Intro

Unlock investment opportunities with a 5 Ways Equity Letter, leveraging private equity, venture capital, and alternative investments to drive growth and returns, while navigating due diligence and deal structuring.

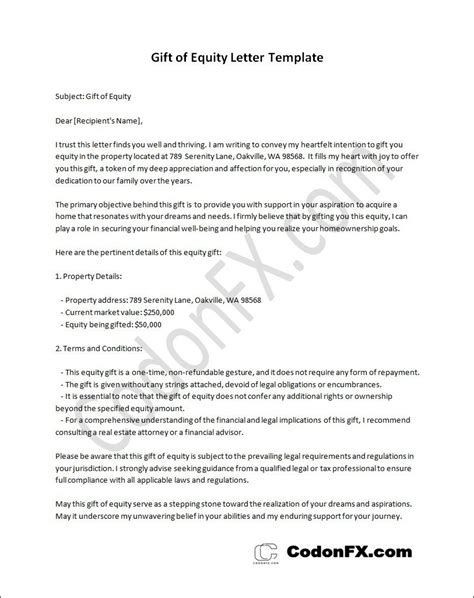

In today's fast-paced business world, equity letters have become an essential tool for companies looking to secure funding, negotiate deals, and establish partnerships. An equity letter, also known as a term sheet, is a non-binding document that outlines the terms and conditions of a potential investment or partnership. It serves as a foundation for further negotiations and can help prevent misunderstandings down the line. With the rise of startup culture and venture capital, understanding the ins and outs of equity letters is more crucial than ever. In this article, we will delve into the world of equity letters, exploring their importance, benefits, and key components.

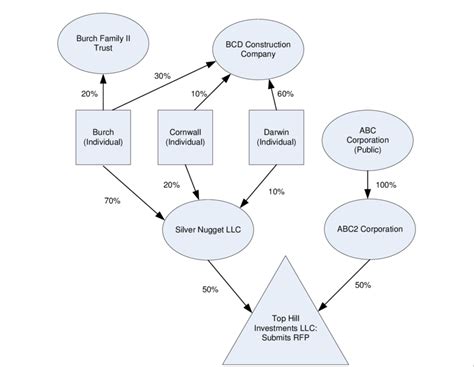

The significance of equity letters cannot be overstated. They provide a clear and concise summary of the proposed investment, including the amount of funding, valuation, and ownership stakes. This document helps investors and founders alike to assess the risks and rewards associated with the deal, making it an indispensable resource for anyone involved in the process. Moreover, equity letters can facilitate smoother negotiations, reduce the risk of miscommunication, and ultimately lead to more successful partnerships.

As the business landscape continues to evolve, it's essential to stay ahead of the curve when it comes to equity letters. Whether you're a seasoned entrepreneur or an aspiring startup founder, having a solid grasp of these documents can make all the difference. In the following sections, we will explore five key aspects of equity letters, providing valuable insights and practical advice for navigating this complex and often daunting world.

Understanding Equity Letters

Key Components of Equity Letters

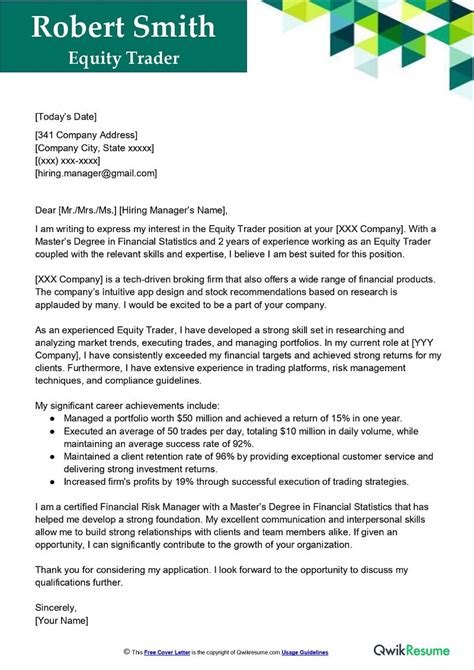

Benefits of Equity Letters

Negotiating Equity Letters

Best Practices for Equity Letters

Gallery of Equity Letters

Equity Letters Image Gallery

What is an equity letter?

+An equity letter, also known as a term sheet, is a non-binding document that outlines the terms and conditions of a potential investment or partnership.

What are the key components of an equity letter?

+The key components of an equity letter include the investment amount, valuation, ownership stakes, terms and conditions, and exclusivity.

How do I negotiate an equity letter?

+To negotiate an equity letter, clearly define the terms and conditions of the investment, establish a strong relationship with potential investors, and be open to compromise and flexibility.

What are the benefits of using an equity letter?

+The benefits of using an equity letter include reduced risk of miscommunication, increased transparency, improved negotiation outcomes, and enhanced credibility and trust.

How do I create an effective equity letter?

+To create an effective equity letter, clearly outline the terms and conditions of the investment, establish a strong and transparent relationship with investors, and seek professional advice and guidance.

In conclusion, equity letters are a vital tool for businesses looking to secure funding, negotiate deals, and establish partnerships. By understanding the key components, benefits, and best practices of equity letters, companies can navigate the complex world of finance with confidence. Whether you're a seasoned entrepreneur or an aspiring startup founder, having a solid grasp of equity letters can make all the difference. We encourage you to share your thoughts and experiences with equity letters in the comments below, and don't forget to share this article with anyone who may benefit from this valuable information.