Intro

Plan your golden years with 5 free retirement templates, featuring customizable pension calculators, savings trackers, and investment planners to secure your financial future.

Retirement is a significant milestone in one's life, marking the end of a long career and the beginning of a new chapter. It's a time to relax, pursue hobbies, and spend quality time with loved ones. However, planning for retirement can be overwhelming, especially when it comes to organizing finances, creating a budget, and setting goals. This is where retirement templates come in handy. In this article, we will explore five free retirement templates that can help individuals plan and track their retirement journey.

Retirement templates are essential tools that provide a structured approach to retirement planning. They help individuals assess their financial situation, set realistic goals, and create a roadmap for achieving those goals. With a retirement template, individuals can easily track their progress, make adjustments as needed, and ensure a smooth transition into retirement. Whether you're just starting to plan for retirement or are already retired, these templates can help you stay organized and focused on your goals.

Retirement planning involves a range of activities, from assessing one's financial situation to creating a sustainable income stream. It requires careful consideration of various factors, including inflation, healthcare costs, and investment returns. A well-structured retirement template can help individuals navigate these complexities and make informed decisions about their retirement. By using a retirement template, individuals can ensure that they are adequately prepared for retirement and can enjoy their golden years with confidence.

Introduction to Retirement Templates

Retirement templates are designed to provide a comprehensive framework for retirement planning. They typically include sections for assessing financial situation, setting goals, and tracking progress. These templates can be customized to suit individual needs and preferences, making them a versatile tool for retirement planning. By using a retirement template, individuals can ensure that they are covering all aspects of retirement planning and are well-prepared for the challenges and opportunities that lie ahead.

Benefits of Using Retirement Templates

There are several benefits to using retirement templates. Firstly, they provide a structured approach to retirement planning, helping individuals stay organized and focused on their goals. Secondly, they enable individuals to track their progress and make adjustments as needed, ensuring that they are on track to meet their retirement objectives. Thirdly, retirement templates can help individuals identify potential pitfalls and develop strategies to mitigate them. By using a retirement template, individuals can ensure that they are adequately prepared for retirement and can enjoy their golden years with confidence.

Types of Retirement Templates

There are several types of retirement templates available, each designed to meet specific needs and preferences. Some common types of retirement templates include:

- Budget templates: These templates help individuals track their income and expenses, ensuring that they are living within their means.

- Investment templates: These templates help individuals manage their investments, including stocks, bonds, and other assets.

- Goal-setting templates: These templates help individuals set and track their retirement goals, including travel, hobbies, and other activities.

- Risk assessment templates: These templates help individuals identify potential risks and develop strategies to mitigate them.

5 Free Retirement Templates

Here are five free retirement templates that can help individuals plan and track their retirement journey:

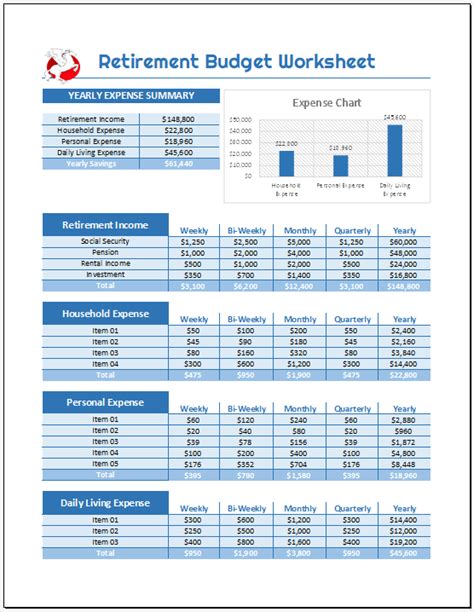

- Retirement Budget Template: This template helps individuals track their income and expenses, ensuring that they are living within their means.

- Retirement Investment Template: This template helps individuals manage their investments, including stocks, bonds, and other assets.

- Retirement Goal-Setting Template: This template helps individuals set and track their retirement goals, including travel, hobbies, and other activities.

- Retirement Risk Assessment Template: This template helps individuals identify potential risks and develop strategies to mitigate them.

- Retirement Progress Tracking Template: This template helps individuals track their progress towards their retirement goals, making adjustments as needed.

Retirement Budget Template

The retirement budget template is a comprehensive tool that helps individuals track their income and expenses. It includes sections for:

- Income: This section helps individuals track their retirement income, including pensions, Social Security, and other sources.

- Fixed expenses: This section helps individuals track their fixed expenses, including housing, utilities, and other essential costs.

- Discretionary expenses: This section helps individuals track their discretionary expenses, including travel, hobbies, and other non-essential costs.

- Savings: This section helps individuals track their savings, including emergency funds and other savings goals.

Retirement Investment Template

The retirement investment template is a powerful tool that helps individuals manage their investments. It includes sections for:

- Asset allocation: This section helps individuals track their asset allocation, including stocks, bonds, and other assets.

- Investment returns: This section helps individuals track their investment returns, including dividends, interest, and capital gains.

- Risk assessment: This section helps individuals assess their investment risk, including potential losses and other risks.

Retirement Goal-Setting Template

The retirement goal-setting template is a helpful tool that enables individuals to set and track their retirement goals. It includes sections for:

- Short-term goals: This section helps individuals set and track their short-term goals, including travel, hobbies, and other activities.

- Long-term goals: This section helps individuals set and track their long-term goals, including retirement income, healthcare, and other essential costs.

- Progress tracking: This section helps individuals track their progress towards their retirement goals, making adjustments as needed.

Retirement Risk Assessment Template

The retirement risk assessment template is a valuable tool that helps individuals identify potential risks and develop strategies to mitigate them. It includes sections for:

- Health risks: This section helps individuals assess their health risks, including chronic illnesses, disabilities, and other health concerns.

- Financial risks: This section helps individuals assess their financial risks, including market volatility, inflation, and other financial risks.

- Strategic planning: This section helps individuals develop strategies to mitigate their risks, including insurance, diversification, and other risk management techniques.

Retirement Progress Tracking Template

The retirement progress tracking template is a useful tool that enables individuals to track their progress towards their retirement goals. It includes sections for:

- Goal tracking: This section helps individuals track their progress towards their retirement goals, including income, expenses, and other essential costs.

- Adjustment planning: This section helps individuals make adjustments to their retirement plan, including changes to income, expenses, and other factors.

- Review and revision: This section helps individuals review and revise their retirement plan, ensuring that they are on track to meet their retirement objectives.

Retirement Planning Image Gallery

What is a retirement template?

+A retirement template is a tool that helps individuals plan and track their retirement journey. It provides a structured approach to retirement planning, enabling individuals to assess their financial situation, set goals, and track progress.

Why do I need a retirement template?

+You need a retirement template to ensure that you are adequately prepared for retirement. A retirement template helps you assess your financial situation, set realistic goals, and create a roadmap for achieving those goals. It also enables you to track your progress and make adjustments as needed.

How do I choose a retirement template?

+To choose a retirement template, consider your individual needs and preferences. Look for a template that provides a comprehensive framework for retirement planning, including sections for assessing financial situation, setting goals, and tracking progress. You can also consider templates that offer customization options, enabling you to tailor the template to your specific needs.

Can I use a retirement template if I'm already retired?

+Yes, you can use a retirement template even if you're already retired. A retirement template can help you track your expenses, manage your investments, and ensure that you're living within your means. It can also help you identify potential risks and develop strategies to mitigate them.

Are retirement templates free?

+Yes, there are many free retirement templates available online. You can search for templates on websites, blogs, and other online resources. Some templates may offer basic features for free, while others may require a subscription or payment for advanced features.

In conclusion, retirement templates are essential tools that can help individuals plan and track their retirement journey. By using a retirement template, individuals can ensure that they are adequately prepared for retirement and can enjoy their golden years with confidence. Whether you're just starting to plan for retirement or are already retired, a retirement template can provide a comprehensive framework for retirement planning, enabling you to assess your financial situation, set realistic goals, and track progress. So why not start using a retirement template today and take the first step towards a secure and fulfilling retirement? We invite you to share your thoughts and experiences with retirement templates in the comments section below. You can also share this article with your friends and family who may be planning for retirement.