Intro

Conduct thorough 5-hour due diligence checks, including risk assessment, financial analysis, and compliance review, to ensure informed decisions and mitigate potential liabilities with comprehensive verification and validation procedures.

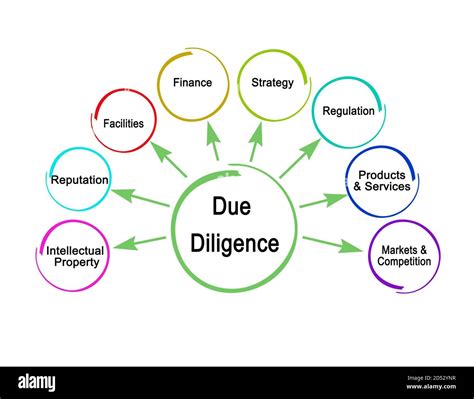

Conducting thorough due diligence checks is a crucial step in any business transaction, investment, or partnership. It involves a comprehensive review of a company's or individual's financial, operational, and strategic aspects to identify potential risks, opportunities, and areas for improvement. In this article, we will delve into the importance of 5-hour due diligence checks, their benefits, and the key areas to focus on during this process.

Due diligence checks are essential in today's fast-paced business environment, where companies are constantly looking to expand, merge, or acquire new entities. A thorough review of a company's financial statements, contracts, and operational processes can help identify potential red flags, such as financial instability, legal issues, or regulatory non-compliance. By conducting 5-hour due diligence checks, businesses can make informed decisions, mitigate risks, and ensure a smooth transition.

The benefits of 5-hour due diligence checks are numerous. They provide a comprehensive overview of a company's financial health, operational efficiency, and strategic positioning. This information can be used to negotiate better deals, identify areas for cost savings, and develop strategies for growth and improvement. Additionally, 5-hour due diligence checks can help businesses identify potential risks and liabilities, such as outstanding debts, legal disputes, or environmental concerns.

Introduction to 5-Hour Due Diligence Checks

Benefits of 5-Hour Due Diligence Checks

The benefits of 5-hour due diligence checks include: * Rapid assessment of a company's financial health and operational efficiency * Identification of potential risks and opportunities * Informed decision-making * Mitigation of risks and liabilities * Development of strategies for growth and improvementKey Areas to Focus on During 5-Hour Due Diligence Checks

Financial Statement Review

A thorough review of a company's financial statements is essential during the 5-hour due diligence checks. This includes: * Balance sheet review: Review of assets, liabilities, and equity * Income statement review: Review of revenue, expenses, and profit * Cash flow statement review: Review of cash inflows and outflowsSteps Involved in 5-Hour Due Diligence Checks

Preparation Phase

The preparation phase involves gathering of financial statements, contracts, and operational documents. This includes: * Financial statements: Gathering of financial statements, including balance sheets, income statements, and cash flow statements * Contracts: Gathering of contracts, including customer contracts, supplier contracts, and partnership agreements * Operational documents: Gathering of operational documents, including production schedules, logistics documents, and supply chain management documentsTools and Techniques Used in 5-Hour Due Diligence Checks

Financial Modeling

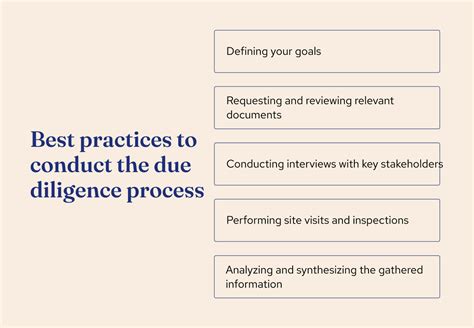

Financial modeling involves the use of financial models to analyze financial data and identify trends. This includes: * Financial statement analysis: Analysis of financial statements to identify trends and anomalies * Ratio analysis: Analysis of financial ratios to assess liquidity, profitability, and efficiencyBest Practices for 5-Hour Due Diligence Checks

Use of Experienced Professionals

The use of experienced professionals is essential during the 5-hour due diligence checks. This includes: * Financial experts: Use of financial experts to review financial statements and analyze financial data * Contract experts: Use of contract experts to review contracts and identify potential risks and liabilities * Operational experts: Use of operational experts to assess operational efficiency and identify areas for improvementCommon Mistakes to Avoid During 5-Hour Due Diligence Checks

Inadequate Preparation

Inadequate preparation is a common mistake during the 5-hour due diligence checks. This includes: * Failure to gather necessary documents: Failure to gather necessary documents, including financial statements, contracts, and operational documents * Failure to review documents: Failure to review documents, including financial statements, contracts, and operational documentsDue Diligence Image Gallery

What is the purpose of 5-hour due diligence checks?

+The purpose of 5-hour due diligence checks is to provide a rapid assessment of a company's financial health, operational efficiency, and strategic positioning.

What are the key areas to focus on during 5-hour due diligence checks?

+The key areas to focus on during 5-hour due diligence checks include financial statements, contracts, and operational processes.

What are the benefits of 5-hour due diligence checks?

+The benefits of 5-hour due diligence checks include rapid assessment of a company's financial health and operational efficiency, identification of potential risks and opportunities, and informed decision-making.

What are the common mistakes to avoid during 5-hour due diligence checks?

+The common mistakes to avoid during 5-hour due diligence checks include inadequate preparation, lack of expertise, and focus on wrong areas.

How can 5-hour due diligence checks be conducted effectively?

+5-hour due diligence checks can be conducted effectively by using experienced professionals, specialized tools and techniques, and focusing on key areas such as financial statements, contracts, and operational processes.

In