Intro

Get organized with 5 free ledger templates, featuring accounting sheets, budget planners, and financial trackers, perfect for small businesses and personal finance management, including expense logs and invoice templates.

Accounting and bookkeeping are essential components of any business, and using a ledger can help you keep track of your financial transactions. A ledger is a book or digital file that contains a record of all your business's financial transactions, including income, expenses, assets, liabilities, and equity. In this article, we will discuss the importance of using a ledger and provide you with 5 free ledger templates that you can use for your business.

Using a ledger can help you stay organized and ensure that your financial records are accurate and up-to-date. It can also help you identify areas where you can cut costs and improve your business's financial performance. Additionally, a ledger can help you prepare for tax season and make it easier to file your taxes. Whether you are a small business owner or a large corporation, using a ledger is an essential part of managing your finances.

A ledger can be used to record a variety of financial transactions, including sales, purchases, payments, and receipts. It can also be used to track your business's assets, liabilities, and equity. By using a ledger, you can get a clear picture of your business's financial situation and make informed decisions about how to manage your finances. In the following sections, we will discuss the different types of ledgers and provide you with 5 free ledger templates that you can use for your business.

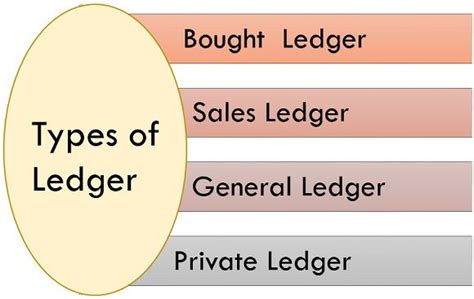

Types of Ledgers

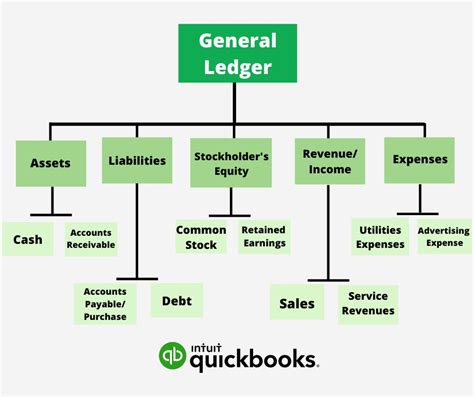

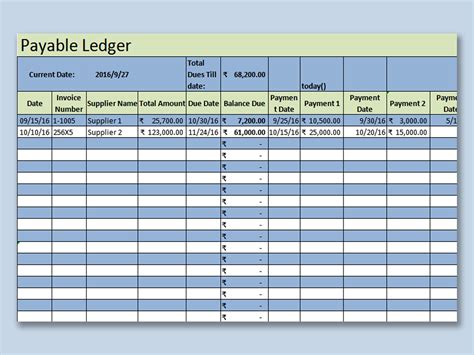

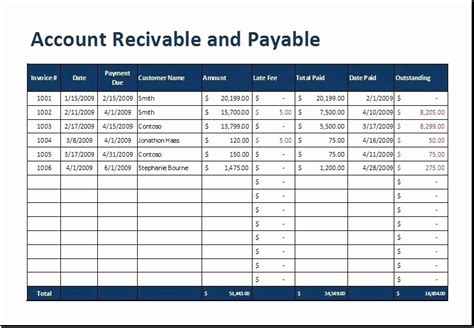

There are several types of ledgers that you can use, depending on your business needs. Some common types of ledgers include general ledgers, accounts payable ledgers, accounts receivable ledgers, and payroll ledgers. A general ledger is a comprehensive ledger that contains all of your business's financial transactions. An accounts payable ledger is used to track the money that your business owes to its suppliers and creditors. An accounts receivable ledger is used to track the money that your business is owed by its customers. A payroll ledger is used to track your business's payroll expenses, including employee salaries and benefits.

Benefits of Using a Ledger

Using a ledger can provide several benefits for your business. Some of the benefits of using a ledger include improved financial organization, increased accuracy, and better decision-making. By using a ledger, you can keep track of all your business's financial transactions in one place, making it easier to manage your finances. A ledger can also help you identify errors and discrepancies in your financial records, ensuring that your financial statements are accurate and reliable. Additionally, a ledger can provide you with valuable insights into your business's financial performance, helping you make informed decisions about how to manage your finances.

How to Choose a Ledger Template

When choosing a ledger template, there are several factors to consider. Some of the factors to consider include the type of ledger you need, the level of complexity, and the format. You should choose a ledger template that is tailored to your business needs and is easy to use. You should also consider the level of complexity of the template, as well as the format. Some common formats for ledger templates include Excel, Google Sheets, and PDF.

5 Free Ledger Templates

Here are 5 free ledger templates that you can use for your business:

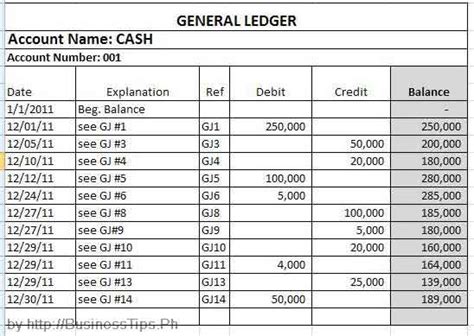

- General Ledger Template: This template is a comprehensive ledger that contains all of your business's financial transactions. It includes columns for date, description, debit, and credit.

- Accounts Payable Ledger Template: This template is used to track the money that your business owes to its suppliers and creditors. It includes columns for date, supplier, amount, and payment status.

- Accounts Receivable Ledger Template: This template is used to track the money that your business is owed by its customers. It includes columns for date, customer, amount, and payment status.

- Payroll Ledger Template: This template is used to track your business's payroll expenses, including employee salaries and benefits. It includes columns for date, employee, amount, and payment status.

- Cash Ledger Template: This template is used to track your business's cash transactions, including income and expenses. It includes columns for date, description, debit, and credit.

Using the Ledger Templates

To use the ledger templates, simply download the template and fill in the columns with your business's financial transactions. You can customize the template to fit your business needs by adding or removing columns. You should update the ledger regularly to ensure that your financial records are accurate and up-to-date.Best Practices for Using a Ledger

Here are some best practices for using a ledger:

- Update the ledger regularly to ensure that your financial records are accurate and up-to-date.

- Use a consistent format for recording financial transactions.

- Review the ledger regularly to identify errors and discrepancies.

- Use the ledger to track your business's financial performance and make informed decisions about how to manage your finances.

- Consider using accounting software to automate the ledger and make it easier to manage your finances.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using a ledger:

- Failing to update the ledger regularly.

- Using an inconsistent format for recording financial transactions.

- Failing to review the ledger regularly to identify errors and discrepancies.

- Not using the ledger to track your business's financial performance.

- Not considering using accounting software to automate the ledger.

Conclusion and Next Steps

In conclusion, using a ledger is an essential part of managing your business's finances. By using a ledger, you can keep track of all your business's financial transactions, identify areas where you can cut costs, and make informed decisions about how to manage your finances. We have provided you with 5 free ledger templates that you can use for your business, as well as best practices for using a ledger and common mistakes to avoid. Next steps, download the ledger templates and start using them to manage your business's finances.

Ledger Image Gallery

What is a ledger and why is it important?

+A ledger is a book or digital file that contains a record of all your business's financial transactions. It is important because it helps you keep track of your financial records, identify areas where you can cut costs, and make informed decisions about how to manage your finances.

What are the different types of ledgers?

+There are several types of ledgers, including general ledgers, accounts payable ledgers, accounts receivable ledgers, and payroll ledgers. Each type of ledger is used to track specific financial transactions and is tailored to the needs of your business.

How do I choose a ledger template?

+When choosing a ledger template, consider the type of ledger you need, the level of complexity, and the format. You should choose a template that is tailored to your business needs and is easy to use. You should also consider the level of complexity of the template, as well as the format.

What are some best practices for using a ledger?

+Some best practices for using a ledger include updating the ledger regularly, using a consistent format for recording financial transactions, reviewing the ledger regularly to identify errors and discrepancies, and using the ledger to track your business's financial performance and make informed decisions about how to manage your finances.

What are some common mistakes to avoid when using a ledger?

+Some common mistakes to avoid when using a ledger include failing to update the ledger regularly, using an inconsistent format for recording financial transactions, failing to review the ledger regularly to identify errors and discrepancies, not using the ledger to track your business's financial performance, and not considering using accounting software to automate the ledger.

We hope that this article has provided you with valuable information about using a ledger and has helped you to choose the right ledger template for your business. If you have any further questions or need more information, please do not hesitate to contact us. We are always here to help. Additionally, we would love to hear your feedback and suggestions on how we can improve our article and provide more value to our readers. Please feel free to share your thoughts and ideas with us by commenting below. Thank you for reading!