Intro

Master GL reconciliation with our 5 tips and Excel template, ensuring accurate financial reporting, account balancing, and error-free ledger management, streamlining your accounting process.

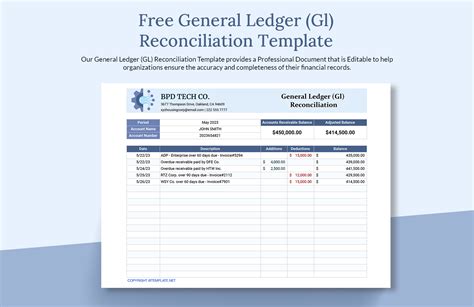

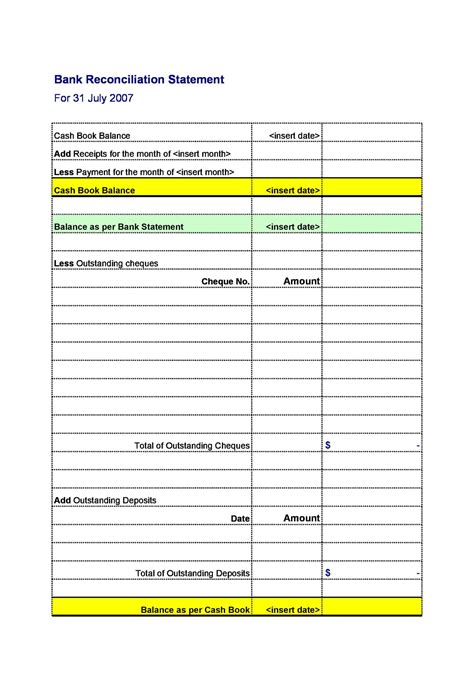

Reconciling financial statements and accounts is a crucial task for businesses and individuals alike. It helps ensure the accuracy and reliability of financial data, which in turn supports informed decision-making. One of the most effective tools for reconciliations is the General Ledger (GL) Reconciliation Template in Excel. This template provides a structured format for comparing and matching transactions from different sources, such as bank statements and internal accounting records. Here are five tips to maximize the use of a GL Reconciliation Template in Excel:

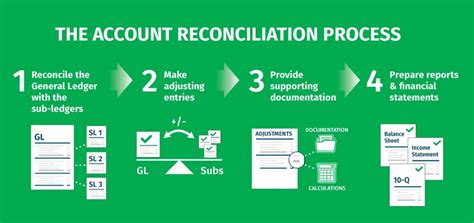

The process of reconciliation involves several steps, including data collection, transaction matching, and discrepancy resolution. The GL Reconciliation Template in Excel is designed to facilitate these steps by offering a clear and organized framework. Before diving into the tips, it's essential to understand the importance of reconciliation in financial management. Reconciliation helps detect errors, prevent fraud, and ensure compliance with financial regulations. It's a critical control measure that provides assurance over the integrity of financial reporting.

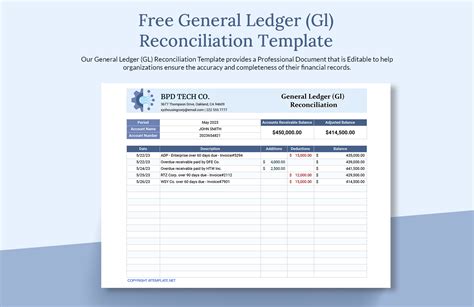

Understanding the GL Reconciliation Template

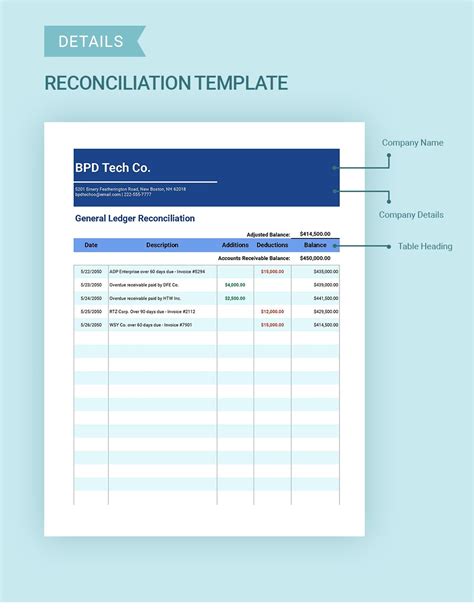

The GL Reconciliation Template in Excel typically consists of several columns and rows designed to capture detailed information about transactions. The template may include fields for transaction dates, descriptions, debit and credit amounts, and a column to indicate whether the transaction has been reconciled. Understanding the structure and functionality of the template is key to effective use.

Benefits of Using a GL Reconciliation Template

The benefits of using a GL Reconciliation Template in Excel are numerous. It enhances accuracy by reducing manual errors, increases efficiency by automating the reconciliation process, and improves transparency by providing a clear audit trail. Additionally, it facilitates the identification of discrepancies and supports timely resolution, which is critical for maintaining the integrity of financial records.

Customizing the GL Reconciliation Template

One of the advantages of using an Excel template is the ability to customize it according to specific needs. Users can add or remove columns, modify formulas, and adjust the layout to better suit their reconciliation processes. Customization can enhance the template's effectiveness and make it more user-friendly.

Automating Reconciliation Processes

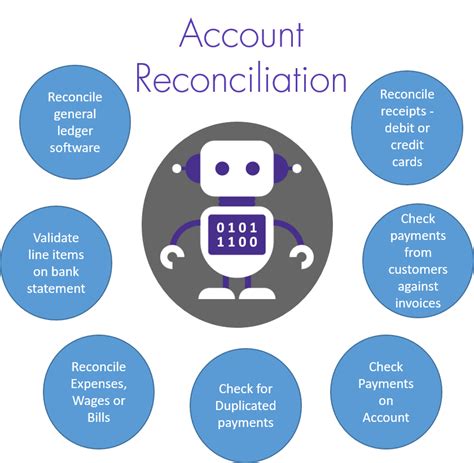

Excel offers various tools and functions that can automate parts of the reconciliation process. For example, formulas can be used to automatically match transactions based on certain criteria, and macros can be created to perform repetitive tasks. Automating these processes can significantly reduce the time and effort required for reconciliation.

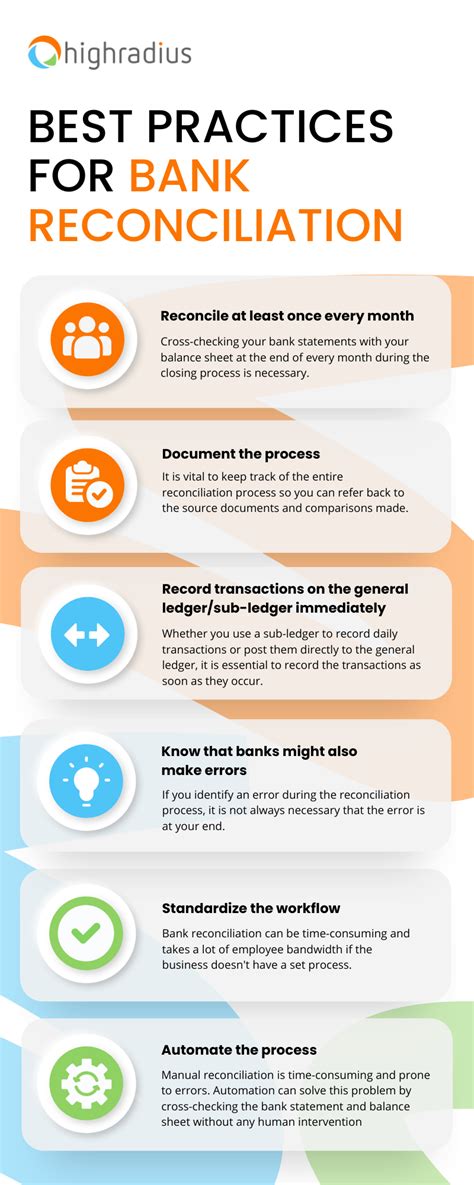

Best Practices for GL Reconciliation

Adhering to best practices is crucial for effective GL reconciliation. This includes regularly reviewing and updating the template, ensuring that all transactions are accounted for, and maintaining detailed records of the reconciliation process. Best practices also involve ongoing training for users to ensure they are proficient in using the template and understanding the reconciliation process.

Key Considerations for Effective Reconciliation

- Accuracy and Attention to Detail: Reconciliation requires a high level of accuracy and attention to detail. Small discrepancies can lead to significant issues if not identified and resolved promptly.

- Timeliness: Reconciliation should be performed regularly and in a timely manner. Delaying reconciliation can complicate the process and make it more challenging to identify and resolve discrepancies.

- Documentation: Maintaining comprehensive documentation of the reconciliation process is essential. This includes records of transactions, discrepancies found, and actions taken to resolve them.

Common Challenges in GL Reconciliation

- Manual Errors: Manual errors are a common challenge in GL reconciliation. These can arise from incorrect data entry, misinterpretation of transactions, or simple oversights.

- System Limitations: The effectiveness of GL reconciliation can be limited by the capabilities of the accounting system or Excel template being used. Understanding these limitations is crucial for developing workaround strategies.

- Lack of Training: Insufficient training on how to use the GL Reconciliation Template in Excel or how to perform reconciliation can lead to inefficiencies and inaccuracies.

Advanced Features for Enhanced Reconciliation

Excel offers several advanced features that can enhance the reconciliation process. These include pivot tables for data analysis, conditional formatting for highlighting discrepancies, and VLOOKUP functions for automating transaction matching. Utilizing these features can streamline the reconciliation process and improve its accuracy.

Future of GL Reconciliation

The future of GL reconciliation is likely to be shaped by technological advancements, including artificial intelligence (AI), machine learning (ML), and cloud computing. These technologies have the potential to automate more aspects of the reconciliation process, reduce manual errors, and provide real-time insights into financial data.

Gallery of GL Reconciliation Templates

GL Reconciliation Template Gallery

What is GL Reconciliation?

+GL Reconciliation is the process of comparing and matching transactions from different sources to ensure accuracy and reliability of financial data.

Why is GL Reconciliation Important?

+GL Reconciliation is important because it helps detect errors, prevent fraud, and ensure compliance with financial regulations, thereby providing assurance over the integrity of financial reporting.

How Often Should GL Reconciliation Be Performed?

+GL Reconciliation should be performed regularly, ideally on a monthly basis, to ensure timely identification and resolution of discrepancies.

In conclusion, the GL Reconciliation Template in Excel is a powerful tool for managing financial reconciliations. By understanding its structure, customizing it to meet specific needs, automating processes, and following best practices, users can maximize its benefits. As technology continues to evolve, the future of GL reconciliation holds promise for even more efficient and accurate financial management. We invite readers to share their experiences with GL reconciliation templates and tips for improving the process. Your insights can help others optimize their financial management practices.