Intro

Download a free California promissory note template to create a legally binding loan agreement, outlining repayment terms, interest rates, and borrower obligations, ensuring secure lending transactions in California.

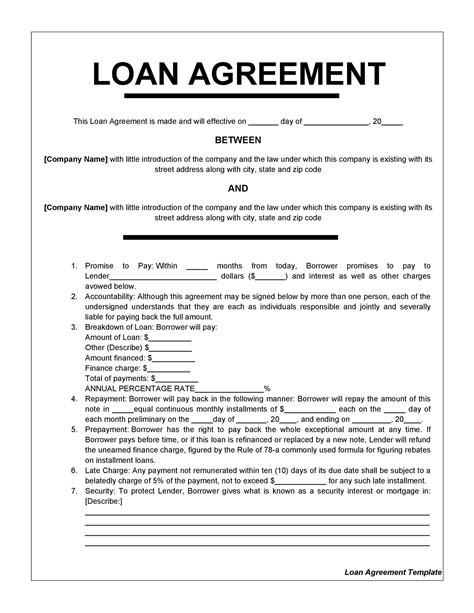

In the state of California, a promissory note is a written agreement where one party, known as the borrower or maker, promises to pay a certain amount of money to another party, known as the lender or payee. This agreement is legally binding and outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any other conditions. Having a well-structured promissory note template is essential for both lenders and borrowers to ensure clarity and protection of their rights.

A free promissory note template for California can be a valuable resource for individuals and businesses looking to formalize loan agreements without incurring the expense of hiring a lawyer. However, it's crucial to ensure that the template complies with California state laws and includes all necessary provisions to protect both parties.

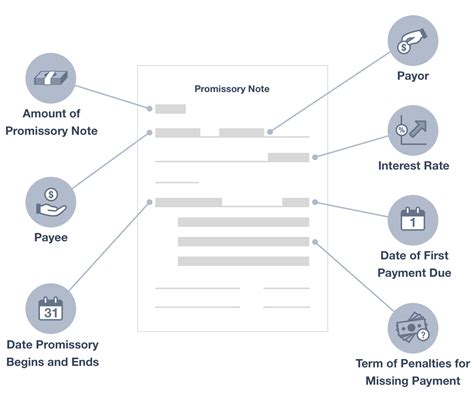

When using a promissory note template in California, several key elements must be included:

- Amount of the Loan: The total amount borrowed.

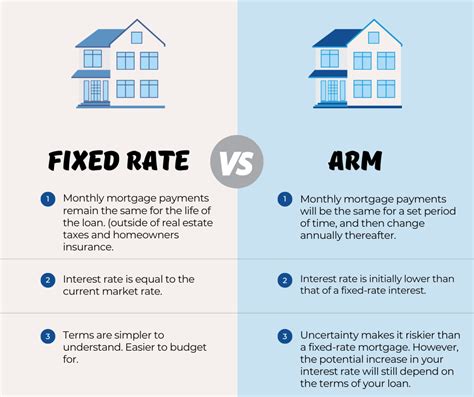

- Interest Rate: The rate at which interest accrues on the loan. This must comply with California's usury laws, which dictate the maximum legal interest rate that can be charged.

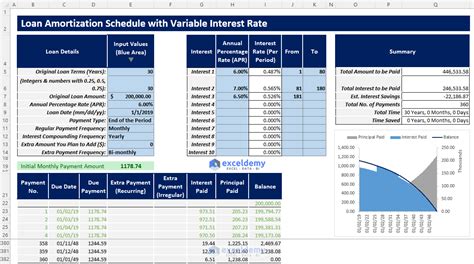

- Repayment Terms: Details on how and when the loan will be repaid, including the payment schedule and any late payment penalties.

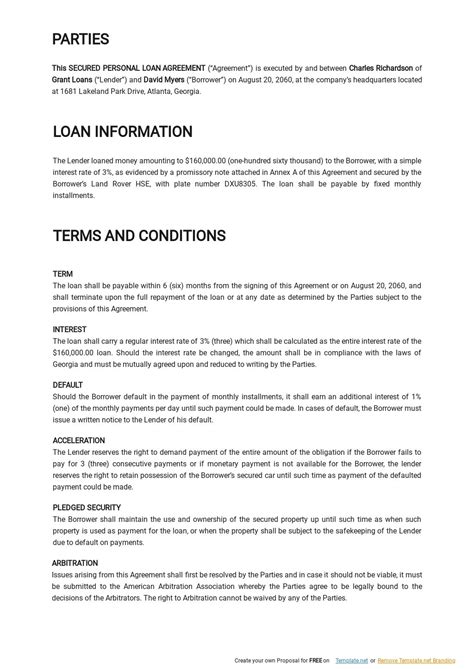

- Security: If the loan is secured, a description of the collateral.

- Default and Remedies: What constitutes default and the actions the lender can take if the borrower defaults.

Understanding Promissory Notes in California

To use a free promissory note template effectively in California, it's essential to understand the legal framework governing these agreements. California law provides certain protections for both lenders and borrowers, and being aware of these can help in drafting a comprehensive and legally binding promissory note.

Benefits of Using a Promissory Note Template

Utilizing a promissory note template offers several benefits, including clarity, legal protection, and efficiency. It ensures that the agreement is clear and understandable, reducing the risk of misunderstandings. Additionally, it provides a legally binding contract that protects both parties' rights and can be enforceable in court if necessary.

Key Components of a Promissory Note

A comprehensive promissory note should include several key components:

- Parties Involved: The names and addresses of both the borrower and the lender.

- Loan Details: The amount of the loan, the interest rate, and how the interest will be calculated.

- Repayment Terms: The schedule for repayments, including the amount of each payment and the date of the first and last payments.

- Default Provisions: The conditions under which the borrower will be considered in default and the actions the lender can take in such cases.

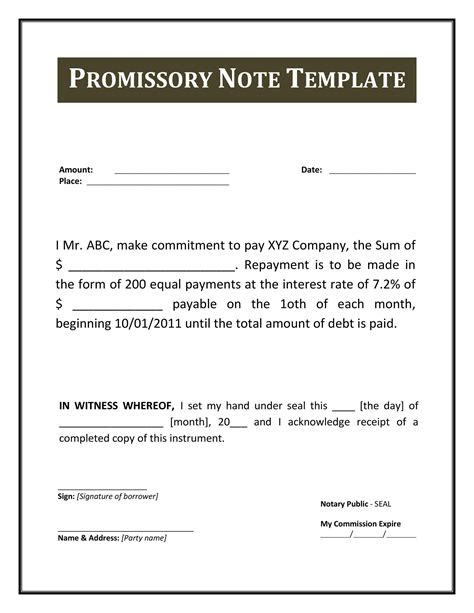

How to Fill Out a Promissory Note Template

Filling out a promissory note template requires careful attention to detail to ensure that the agreement accurately reflects the terms of the loan. Here are the steps to follow:

- Identify the Parties: Clearly state the names and addresses of the borrower and the lender.

- Specify the Loan Amount: Write the total amount being borrowed.

- Define the Interest Rate: State the interest rate and how it will be applied.

- Outline Repayment Terms: Detail the repayment schedule, including the payment amounts and due dates.

- Include Default and Remedies Clauses: Specify what constitutes default and the lender's remedies.

California Laws Governing Promissory Notes

California has specific laws that govern promissory notes, particularly regarding usury and the maximum interest rates that can be charged. Understanding these laws is crucial to ensure that the promissory note is legally enforceable.

Common Uses of Promissory Notes in California

Promissory notes are used in various transactions in California, including personal loans between friends or family members, business loans, real estate transactions, and student loans. They provide a formal and legally binding agreement that protects both the lender and the borrower.

Creating a Customized Promissory Note

While templates can provide a good starting point, it may be necessary to create a customized promissory note that fits the specific needs of the loan. This can involve adding or modifying clauses to address unique aspects of the agreement.

Gallery of Promissory Note Templates

Promissory Note Templates Image Gallery

What is a promissory note in California?

+A promissory note in California is a written agreement where one party promises to pay a certain amount of money to another party, outlining the terms of the loan, including the amount, interest rate, and repayment schedule.

How do I create a promissory note in California?

+To create a promissory note in California, you can use a template and fill in the necessary details such as the loan amount, interest rate, repayment terms, and the names and addresses of the parties involved. Ensure the note complies with California laws.

What are the benefits of using a promissory note template in California?

+The benefits include clarity, legal protection, and efficiency. It ensures the agreement is clear and understandable, provides a legally binding contract, and can be enforceable in court if necessary.

In conclusion, utilizing a free promissory note template in California can be a cost-effective and efficient way to formalize loan agreements, provided that the template is comprehensive, legally binding, and compliant with California state laws. It's essential for both lenders and borrowers to understand the key components of a promissory note and the legal framework governing these agreements in California. By doing so, they can protect their rights and ensure a smooth loan process. If you have any experiences or questions regarding promissory notes in California, feel free to share them in the comments below. Additionally, if you found this information helpful, consider sharing it with others who might benefit from understanding how to use a promissory note template effectively in California.