Intro

Streamline lease accounting with the 5 Ways Gasb 87 Excel Template, featuring lease classification, amortization, and disclosure tools, simplifying compliance and financial reporting.

The implementation of GASB 87, a new standard for lease accounting, has brought significant changes to the way governments and other organizations account for their leases. To help navigate these changes, a GASB 87 Excel template can be a valuable tool. In this article, we will explore five ways a GASB 87 Excel template can assist with lease accounting.

GASB 87 introduces a single model for lease accounting, which requires lessees to recognize lease assets and liabilities on their balance sheets. This new standard applies to all leases with terms of 12 months or more, and it requires significant disclosures about lease transactions. The complexity of these new requirements makes a GASB 87 Excel template an essential resource for organizations seeking to ensure compliance.

A GASB 87 Excel template can help organizations streamline their lease accounting processes, reduce errors, and improve transparency. By utilizing a template, organizations can ensure that they are accurately accounting for their leases and making the necessary disclosures. In the following sections, we will delve into the specifics of how a GASB 87 Excel template can facilitate lease accounting.

Understanding GASB 87 Requirements

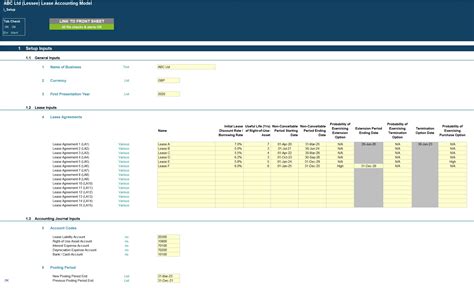

To effectively use a GASB 87 Excel template, it is crucial to understand the requirements of the standard. GASB 87 provides guidance on the classification of leases, the measurement of lease assets and liabilities, and the disclosures required for lease transactions. A GASB 87 Excel template can help organizations apply these requirements by providing pre-built formulas and worksheets for calculating lease assets and liabilities.

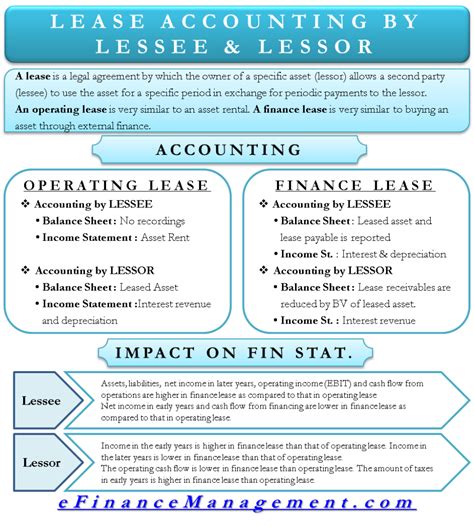

Classification of Leases

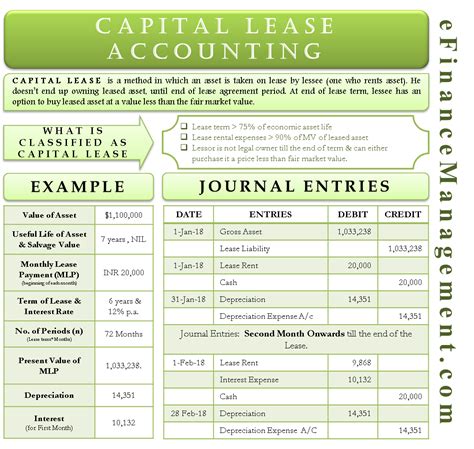

The classification of leases under GASB 87 is based on the type of lease and the terms of the lease agreement. Leases can be classified as finance leases or operating leases, and each type of lease has different accounting requirements. A GASB 87 Excel template can assist with the classification of leases by providing worksheets for determining the type of lease and calculating the lease assets and liabilities.Calculating Lease Assets and Liabilities

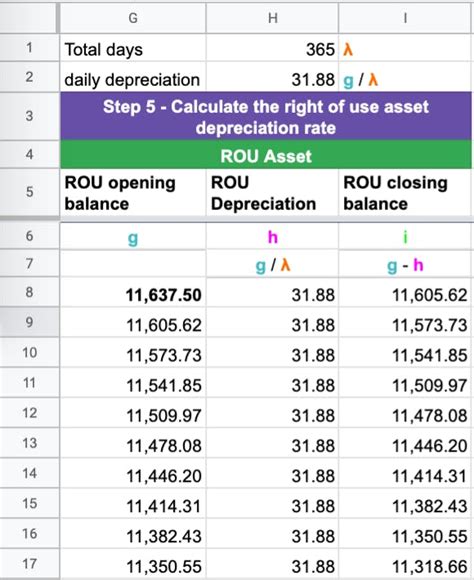

One of the primary benefits of a GASB 87 Excel template is its ability to calculate lease assets and liabilities. The template can provide pre-built formulas for calculating the present value of lease payments, the lease asset, and the lease liability. These calculations can be complex, but a GASB 87 Excel template can simplify the process and reduce the risk of errors.

Present Value of Lease Payments

The present value of lease payments is a critical component of lease accounting under GASB 87. The present value represents the amount of the lease payments discounted to their present value using an appropriate discount rate. A GASB 87 Excel template can assist with the calculation of the present value by providing a worksheet for determining the discount rate and calculating the present value of the lease payments.Disclosures and Reporting

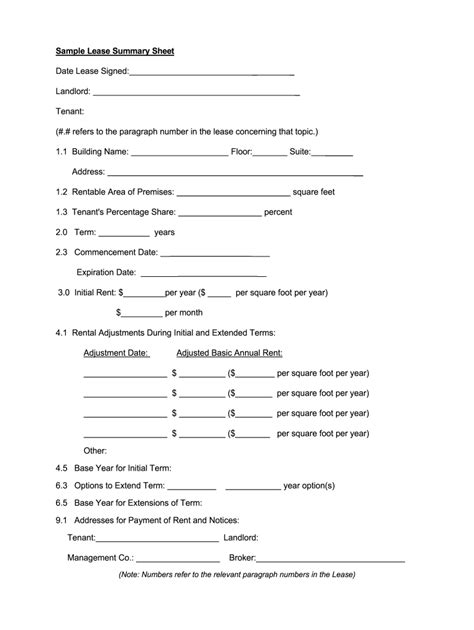

GASB 87 requires significant disclosures about lease transactions, including the lease assets and liabilities, the lease payments, and the discount rates used to calculate the present value of the lease payments. A GASB 87 Excel template can help organizations prepare these disclosures by providing worksheets for calculating the required information and formatting the disclosures according to the standard.

Disclosure Requirements

The disclosure requirements under GASB 87 are extensive and require organizations to provide detailed information about their leases. A GASB 87 Excel template can assist with these disclosures by providing pre-built worksheets for calculating the required information and formatting the disclosures according to the standard.Implementation and Transition

The implementation of GASB 87 can be complex, and organizations may need to transition their existing lease accounting processes to comply with the new standard. A GASB 87 Excel template can help organizations navigate this transition by providing a framework for implementing the new standard and calculating the lease assets and liabilities.

Transition Guidance

GASB 87 provides guidance on the transition to the new standard, including the requirement to recognize a cumulative effect adjustment to the beginning balance of net position. A GASB 87 Excel template can assist with the transition by providing worksheets for calculating the cumulative effect adjustment and implementing the new standard.Best Practices for Using a GASB 87 Excel Template

To get the most out of a GASB 87 Excel template, organizations should follow best practices for using the template. These best practices include regularly updating the template to reflect changes in the lease portfolio, reviewing the template for accuracy and completeness, and providing training to users on the proper use of the template.

Regular Updates

Regular updates to the GASB 87 Excel template are essential to ensure that the template remains accurate and complete. Organizations should regularly review the template to ensure that it reflects changes in the lease portfolio and that the calculations are accurate.GASB 87 Template Image Gallery

What is GASB 87?

+GASB 87 is a new standard for lease accounting that requires governments and other organizations to recognize lease assets and liabilities on their balance sheets.

What are the benefits of using a GASB 87 Excel template?

+The benefits of using a GASB 87 Excel template include streamlining lease accounting processes, reducing errors, and improving transparency.

How can a GASB 87 Excel template assist with lease accounting?

+A GASB 87 Excel template can assist with lease accounting by providing pre-built formulas and worksheets for calculating lease assets and liabilities, as well as formatting disclosures according to the standard.

What are the disclosure requirements under GASB 87?

+The disclosure requirements under GASB 87 include providing detailed information about lease transactions, including the lease assets and liabilities, the lease payments, and the discount rates used to calculate the present value of the lease payments.

How can a GASB 87 Excel template help with the implementation of GASB 87?

+A GASB 87 Excel template can help with the implementation of GASB 87 by providing a framework for implementing the new standard and calculating the lease assets and liabilities.

In conclusion, a GASB 87 Excel template can be a valuable tool for organizations seeking to navigate the complexities of lease accounting under the new standard. By providing pre-built formulas and worksheets for calculating lease assets and liabilities, as well as formatting disclosures according to the standard, a GASB 87 Excel template can help organizations ensure compliance with GASB 87. We invite you to share your thoughts on how a GASB 87 Excel template can assist with lease accounting, and we encourage you to explore the resources provided in this article to learn more about the benefits and best practices for using a GASB 87 Excel template.