Intro

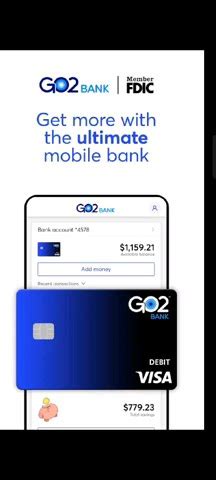

Master Go2bank statements with 5 expert tips, including online access, paperless settings, and transaction tracking, to streamline mobile banking and account management.

Understanding and managing your financial statements is crucial for maintaining a healthy financial life. For users of Go2bank, a mobile bank account that offers a variety of features to help you manage your money, being able to navigate and understand your statements is key. Here are some tips to help you make the most out of your Go2bank statements.

The ability to track your spending, monitor your account activity, and stay on top of your finances is essential in today's fast-paced world. Go2bank, with its user-friendly interface and comprehensive features, makes it easier for you to stay in control of your financial situation. By understanding how to read and utilize your Go2bank statements effectively, you can better manage your money, avoid unnecessary fees, and work towards your long-term financial goals.

Effective management of your Go2bank statements involves more than just glancing over your account activity. It requires a thorough understanding of the information provided, the ability to identify trends in your spending, and knowledge of how to use this information to make informed financial decisions. Whether you're looking to save money, reduce debt, or simply keep track of your daily expenses, your Go2bank statement is a powerful tool that can help you achieve your objectives.

Understanding Your Go2bank Statement

Breaking Down the Components

Breaking down the components of your Go2bank statement can help you better understand your financial situation. Here are some key elements to look for: - **Account Summary**: This section provides an overview of your account, including your account number, the statement period, and your current balance. - **Transaction List**: This is a detailed list of all transactions that have occurred on your account during the statement period. It includes the date, description, and amount of each transaction. - **Fees and Charges**: If you've been charged any fees, such as overdraft fees, ATM fees, or monthly maintenance fees, they will be listed here. - **Notifications**: This section may include important notifications, such as reminders about upcoming bill payments or alerts if your account balance is low.Managing Your Go2bank Account

Using Go2bank Features

Go2bank offers several features that can help you manage your account and achieve your financial goals. Some of these features include: - **Direct Deposit**: Setting up direct deposit can help you get access to your money up to 2 days faster. - **Budgeting Tools**: Go2bank offers tools that can help you track your spending and create a budget. - **Secured Credit Card**: For those looking to build credit, Go2bank's secured credit card can be a useful tool.Security and Protection

Reporting Issues

If you notice any suspicious activity or errors on your statement, it's important to report them as soon as possible. Go2bank provides customer support that you can contact to report issues. When reporting an issue, be prepared to provide as much detail as possible about the transaction or error, including the date, amount, and description of the transaction.Conclusion and Next Steps

Final Thoughts

As you continue on your financial journey, keep in mind that knowledge and proactive management are key. Stay engaged with your finances, and don't hesitate to seek help when you need it. Whether you're looking to build credit, save money, or simply keep track of your spending, the right tools and mindset can make all the difference.Go2bank Statement Tips Image Gallery

How do I access my Go2bank statement?

+You can access your Go2bank statement through the Go2bank mobile app or by logging into your account on the Go2bank website.

What information is included on my Go2bank statement?

+Your Go2bank statement includes a summary of your account activity, transactions, current balance, and any fees that have been charged to your account.

How can I report an error or suspicious activity on my statement?

+You can report errors or suspicious activity by contacting Go2bank customer support. They are available to assist you and can guide you through the process of resolving any issues with your account.

We hope this article has provided you with valuable insights and tips on how to make the most out of your Go2bank statements. Whether you're a new user or have been with Go2bank for a while, understanding and effectively managing your account is key to achieving your financial goals. If you have any further questions or would like to share your experiences with managing your Go2bank account, please don't hesitate to comment below. Your feedback and insights are invaluable to us and can help others in their financial journey.