Intro

Discover a comprehensive Gasb 68 template for LGERS, featuring accounting guidelines, financial reporting, and disclosure requirements, to ensure compliance and accurate pension reporting.

The importance of accurate financial reporting cannot be overstated, particularly for local governments and public sector entities. The Governmental Accounting Standards Board (GASB) has established a set of standards to ensure transparency and accountability in financial reporting. One of the most significant standards is GASB 68, which pertains to the accounting and financial reporting of pension plans. In this article, we will delve into the details of GASB 68 and provide a comprehensive template for local governments to follow.

The implementation of GASB 68 has been a significant undertaking for many local governments, requiring substantial changes to their financial reporting processes. The standard introduces new requirements for the measurement and recognition of pension liabilities, as well as the disclosure of pension plan information. As a result, local governments must carefully review and revise their financial statements to ensure compliance with GASB 68.

The benefits of GASB 68 are numerous, including improved transparency and accountability in financial reporting. By providing a standardized framework for pension plan accounting and reporting, GASB 68 enables stakeholders to better understand the financial position and risks associated with local government pension plans. This, in turn, can lead to more informed decision-making and improved fiscal management.

Introduction to GASB 68

Key Components of GASB 68

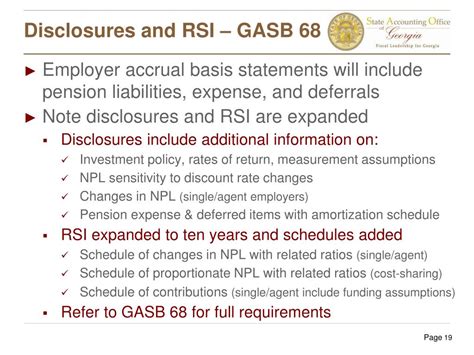

The key components of GASB 68 include: * Measurement of pension liabilities: GASB 68 requires the use of a single, consistent approach to measure pension liabilities, which is based on the projected benefit obligation (PBO) method. * Recognition of pension liabilities: The standard requires that pension liabilities be recognized in the financial statements, rather than being reported as a note disclosure. * Disclosure of pension plan information: GASB 68 requires extensive disclosures about pension plans, including information about plan assets, liabilities, and funding status.GASB 68 Template for Local Governments

Benefits of Using a GASB 68 Template

Using a GASB 68 template can provide numerous benefits for local governments, including: * Improved compliance with GASB 68 requirements * Enhanced transparency and accountability in financial reporting * Increased efficiency in preparing financial statements * Better decision-making and fiscal managementSteps to Implement GASB 68

Common Challenges in Implementing GASB 68

Local governments may encounter several challenges when implementing GASB 68, including: * Complexity of the standard and its requirements * Limited resources and expertise * Difficulty in gathering necessary data and information * Challenges in presenting pension plan information in the financial statementsBest Practices for GASB 68 Implementation

Conclusion and Next Steps

In conclusion, GASB 68 is a significant standard that requires local governments to make substantial changes to their financial reporting processes. By using a comprehensive template and following best practices, local governments can ensure successful implementation of GASB 68 and improve transparency and accountability in financial reporting. Next steps for local governments include reviewing and revising financial statements, providing training and education to staff and stakeholders, and monitoring progress and making adjustments as necessary.GASB 68 Image Gallery

What is GASB 68?

+GASB 68 is a standard issued by the Governmental Accounting Standards Board (GASB) that pertains to the accounting and financial reporting of pension plans.

What are the key components of GASB 68?

+The key components of GASB 68 include the measurement of pension liabilities, recognition of pension liabilities, and disclosure of pension plan information.

How do I implement GASB 68?

+To implement GASB 68, local governments should review and understand the requirements of the standard, gather necessary data and information, determine the measurement approach for pension liabilities, recognize pension liabilities in the financial statements, prepare extensive disclosures, and present pension plan information in the financial statements.

What are the benefits of using a GASB 68 template?

+Using a GASB 68 template can provide numerous benefits, including improved compliance with GASB 68 requirements, enhanced transparency and accountability in financial reporting, increased efficiency in preparing financial statements, and better decision-making and fiscal management.

What are the common challenges in implementing GASB 68?

+Local governments may encounter several challenges when implementing GASB 68, including complexity of the standard and its requirements, limited resources and expertise, difficulty in gathering necessary data and information, and challenges in presenting pension plan information in the financial statements.

We hope this article has provided valuable information and insights on GASB 68 and its implementation. If you have any further questions or would like to share your experiences with implementing GASB 68, please feel free to comment below. Additionally, we encourage you to share this article with others who may benefit from this information. Thank you for reading!