Intro

Get a Goodwill credit letter template example to repair credit scores, remove late payments, and improve credit history with effective debt validation and credit dispute techniques.

The importance of maintaining a good credit score cannot be overstated. A good credit score can open doors to better loan options, lower interest rates, and even affect one's ability to rent an apartment or get a job. However, mistakes can happen, and a single misstep can significantly lower one's credit score. This is where a goodwill credit letter comes into play. A goodwill credit letter is a formal request to a creditor to remove a late payment or other negative mark from one's credit report as an act of goodwill. In this article, we will delve into the world of goodwill credit letters, exploring their importance, benefits, and providing a comprehensive template example.

A goodwill credit letter is essentially a polite and professional request to a creditor to forgive a mistake. It is not a guarantee that the creditor will agree to the request, but it can be an effective way to repair one's credit score. The key to a successful goodwill credit letter is to be honest, take responsibility for the mistake, and demonstrate a commitment to making timely payments in the future. By doing so, individuals can show creditors that they are responsible and deserving of a second chance.

The benefits of a goodwill credit letter are numerous. For one, it can help to improve one's credit score by removing negative marks. This, in turn, can lead to better loan options, lower interest rates, and even lower insurance premiums. Additionally, a goodwill credit letter can help to establish a positive relationship with creditors, which can be beneficial in the long run. By taking the initiative to request forgiveness, individuals can demonstrate their commitment to being responsible and making timely payments.

What is a Goodwill Credit Letter?

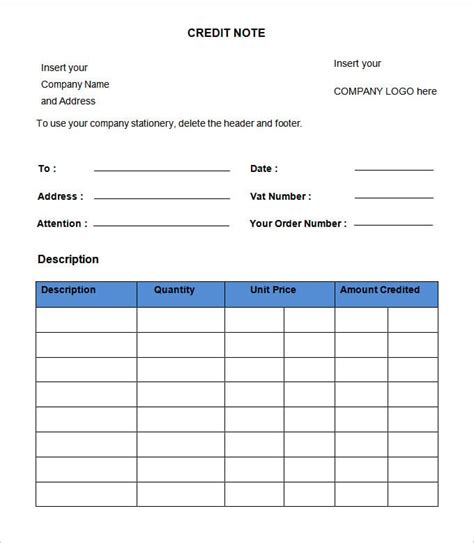

A goodwill credit letter is a formal request to a creditor to remove a negative mark from one's credit report. It is typically used to request the removal of a late payment, but it can also be used to request the removal of other negative marks, such as collections or charge-offs. The letter should be polite, professional, and concise, and should include the following information: the account number, the date of the late payment, and a brief explanation of the circumstances surrounding the late payment.

Benefits of a Goodwill Credit Letter

The benefits of a goodwill credit letter are numerous. Some of the most significant benefits include: * Improved credit score: By removing negative marks from one's credit report, a goodwill credit letter can help to improve one's credit score. * Better loan options: With a improved credit score, individuals may be eligible for better loan options, including lower interest rates and more favorable terms. * Lower insurance premiums: Insurance companies often use credit scores to determine premiums. By improving one's credit score, individuals may be eligible for lower insurance premiums. * Positive relationship with creditors: A goodwill credit letter can help to establish a positive relationship with creditors, which can be beneficial in the long run.How to Write a Goodwill Credit Letter

Writing a goodwill credit letter can be a daunting task, but it doesn't have to be. Here are some tips to keep in mind:

- Be polite and professional: The tone of the letter should be polite and professional. Avoid being confrontational or aggressive, as this can harm one's chances of getting a positive response.

- Be concise: The letter should be concise and to the point. Avoid including unnecessary information or rambling on about unrelated topics.

- Include the necessary information: The letter should include the account number, the date of the late payment, and a brief explanation of the circumstances surrounding the late payment.

- Proofread: Finally, be sure to proofread the letter carefully before sending it. A single mistake can make a negative impression and harm one's chances of getting a positive response.

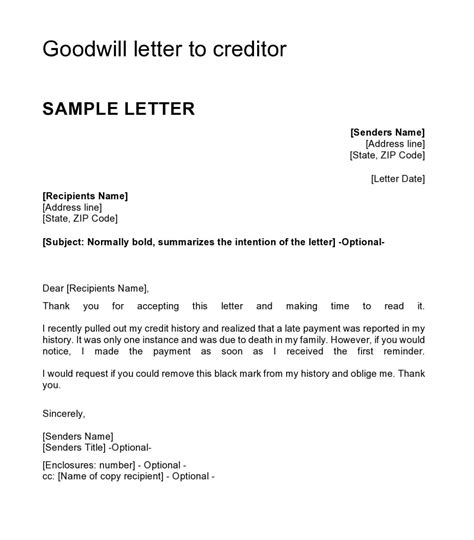

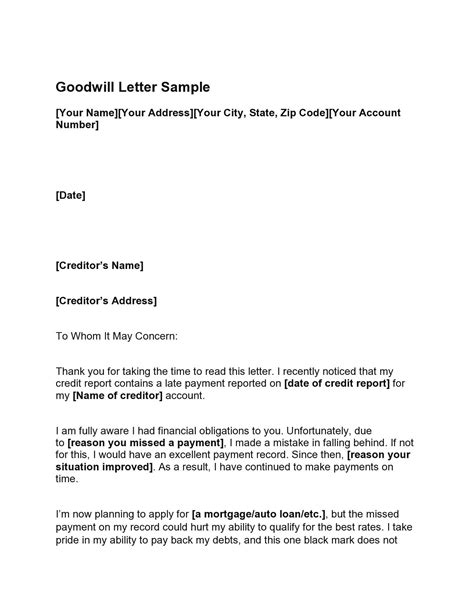

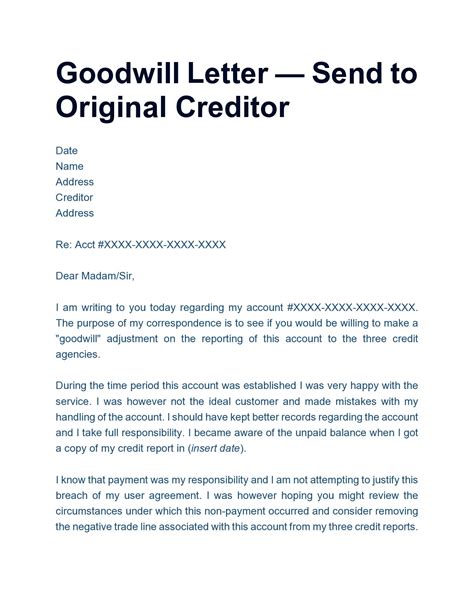

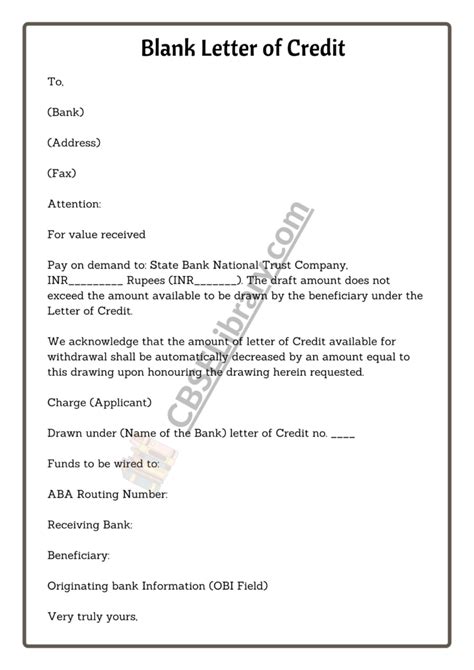

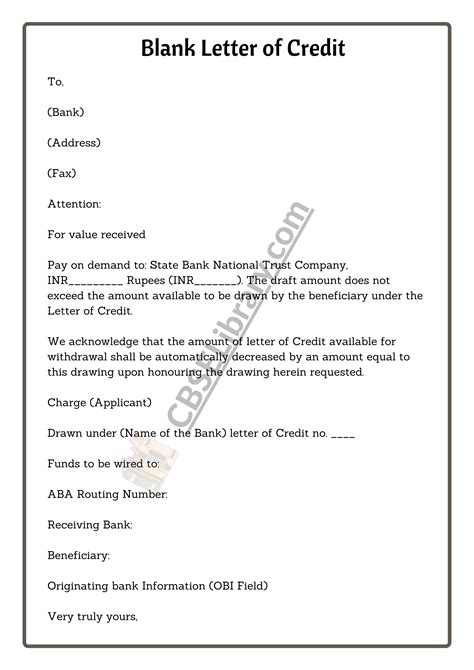

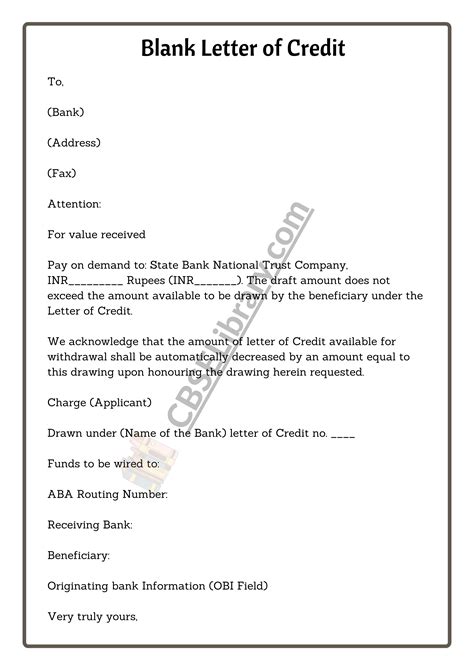

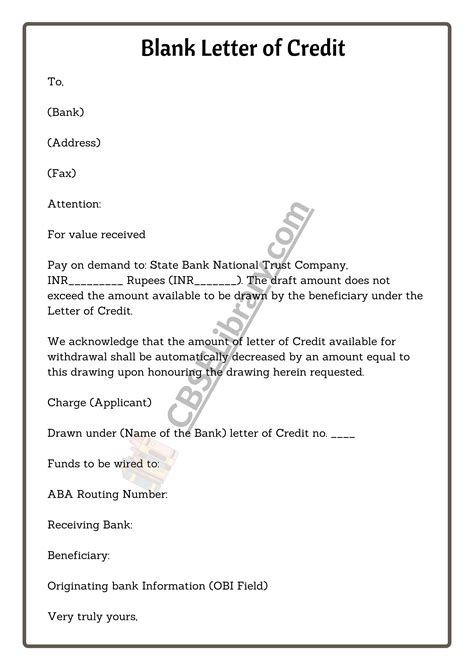

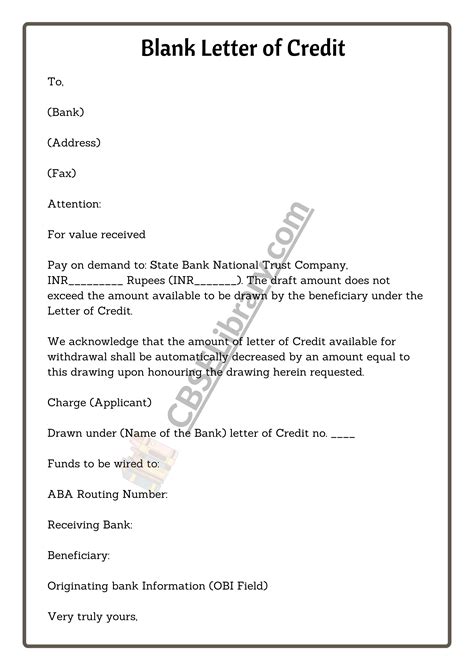

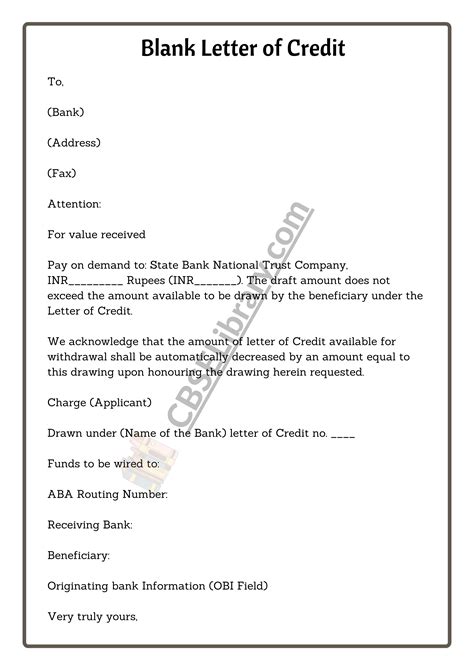

Goodwill Credit Letter Template Example

Here is a sample goodwill credit letter template: [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date][Creditor's Name] [Creditor's Address] [City, State, ZIP]

Dear [Creditor's Name],

Re: Account Number [Account Number]

I am writing to request that you consider removing the late payment that was reported to the credit bureaus on [Date of Late Payment]. I understand that this late payment was a mistake and that it has had a negative impact on my credit score.

I want to assure you that I am committed to making timely payments and that this late payment was an isolated incident. I have been a responsible borrower and have made all of my payments on time since the late payment.

I would greatly appreciate it if you could remove this late payment from my credit report as an act of goodwill. I believe that this would be a fair and reasonable decision, given my history of responsible borrowing and my commitment to making timely payments in the future.

Thank you for considering my request. Please do not hesitate to contact me if you need any additional information.

Sincerely,

[Your Name]

Tips for Getting a Positive Response

Getting a positive response to a goodwill credit letter can be challenging, but there are several tips that can increase one's chances of success. Here are some tips to keep in mind:

- Be persistent: Don't be discouraged if the creditor doesn't respond right away. Follow up with a phone call or another letter to demonstrate your commitment to getting a positive response.

- Be flexible: Be willing to negotiate and compromise. If the creditor is unwilling to remove the late payment, ask if they would be willing to remove it if you make a certain number of on-time payments.

- Be patient: Getting a positive response to a goodwill credit letter can take time. Don't expect the creditor to respond right away, and be patient and persistent in your efforts.

Common Mistakes to Avoid

Here are some common mistakes to avoid when writing a goodwill credit letter: * Being confrontational or aggressive: Avoid being confrontational or aggressive in the letter, as this can harm one's chances of getting a positive response. * Including unnecessary information: Avoid including unnecessary information or rambling on about unrelated topics. * Not proofreading: Finally, be sure to proofread the letter carefully before sending it. A single mistake can make a negative impression and harm one's chances of getting a positive response.Conclusion and Next Steps

In conclusion, a goodwill credit letter can be an effective way to repair one's credit score and establish a positive relationship with creditors. By being polite, professional, and concise, individuals can increase their chances of getting a positive response. Remember to include the necessary information, proofread carefully, and be persistent and patient in your efforts.

If you are considering writing a goodwill credit letter, don't hesitate to take the next step. With the right template and a little bit of effort, you can improve your credit score and achieve your financial goals.

Gallery of Goodwill Credit Letter Examples

Goodwill Credit Letter Image Gallery

What is a goodwill credit letter?

+A goodwill credit letter is a formal request to a creditor to remove a negative mark from one's credit report as an act of goodwill.

How do I write a goodwill credit letter?

+To write a goodwill credit letter, be polite, professional, and concise. Include the necessary information, such as the account number and date of the late payment, and proofread carefully before sending.

What are the benefits of a goodwill credit letter?

+The benefits of a goodwill credit letter include improved credit score, better loan options, and lower insurance premiums. It can also help establish a positive relationship with creditors.

We hope this article has provided you with a comprehensive understanding of goodwill credit letters and how they can be used to repair your credit score. If you have any questions or comments, please don't hesitate to reach out. Share this article with others who may be struggling with their credit score, and let's work together to achieve financial freedom.