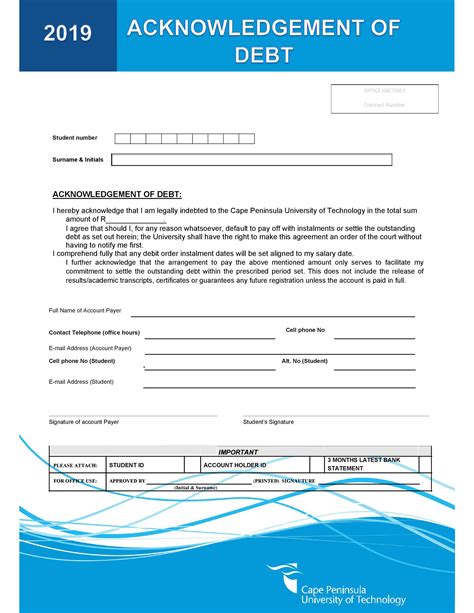

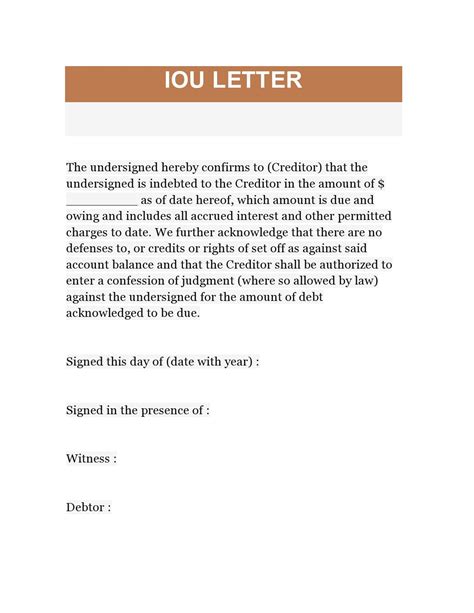

-

Simple IOU Template:

- Borrower: [Name]

- Lender: [Name]

- Amount: [Amount]

- Interest Rate: [Interest Rate]

- Repayment Schedule: [Repayment Schedule]

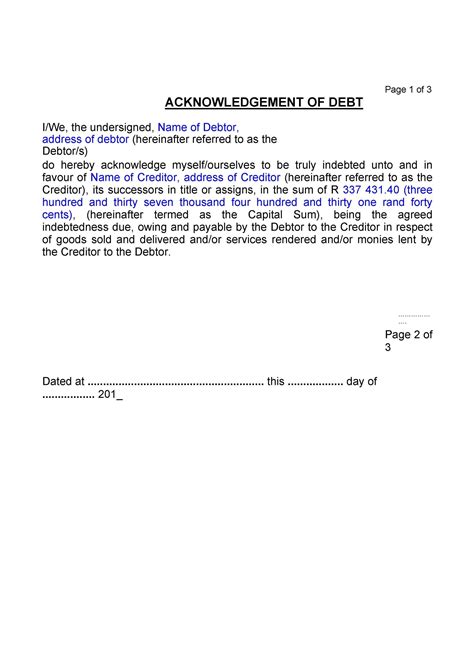

-

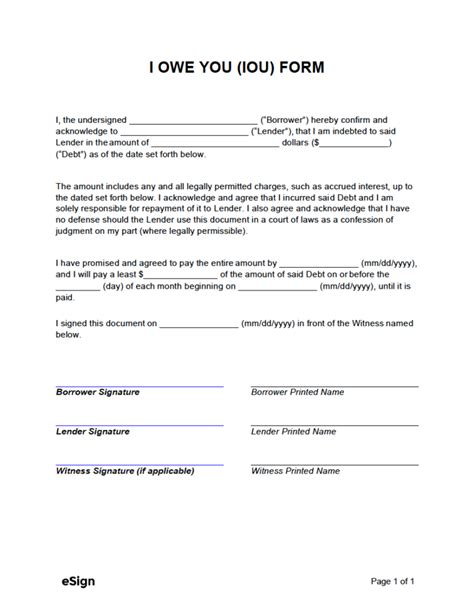

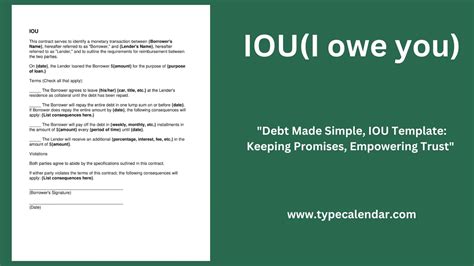

Promissory Note Template:

- Borrower: [Name]

- Lender: [Name]

- Amount: [Amount]

- Interest Rate: [Interest Rate]

- Repayment Schedule: [Repayment Schedule]

- Credit Information: [Credit Information]

- Contact Information: [Contact Information]

-

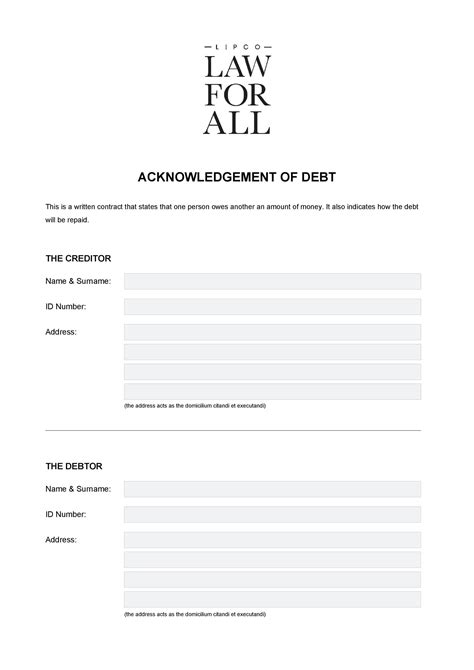

Loan Agreement Template:

- Borrower: [Name]

- Lender: [Name]

- Amount: [Amount]

- Interest Rate: [Interest Rate]

- Repayment Schedule: [Repayment Schedule]

- Collateral: [Collateral]

- Default Provisions: [Default Provisions]

- Dispute Resolution: [Dispute Resolution]

These are just a few examples of the many different types of IOU templates available. By choosing the right template and using it effectively, individuals and businesses can help to ensure that their loans are repaid on time and in full.

Customizing IOU Templates

IOU templates can be customized to suit specific needs. Some of the most common ways to customize IOU templates include:

- Adding or removing provisions: Depending on the specific needs of the loan, provisions can be added or removed to make the template more suitable.

- Changing the language: The language of the template can be changed to make it more formal or informal, depending on the needs of the parties involved.

- Adding or removing parties: The template can be modified to include additional parties, such as co-signers or guarantors.

By customizing IOU templates, individuals and businesses can help to ensure that their loans are repaid on time and in full.

IOU Template Gallery

IOU Template Image Gallery

Frequently Asked Questions

What is an IOU template?

+An IOU template is a document that outlines the terms of a loan, including the amount, interest rate, and repayment schedule.

Why are IOU templates important?

+IOU templates are important because they provide a clear and concise record of the debt, help to establish trust and credibility between parties, and can help to prevent misunderstandings and disputes.

How do I use an IOU template?

+To use an IOU template, simply fill in the relevant details, such as the amount, interest rate, and repayment schedule, and have both parties sign the document.

In conclusion, IOU templates are a valuable tool for individuals and businesses alike. By providing a clear and concise record of the debt, establishing trust and credibility between parties, and helping to prevent misunderstandings and disputes, IOU templates can help to ensure that loans are repaid on time and in full. Whether you are lending money to a friend or family member, or borrowing from a business partner, an IOU template can help to protect your interests and ensure a smooth transaction. We invite you to share your thoughts on IOU templates and how they have helped you in your personal or business dealings. Feel free to comment below and let's continue the conversation.