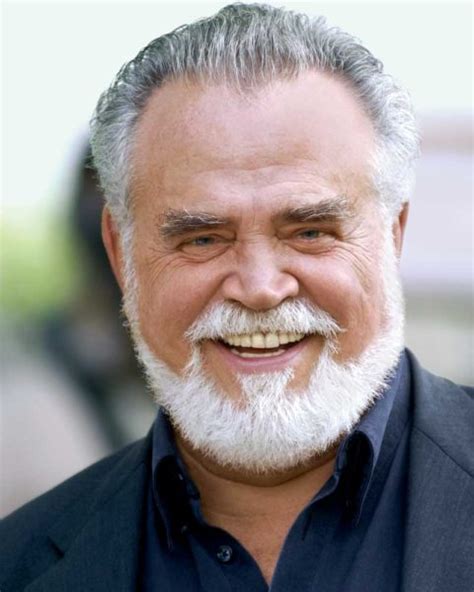

Intro

Discover 5 key facts about Herbert Dotzler, exploring his biography, career highlights, and notable achievements, shedding light on his life, work, and legacy as a renowned figure.

Herbert Dotzler is a name that may not be widely recognized, but for those interested in the world of finance, particularly in the realm of investment and asset management, his contributions and insights are noteworthy. As we delve into the details of his career and the principles he has advocated for, it becomes clear that his work has significant implications for both individual investors and institutional funds. Here are five key facts about Herbert Dotzler that highlight his significance in the financial sector:

-

Career Background: Herbert Dotzler has had a distinguished career in finance, with a focus on investment management and financial analysis. His professional journey is marked by roles in various financial institutions, where he has been responsible for guiding investment strategies and overseeing asset management portfolios. This background has equipped him with a deep understanding of market dynamics and the intricacies of investment decision-making.

-

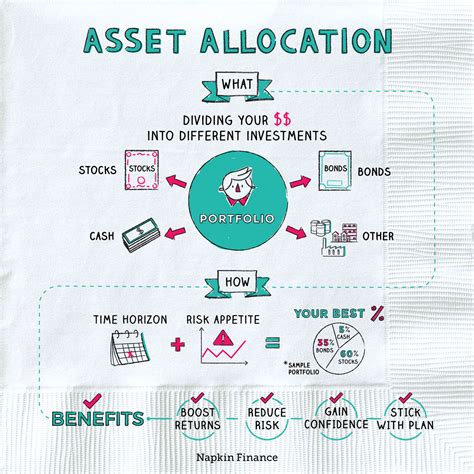

Investment Philosophy: Dotzler is known for advocating a disciplined approach to investment, emphasizing the importance of thorough research, diversification, and a long-term perspective. He believes in the value of fundamental analysis, where the intrinsic value of a company is assessed based on its financial statements, management team, industry trends, and competitive position. This approach is designed to help investors make informed decisions, avoid speculative bubbles, and navigate through volatile market conditions.

-

Educational and Professional Affiliations: Herbert Dotzler's professional stature is also reflected in his educational background and affiliations with prestigious financial organizations. He holds degrees from renowned institutions and is a member of several professional bodies related to finance and investment. These affiliations not only underscore his commitment to the field but also highlight his involvement in ongoing learning and professional development, essential for staying abreast of the latest trends and best practices in finance.

-

Publications and Speaking Engagements: Dotzler has contributed to various financial publications, sharing his insights on investment strategies, market trends, and economic analysis. He is also a sought-after speaker at financial conferences and seminars, where he discusses topics ranging from asset allocation and risk management to the impact of global economic policies on investment outcomes. Through these platforms, he aims to educate and inform both seasoned investors and newcomers to the world of finance, promoting a culture of informed decision-making.

-

Advocacy for Investor Education: One of the key aspects of Herbert Dotzler's work is his advocacy for investor education. He believes that empowering investors with knowledge is crucial for their success in the financial markets. Dotzler has been involved in initiatives aimed at promoting financial literacy, emphasizing the importance of understanding investment products, recognizing risk, and adopting a patient, well-informed approach to wealth creation. By advocating for investor education, he seeks to democratize access to financial information, helping individuals from all walks of life to make better financial decisions.

Investment Strategies and Principles

Herbert Dotzler's investment strategies and principles are centered around a few key concepts that he believes are essential for achieving long-term financial success. These include diversification, which involves spreading investments across different asset classes to minimize risk; a long-term perspective, which helps investors ride out market fluctuations; and a disciplined approach to buying and selling, based on thorough analysis rather than emotional responses to market movements.

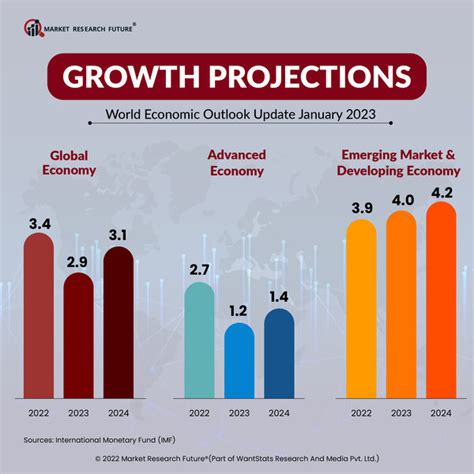

Market Analysis and Trends

Dotzler's work also involves analyzing market trends and economic indicators to forecast future market movements. He believes in the importance of understanding the broader economic context in which investments are made, including factors such as interest rates, inflation, and geopolitical events. By staying informed about these trends, investors can position their portfolios to capitalize on emerging opportunities and mitigate potential risks.

Financial Literacy and Education

The promotion of financial literacy and education is another critical aspect of Herbert Dotzler's advocacy. He recognizes that the world of finance can be complex and intimidating, especially for those who are new to investing. Therefore, he emphasizes the need for accessible, straightforward information that can help individuals make informed financial decisions. Through his work, Dotzler aims to bridge the knowledge gap, empowering more people to take control of their financial futures.

Professional Development and Networking

Herbert Dotzler's commitment to professional development and networking is evident in his involvement with various financial organizations and his participation in industry events. He believes in the value of collaboration and the exchange of ideas among professionals, which can lead to innovative solutions and best practices in investment management. By engaging with peers and thought leaders in the field, Dotzler stays at the forefront of financial knowledge and trends.

Global Economic Outlook

Dotzler's insights into the global economic outlook are highly regarded, as he provides analysis on how international events, policies, and market shifts impact investment opportunities and risks. His global perspective helps investors understand the interconnectedness of economies and financial markets, enabling them to make more informed decisions about their investment portfolios.

Investor Psychology and Behavioral Finance

Herbert Dotzler also explores the realm of investor psychology and behavioral finance, recognizing that emotional and cognitive biases can significantly influence investment decisions. By understanding these biases and how they affect market behavior, investors can develop strategies to overcome them, leading to more rational and successful investment choices.

Technological Innovations in Finance

The impact of technological innovations on the financial sector is another area of interest for Dotzler. He discusses how advancements in digital technologies, such as blockchain, artificial intelligence, and fintech, are transforming the way investments are managed, transactions are conducted, and financial services are delivered. By embracing these innovations, investors and financial institutions can enhance efficiency, reduce costs, and improve customer experience.

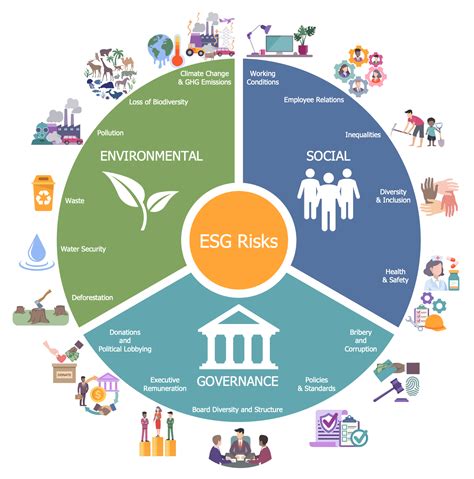

Sustainable Investing and ESG Factors

Lastly, Herbert Dotzler highlights the growing importance of sustainable investing and Environmental, Social, and Governance (ESG) factors in investment decisions. He advocates for considering these factors not only for their ethical implications but also for their potential impact on long-term financial performance. By integrating ESG considerations into investment strategies, investors can contribute to a more sustainable future while also protecting and growing their wealth.

Herbert Dotzler Image Gallery

What is the importance of diversification in investment portfolios?

+Diversification is crucial as it helps in spreading risk across different asset classes, thereby minimizing the impact of any one investment on the overall portfolio performance.

How does Herbert Dotzler approach investment analysis?

+Herbert Dotzler emphasizes a disciplined approach to investment, focusing on fundamental analysis, a long-term perspective, and the consideration of ESG factors to guide investment decisions.

What role does financial literacy play in successful investing?

+Financial literacy is essential for making informed investment decisions. It empowers investors to understand investment products, recognize risks, and adopt strategies that align with their financial goals.

As we reflect on the insights and principles shared by Herbert Dotzler, it becomes evident that his work offers valuable lessons for investors seeking to navigate the complexities of the financial markets. By embracing a disciplined investment approach, prioritizing financial literacy, and staying informed about market trends and technological innovations, individuals can better position themselves for long-term financial success. We invite readers to share their thoughts on the importance of investor education and the role of sustainable investing in the comments below, and to consider how the principles outlined here can be applied to their own investment strategies.