Intro

Track trades with a free trading journal template, optimizing trading strategies and improving market analysis with record-keeping, risk management, and performance tracking tools.

The importance of keeping a trading journal cannot be overstated. It is a crucial tool for traders of all levels, from beginners to experienced professionals. A trading journal helps traders to track their progress, identify areas for improvement, and refine their trading strategies. In this article, we will discuss the benefits of using a free trading journal template and provide guidance on how to get the most out of it.

Trading is a complex and challenging activity that requires a great deal of skill, knowledge, and discipline. Even with the best trading strategy, it is possible to make mistakes and experience losses. A trading journal helps traders to learn from their mistakes and avoid repeating them in the future. By keeping a record of their trades, traders can identify patterns and trends that may not be immediately apparent. This information can be used to adjust their trading strategy and improve their overall performance.

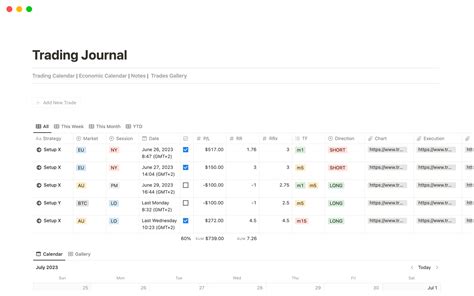

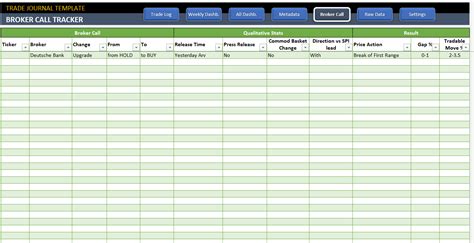

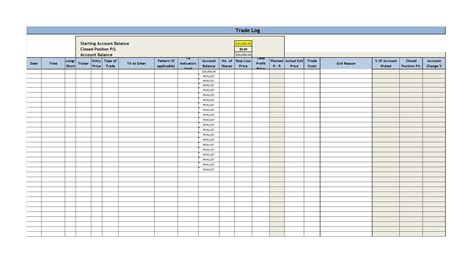

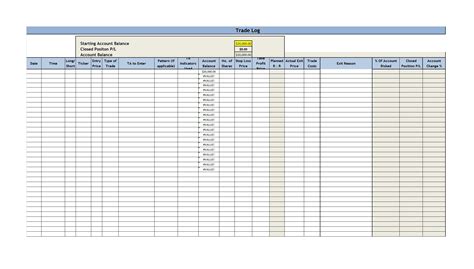

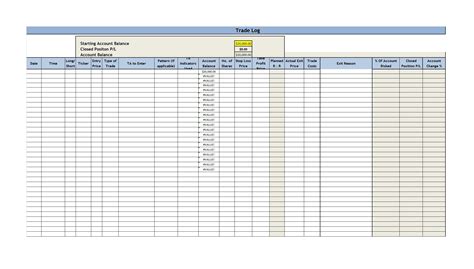

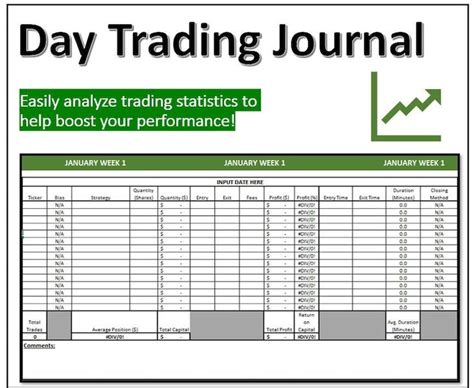

A free trading journal template is a valuable resource for traders who want to improve their trading skills. It provides a structured format for recording trades, which makes it easier to track progress and identify areas for improvement. A good trading journal template should include space for recording the date and time of each trade, the type of trade, the entry and exit points, and the profit or loss. It should also include space for notes and comments, which can be used to record any relevant observations or insights.

Benefits of Using a Trading Journal

Using a trading journal can have a significant impact on a trader's performance. Some of the benefits of using a trading journal include:

- Improved record-keeping: A trading journal provides a structured format for recording trades, which makes it easier to track progress and identify areas for improvement.

- Enhanced analysis: By keeping a record of their trades, traders can analyze their performance and identify patterns and trends that may not be immediately apparent.

- Better decision-making: A trading journal can help traders to make more informed decisions by providing a clear and objective record of their trading activity.

- Increased discipline: Using a trading journal can help traders to stay disciplined and focused, which is essential for achieving success in the markets.

Key Components of a Trading Journal

A good trading journal should include the following components:- Date and time of each trade

- Type of trade (e.g. long, short, scalp, etc.)

- Entry and exit points

- Profit or loss

- Notes and comments

By including these components, traders can create a comprehensive record of their trading activity, which can be used to analyze their performance and identify areas for improvement.

How to Use a Trading Journal

Using a trading journal is a straightforward process. Here are the steps to follow:

- Record each trade: As soon as a trade is executed, record the details in the trading journal. This should include the date and time of the trade, the type of trade, the entry and exit points, and the profit or loss.

- Review and analyze: Regularly review and analyze the trading journal to identify patterns and trends. This can help to identify areas for improvement and refine the trading strategy.

- Adjust the strategy: Based on the analysis, adjust the trading strategy as needed. This may involve changing the entry and exit points, adjusting the position size, or using different indicators.

- Continuously monitor: Continuously monitor the trading journal to ensure that the strategy is working effectively. This may involve making adjustments to the strategy over time.

Tips for Getting the Most Out of a Trading Journal

Here are some tips for getting the most out of a trading journal:- Be consistent: Record every trade, no matter how small. This will help to create a comprehensive record of trading activity.

- Be objective: Avoid making subjective judgments about trades. Instead, focus on the facts and analyze the performance objectively.

- Be patient: Analyzing a trading journal takes time and effort. Be patient and don't rush to conclusions.

- Be open-minded: Be willing to adjust the trading strategy based on the analysis. This may involve trying new approaches or indicators.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using a trading journal:

- Inconsistent recording: Failing to record every trade can create an incomplete and inaccurate record of trading activity.

- Subjective analysis: Making subjective judgments about trades can lead to biased conclusions and ineffective adjustments to the trading strategy.

- Lack of patience: Rushing to conclusions or making impulsive decisions can lead to poor trading decisions and decreased performance.

- Failure to adjust: Failing to adjust the trading strategy based on the analysis can lead to stagnation and decreased performance.

Best Practices for Trading Journal Maintenance

Here are some best practices for maintaining a trading journal:- Regularly review and update: Regularly review and update the trading journal to ensure that it remains accurate and relevant.

- Use a consistent format: Use a consistent format for recording trades, which makes it easier to analyze and compare performance.

- Keep it concise: Keep the trading journal concise and focused on the most important information.

- Use it as a tool: Use the trading journal as a tool for improving trading performance, rather than just a record of trades.

Conclusion and Next Steps

In conclusion, a free trading journal template is a valuable resource for traders who want to improve their trading skills. By using a trading journal, traders can track their progress, identify areas for improvement, and refine their trading strategies. To get the most out of a trading journal, it's essential to be consistent, objective, patient, and open-minded. By following these tips and avoiding common mistakes, traders can use a trading journal to improve their performance and achieve their trading goals.

Gallery of Trading Journal Templates

What is a trading journal?

+A trading journal is a record of a trader's transactions, including the date, time, and details of each trade.

Why is a trading journal important?

+A trading journal is important because it helps traders to track their progress, identify areas for improvement, and refine their trading strategies.

How do I use a trading journal?

+To use a trading journal, simply record each trade, including the date, time, and details of the trade. Then, regularly review and analyze the journal to identify patterns and trends, and adjust your trading strategy accordingly.

We hope this article has provided you with a comprehensive understanding of the importance of using a free trading journal template. By following the tips and best practices outlined in this article, you can use a trading journal to improve your trading performance and achieve your trading goals. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues who may be interested in learning more about trading journals.