Intro

Boost credit scores with a goodwill letter to creditor template, removing late payments and negative marks, through effective debt negotiation and creditor forgiveness, using a proven sample letter.

Receiving a goodwill letter from a creditor can be a significant relief for individuals who have fallen behind on their payments. A goodwill letter is a formal request to a creditor to remove a late payment or other negative mark from a credit report. In this article, we will explore the importance of goodwill letters, their benefits, and provide a template for writing an effective goodwill letter to a creditor.

Goodwill letters are essential for individuals who have experienced unforeseen circumstances, such as illness, job loss, or family emergencies, that have affected their ability to make timely payments. By writing a goodwill letter, individuals can demonstrate their commitment to making payments and their desire to maintain a positive credit history. Creditors may be willing to work with individuals who have experienced unexpected difficulties, and a goodwill letter can be an effective way to initiate this process.

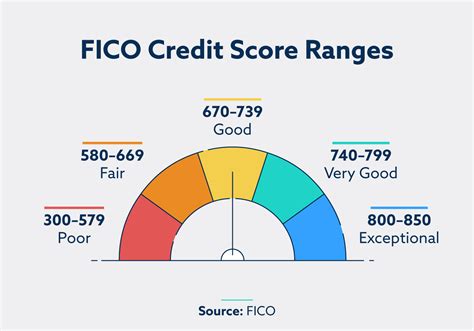

The benefits of goodwill letters are numerous. They can help individuals avoid the negative consequences of late payments, such as higher interest rates and lower credit scores. Additionally, goodwill letters can demonstrate an individual's responsibility and willingness to make amends, which can lead to more favorable treatment from creditors in the future. By writing a goodwill letter, individuals can take the first step towards repairing their credit and improving their financial stability.

Understanding Goodwill Letters

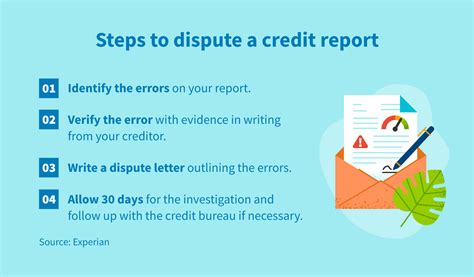

Goodwill letters are formal requests to creditors to remove negative marks from credit reports. They are typically used to address late payments, but can also be used to dispute other errors or inaccuracies on credit reports. When writing a goodwill letter, it is essential to be honest and transparent about the circumstances that led to the late payment. Creditors are more likely to respond favorably to individuals who take responsibility for their actions and demonstrate a commitment to making payments.

Benefits of Goodwill Letters

The benefits of goodwill letters include: * Removal of negative marks from credit reports * Improvement of credit scores * Avoidance of higher interest rates and fees * Demonstration of responsibility and commitment to making payments * Potential for more favorable treatment from creditors in the futureWriting an Effective Goodwill Letter

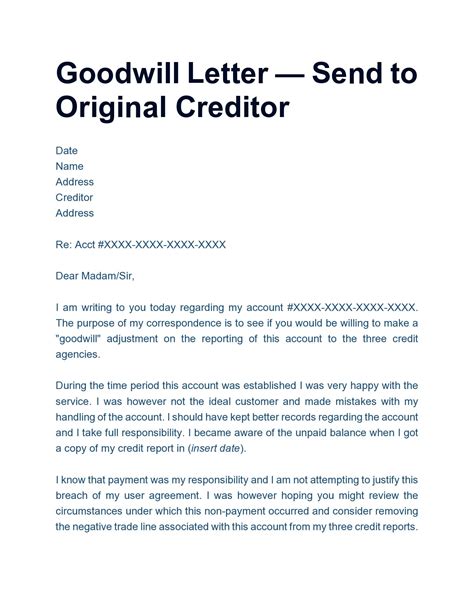

When writing a goodwill letter, it is essential to be clear and concise. The letter should include the following information:

- A formal greeting and introduction

- A clear explanation of the circumstances that led to the late payment

- A statement of responsibility and commitment to making payments

- A request for the creditor to remove the negative mark from the credit report

- A closing and signature

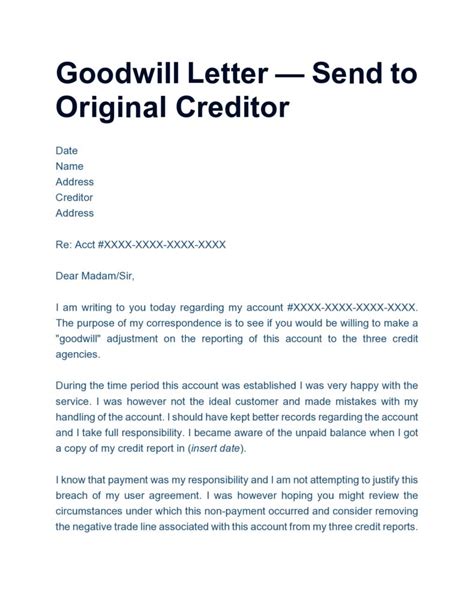

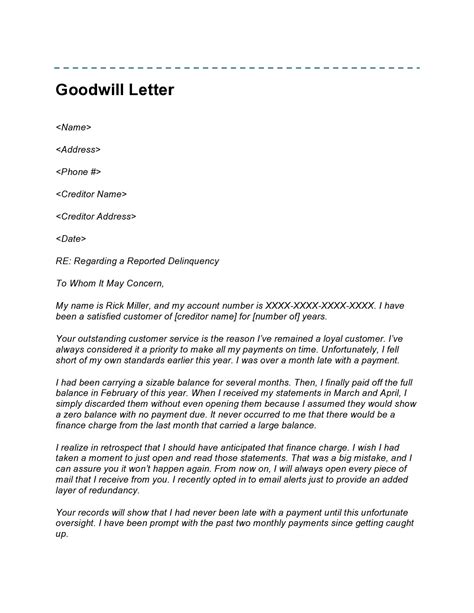

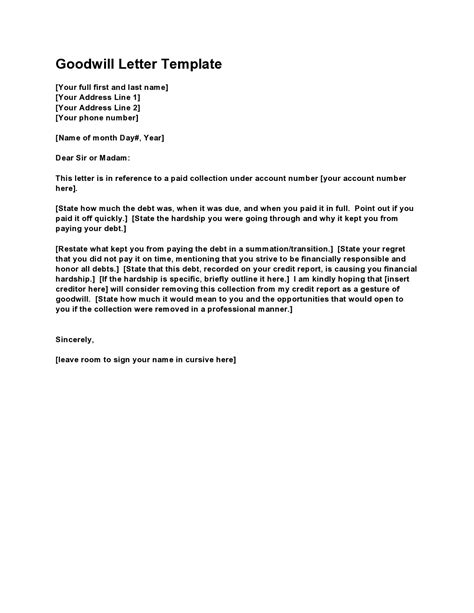

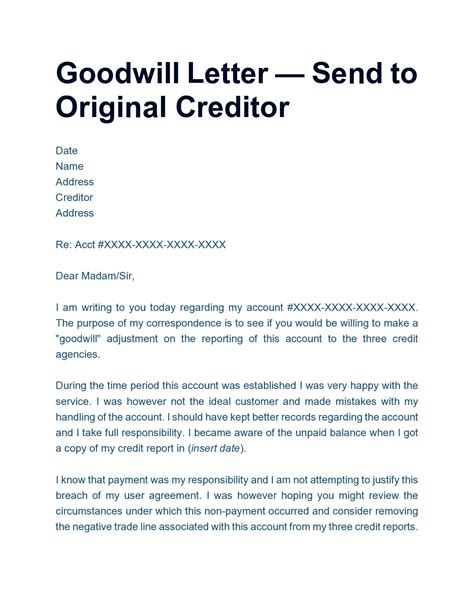

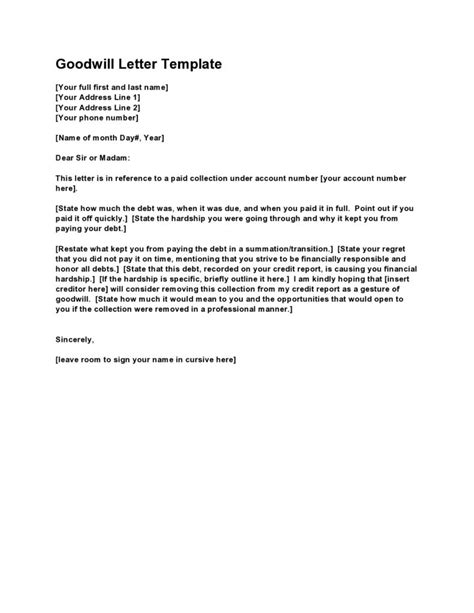

Goodwill Letter Template

Here is a template for a goodwill letter: [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Date][Creditor's Name] [Creditor's Address] [City, State, ZIP]

Dear [Creditor's Name],

I am writing to request that you consider removing the late payment mark from my credit report. On [date], I missed a payment due to [briefly explain the circumstances that led to the late payment]. I take full responsibility for the late payment and assure you that it was an isolated incident.

I have since [describe any steps you have taken to prevent future late payments, such as setting up automatic payments]. I am committed to making all future payments on time and maintaining a positive credit history.

I would greatly appreciate it if you could remove the late payment mark from my credit report. I believe that this would be a fair and reasonable decision, given my circumstances and my commitment to making payments.

Thank you for considering my request. Please do not hesitate to contact me if you require any additional information.

Sincerely,

[Your Name]

Tips for Writing a Goodwill Letter

When writing a goodwill letter, it is essential to keep the following tips in mind:

- Be honest and transparent about the circumstances that led to the late payment

- Take responsibility for the late payment and demonstrate a commitment to making payments

- Be clear and concise in your request

- Include any relevant documentation, such as proof of payment or correspondence with the creditor

- Follow up with the creditor if you do not receive a response within a reasonable timeframe

Common Mistakes to Avoid

When writing a goodwill letter, it is essential to avoid the following common mistakes: * Making excuses or blaming others for the late payment * Being aggressive or confrontational * Failing to take responsibility for the late payment * Not including relevant documentation or information * Not following up with the creditorConclusion and Next Steps

In conclusion, goodwill letters can be an effective way to address late payments and improve credit scores. By being honest and transparent, taking responsibility for the late payment, and demonstrating a commitment to making payments, individuals can increase their chances of success. It is essential to follow the tips outlined in this article and avoid common mistakes when writing a goodwill letter.

If you have any questions or concerns about writing a goodwill letter, please do not hesitate to comment below. We would be happy to help you with your inquiry.

Goodwill Letter Image Gallery

What is a goodwill letter?

+A goodwill letter is a formal request to a creditor to remove a late payment or other negative mark from a credit report.

How do I write a goodwill letter?

+To write a goodwill letter, include a formal greeting and introduction, a clear explanation of the circumstances that led to the late payment, a statement of responsibility and commitment to making payments, and a request for the creditor to remove the negative mark from the credit report.

What are the benefits of a goodwill letter?

+The benefits of a goodwill letter include removal of negative marks from credit reports, improvement of credit scores, avoidance of higher interest rates and fees, demonstration of responsibility and commitment to making payments, and potential for more favorable treatment from creditors in the future.